Our college years are often the stage of life where we first learn how to pay taxes. To be honest, it’s a bit of a nasty and complicated process. When students lack knowledge and don’t take their time to figure everything out, they can make mistakes and waste both time and money. And those who master their college student tax return can actually save money!

With this handy article written by our team, you’ll become a pro at filing your taxes and navigating the whole US tax system. There is also a bonus at the end, so let’s get started!

🎓 Student Taxes 101

Now that you’re ready to dive into the mysterious world of taxation, let’s start with the easiest step: understanding what tax is.

Essentially, taxes are mandatory payments the US government receives to provide free goods and services that benefit the entire population. These include metro systems, buses, healthcare, academic grants, park benches, and much more.

You can try to imagine taxes as the toll we pay to maintain things that connect our society. Much like tolls help to fund the upkeep of bridges and highways, taxes support essential services responsible for our economy’s functioning.

Tax may seem like unnecessary spending, but it’s absolutely not! It has many important benefits that everyone can appreciate:

- Investment in research and development,

- Safety of citizens and national defense,

- Public healthcare services,

- Environmental initiatives, e.g., pollution control.

And that’s only scratching the surface!

Glossary of Terms

As you can see, taxes are easy to understand. Still, the system around them is a total mess. To start comprehending it, you should first discover its major concepts and make sure you get their meaning:

- Dependent. A dependent is a family member of a taxpayer who financially relies on said taxpayer. Usually, the dependents are underage, but sometimes they can also be adults. An essential quality of a dependent is that they can’t go to work and make money themselves due to their young age or physical disability.

- Earned income. This comprises all sources of money-making. For example, salaries, wages, tips, and net earnings from self-employment all count as earned income.

- Income taxes. A sum of money the US government takes from business or individual income through taxation.

- IRS. AKA Internal Revenue Service Center—a governmental organization that is responsible for taxation.

- File a return. Filing a return means sending the taxpayer’s income and tax liability information in a particular format to an Internal Revenue Service Center. It can be submitted via e-mail or as a printed submission.

- Filing status. Filing status defines the rate at which income is taxed. The five filing statuses are single, head of household, married filing a separate return, married filing a joint return, and widow(er) with a dependent child.

- Refund. A refund is a sum of money owed to taxpayers when their tax payments exceed the aggregate tax. Simply put, when the government collects your taxes, you’re able to take some of the money back if you’ve overpaid the expected sum.

- Tax benefits. A tax benefit is a special status that lets you pay less tax if you fall under a specific population type. For instance, you’ll get tax benefits if you have a big family or have suffered from a natural catastrophe.

- Exemptions. Exemption is a form of tax benefit that lowers the sum of taxable funds. The more exemptions you have, the less tax you’ll need to pay.

- Deductions. These are expenses that decrease your taxes, for instance, retirement plans, student loans, gambling losses, etc.

