Rights issues

Selling of ordinary shares to the existing shareholders of the company to raise capital is called right issues. The law necessitates that the new ordinary shares must be first issued to the existing shareholders on a pro rata basis. Shareholders through a special resolution can forfeit this pre-emptive right. Obviously, this will dilute their ownership. A company can make rights offering to its shareholders after meeting the requirements specified by the Securities and Exchange Board of UK (SEB, UK). Those shareholders who renounce their rights are not entitled for additional shares. Shares becoming available on account of non-exercise of rights are allotted to shareholders who have applied for additional shares on pro rata basis. Any balance of shares left after issuing the additional shares can be sold in the open market.

The provision is that share may be traded (bought and sold) a few days before the holder-of-the-register-of-members date and it may not be transferred and registered in the new name. The rights might then be imperfectly sent to the old shareholder. If the share is traded within the ex-rights date, it will be duly registered in the name of purchaser. The ex-rights date occurs a few days prior to the holder-of-the-register-of-member date. This implies that after the ex-rights date the share sells without the rights. The price of the share before the ex-rights date is called as right-on or cum-rights while the price after this date is referred to as the ex-rights price.

Along with the letter of rights, four forms may be sent. Form A is intended for accepting the rights and applying for additional shares. Form B is meant for the purpose of forgoing the rights in favour of other person. Form C has to be used by the person in whose favour the rights have been renounced for making application. Form D is for the purpose of requesting for the split forms. When rights are offered for raising funds, three issues are involved:

- the number of rights needed to buy a new share,

- the theoretical value of a right, and

- the effect of rights offering on the value of the ordinary shares outstanding.

Right Issues of RBS

Let us assume that RBS announces on 2nd January 2004 that all Shareholders whose names are in the register of members as on 25th February 2004 will be issued rights, which will expire on 10th march 2004. The company will mail the “letter of rights” on 5th April 2004. In the example, 2nd January 2004 is the announcement date; 25th February 2004 is the holder- of-the-register-of-members date, 5th April 2004 is the offer-of-rights date and 10th march 2004 is the expiration-of-rights date. It may be possible that the share may be traded thought and sold) a few days before the holder- of-the-register-of-members date (5th April 2004 in the example), and it may not be transferred and registered in the new name. The rights then be wrongly sent to the old Shareholder. If the share is traded within the ex-rights date, it will be duly registered in the name of purchasers. The ex-rights date occurs a few days prior to the holder- of-the-register-of-members date. This implies that after the ex-rights date the share sells without the rights. The price of the share before the ex-rights date is called as right-on or cum-rights while the price after this date is referred to as the ex-rights price.

The Value of a Right

To evaluate value of a right need following steps-

- Determine the number of new shares to be issued:

No. of new shares (s) = (Desired funds/Subscription price)

- Determine the number of rights:

No. of rights = Existing shares (So)/ New shares (s)

- After rights issue price of a share (Px):

Price of share after rights issue = (Existing shares x Current market price + New shares x Subscription price) + (Existing shares + New shares)

Effects on Shareholders

From the calculations of the value of a right when the share is selling ex-rights, or cum-rights, it should be clear that the existing shareholder does not benefit or lose from rights issue. What shareholder receives in the form of the value of a right, and loses in the form of decline in share price. Wealth remains unaffected when shareholders exercises his rights. Of course, he will lose if he does not exercise his rights or sells them.

Beta (β) Estimation

The risk of a portfolio of securities is measured by its variance or standard deviation. The variance of a portfolio is the sum of:

- the variances of individual securities times (the square of) their respective weights and

- the covariance (that is, the correlation coefficient between securities times their standard deviations) of securities times twice the product of their respective weights.

