Executive Summary

Delta Designers is a sports footwear manufacturer known for its affordable and stylish products. This report analyzes the years 11 to 16 of Delta Designers, focusing on such topics as the company’s objectives, execution of its strategy, performance on the market, and future possibilities. The company went through an unstable period during these years, although it could recoup its losses from misaligned decisions through adjustments to its manufacturing, workforce, and marketing aspects. 3D printing technology was discussed as the innovation that has the highest potential for a disruptive impact on the footwear market. The report utilized Porter’s Five Forces, PESTLE analysis, SWOT framework, and McKinsey’s 7S model to analyze different layers of environments affecting Delta Designers.

Introduction

Delta Designers is a sports footwear firm that manufactures various shoes for reasonable prices.

Mission

We strive to ignite the spark of athletes worldwide by providing affordable brand and private-label sports footwear for all communities.

Vision

Delta Designers’ vision is to manufacture sports shoes and provide a variety of options that maintain a balanced quality-to-price ratio to obtain a high market share.

Values

The company’s primary value is accessibility, enabling everyone to obtain unique yet reasonably-priced sports shoes. Sustainability is among the top priorities, as it allows our company to create affordable products while leaving as little adverse impact on the environment as possible. The company also focuses on inclusivity, as we strive to provide products that will meet the demands of a vast portion of the customer base through designs suitable for each individual. Fairness is also crucial for Delta Designers, as our goal is to outperform our competitors through the hard work of our employees, whom we recognize as the backbone of our company.

Corporate Objectives

The company pursues a cost-optimization approach, which prompts us to strive for lower prices. Our primary objective is doubting our revenue in 6 years, which must be done alongside similar outcomes for our market share. The number of shoe pairs sold is expected to increase by 10% annually. At the same time, manufacturing costs must be kept below the industry average, which requires a decrease of at least 7% annually. Upholding our image rating at 90 or above is vital to promoting our values. Simultaneously, our goal in marketing is to explore the best path for our company to connect with its customers. Finally, an increase in investments to train employees by 7% can assist us with improving the quality of the product.

Business Strategy

Delta Designers’ approach focuses on maximizing production costs while providing customers with quality sports footwear. Our global low-cost leadership strategy prompts us to strive for the best ratio between quality and affordability. By prioritizing both factors, we aim to maximize our productivity and transfer these benefits to our clients. The manufacturing facilities of Delta Designers are located in North America and Asia/Pacific regions, which enables the firm’s products to reach its customers through both Internet and wholesale channels in a reasonable time period. We prioritize maintaining quality and production costs at the desired position to gain the largest market share.