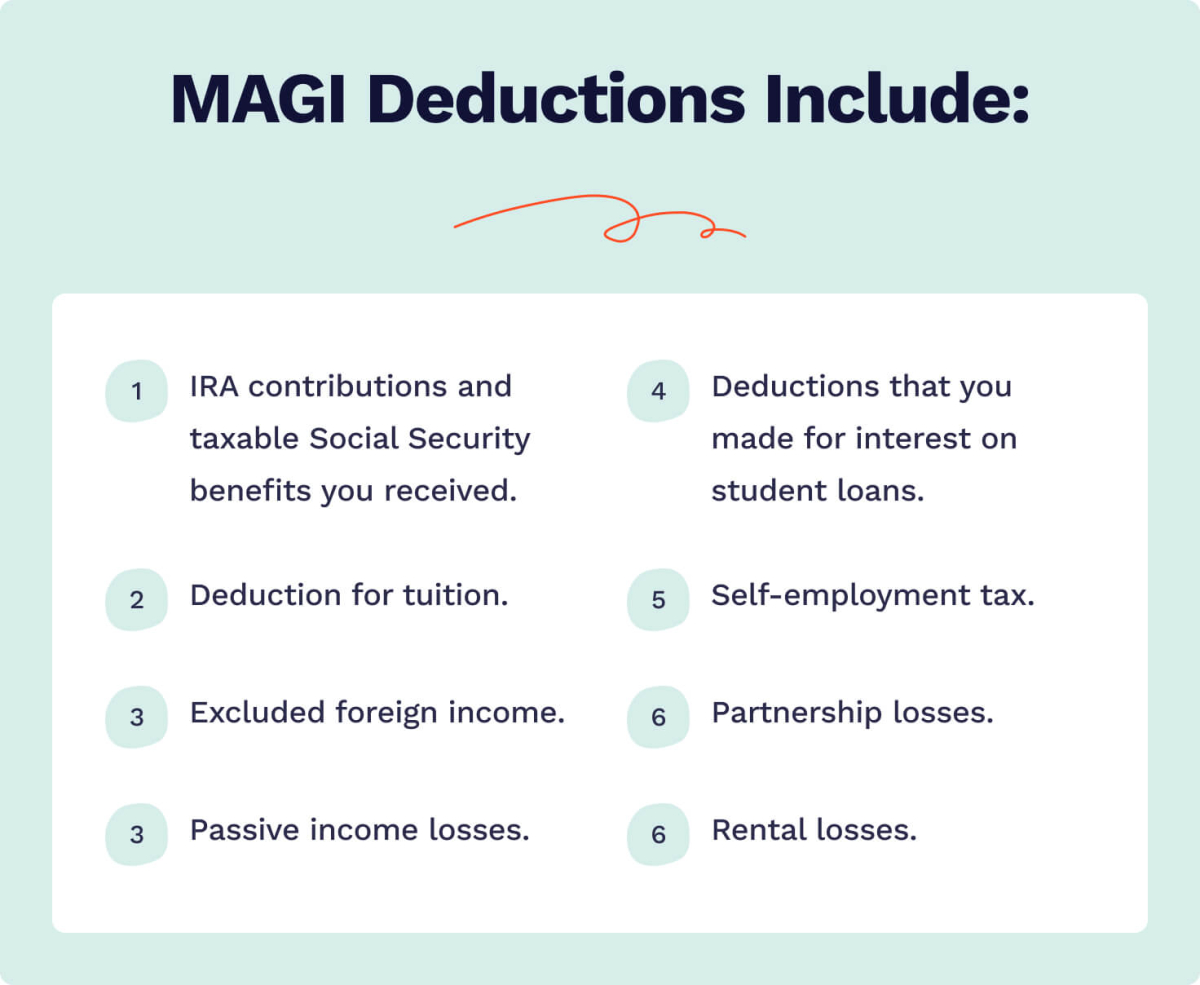

- MAGI. AKA Modified Adjusted Gross Income— it’s your annual earnings minus all the taxes plus deductions. The IRS uses it to decide whether or not you’re suited for tax benefits and credits.

- Qualified expenses. This is the funds you’ve used for various fees and other study-related things.

What Will Be Taxable & Tax-Free

You may think that as a student, you’re too young for tax. Well, that’s not how things are. If you receive earnings while at college, you already pay taxes just like any US citizen. Still, not everything you earn is regarded as taxable, and you might still have numerous things for which you don’t need to pay.

The earnings that require you to pay taxes are:

- Sums of money used for incidental expenses, including lodging, transportation, and study equipment.

- Money received as compensation for something you performed in order to be eligible for a fellowship or scholarship grant, such as research, teaching, etc.

Everything you receive through a scholarship, fellowship grant, or other possible grant could be exempt from taxes if you fit these specific criteria:

- You attend a college that regularly maintains its faculty, curriculum, and student body at the site where it conducts its educational activities.

- The money you get is used to pay for your tuition, attendance fees, and any additional expenses for textbooks and other study-related necessities.

As you can see, taxes depend on what you spend the income on. This reflects the golden rule of taxation: contributions to public finances are directly linked to people’s economic activities. It means that those who benefit from public goods and services contribute their fair amount in taxes. Earnings spent on essential things like textbooks are different, so they’re free from taxes.

If you have any amounts subject to tax, read on to learn how to properly file your taxes.

What Happens if You Don’t File Taxes

“There are billions of people out there. Nobody would notice if I don’t pay my taxes.” Thoughts like this strike many students down. They think that if they avoid filing taxes, nothing serious will happen, and they will save some money.

Don’t make this mistake! The IRS has a giant network that gathers data about each and every penny earned in the USA. Should you avoid paying taxes, you’ll face nasty consequences that include:

- Penalty fees. You can get punished with penalties if you don’t file your taxes. In time, these fees might gather into quite a significant debt.

- Interest charges. In addition to penalty fees, there is also a percentage charged on any tax liability you owe. They can also accumulate over time and make it more troublesome for you to pay back your debt.

- Loss of refund. Refunds are very helpful in many situations, as they can get you certain sums back. But you won’t be able to ask for a repayment if you don’t file your taxes.

- Legal action. The IRS can initiate a lawsuit against you if you don’t pay your taxes promptly. It can lead to the government confiscating your belongings, withholding your salary, or putting a lien on your property.

- Difficulty securing loans. Students who don’t pay taxes may have trouble getting bank loans for big acquisitions. This is because tax returns are frequently used by lenders to assess a client’s credit trustworthiness and capacity to repay a loan.

All in all, it’s a terrible idea to avoid paying taxes. You’ll eventually lose much more money than any short-term savings. Besides, you’ll be breaking federal law.

Instead, follow our instructions to learn how to file taxes correctly and even benefit from them!

🤔 Do You Need to File Taxes? Let’s Find Out

As you already know, being a student doesn’t free you from various taxes. Still, some aspects of the taxation system can give you a nice advantage and offer amazing perks. Some things will let you pay fewer taxes, some will allow you to legally skip taxation, and some will even provide you with funds you can spend however you like!

Let’s examine each of these factors separately.

Your Filing Status

Your filing status depends upon whether you are married or have kids. There are five different categories:

- Single. This status includes those who are unmarried or separated. It has lower income limits for most tax exemptions.

- Married, filing jointly. This implies you’re married and want to split taxes with your spouse. A joint tax return results in a larger refund or a decreased liability.

- Married, filing separately. This status means you’re married but want to file taxes independently from your partner. It may be more profitable to file separately if both spouses are employed and one of them earns substantially more than the other.

- Head of household. A taxpayer who has contributed more than half to maintaining a house and its residents for half the year can have lower tax rates.

- Qualified widow(er) with dependent child. This status is applied if a taxpayer’s spouse passed away a year ago, they didn’t remarry by the end of the present year, and they have a dependent minor. Such persons get the lowest tax rate.

Your Income

Your income is a central factor that determines whether or not you need to file taxes. This system may seem puzzling at first, but in truth, it’s a piece of cake.

The IRS will take the standard deduction amount and compare it to your factual income. This means that you won’t need to file taxes if your earnings are lower than the standard deduction for your filing status. Check out the standard deduction rates for 2023 below:

Note that you might still be asked to pay taxes even if your salary is below the standard deduction limit. This pertains to the following cases:

- You had federal taxes deducted from your paycheck.

