Introduction

Choice Hotels International, Inc. (CHH) is a hospitality holding entity intent on acquiring variegated shares for its brands, including Comfort Suites, Quality Inn, and Sleep Inn (Fraser, 2012). This paper enumerates a detailed analysis of the CHH Inc. by way of outlining its size and growth, industry classification, vision, mission, profitability, price factors, and guiding principles, among other important aspects.

Company Profile

As Orr writes, the conglomerate inaugurated its operations in 1939 when seven motel proprietors in Florida established a joint association as grounds for the incorporation of the CHH hotel institution (2013). The core objective of the partnership aimed at assimilating elevated services and quality standards into the hotel industry by exploiting the benefits of business alliances and unions. Sloat-Spencer (2013) asserts that the result of this undertaking has proved lucrative and rewarding as the present-day CHH reaps huge revenues and global recognition.

CHH, a subservient of Manor Care, Inc. (Orr, 2013), constitutes the second-largest hotel franchisor overlooking 6,200 hotels as well as 499,000 lodging chambers. The multinational, situated at Rockville, Maryland, franchises its hotel brands, instituted in 34 states encompassing the United States, Columbia, and Puerto Rico, among others (Maltbie, 2009). CHH adds to the list of flourishing hotel chains in the contemporary hospitality sphere as it implements luxurious and economical modes of operation.

Among other clientele, Choice Hotels holds senior citizens, expatriates, dignitaries, and business travelers in high esteem as regards provisions of business-class services and quality. As explained by Freed (2013), the corporation furnishes its franchisees with exceptional reservation platforms, quality assurance, and marketing programs in exchange for a licensing fee (3%-8%).

Industry classification

Choice Hotels International, as described by Orr (2013), lists under the lodging and travel stratum. The incorporation is a service-entailed establishment that functions to dispense leisure facilities and products. The company executives accommodate business travelers and dignitaries in respect of travel and lodging particulars and developments. Its constituent brand hotels, including Comfort Inn, Sleep Inn, and Mainstay Suites, entail restaurant service catering and facilities, targeting consumers and developers (Sloat-Spencer, 2013). The CHH Inc. also doubles up as a hotel franchisor with multiple franchise units spread in numerous jurisdictions, dispensing ‘economy’ hotel services ranging from lower scale to upper mid-scale properties.

Size and growth

Presently, Choice Hotels holds variegated franchise agreements and contracts, defining 6,372 operating hotels in conjunction with 516 restaurants under construction, outlines Freed (2013). Fraser (2012) attributes that the enterprises under construction are anticipating conversion or have received approval for erection as of 30 June 2014. The 6,372 subsidiary entities comprise 506,523 rooms, while the other 516 hotels consisting of 40,946 rooms established in the Columbia District, the USA, and in other 35 countries.

The brands encompass the Comfort Suites, Quality, Clarion, Comfort Inn, Ascend Hotel Collection, Econo Lodge, Rodeway Inn, Mainstay Suites, Sleep Inn, Cambria Suites, and the Suburban Extended Stay. CHH Inc. employs two strategic management skills for the efficient supervision and running of these products (Maltbie, 2009).

They include the direct and master franchising relationships integrated to recruit those partners equipped with professional asset handling capabilities, remarks Fraser (2012). The growth of the transnational company lies heavily on the forged master franchising affiliations to strengthen the financing capacity of funding and to build the brands into their pertinent markets.

Company Profitability

According to Orr (2013), company profitability embodies the financial metrics that gauge an entity’s ability to generate higher revenues against its expenditures and other germane costs. The return on stocks, equity, as well as profit margin, constitute the core financial metrics and ratios used for dissecting a corporation’s financial analysis and profitability (Porter, 2008). As regards the CHH Inc., the fundamental ratios and stats regarding its financial metrics are as follows (see Table 1).

Table 1: Profitability Ratios for the Period Ended March 2014 (Q1).

Source: Choice Hotels International Inc.: Financials 2015, para. 2.