Critical Decisions

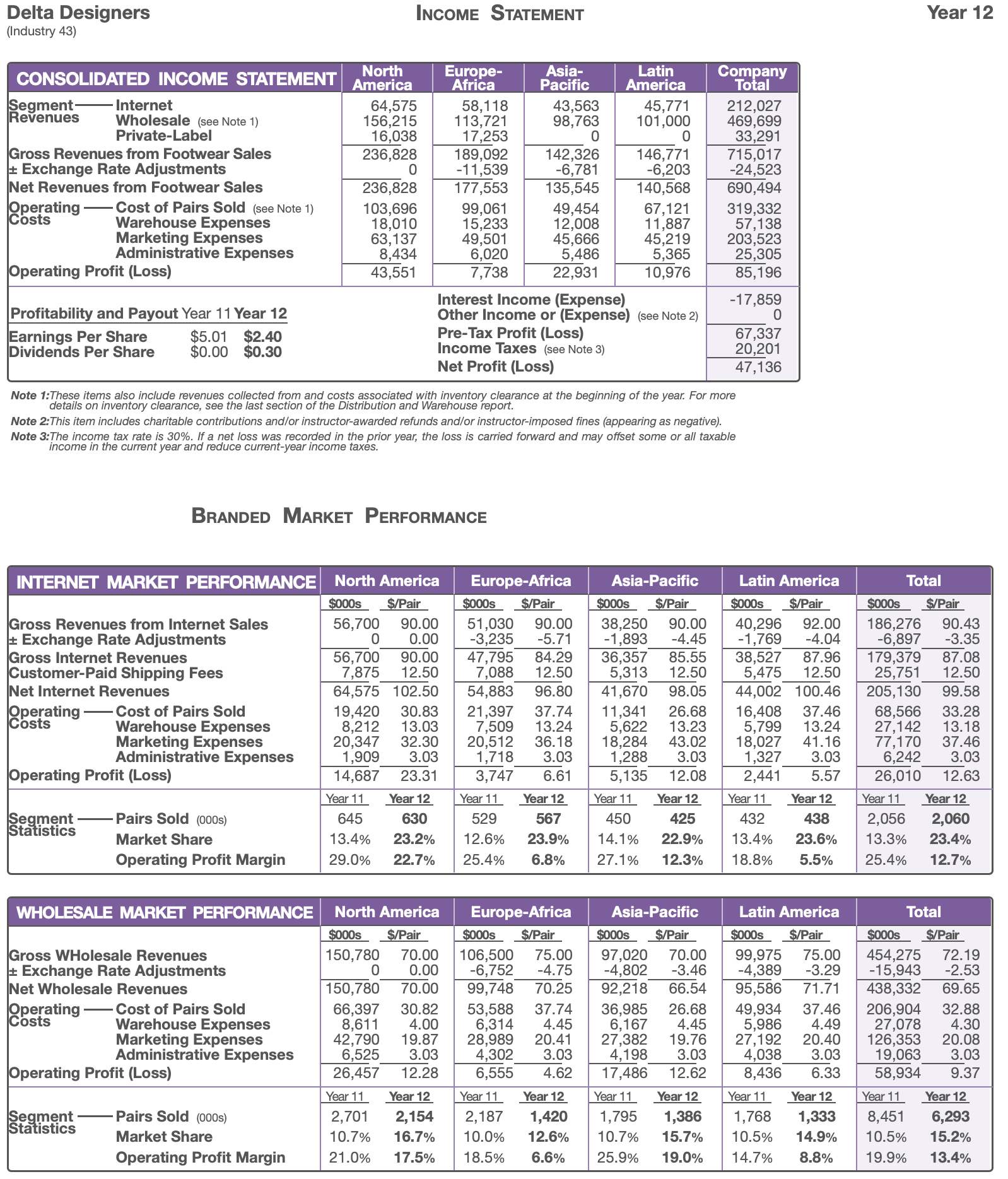

Due to the chosen business strategy, our firm has focused on low production costs throughout the first years of its existence, alongside creating high-quality goods within a reasonable price range. From years 11 to 13, we used superior materials in our footwear to establish ourselves as manufacturers of high-quality sports shoes. As seen in Table 1, year 12 was a deciding point in our strategy, as we previously increased our product prices alongside their quality. However, as a result, our goods became less desirable since they were less affordable for consumers. During years 12 and 13, the decrease in prices made our products more competitive, although it led to smaller margins, which, in turn, backfired due to the increased operation costs. The benefit of the captured market share led to an opportunity to explore the possibility of decreased product quality in year 14.

The use of loans also assisted the company with expanding its operations throughout these years without overburdening it with repayments. Loans in years 11, 12, 14, and 15 boosted our manufacturing facilities and allowed us to purchase production equipment without deflations. Moreover, our ability to repay past loans quickly indicates that the business is ready for expansion through investments and has stable growth. In fact, we can repurchase stocks in years 13-16 to maximize our profits and return on equity to obtain resources for expansion efforts.

Manufacturing branded sports footwear required significant facility investments, employee training and compensation, and marketing. However, Delta Designers was able to execute its strategy throughout the years, adjusting these parameters on the fly to remain within its desired position, except for years 13 and 14. The hit we took after the initial excessive focus on product quality did result in a decrease in revenue. Production equipment we purchased for both North America and Asia/Pacific regions during year 15 assisted us with meeting customer demands and capitalizing on this opportunity. Eventually, we were able to find a way to achieve a higher market share through Internet advertisements, which resulted in a boom in digital sales. Compared to year 11, our customers bought 110% more shoes online in year 16. Simultaneously, wholesale locations sold 25.6% more branded sports footwear than we produced in the same period.

