Introduction

This paper focuses on an article published by Bloomberg in January 2021. It is titled: “U.S. Economic Growth Moderated to 4% in Final Quarter of 2020” (Pickert, 2021). The central topic of the article is economic growth in the United States. More specifically, it touches the subjects of Gross Domestic Product growth, goods and services output, investments, and how they grew over the course of the pandemic year.

Summary of Article

The article discusses the current state of the US economy. First, the GDP growth considerably slowed in comparison to previous years (Pickert, 2021, para. 9). The reason for such a downturn lies in the decreased consumer consumption and rising state unemployment. Second, the year saw the expansion of non-residential investment and the growth in home sales. Overall, the pandemic slowed the economy and created a recession.

Discussion

In my opinion, there are three major ways this topic can affect me. The first is the rising unemployment rate, which will likely manifest in the deficit of available jobs. The second is low purchasing capacity, which means rising prices. Moreover, many people will probably switch to more substantial money-saving strategies. Finally, it is viable to suggest that housing prices will increase, making purchases less available and the rent more taxing.

Graphical Analysis

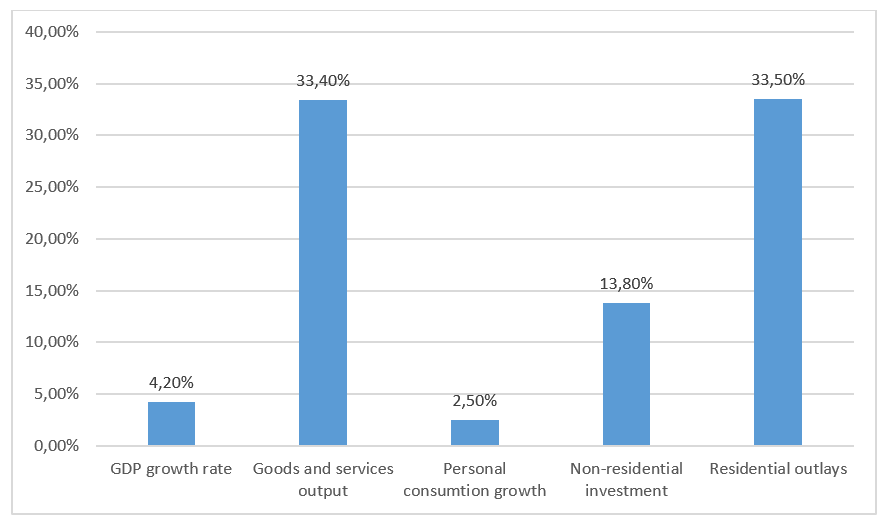

As the article covers a wide range of economic topics and does not offer various values, it is not possible to showcase the change in numbers. It is also not plausible to express all concepts in a single model. However, the article does show the growth rate of different indicators, which can be seen on the image. As such, the GDP growth rate constituted 4.2%, the production of goods and services was 33,4 %, personal consumption increased by 2,5%, non-residential investment grew by 13,8%, and the residential outlays comprised 33,5% (Pickert, 2021). All these indicators show the relative value of change because the specified value is not presented in the article.

Consequences

It could be argued that the governmental financial aid, which was promised by President Biden, will help the economy recuperate and achieve the pre-pandemic growth rates. However, this outcome is only possible if lawmakers follow through the Democrats’ aid bill (Pickert, 2021). Although the pandemic hit everyone, small businesses, such as retail, experienced the most adverse impact because they were forced to close due to the quarantine measures. As a result, consumers were restricted both financially and physically.

Reference

Pickert, R. (2021). U.S. economic growth moderated to 4% in final quarter of 2020. Bloomberg. Web.