Introduction

In the recent years, there have been significant changes in management planning and control. For instance, entities prefer to have several small organizational units that operate as profit centers. This has replaced the common hierarchical system of control. Integrated Technology Services (ITS-UK) has a number of departments that act as profit centers. These units are consultancy department, outsourcing, and support services. In such as set up, the hierarchical system cannot be used. Thus, the modern management control tends to focus on linking the function of the several units in the organization so as to create a value chain. These changes have forced companies to move from the traditional control of performance management. In the recent times, companies tend to use both financial and non-financial performance measures to gauge the overall performance of an entity. Further, it is worth mentioning that the existence of headquarters-subsidiary interdependence, as in the case of the ITS-UK, makes it more cumbersome to measure performance (Du, Deloof & Jorissen 2013). This paper seeks to evaluate the performance measurement system at the ITS-UK.

Net margin as a performance metric

The net margin is a significant performance metric because it is one of the most widely and easiest to use technique. The stakeholders of an organization tend to analyze the net margin of entity first before checking other tools for measuring performance. The net margin is arrived at after deducting the cost of sales, operating expenses, and non-operating expenses from the sales revenue and adding non-operating income. Thus, it yields the ultimate amount that will be added to the reserves at the end of a financial year. In the case of the ITS-UK, the predetermined net margin is 6%. The value is set by the headquarters and the subsidiaries are expected to meet this target. Therefore, the net margin is used as a performance measurement tool.

Advantages

There are a number of merits of using the net margin metric. First, it is quite straight forward and easy to use. The ITS-UK Company prepares the financial statements at the end of a financial year. Therefore, the value will be picked from the income statement and compared with the predetermined value of 6%. There will be no additional processes or estimations that to be used to obtain the value. Secondly, it is easy to interpret because if the value is less than 6%, it means that ITS-UK has underperformed during that financial year. Thirdly, the metric is effectively used as an internal control tool. The management at the headquarters will use the net margin to evaluate the performance of various subsidiaries and other business units. It will enable the management of the ITS-UK to evaluate the trend of performance over a long period. Also, it allows the management to compare performance of the company with its competitors in the industry and in the financial markets. It is worth mentioning that financial markets prefer to review the performance of an entity as a whole. Therefore, the net margin will be suitable. Another reason is that it signifies the use of the controllability principle through the use of comparative performance assessment.

Problems

The ITS-UK Company faces a number of problems when using the net margin metric. First, there is a variance between the gross margin and the net margin metrics. The company charges customers price that will generate a gross margin that is at least 20%. However, the company cannot generate net margin of 6% from the gross margin of 20%. This can be explained by a number of factors. For instance, it only covers the production overhead and profit. Further, the company experiences problems with small contracts. The expenses for these small contracts are as much as those of large contracts, especially when looking at the administrative costs. This results in lower net margin. The contract duration also has an impact on the administrative costs. The contracts run for different durations and this makes it difficult to control costs. Further, an organization can have different goals during different periods. Some may not be aimed at profit maximization. This will tend to contradict with the net margin metric. For instance, the ITS-UK has been keen on increasing market share and this has overshadowed the gross margin. Thus, the company took some contracts with low gross margin hoping that it will open ways for other contracts. Further, the complexities involved in estimating and allocating the administrative costs to the clients often lead to charging wrong costs to clients. These will later be reversed and the company will absorb these costs that arise from such errors, thus, reducing the net margin. This complicates the use of net margin metrics as a performance measurement and control tool. Finally, the use of net margin does not take into account the non-financial attributes in the performance of an entity (Otley 2003). These non-financial attributes are equally important because they contribute to the overall success of the organization. Therefore, net margin is inadequate.

Alternative measures

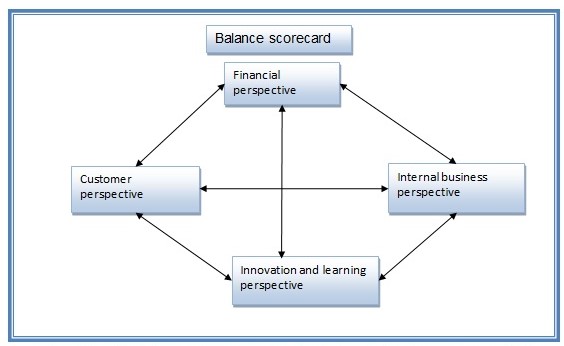

There are a number of alternative measures that can be used to evaluate the performance of the ITS-UK. The measures that will be discussed focuses on both financial and non-financial factors. The first measure is the use of the balanced scorecard (Kaplan & Norton 2009a). The perspectives of balanced scorecard are discussed in the subsequent tables.

Perspective: Learning and innovation

Perspective: Internal business process

Perspective: customer

Perspective: Financial

The map for the balanced scorecard is presented below.

Apart from the balance scorecard and net margin metrics, there are several other alternative measures. The first one is return on investment. This parameter gives information on the profitability of a division when the total assets are taken into account. The method is suitable when comparing the performance of more than one division. The second approach is the use of residual income. This method evaluates the economic performance of a division by deducting the cost of capital charge on capital employed from the profits earned. The final approach is the use of economic value added. This metric extends the residual income approach by taking into account the accounting adjustments (Drury 2012).

Using net margin to determine bonus payment

There are several theoretical views that oppose the use of net margin to determine bonus payments. However, there is a lot of evidence showing that net margin is used to determine bonus payments. The ITS-UK Company has profit centers and in some cases uses contracts as profit centers. Therefore, for each profit center cost item, the department accountable will be identified. The resulting profit will be allocated to each manager and they will be held accountable for the performance. This, allocation also trickles down to the support service and back office departments. With these allocations, the division is able to estimate bonuses using the net margin. This approach has a number of merits (Kaplan & Norton 2009b). First, the employees in the business are held accountable for the performance of the organization. Besides, it motivates the employees to improve profitability of the organization because an increase in net margin will result in an increase in their bonuses. A number of studies that have been carried out to show that there is a positive correlation between cash bonus payment based on net margin and growth in profitability that is earned by a company.

This approach has a number of demerits. First, the system is complex. The process of arriving at the bonuses is quite involving and it may consume a lot of company’s resources that would otherwise be concentrated on completing more contracts. Secondly, the company needs to comply with a number of regulations provided by tax authorities before rolling out this scheme. This regulation focuses on how to calculate taxes (Norreklit 2000). The two most commonly used approaches are the percentage of payroll approach and the use of sliding scale on the basis of duration of employment or other factors. The company and the employees are likely to lose tax benefits that arise from such bonus scheme if the correct method is not used. Also, the tax authorities provide limits on the amount of bonus that can be paid from the net income.

References

Drury, C 2012, Management and cost accounting, Cengage Learning, USA.

Du, Y, Deloof, M, & Jorissen, A 2013, ‘Headquarters-subsidiary interdependencies and the design of performance evaluation and reward systems in multinational enterprises’, European Accounting Review, vol. 22, no. 2, pp. 391-424.

Kaplan, R & Norton, D 2009a, Mastering the management system, Harvard Business Publishing, USA.

Kaplan, R & Norton, D 2009b, Using the balanced scorecard as a strategic management system, Harvard Business Publishing, USA.

Norreklit, H 2000, ‘The balance on the balanced scorecard – a critical analysis of some of its assumptions’, Management Accounting Research, vol. 11, no. 1, pp. 65-88.

Otley, D 2003, ‘Management control and performance management: whence and whither?’ The British Accounting Review, vol. 35, no. 1, pp. 309-326.