- You are eligible for specific tax deductions.

- You generate money from your personal enterprise.

Your Age

Your age is another decisive element in determining whether you must deal with taxes. If your income surpasses the standard deduction amount for your filing status and you are under 65, you must file taxes. You can exceed a standard deduction and skip paying taxes if you’re over 65 or blind.

Your Dependency Status

Dependency status also impacts whether or not you should file taxes while you are studying. Also, the person who declares you as a dependant might be granted tax breaks and credits for education-related stuff, which is a nice bonus.

Here are some other vital aspects of dependency status:

- A person can be claimed as a dependant until they are 24.

- The child tax credit is worth up to $2,000 for each qualified dependant under the age of 17 for the 2023 tax year.

- The credit amount is lowered if you earn more than $400,000 (spouses filing jointly) or $200,000 (all other filers).

- Although the credit is nonrefundable, certain taxpayers who file in 2024 may qualify for a limited refund of up to $1,600 through the increased child tax credit.

What about International Students?

If you’re a foreign student, then this segment is for you. There exist specific laws that regulate the taxation of the money of foreigners temporarily staying in America, including learners, trainees, scholars, teachers, researchers, or exchange visitors.

International students will have to prepare taxes if they have the following:

- Any source of funds that is taxable under the IRC.

- A taxable scholarship or fellowship grant.

- A sum that is partially or fully free from tax under the conditions of a tax agreement.

Foreign students won’t have to prepare taxes if they have the following:

- Income sources outside of the US.

- Interest earnings from a US bank, American savings and loan organization, American Credit Union, or American insurance firm.

- An investment that generates portfolio interest.

- Any other money source exempt from taxation under the Internal Revenue Code. The income that is untaxed must still be recorded on a US income tax return.

Remember that each student has a particular status and tax requirements. Go ahead and determine yours according to the aspects we’ve enumerated!

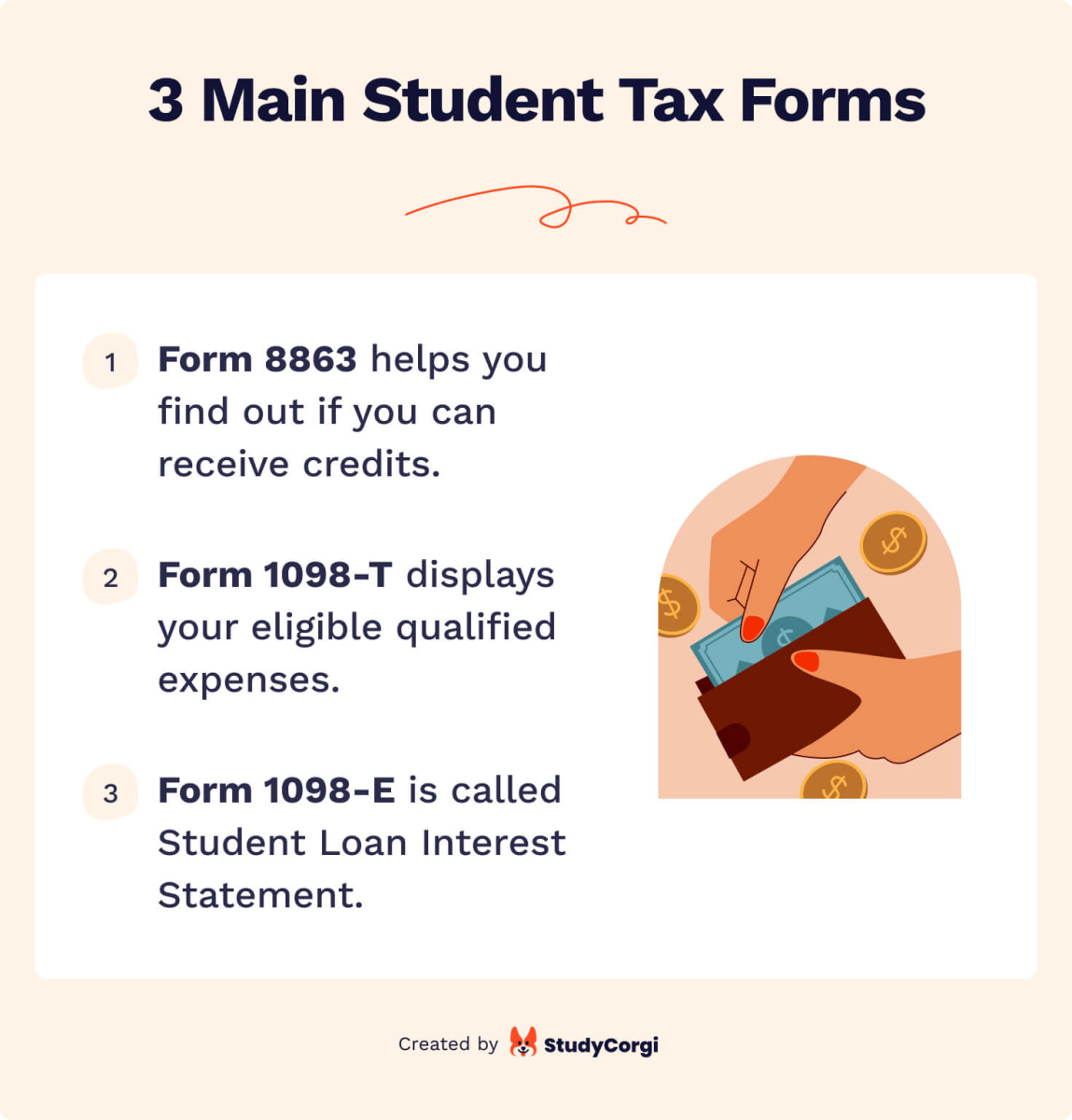

✍️ Student Tax Forms & How to File Them

Now we’ve come to the most helpful segment of our article. Here, we will detail how to prepare your taxes and correctly fill out the required blanks and forms. This task may seem confusing initially, but worry not: we will help you figure it out!