Over the years, ranging from 2011, 2012, 2013, and 2014, the multinational corporation has continuously increased its revenue integers from $640.6M, $692.7M, $724.7M, and $758.0M USD, respectively. The corporation has also downplayed its overheads as regards the cost of commodities sold from 45.18% to 42.90% (Choice Hotels, 2015). This impressive cut of fees has facilitated bottom line progress for the entity from $113.7M USD to $123.2M USD, asserts Orr (2013).

The gross profits corresponding to the years 2011, 2012, 2013, and 2014 are $362.5M, $382.8M, $401.7M, and $439.1M USD, respectively (Choice Hotels, 2015). A review of all these statistics clearly depicts that the transnational entity is significantly profitable regarding its expanding gross profits and revenues over the past four years. The aggregate assets held by the incorporation attribute to $661.1M USD as quoted at the end of the first quarterly period- March 2015 (Choice Hotels, 2015). The total number of workforce enlisted in the business is 1,331 persons.

Factors affecting profitability

The factors influencing CHH Incorporation’s profitability constitute the risk elements capable of triggering adverse financial impacts on the company and its subsidiaries if not regulated. Outlined below are the risk factors whose effects could engender results that differ from those expressed in specified ‘forward-looking statements’ (Fraser, 2012).

- The Subsidiaries’ financial conditions. Decreases in the fiscal conditions of ancillary travel firms and incorporated franchisees minimize the overall gross income of CHH Inc.

- The rise in operating costs. The escalation of administration and selling expenses trigger lower operating (profit) margins.

- Operating capital inaccessibility. The absence of operating funds inhibits the firm’s developers and hotel managers from supporting relevant investments or building new hotel establishments.

- Fluctuation mannerisms of exchange rates. Unprecedented changes in exchange rates and prolonged economic weaknesses hinder domestic and international travel tendencies, thus affecting the hotel’s revenue.

- Business relationships. Inadequacies encountered in maintaining positive associations and partnerships with the franchisees’ managers precipitate poor business positioning and reputation. Furthermore, misunderstandings and fall outs between the CHH’s executive board and the suppliers affects the quality of the purchased raw materials.

- Consumer unemployment. Small numbers of product purchases by clients translate into diminished gains and profits on commodities and services sold.

- Diseases. The hasty conception of insect infestations and contagious diseases thought to be present in hotel rooms discourages travelers against booking into resorts.

- Travel advisories. The imposition of travel restrictions into selected jurisdictions by federal governments and state authorities discourages travel. These limitations result in consumer unemployment in the hotel industry.

- Rigorous legislations. Extremely rigid government regulations encompassing construction costs, maintenance & operating expenses, benefits, and wages suppress the smooth running of operations in hotels. The relevant authorities should thus Laxen the pertinent rules to facilitate smooth procedures and trade.

- Demographic aspects. Factors affecting room occupancy, rates, geographic location desirability, and market conditions precipitate lower leisure and corporate travel. The result is a gradually reduced need for lodging and other accompanying services.

Product segmentation

Choice Hotels’ management board has implemented two strategic models as regards product segmentation, namely the hotel franchising model as well as the SkyTouch Technology design (Choice Hotels, 2015). The franchising model furnishes 11 subsidiary brand names that spawn huge revenues by way of levying royalty fees. As detailed by Porter (2008), these costs and billings entail the initial commissions and the rolling fee compensation in combination with specified reservation system & marketing charges.

CHH’s production department allocates the various ticket and promotional charges depending on the franchisees’ aggregate room income (Choice, 2008). On the other hand, the SkyTouch Technology division configures and vendors cloud-based applications to hoteliers based on the choiceADVANTAGE platform attributes Freed (2013).

These capabilities embody mobile-native interfaces that facilitate mobile capabilities such as housekeeping, property management, occupancy, ADR, rate management, guest stays, and Availability for Tonight. Fraser (2012) adds that the SkyTouch OS model administers real-time support chats and onsite training that entails simulation-grounded eLearning components.