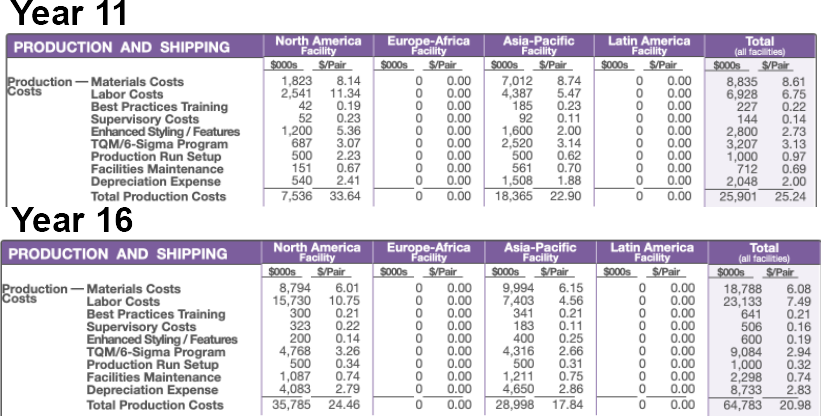

Sales from private-label operations became a stable addition to our revenue stream. As seen in Table 2, the cost of manufacturing per pair of shoes went down by $4.25, which enabled us to sell more products and double our revenue throughout this period. The quality of private-label sports footwear that we produce remained close to 5.0 S/Q from year 11 to 16, although we did lower it after the initial increase stemming from the use of superior quality materials. Our Asia/Pacific facilities have been performing exceptionally well, as their manufacturing facilities outperformed North American ones despite being slightly lower in quality. In turn, North American factories gave us access to markets where we could capture a significant portion of the local market share.