The college student tax filing system has different forms that you’ll need to complete and transfer to the IRS. These documents may be obtained from your college, place of work, loan company, or any financial body where you hold a retirement account. April 18 is the deadline to send completed forms to the IRS via e-mail or delivery. Now, let’s examine the papers you’ll need to file.

Form 8863

You use form 8863 to figure out if you can receive education credits like the American Opportunity Tax Credit or the Lifetime Learning Credit. If you haven’t previously heard of them, here’s what they represent:

🇺🇸 American Opportunity Tax Credit (AOTC) can lower your taxes sum by up to $2,500 per individual.

⭐ Lifetime Learning Credit (LLC) can decrease your tax liability for the expense of completing a post-secondary program by up to $2,000 for every tax return.

Sounds interesting? Getting one of these beauties is fairly easy. You must simply fit some specific parameters that we review below.

Can You Claim an Education Credit?

To learn whether you might get the American Opportunity Tax Credit, check out the list below.

You can claim the AOTC if:

- You are (or have been) a student pursuing a degree from an accredited school.

- You are an undergrad and didn’t finish the first 4 years of post-secondary study.

- Your MAGI is $180,000 or lower if you’re married filing jointly and $90,000 or lower if you’re unmarried.

- You’re eligible only for a lesser portion of the credit if your MAGI is between $160,000 and $180,000 for joint filers and between $80,000 and $90,000 for single filers.

You can’t receive the AOTC if:

- You’re listed as someone’s dependant.

- Your marital status is filed separately.

- You (or your spouse) did not choose to be regarded as a foreigner while you were a non-resident.

- You’ve already applied for the American Opportunity Credit.

- Your MAGI is higher than $180,000 if you’re married filing together and $90,000 if you’re single.

And here are the criteria for the Lifetime Learning Credit.

You can claim the LLC if:

- You (or your dependent) are (or have been) a student enrolled in a course during the tax year.

- Your MAGI is $180,000 or lower if you’re married filing jointly and $90,000 or lower if you’re single.

- You’re a student pursuing any level of education, including part-time or non-degree courses.

You can’t claim the LLC if:

- You’re listed as depending on someone else’s tax return.

- Your marital status is filed separately.

- You (or your spouse) did not choose to be regarded as a foreigner while you were a non-resident.

- You’ve already applied for the American Opportunity Credit.

- Your MAGI is exceeding than $180,000 if you’re married filing jointly and $90,000 if you’re unmarried.