Degree of company concentration

According to Maltbie, the level of group concentration refers to the calculated technique employed to exploit a single commodity or market (2009). This tactic enables the involved enterprise to input more resources into the procreation and retailing of one product, waiving the perils of competition increments or demand cutback. Choice Hotel’s mainstay business concentration favors hotel franchising as opposed to direct ownership of the subunits (Fraser, 2012).

The franchising structure helps Choice Hotels to profit from the ‘economies of scale’ arising from the germane franchising transactions (Freed, 2013). Choice Hotels’ brand’s outlay services aimed at the middle-income and upscale patrons. The multinational’s moneymakers include the number and appropriate mix of franchised hotels, room rates & tenancy, and royalty fees write Sloat-Spencer (2013). Additionally, the subunit owners pay a 4%-6% of the yearly combined room revenue to account for the life of the engagement, details Orr (2013).

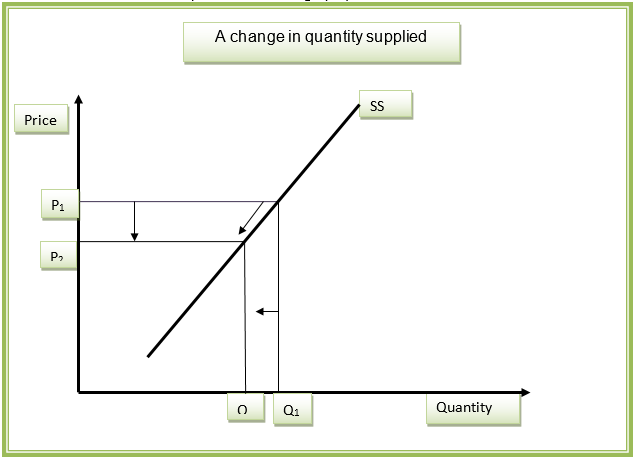

Price factors

Choice Hotels’ pricing strategies hinge on guest factors, the industry competition, and the demand & supply conception (Fraser, 2012). As regards demand and supply, analysts prompt hoteliers to manipulate the Property Management System and retract data that would help the executives know which market segment is most productive (Marketing, 2013).

Company vision

The stipulated vision is to beget the highest proceeds and yields on the investments incorporated for launching the varied franchise hotels (Choice Hotels, 2015).

Mission

Choice Hotel’s mission, as defined by Orr (2013), entails the delivery of a successful system and network of strong franchise brands that emphasize on ample consumer size and reach. The subsidiaries will comprise of commendable service quality, distribution, and scope that entices and gratifies guests while abating expenses for the hotel proprietors (Fraser, 2012).

Guiding principles

The corporation’s guidelines encompass appropriate values and cultures designed to equip the stakeholders with the conviction that projected accomplishment is attainable with considerable teamwork efforts. Regarding Sloat-Spencer (2013), the set principles and value-star standards reinforce the stakeholders to labor together in harmony to reach mutual goals and targets. People share articulated values, attitudes, and opinions intent on shaping and defining personalities, business operations, and ultimate prosperity (Choice, 2008).

External Environment Evaluation

The external environment evaluation of a business entity entails the contemplation of varied aspects such as competition, performance prospects, market positions, and the dominant economic constituents (Porter, Argyres, & McGahan, 2005). The external business environment comprises two paradigms, namely the general environment and the industry. As enumerated by Porter (2008), the general macro environment accommodates events and trends in the social, technological, economic, and demographics realms.

By contrast, the competitive industry environment takes into account the forces that drive firms in similar sectors to wrestle with each other by dispensing comparable goods and services (Porter, Argyres, & McGahan, 2005). Comprehending the external business environment helps to decipher the opportunities and threats encountered in the firm’s maneuvers and activities. This segment highlights the competitive industry environment of Choice Hotels Inc. by way of analyzing Porter’s Five Forces (see Figure 1).

Porter’s five forces analysis involves an outline structure that examines the intensity of competition within a trade as well as the business strategy advancement (Porter, 2008). The five forces constitute a microenvironment that influences an entity’s ability to attend to its patronage as well as create profits. According to Porter, Argyres, and McGahan (2005), business analysts employ these forces to prescribe the attractiveness of the specified trade industry.

