Financial ratios may be clclassified into the following broad categories:

- Short term liquidity ratios, also known as working capital management ratios,

- Long term risks and capital structure ratios, also known as leverage or debt management or solvency ratios,

- Operating efficiency and profitability ratios,

- Investment ratios (Graham, J., Smart, S., Megginson, W. 2009).

The purpose of this paper is to carry out a financial analysis of The University Ambulatory Care Center (UACC) by computing financial ratios based on the information given on the financial statements.

Short term liquidity ratios

Liquidity refers to an enterprise’s ability to meet its short-term debts as and when they fall due. Liquidity ratios measure a firm’s ability to meet its short-term debts as and when they fall due. (Graham, J., Smart, S., Megginson, W. 2009).

There are several liquidity ratios, in the case of The University Ambulatory Care Center (UACC), the relevant liquidity ratios are the working capital ratio, and the current ratio.

Working capital ratio

The working capital ratio represents current assets that are financed from long-term capital resources that do not require repayment in the short run, implying that the portion that is financed by long-term capital is still available for repayment of short-term debts. It is computed as follows:

- Working capital = Current Assets – Current Liabilities (Graham, J., Smart, S., Megginson, W. 2009).

From the financial statements, Working capital can be computed as follows:

2007 2008

$ $

Current assets 9,143,000 10,209,000

Current Liabilities (7,306,000) (5,358,000)

Working Capital 1,837,000 4,851,000

In the year 2007, $ 1,837,000 of working capital, representing current assets financed by long-term capital resources is available to pay short-term debts and in 2008, $ 4,851,000 of working capital is available to pay short-term obligations.

The working capital ratio has improved in 2008 as compared to 2007; meaning that in 2008, UACC had more current assets financed by long-term capital resources is available to pay short-term debts as compared to 2007.

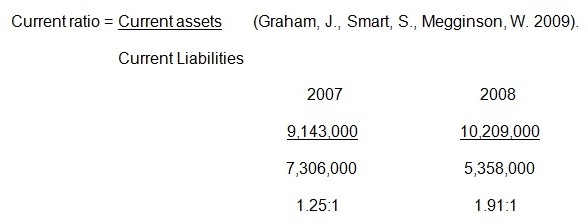

Current ratio

The current ratio also tests short term debt paying ability of an enterprise. It measures the amount of liquid and near liquid resources available to meet short-term debts. A high current ratio is assumed to indicate a strong liquidity position, while a low current ratio is assumed to indicate a weak liquidity position. This ratio can be computed as follows:

For every dollar that is owed current liabilities in 2008, the firm has 1.25 dollars to pay the debt and for every dollar that is owed current liabilities in 2007, the firm had 1.91 dollars to pay the debt.

The current ratio has also improved in 2008 as compared to 2007, meaning that for every dollar that is owed current liabilities in 2008, the firm has more dollars to pay the debt as compared to 2007.

Long term solvency ratios

A firm is said to be leveraged whenever it finances a portion of its assets by debts. Debts commit a firm to payment of interest and repayment of capital. Borrowing increases the risk of default and it is only advantageous to the shareholders if the return earned on the funds borrowed is greater than the cost of the funds.

Long-term solvency ratios measure the extent to which the enterprise is financed by borrowed funds. (Graham, J., Smart, S., Megginson, W. 2009).

There are several long-term solvency ratios. In the case of UACC, the relevant long-term solvency ratio is the debt to equity ratio.

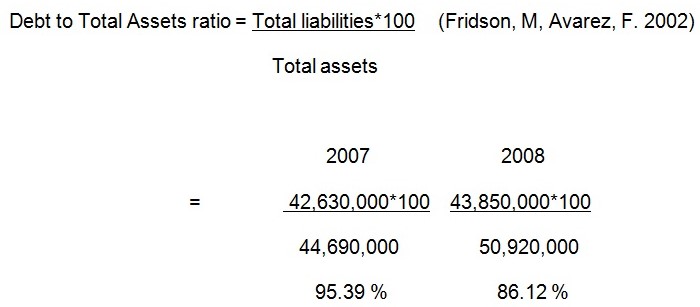

Debt to Total Assets ratio

This ratio measures the proportion of assets financed by outsiders. It is calculated as follows:

This ratio shows that in 2007, 95.39 % of the company’s assets were financed by outsiders while in 2008, 86.12 % of the company’s assets were financed by outsiders. This ratio has also improved in 2008 because, in 2008, the proportion of the company’s assets was financed by outsiders is lower than the proportion in 2007.

Profitability and operating efficiency ratios

Profitability and operating efficiency ratios consist of tests used to evaluate a firm’s earnings performance during the year. These ratios combined with other data can be used to forecast the earning potential of a firm since, in the long run, the firm has to operate profitably to survive. (Erich, H. n.d)

There are several Profitability ratios. In the case of UACC, the relevant profitability ratios are the Profit margin, and the Return on total assets.

Profit margin

This ratio describes the company’s ability to earn income. It is a measure of the proportion of sales that contribute to profit. In our case, we shall substitute sales with revenue. (Bragg, S. 2007)

Profit margin = Net income

Net sales

2007 2008

25,298,000*100 34,181,000*100

45,546,000 52,574,000

55.54 % 65.02 %

This ratio shows that in 2007, 55.54 % of the company’s revenue contributed to profit while in 2008, 65.02 % of the company’s revenue contributed to profit. This ratio has also improved in 2008, meaning that in 2008, a higher proportion of revenue contributed to profit as compared to 2007.

Return on total assets

Return on total assets ratio measures how well management has employed assets, and is given by the formula:

Net income*100 (Graham, J., Smart, S., Megginson, W. 2009).

Average total assets

2007 2008

= 25,298,000*100 34,181,000*100

44,690,000 50,920,000

56.61% 67.13%

This ratio shows that in 2008, management was able to employ the assets better than in 2007.

Conclusion

From the computations of the above financial ratios, it is clear that UACC financial health has improved in 2008 as compared to 2007. This is evident in the working capital, current ratio, debt to total assets ratio, profit margin, and return on total assets.

Reference List

Bragg, S. (2007). Financial statement analysis: a controllers’ guide. John Wiley & Sons, Inc.

Erich, H. (n.d). Financial analysis tools and techniques: a guide for managers. Hill: McGraw.

Fridson, M, Avarez, F. (2002). Financial statement analysis: a practitioners’ guide. John Wiley & Sons, Inc.

Graham, J., Smart, S., Megginson, W. (2009). Corporate Finance: Linking Theory to What Companies Do. South-Western Educational Publishing.