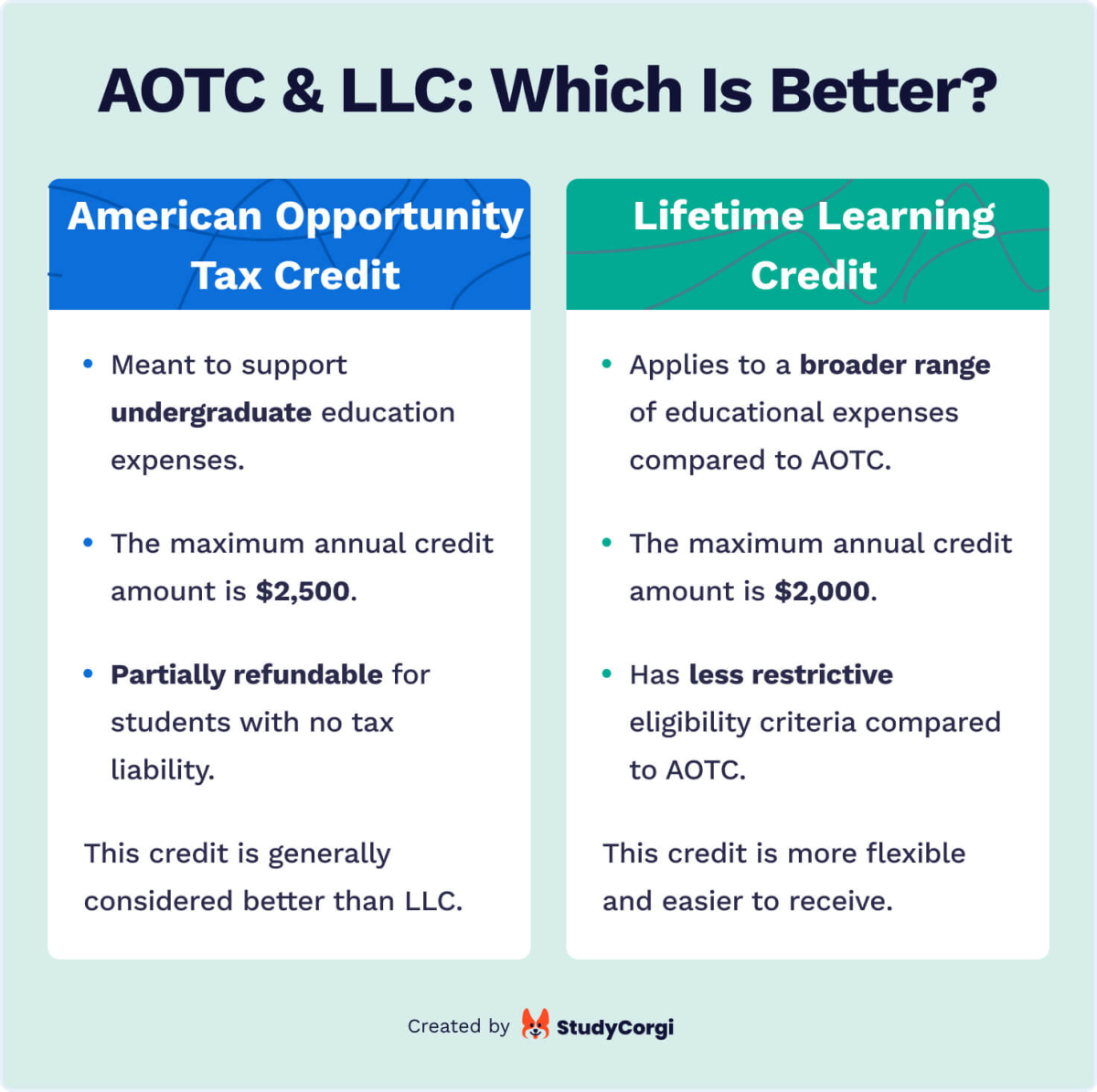

AOTC & LLC: Which Credit Should You Claim?

Both credits are great, but unfortunately, you can’t select both. Let’s check out their advantages and possible impediments:

American Opportunity Tax Credit:

- Covers up to $2,500 for the cost of tuition, fees, and supplementary materials for each student during the tax year.

- This credit is also 40% refundable up to $1,000, so you’d still receive funds even if you don’t owe taxes.

- You can’t claim it if you’re married filing separately or if you’re dependent on another taxpayer’s return.

Lifetime Learning Credit:

- This credit is valid for post-secondary education and courses that develop employment skills.

- Also, a felony drug conviction does not disqualify you from LLC.

- With this credit, you can deduct up to $2,000 from eligible education costs.

There is no universal strategy for choosing your first credit. Overall, the AOTC is considered a better option, and most people take it first. Nevertheless, its criteria are very straightforward. That’s why if you don’t meet American Opportunity Tax Credit conditions, then go for Lifetime Learning Credit.

Claiming an Education Credit

So, you’ve checked that you’re eligible, calculated your MAGI, and are set to grab your credit. Now, let’s determine how to actually obtain it. Just follow our explanations below.

The first step is to calculate your MAGI correctly. Here’s how:

- Count your yearly income (everything you’ve earned from salaries, compensations, tips, interests, etc.)

- Determine your AGI (your yearly earnings minus all the taxes.)

- Take your AGI number and add deductions to it.

Now, you’re ready to claim your credit of choice!

🇺🇸 To get the AOTC:

- Obtain form 1098-T from an approved educational institution. Students can get this document from their school by January 31.

- Make sure the form 1098-T you received is accurate and correct.

- Contact your school if you think something is wrong.

- Remember to calculate your MAGI and check if you’re eligible.

- Finally, you must complete form 8863 and attach it to your tax return.

⭐ To claim the LLC:

- Get form 1098-T from an approved educational institution. It can be collected from your university by January 31.

- Verify that the document you received is correct.

- Calculate your MAGI and check if you’re eligible.

- Fill out form 8863.

- Attach the completed form 8863 to form 1040 or form 1040-SR.

We suggest you preserve all copies of the documents you have used to prove your eligibility. The IRS can decline your request and state that your credit claim is inaccurate and that you lack the supporting materials to demonstrate your eligibility. In that case, you’ll have to send back all the money you’ve improperly received.

What Should You Do with Form 8863?

If you meet the required parameters for either AOTC or LLC, you can complete the two-page form 8863 and attach it to your tax filing. An online calculator will show you the sum you’ll be able to receive after providing your name and Social Security number. You’ll also need to ensure your MAGI doesn’t exceed the specified sum.

Make sure to fill out the form correctly according to the regulations! Otherwise, you won’t be able to claim the credit and receive tax benefits.

Form 1098-T

Completed form 8863? Great! Now, let’s examine the next document required for claiming the AOTC or LLC credit—form 1098-T.

1098-T is used to display your eligible qualified expenses, which is an amount paid for tuition, fees, and similar study-related services. Other things, like lodging, transportation, and comparable personal charges, are not eligible. Therefore, they won’t appear on your form 1098-T. Expenses for continuing classes that aren’t for academic credit might also not be considered eligible.

Will You Get This Form?

You’ll need to obtain form 1098-T from an accredited educational institution to claim the AOTC and LLC credits. The school must report these forms to both you and the IRS.

However, there are some circumstances in which your college is exempt from submitting a 1098-T, including the following:

- You didn’t receive any academic credit for a course you took.

- You are a foreigner.

- Your tuition and other costs were covered by your institution or by scholarships.

- Your tuition was fully covered by a company or a governmental organization, such as the Department of Veterans Affairs or the Department of Defense.

If you feel like there is a mistake and you were on the list to receive 1098-T, then reach out to your school and double-check their postal address. They will likely have your document.

What Does It Include?

Form 1098-T consists of 10 numbered boxes along with several fields for basic identifying information.

Here is what each section should contain:

- Identifying information. This includes the name of the school sending the 1098-T, its address, phone number, and tax identification number. Additionally, an extra field is provided for the student’s account info.

- Student details. Here, you write your name, address, and tax ID.

- Box 1. This box sums the total amount of all payments made by you to the school throughout the calendar year for eligible tuition and related expenditures, subtracting refunds.