In a well-diversified portfolio the weights of individual securities will be very small and therefore, the variances of individual securities will be quite insignificant. But the covariance between the securities will be significant, and its magnitude will depend on the correlation coefficients between securities. The covariance will be negative if all securities in the portfolio are negatively correlated. In practice, securities may have some correlation because they all have a tendency to move with market. This logic introduces the concepts of diversifiable risk and non-diversifiable risk. The unique or the unsystematic risk of a security can be diversified when it is combined with other securities to form a well-diversified portfolio. On the other hand, the market or the systematic risk of also moves with the market. Estimation of beta, (β) followed two method or model. Methods of beta estimation are explained as follow-

- Direct Method: Beta is measure of systematic risk and it is the ratio of covariance between market return and the security’s return to the market return variance:

β = (Covariance of x &y)/ (Standard deviation of y)

= (Standard deviation of x) x (Correlation coefficient between x &y)/ (Standard

deviation of y)

- The Market Model: Yet another procedure for calculating beta is the use of the

Market or Index model. In the market model, returns on a security against returns

of the market index. The market model is given by the following regression equation:

RJ = α + βj.Rm + ej

Where, RJ = The expected return on security

Rm = The expected market return

βj = Slope of the regression

ej = The error term (with a zero mean and constant standard deviation)

Practice of Beta (β) Estimation:

In practice, the market portfolio is approximated by a well diversified share price index. In theory, the market portfolio should include all risky assets-shares, bonds, gold, silver, real estate, art objects etc.

In computing beta by regression, we need data on returns on market index and the security for which beta is estimated over a period of time. There is no theoretically determined time period and time interval may vary. The return may be measured on a daily, weekly or monthly basis. One should have sufficient number of observation over a reasonable period of time. A number of agencies providing the beta values in developed countries like the USA and the UK use monthly returns for five year period for estimate beta.

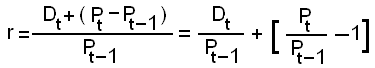

The return on share and market index may be calculated as total return; that is, dividend yield plus capital gain:

Rate of Return = [Current Dividend + (Share price in the beginning – Share price at the end)]/ Share price in the beginning = Dividend yield – Capital Gain/loss

In practice, one may use capital gains/loss or price returns [i.e., Pt –Pt –1] rather total returns to estimate beta of a company’s share. A further modification may be made in calculating the return as shown below:

rj= log [Pt –Pt –1]=log [Pt/Pt –1] the advantage of this equation is that is not influenced by extreme observations.

Cost of equity

Firms may raise equity capital internally by retaining earnings. Alternatively, they could distribute the entire earnings to equity shareholders and raise equity capital externally by issuing new shares. In both cases, shareholders are providing funds to the firms to finance their capital expenditures. Therefore, the equity shareholders’ required rate of return would be the same whether they supply funds by purchasing new shares or by foregoing dividends, which could have been distributed to them. There is, however, a difference between retained earn and issue of shares from the firm’s point of view. The firm may have to issue new shares at a price lower than the current market price. Also, it may have to incur flotation costs. Thus, external equity will cost more to the firm than the internal equity.

Equity Capital Free of Cost

It is some time argued that the equity capital is free of cost. The reason for such argument is that it is not legally binding for firms to pay dividends to ordinary shareholders. Further, unlike the interest rate, the equity dividend rate is not fixed. It is fallacious to assume equity capital to be free of cost. As we have discussed earlier, equity capital involves an opportunity cost; ordinary shareholders supply funds to the firms in the expectation to dividends and capital gains commensurate with their risk of investment. The market value of the shares determined by the demand and supply forces in a well functioning capital market reflects the return required by ordinary shareholders. Thus the shareholders’ required rate of return, which equates the present value of the expected dividends with the market value of the shares, is the cost of equity. The cost of external equity would, however, would be more than the shareholders’ required rate of return if the issue of price were different from the market price of the shares.

In practice, it is formidable task to measure the cost of equity. The difficulty derives from two factors: first, it is very difficult to estimate the expected dividends. Second the future earnings and dividends are expected to grow over time. Growth in dividends should be estimated and incorporated in the computation of the cost of equity. The estimation of growth is not easy task. Keeping these difficulties in mind, the methods of computing the cost of internal and external are discussed below:

Internal Equity: The Dividend Growth Model

A firm’s internal equity consists of retained earnings. The opportunity cost of retained earnings is the return forgone by equity shareholders. The shareholders generally except dividend and capital gain from their investment. The required rate of return of shareholders can be determined from the dividend valuation model.