The threat of new entrants

Porter (2008) articulates the ‘New Entrants Threat’ as the menace facing high-yield trades when budding individuals come aboard the market. The market access by many new entrants dilutes the profits and revenue-generation capability of the involved business units. Porter, Argyres, and McGahan (2005) identify some factors that can hamper this threat, namely rights & patents, capital requirements, absolute cost, economies of scale, brand equity, and government policies.

As regards the external environment situation for Choice Hotels, Orr (2013) points out that the hotel (franchising) commerce has relished in a substantial market progression over the past income years. The travel and tourism opportunities that come along with this hotel industry have conceived tremendous earnings and returns, thus serving as an enticing tool for new entrants eyeing the market (Porter, 2008).

Maltbie remarks that despite the setback impacted by the financial catastrophe, the general expectations are that the hospitality trade will continue accelerating (2009). The ‘new entrants’ threat manifests better in the Asia-Pacific locality as tourists voyage in high numbers and reveals new flight pathways (Marketing, 2013). The result is that numerous entrants sign up for the hotel industry in the form of small exclusive traders despite the uncertainty of their victory. In a corrective move, therefore, relevant authorities impose certain capital prerequisites, initial funds, product differentiation, and foreign investment restrictions to retain the escalated revenue gains (Marketing, 2013).

Threat of substitutes

The alternatives that compete against Choice Hotels comprise of camping sites, RV’s, and visitations to friends and families (Marketing, 2013). The mere presence of these equivalents proffers significant hazards to Choice Hotels’ income-generating activities as consumers resort to the alternatives. The identified driving factors attributed to switching to equivalents encompass product differentiation, substitute accessibilities, ease of substitution, buyer propensity, customer switching expenses, quality depreciation, and substandard merchandise.

Regardless, CHH’s threat of substitutes is quite small as its franchise hotels provide premium utilities and services as compared to outdoor camping and hiring of RV’s (Sloat-Spencer, 2013). The subsidiary hotels assimilate extra benefits that ratify customer satisfaction, such as spas, conference rooms, restaurants, and entertainment scenarios, attests Freed (2013). Further, the multinational’s trademark and brand equity nurtured in the past has grown so strong that it surpasses this threat.

Power of suppliers

The bargaining power of providers takes into consideration the characteristic traits and mannerisms of suppliers engaged in a market of varied businesses (Marketing, 2013). Suppliers include suppliers of labor, services, expertise, raw materials, and components. When plunged into congested markets, these suppliers may hoist the prices of their supplies or even refuse to associate with selected institutions (Porter, 2008).

Congested industries elevate the supplier power as they (providers) have a broad range of firms with whom to work. In the context of CHH’s supplier power, the sellers’ privilege is somewhat temperate owing to the outlaid advantages, announces Freed (2013). CHH’s suppliers entail developers, real estate agencies, marketing companies, architects, property owners, and food suppliers, among others (Orr, 2013). Since the hotel industry is labor-intensive, CHH has implemented competent strategies to bargain with the suppliers above.

Fraser states that the corporation’s managers utilize advanced technology systems to locate, probe, and manage exemplary property suppliers whose provisions will complement the hotel’s reputation (2012). The prospecting of property equipment sellers in the midst of developing new franchisees ensures that the incorporation attains a high degree of quality and success.

Power of consumers

Also referred to as the market of outputs (Marketing, 2013), the bargaining power of buyers embodies the external coercion and persistence placed upon business entities by buyers to condense product prices. The market of outputs convenes on the clientele sensitivity to price fluctuations and other factors such as bargaining advantage, information availability, substitute merchandise, and customer value.

According to Porter, Argyres, and McGahan (2005), the consumers’ bargaining power becomes high if the market consists of multiple alternatives, allowing the clients to be choosy. In the case of Choice Hotels, the buyer power is modest as the organization relentlessly integrates strategic techniques directed at abating the bargaining power (Marketing, 2013). The executives of the transnational have labored to build a steadfast trademark and brand recognition across the globe (Fraser, 2012). CHH’s global credit and acknowledgment lure first-time patrons as well as repeat businesses that are out to deflect the trifling switching costs.