- Box 2 and 3. Before 2017, schools had two options for disclosing costs: using the amount the student paid over the year or the amount the school billed. As of 2023, Box 2 is no longer used, and schools must instead report received payments in Box 1. The form still lists both boxes, but nothing should be written here.

- Box 4. This box is meant for recording an adjustment the school made for a previous year.

- Box 5 and Box 6. Box 5 lists any grants or scholarships the institution processed and used to offset your tuition throughout the tax year. Box 6 displays modifications made to said scholarships or grants.

- Box 7. If a portion of the tuition you paid during the tax year was applied to a semester beginning in the following year’s first quarter, the school will note that in this box.

- Box 8. The school should fill in this box if you were enrolled at least half-time during any academic session that started the current year.

- Box 9. Checking this box means you are a graduate student.

- Box 10. Only insurers that provide reimbursements or refunds for acceptable tuition and associated costs should fill this box in.

What Should You Do with It?

If you received form 1098-T, have it available when you’re ready to complete your federal income tax return, calculate your MAGI, and apply for education credits.

Determine the credit you can claim by using the data on the 1098-T form. Check out the prerequisites to find out who is qualified to claim the education credits. Just be careful not to claim them twice by including your parents’ return alongside yours (if you file as a dependent.)

Form 1098-E

You’ve completed forms 1098-T and 8863, but there is a third document lying on your desk—1098-E. What is it for?

Well, anyone who spent at least $600 on a student loan will get a 1098-E from the loan servicing company. You can use this form to deduct money from your federal tax return.

Will You Get This Form?

A copy of 1098-E will be given to you by the organization to which you pay your tuition loan. You can get more than one 1098-E if you paid a federal loan servicer interest of $600 or more to multiple loan services during the fiscal year.

To verify whether you are fit to receive 1098-E, consider the following:

- If you paid interest of $600 or more, your existing federal loan servicer should offer you a copy of your 1098-E. Your 1098-E may be delivered online or by US mail from your servicer.

- If you paid interest of $600 or more to each of your federal loan servicers, they will each hand you a copy of your 1098-E.

How Do You Get This Form?

The simplest way to get the 1098-E form is to ask your loan servicer. It’s also available to download on the webpage of your servicer.

Check StudentAid.gov and get all the info if you don’t know who your servicer is. You can also dial 1-800-433-3243 to contact the Federal Student Aid Information Center.

How to File This Form

You’re almost there! Next, you just need to complete the form and send it. But first, check out our handy guidelines that will help you fill out your 1098-E correctly:

- Write your name, address, and phone number on the corresponding fields of the form 1098-E.

- If you have numerous accounts and are filing more than one 1098-E, add all the account numbers. The IRS also advises providing an account number for each form you send.

- Enter the interest that you paid on student loans during the year. For loans provided after September 1, 2004, you must add interest payments in box 1 as outlined in Regulations section 1.221-1(f). According to that principle, interest includes loan origination costs and capitalized interest, which are fees for using or withholding money.

- If capitalized interest or loan origination fees are not recorded in box 1 for loans prior to September 1, 2004, check box 2.

Your form is now done!

Additional Student Tax Forms

Aside from the forms we’ve enumerated, you might encounter some more documents. Let’s see what those are for.

- 1042-S. This form is similar to the 1040 but is used by international students only. It helps to record all your earnings that your employer will send you. Your college would mail you this form if you received any grants.

- W-2. Your employer is expected to provide you with a W-2 if you earned $600 or more during the previous year. This form will detail any income tax withholding that occurred.

- W-7. Fill out this form to request or renew an ITIN (individual taxpayer identification number.) Include it on your tax return when you send it. If you have a valid SSN or ITIN, you don’t need to fill out this form.

- 8843. This form must be prepared and submitted to the IRS by international students without income in the United States.

- State tax return forms. These are different forms that each state has. They’re used by residents, non-residents, and part-year residents.

Congratulations! You’ve conquered the tax forms! From now on, you will be okay knowing what to do with all the papers the IRS sends you. Hooray!

🎉 Important Benefits Related to Student Taxes

We’ve covered all the basics, so the boring part is over. Now that you’ve understood the fiscal system, it’s time to make money off your taxes! In this next segment, we’ll reveal many exciting ideas and lifehacks to help you use the tax system to your benefit.