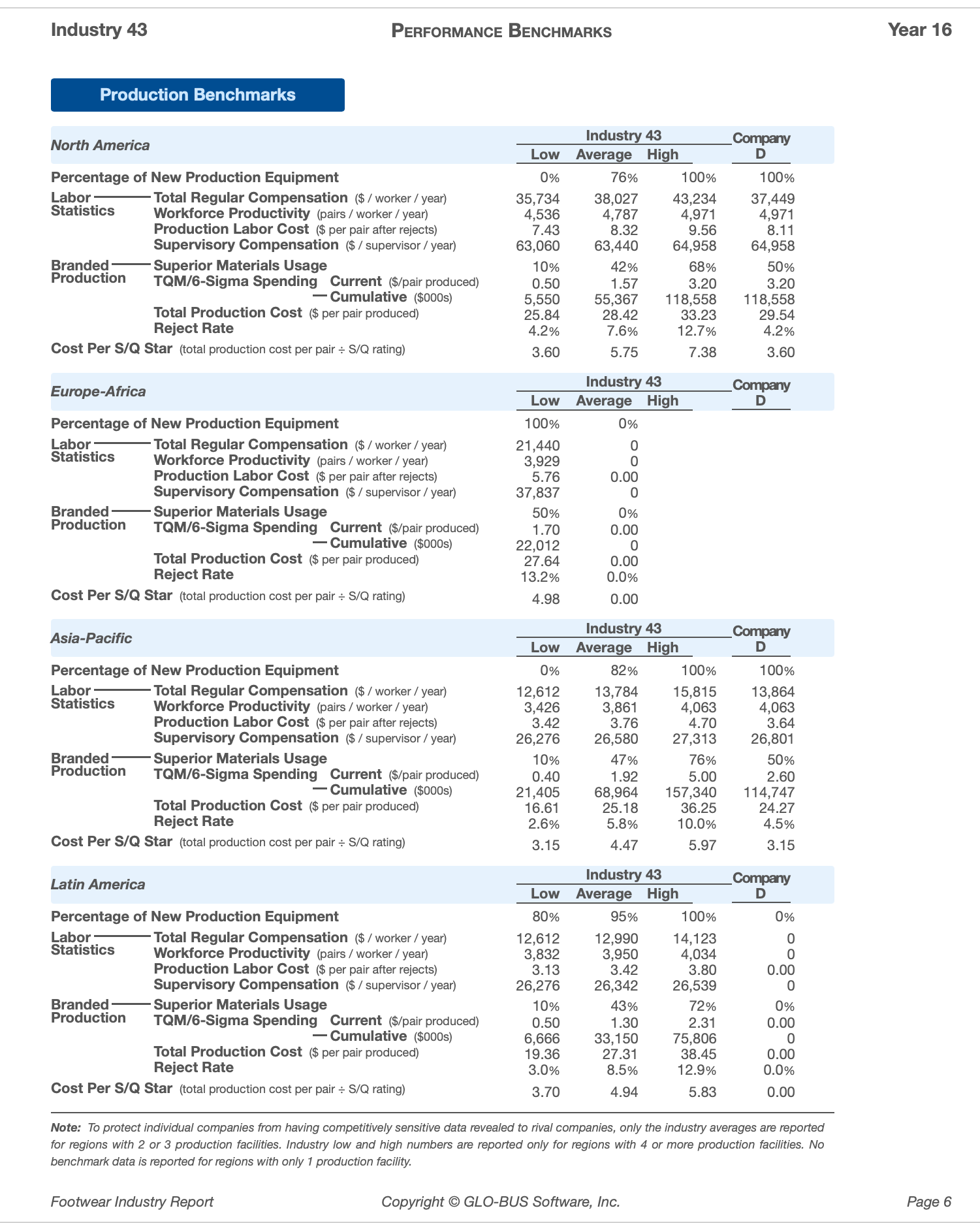

Our workforce was a critical part of our optimization strategies, as we were able to increase the quality and quantity of shoes produced through employee incentives. In conjunction with an increase in base wages, the decrease in incentive payouts stabilized the number of rejected pairs while giving employees 19.7% more compensation for their labor when comparing years 11 and 16. Throughout the years, we have increased the number of supervisors from 51 to 58, which allowed us to expand both the number of employees and the utilization of production capacity. As seen in Table 3, above-average compensations reduced the costs per S/Q star, boosting Delta Designers’ revenue significantly.

Internet marketing has proven to be an efficient marketing approach. By increasing our expenses on digital advertisements by 26-92%, depending on the region, we achieved the set goal of doubling the online market share, earning 10-13% in most locations. Even though we have attempted to utilize celebrity endorsements, expenditures on search engine advertisements have proven to be more fruitful in the long term. Marketing expenditures per pair of shoes have decreased after the initial spike, while we were able to preserve funds for future investments in search engine optimizations and brand ads.

Social responsibility initiatives also played a crucial role in our company. Throughout the years, the company has been utilizing recycled cardboard, although we had to switch to energy-efficient production instead. We strive to use close measurements of our environmental impact and adjust the sustainability initiatives accordingly. We are dedicated to helping communities across the globe through better salaries for our workers, improved S/Q of our shoes, and expenditures on Corporate Social Responsibility (CSR) investments. Our goal is to keep our CSR rating at 90 or above, which we almost succeeded at upholding, except for years 13 to 14, when our product quality took a hit.

Macro Environment

We have been analyzing outside factors that affect our firm’s performance in order to adapt to the global situation and developments that are out of our control. It became essential for Delta Designers to keep an eye on its competitors, market regulations, changes in regional economies, and customer trends. Political, economic, socio-demographic, technological, legal, and environmental (PESTLE) aspects were closely monitored, and Porter’s Five Forces model was applied. The assessment of macro environment factors from Figure 1 enabled Delta Designers to avoid taking significant hits during its production expansion.