Additionally, the establishment works to achieve excellent innovations, including spas, gyms, and golf complexes, among other style designs to capture a vast consumer grouping despite the higher-priced services (Marketing, 2013). The emphasis on innovation creation lies in the valuation of the patrons’ needs, wants tastes, and preferences. Sloat-Spencer (2013) adds that the corporation strives to retain its current customer base and win over others through the implementation of new tactics such as loyalty programs to lessen buyer power.

Intensity of rivalry

The intensity of rivalry consists of the relentless efforts by the distinctive entities to surpass and outsmart each other (Marketing, 2013). Porter (2008) catalogs the agents of intense rivalry as rigid concentration ratio, advertising costs, robust competitive methodologies, the degree of transparency, innovation advantages, and the antagonism between online and offline platforms. Choice Hotels’ threat of rivalry constitutes a balanced and bearable ratio owing to the pertinent logistical and financial agents (Marketing, 2013).

Regardless of the existent competitors such as Country Inn and Best Western, Choice Hotels, in its capacity as a hotel franchisor, has diversified its interests. The organization fixates on mid-scale as well as ‘economy’ service categories that fit travelers’ needs, looking for low tariff lodgings. Furthermore, the enterprise engages in international franchising of hotels in preference to outright property ownership.

According to Fraser (2012), this structure hatches numerous advantages for its employer as it incorporates a global footprint, among other elements. The global footprint agent capacitates diversification and increased earnings as the employees concentrate on returning the share repurchases and dividends to the stockholders. The proceeds acquired avail the prerequisite capital necessary for CHH to delve into other operations and acquisitions in conjunction with shielding the institution against volatile market circumstances (Marketing, 2013).

Identification of Differentiators

Differentiators encompass the distinctive features, aspects, and benefits accredited to an identified product or brand to help it outshine other commodities (Freed, 2013). Choice Hotels’ characteristic differentiators converge on a multipronged hotel technology space that comprises of mobile, big data, and cloud-based application trends (Sloat-Spencer, 2013). This revolution, which CHH’s CEO (Steve Joyce) credits as a premier module, disburses scalable property management systems to its franchisees.

These functionalities ameliorate on-site connectivity, data, technology architecture, and the mobile platform by way of engaging a Smartphone app. Freed maintains that one million subscribers had already viewed and downloaded the app even before its constituent subsidiaries unveiled the package, thus proving its prosperity (2013). The app’s objective is to empower room reservation and mobile booking, which it has triumphantly achieved, considering CHH’s 13% gross online proceeds retrieved from the mobile booking transactions.

An additional technology differentiator implemented by CHH is the revenue management tool denoted as the Rate Center. The Rate Center functions to forward signals to the franchisees’ hotel executives when the resorts are not capitalizing on the projected pricing strategy and proffers suggestions on the manipulation of rates (Freed, 2013).

Analysis of Internal Environment

The internal environment refers to the intrinsic events, agents, and conditions of an entity that impel its choices and procedures (Orr, 2013). These agents include employee behavior, leadership styles, organizational cultures, and mission statements. This segment evaluates the internal environment of Choice Hotels concerning the SWOT (Strengths, Weaknesses, Opportunities, and Threats) matrix. The SWOT matrix is a calculated planning methodology enlisted in the investigation of threats, opportunities, weaknesses, and strengths inherent in a business venture (Choice, 2008).

Strengths

Fraser (2012) defines strengths as those properties and traits credited to a company that proffers it with certain supremacies and eminence. Outlined beneath are the Choice Hotels’ intrinsic advantages (Choice, 2008).

- Diverse portfolio.

- Acknowledged operations in the United States.

- USA’s premier hotel chain entity.

- Inexpensive quality service that guarantees exemplary consumer experience.

- Easier expansion owing to the franchise framework.

- One of the greatest lodging franchisor.