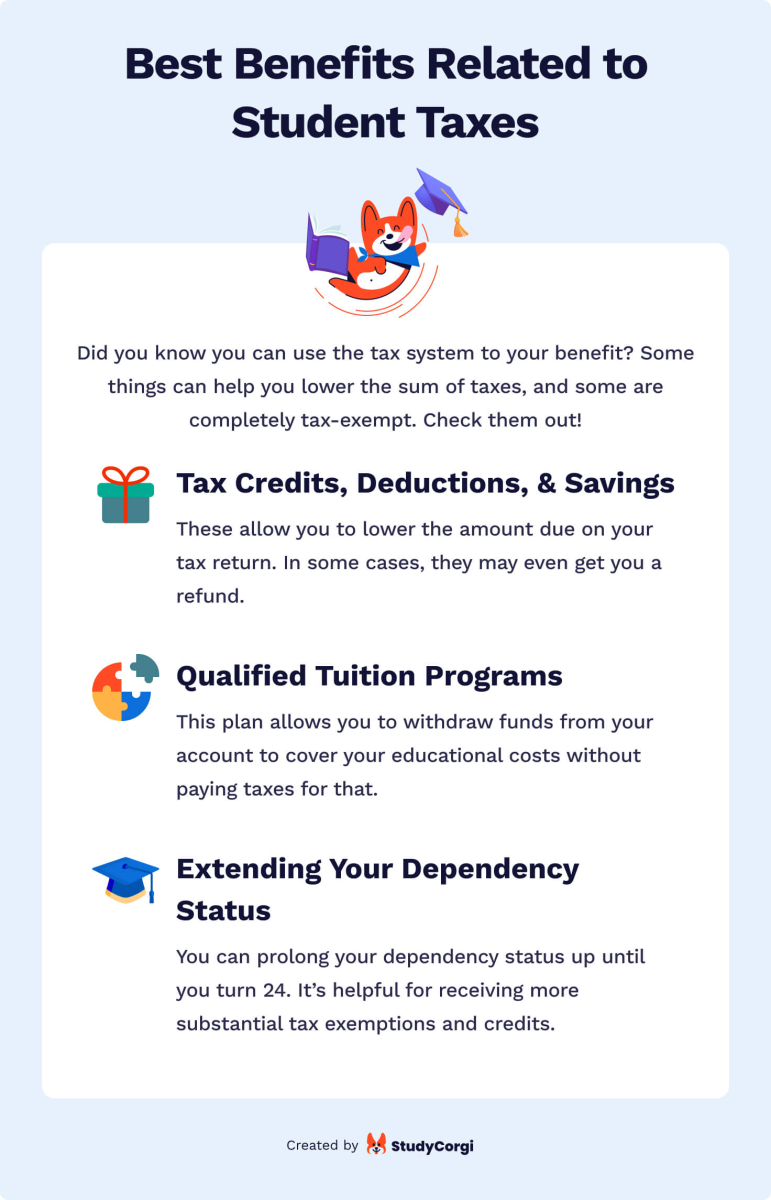

Tax Credits, Deductions, & Savings Plans

Did you know that taxpayers can cut their higher education costs through tax credits, deductions, and savings plans? Check this out:

- Tax credits can help you pay lower income tax by curtailing the amount due on your tax return. If the credit cuts your tax to less than 0, you can potentially get a compensation.

- A deduction decreases the share of your money that is taxable, reducing the total tax you owe as a result.

- Some savings programs allow tax-free distribution from your bank accounts.

You won’t owe income tax on the benefit you receive if it is excluded from your income, but you also won’t be able to claim it as a deduction or credit.

Qualified Tuition Programs

To help you save money for education-related fees, a state or school can give you a QTP/529 plan. This plan allows you to withdraw funds from your account to cover your educational costs while attending college or a career school without paying taxes. If you wish to use this benefit, educate yourself about state 529 schemes.

Extending Your Dependency Status

That’s not all of it—we have another beneficial option just for you! Would you believe that there can actually be an advantage to staying as a dependent while you’re in college?

Tax exemptions and credits are much more substantial for parents than students, making staying dependent a better option for the family. If you wish to use this strategy, note that you can officially remain dependent only until you become 19. However, you can prolong this status until you turn 24 if you start college. You would still be able to file taxes, but you must state on your tax return that another person claims you as a dependent.

Remember that if you plan on using this strategy, any credits or deductions your parents previously claimed on their tax return will be ineligible for you.