The PESTLE analysis enabled Delta Designers to maintain a balance between investments in different aspects of business operations. Workforce training, salaries, and benefits were aligned with our company’s values, which enabled us to avoid additional adverse effects from external political factors. Simultaneously, technological aspects were taken into account as we prioritized digital expansion throughout the past six years.

Moreover, our CSR initiatives focused on socio-demographic factors that promoted equity and inclusivity. Economic fluctuations in regions prompted us to either expand or contract our manufacturing and marketing activities. The change in economic rates coincided with our decisions to reimagine production in terms of quality, which led to an amplification of its detrimental impact, although we were able to rebound from this situation.

As seen in Figure 2, the Five Forces model by Michael Porter was employed throughout years 11-16 to assess the competitive environment of Delta Designers. We took a focus on industry rivalry and monitored average prices as closely as possible, adjusting our processes to fit within the desired position. However, the threat of substitutes was miscalculated, as our costs soared due to the use of superior quality materials.

The disconnection between the firm’s values and its activities led to the loss of a significant portion of its competitive advantage, as other firms were able to keep their products cheaper and more accessible. As the average cost of materials decreased, our company was able to transfer this benefit to our customers and employees. Throughout the years 11 to 16, competitors were able to gradually increase the quality of their products in most regional markets. In turn, we worked on sustaining our standards while following other manufacturers’ trends.

Micro and Internal Environment

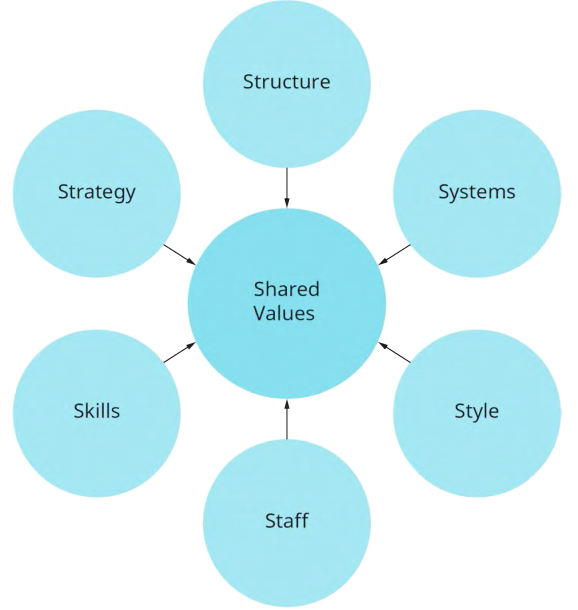

The internal situation of Delta Designers required constant monitoring and a solid focus on the alignment of its operations with the initially set goals. For this task, Delta Designers employed the SWOT analysis to determine what aspects are crucial for us to monitor, while McKinsey’s 7S model was used to assess its functions. It is possible to perceive how the downturn of the firm’s activities is linked to its deviation from its values and a missed opportunity that opened up the field for Delta Designers’ competitors to gain the upper hand.

The SWOT assessment gave Delta Designers a clear view of the priorities that would capture a greater market share. Throughout these six years, our company was able to play on its strengths by adjusting its manufacturing processes and gradually decreasing the costs of production while using online marketing as a path to connect with consumers. However, the weaknesses that were identified in Table 4 did backfire, as the company suffered a downturn stemming from the imbalance of priorities. Simultaneously, our competitors were able to follow their business strategies consistently, leaving us to adapt to their progress. However, we were able to use the opportunity to explore the digital market and capture a significant market share through online channels.

Table 4: SWOT analysis of Delta Designers.

As seen in Figure 3, the 7S model proposed by McKinsey provides an outlook on Delta Designers’ internal activities. With a solid focus on the company’s values, each component can perform better, as can be seen in the example of a temporary downturn experienced by Delta Designers during its deviation from its vision (Bright & Cortes, 2019). The style rating of our products remained consistent throughout the years, giving us the resources to improve on other aspects of our operations. The systems that were put in place provided a solid foundation for our starting position during year 11, although we had to realign them again after the disastrous continuation that pushed us back.