Weaknesses

Weaknesses entail the instruments that present disadvantages to an enterprise compared to other businesses. CHH’s weaknesses are as follows (Choice, 2008).

- Credibility reduction due to overblown aggressiveness by the sales team.

- Minimal international presence as it heavily leans on the Indian market.

- Tricky to sustain control over all the subsidiaries (over 6,500 franchisees).

Opportunities

Opportunities highlight those aspects that the involved firms can manipulate to escalate their advantages. CHH’s identified opportunities include the below essentials (Choice, 2008).

- Service expansion.

- Rising revenue gains.

- Developing markets and extensions overseas.

- Package disbursement to encourage loyalty and promotional programs.

Threats

Threats constitute the parameters capable of engendering trouble for the firm. CHH’s threats encompass the following points (Choice, 2008).

- New entrants and competitors invading the trade market.

- Availability of equivalents including inns and local hotels.

- Buyer predisposition to veer towards other brands such as Best Western.

Competitive Analysis

Porter, Argyres, and McGahan (2005) assert that a competitive analysis is a business plan subsection formulated for the sole purpose of examining and dissecting your current and potential competitors. The competitive study endows knowledge on the strengths and weaknesses of your rivals and challengers, writes Porter (2008). This section focuses on three analytical techniques, namely the value chain, rivalry, and financial elements.

Value chain analysis

The value chain analysis is a medium that works to recognize the viable ways and means that will help you spawn value and merit for your patronage (Porter, 2008). This tool necessitates a significant input of expertise, knowledge, and time to deliver outstanding services and products. The value chain activities assimilated in Choice Hotels include hotel membership, guest engagement, employee recruitment (KPI scheme), synchronized inbound & outbound logistics, operations, and marketing procedures (Marketing, 2013).

Rivalry analysis

Rivalry analysis involves the evaluation of the existent competition among various businesses within a given industry, which takes the form of jockeying for positions (Porter, Argyres, & McGahan, 2005). It is imperative for a firm to curb against industry antagonism to ensure its continuity. Choice Hotels’ efforts in value augmentation of their products and services include product differentiation, brand identity, high switching costs, industry commitment, and informational complexity (Marketing, 2013). The conglomerate has also invested in cloud-based hotel technology, worldwide ‘economy’ franchising, price competition, ideal customer gratification, loyalty schedules, and promotional activities of their sales department (Freed, 2013).

Financial analysis

Financial analysts employ the economic analysis implement to scrutinize the liquidity, solvency, stability, and profitability of businesses before settling to invest in them (Sloat-Spencer, 2013).As of December 31, 2014, CHH’s net profits, revenue, and dividends were $112.6M, $757.97M, and $0.75 USD- the highest recorded metrics (Choice Hotels, 2015). These performance integers reveal that the conglomerate is indeed productive and fertile for investment.

Conclusion

In conclusion, Choice Hotels International is a dominating champion in the sphere of hotel franchising. This success is evident as per the strengths and opportunities listed above, the value chain & financial analysis, the profitability fractions, its size and growth, and the international eminence. However, the management board can improve its prominence by way of conducting leadership orientation, live training webinars, online courses, strategic sourcing, and consultations (Orr, 2013).

References

Choice Hotels. (2008).

Choice Hotels International Inc: Financials. (2015). Web.

Fraser, T. (2012). Choice’s winning ways. Hotel & Accommodation Management, 16(6): 17-23. Web.

Freed, J. (2013). The choice looks to technology as a differentiator. Web.

Maltbie, R. (2009). Choice Hotels: Outperforming its peers. Web.

Marketing. (2013). Web.

Orr, H. (2013). CHH- Choice Hotels International Inc.: Company analysis and ASR Ranking Report. Alpha Street Research Report. Web.

Porter, M. (2008). The five competitive forces that shape strategy. Harvard Business Review.

Porter, M., Argyres N., & McGahan, A. (2005). An interview with Michael Porter. The Academy of Management Executive 16(2): 43-52.

Sloat-Spencer, J. (2013). Stepping up. Hotelier, 25(4): 2-7. Web.