🚀 8 Best Tax Tips for Students

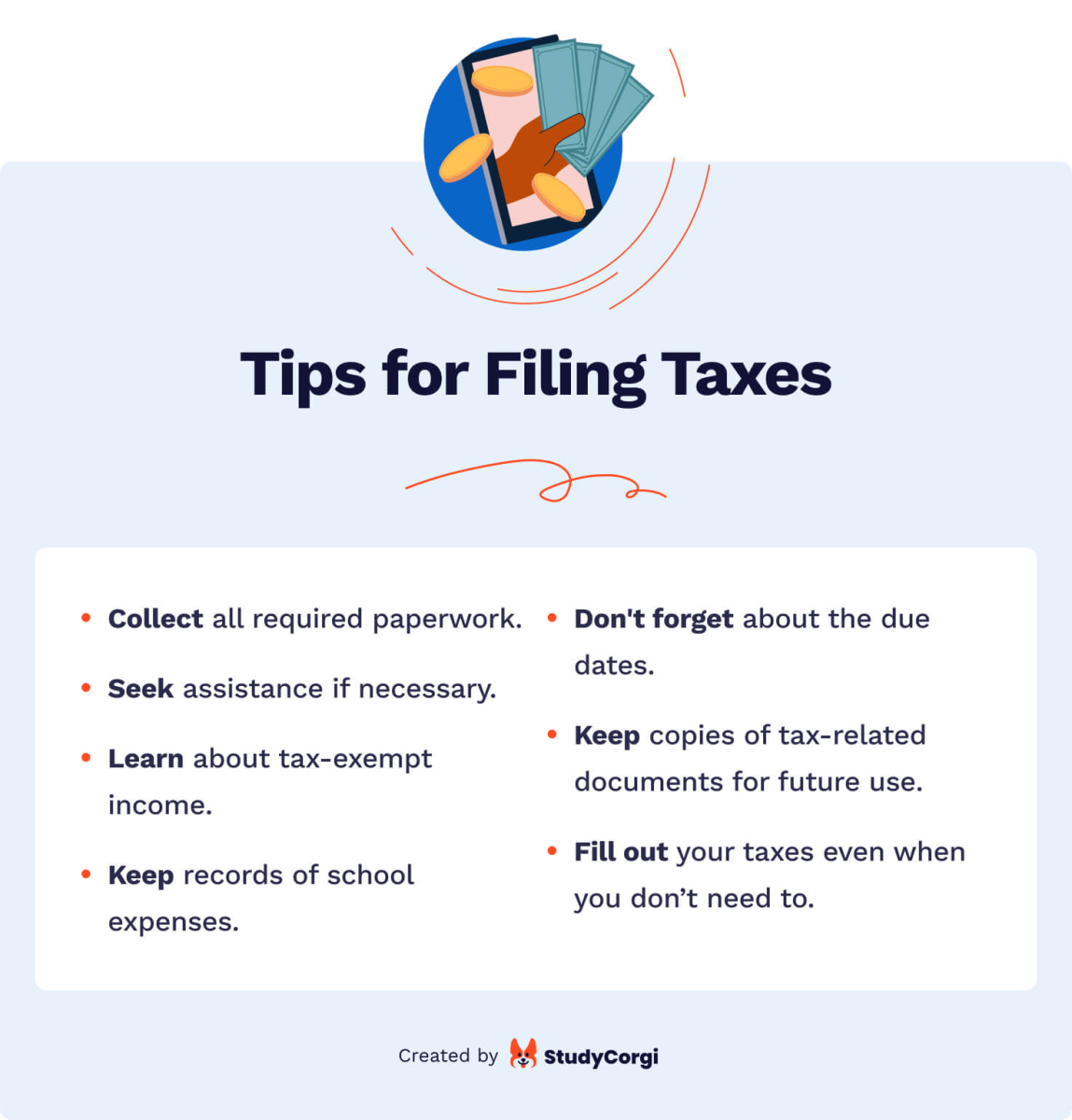

Want to handle your taxes even better? Check out our top tips to get you through your tax filing process:

1. Collect All Required Paperwork

Make sure you have all the required paperwork before submitting your taxes. This will help you save your time on preparations, and you will remember about all the forms when the time comes. The documents that you’ll need are:

- W-2 form from employment you had throughout the year.

- 1099 form for income from your workplace or freelance.

- Receipts for any tax-deductible expenses, such as books or computer equipment, as well as any paperwork relating to any scholarships or awards you may have earned over the course of the year.

- Your ITIN (individual taxpayer identification number) or Social Security number.

2. Don’t Forget about Due Dates

The tax filing deadline is in the middle of April. However, this date may change depending on the year and your particular situation. It’s critical to be aware of these deadlines and complete your taxes on time. Try to give yourself some extra time to better prepare for the due date.

3. Seek Assistance if Necessary

If you need help comprehending the filing specifics, try asking for assistance. The Volunteer Income Tax Assistance, among other tools provided by the IRS, can help you should you have any questions. Additionally, a lot of colleges offer students free tax preparation services. Trust us, seeking help is much better than suffering the effects of an incorrectly filed tax form.

4. Keep Copies of Tax-Related Documents

We advise you to keep copies of all tax-related paperwork, such as your tax return, forms, and any receipts for credits or deductions. Keeping meticulous records might make filing taxes in the future a lot easier. Also, it’s a fantastic idea to keep all of your invoices for supplies, equipment, and books. You can later use those for deductions and tax-exempts.

5. Familiarize Yourself with Tax-Exempt Income

Learn about possible tax repercussions of stipends, fellowships, grants, and scholarships. It’ll allow you to save money from tax-exempted programs to pay for tuition or cover your other expenses. If you want to maximize your tax-free income, ask your university to eliminate the requirement that your stipend be used for room and board.

6. Keep Records of School Expenses

We recommend you write a precise account of every penny you spend on study needs to guarantee that you don’t lose out on any educational credits or deductions. This practice not only ensures that you’re accurately reflecting your educational expenses but also empowers you to capitalize on the financial perks you’re entitled to.

7. Fill Out Your Taxes Even if You Don’t Need To

This will definitely give you an upper hand if you file your tax return even when you don’t have to. There’s always a possibility that you will become eligible for tax credits and refunds. In addition, it’s wise to start learning how to fill them out as early as possible, as this is a necessary lifelong skill.

8. Try Using Tax Software

For a college student, tax filing process may seem scary, especially the first time. Online software can significantly simplify the process of filing taxes and ensure you don’t overlook any credits or perks. We’ve collected some of the best tools and resources that will be a massive help to any student starting their tax journey. Check them out below!

🎁 BONUS: Helpful Tax Resources for Students

If you want to truly master the tax system, you’ll definitely benefit from informative resources and apps at your disposal. Use them to simplify the tax filing process and save you time!

- H&R Block. This website has a lot of valuable information about what to do in different situations associated with tax filing. They also provide some sources for other helpful apps.

- FreeTaxUSA. This is an excellent website that can streamline the tax filing process and provide you with step-by-step instructions and guidelines.

- IRS.gov. This is definitely the most informative tax website of them all. And the best part is that it’s actually owned by the US government. It’s full of valuable tips, guides, and instructions. Also, it shows only the most recent law regulations, so you’ll find only the most accurate information here.

- Cash App Taxes. This app allows you to file your taxes in mere minutes. Also, it’s 100% free with a Max Refund Guarantee.

- Turbo Tax Deluxe. This is another easy-to-use app with many advanced functions. It’s especially suitable for education expenses.

- Tax Calculator. This website is a must for everyone who wishes to file their taxes correctly. The tax calculator will help you determine the exact sum of your income taxes, deductions, and credits, plus it’s 100% free.

We hope you’ve enjoyed our guidelines and tips. The tax system and the process of filing your taxes may seem complicated initially, but once you get the hang of it, it’s a piece of cake. Use this article to use tax to your advantage, and have fun!