In turn, Delta Designers prioritized cost optimization strategies by inspecting and improving on all factors involved in the manufacturing and marketing of our products. The skills of our workers were a focus during the first years described in this report. The quality and affordability of our sports footwear have seen a gradual improvement after the corrections made to the alignment of our corporate culture with the values on which we are based.

Emerging Technology

Among the emerging technologies, 3D printing has the highest potential to disrupt the footwear market. First, this innovation enables firms to reduce the time to produce prototypes by a significant amount of time, allowing footwear designers to see their shoes live almost immediately (Ukobitz & Faullant, 2021). Cooperation with users of Delta Designers products is critical for our long-term success. Innovations that move companies toward user-centeredness are projected to claim a major portion of the footwear market in the near future, which makes it essential for our company to seek the possibility of implementing 3D printers into our manufacturing processes (Fu, 2023). In the following years, the industry is bound to be disrupted by the widespread use of such devices.

However, 3D printers are not currently widely implemented across footwear facilities. 3D printing is projected to enable a high degree of cost optimization within the fashion industry. Since this market relies heavily on the manufacturing of custom products, such a mode of production can give footwear companies a competitive advantage. Moreover, 3D printing enables firms to create molds suited to each client’s demands in a matter of hours, and this gap will grow smaller as technological progress continues (Ukobitz & Faullant, 2021). Therefore, Delta Designers must strive to implement this technology among the first to increase its market share.

It is necessary to comprehend the impact of 3D printing on the competitiveness of manufacturing facilities in different regions. Currently, there are barriers to the adoption of this technology in countries where most manufacturing facilities are located, although this situation is going to change with the development of cheaper 3D printers (Ukobitz & Faullant, 2021). Since Delta Designers has a major portion of its manufacturing done in Asia/Pacific regions, it must strive to become the first to adopt it there for tremendous competitive advantage. As a global sports footwear producer, Delta Designers should be able to invest in 3D printing equipment, as our current situation allows us to increase expenditures for future growth.

Conclusion

In conclusion, Delta Designers is positioned to create a unique value for its customers through cost-optimization for both brand and private label footwear, despite its struggles with its pricing strategy that would align with the company’s values. Throughout the years 11 to 16, the company almost doubled its revenue in nearly all sectors except wholesale, which enabled it to increase its net profit by 36%. Delta Designers went through a rough period in years 12 through 14, although we managed to rebound and are now on a path to stable growth. The issues that put us aside were eliminated via intelligent production cost optimization and digital marketing.

There are lessons that were learned from this experience, including the value of workforce management, optimization of manufacturing processes via asset and inventory adjustments, and the challenges of advertising through the most feasible channel. Both branded and private contracts open up the possibility for Delta Designers to capitalize on the differentiation approach to marketing, as it gives the most expansive reach possible. After these six years, our clients are able to enjoy footwear with reasonable quality at prices below the industry average. Without the assessments conducted throughout this period, Delta Designers would be unable to remain competitive, as the footwear market has shown to require a high degree of adaptability from its players.

Innovations, such as 3D printing, are about to change the landscape of the footwear industry. This technology has the potential to give manufacturing companies the capabilities for customizable products on a large scale, which will push designer-made shoes to a new level. It is essential that Delta Designers remains at least on par with its competitors in terms of the introduction of 3D printing into its production chain, as it has major potential for disruption. In the future, Delta Designers will strive to pursue cutting-edge technologies that align with its vision in order to make a more significant impact on society through its sports shoes.

References

Bright, D.S. and Cortes, A.H. (2019) Principles of Management. 2nd edn. OpenStax.

Fu, X. (2023) ‘Research on sports footwear brand image based on service design’, Highlights in Art and Design, 1(3), pp. 148–150. Web.

Ukobitz, D. and Faullant, R. (2021) ‘Leveraging 3D printing technologies: The case of Mexico’s footwear industry’, Research-Technology Management, 64(2), pp. 20–30. Web.