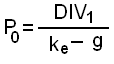

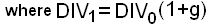

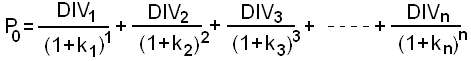

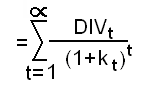

Normal growth: The dividend valuation model for firms whose dividends are excepted to grow at a constant rate of g is as follows:

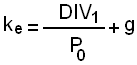

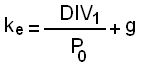

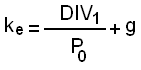

This equation can be solved for calculating the cost of equity ke as follows:

The cost of equity is, thus, equal to the expected dividend yield (DIV1/P0) plus capital gain rate as reflected by excepted growth in dividends (g).

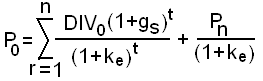

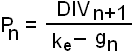

Supernatural growth: a firm may pass through different phases of growth. Hence dividends may grow at different rates in future. The growth may be very high for a few years, and afterwards, it may be become normal indefinitely in the future. The dividend-evaluation model can also be used to calculate the cost of equity under different growth assumptions. For example, if the dividends are expected to grow at a super normal growth rate, (gs), for n years and thereafter, at a normal, perpetual growth rate of (gn), beginning in year n+1, then the cost of equity can be determined by the following formula:

Pn is the discontinued value of the dividend stream, beginning in years n+1 and growing at a constant, perpetual rate (gn) at the year n, and therefore it is equal to:

External Equity: The Dividend Growth Model

A firm’s external equity consists of funds raised externally through public or rights issues. The minimum rate of return, which the equity shareholders require on funds supplied by them by purchasing new shares to prevent a decline in the existing market price of the equity share, is the cost of external equity. The firm can induce the existing or potential shareholders to purchase the new shares when it promises to earn a rate of return equal to:

Thus the shareholders’ required rate of return from retained earnings and external equity is the same. The Cost of external equity is, however, grater than the cost of internal equity for one reason. The selling price of the new shares may be less than the market price.

Cost of Equity: CAPM vs. Dividend-Growth Model

The dividend-growth approach has limited application in practice because of its two assumptions. First, it assumes that the dividend per share will grow at a constant rate, g, should be less than the cost of equity, ke, to arrive at the simple growth formula. That is:

Dividends and Uncertainty

According to Gordon’s model, dividend policy is irrelevant where r=K, when all other assumptions are held valid. But when the simplifying assumptions are modified to confirm more closely to reality, Gordon concludes that dividend policy does affects the value of share when r=K. this view is based on the assumption that under conditions of uncertainty, investors tend to discount distant dividends (capital gains) at a higher rate than they discount near dividends. Investors, behaving rationally, are risk-averse and, therefore, have a preference for near dividends to future dividends.

Value of share in future

When the discount rate is assumed to be increasing, the equation would be as follows-

Where P0 is the price of the share when the relation rate, b, is zero and kt> kt-1. If the firm assumed to retain fraction of earnings, dividend share will be equal to (1-b) EPS1 in the first year.

Answer to the Q. No. 2

Introduction

The Dividend decision of the firm is yet another essential area of financial management. The significant aspect of dividend policy is to settle on the amount of earnings to be distributed to shareholders and the amount to be retained in the firm. Retained earnings are the most significant internal sources of financing the growth of the firm. On the other hand, dividends may be considered desirable from shareholders’ point of view as they tend to increase their current return.

In theory, the objective of a dividend policy should be to maximize a shareholder’s return so that the value of his investment is maximized. Shareholders’ return consists of two components of return. Consider an example to highlight the issues underlying the dividend policy. Payout ratio-, which is dividend as a percentage of earnings-, is an important concept vis-à-vis the dividend policy. 100 percent minus payout percentage is called retained ratio.

Answer to the Question No.- 2 (a)

Current dividend policy of the company

Here the chosen company is RBS (Royal Bank of Scotland). According to the chosen company’s current dividend policy follows Gordon’s Model developed by Myron Gordon. Gordon’s model is one of the very popular models explicitly relating the market value of the firm to dividend policy. To be successful the current dividend policy is based on the following assumptions:

- All-equity firm: The firm is an all-equity firm, and it has no debt.

- No external financing: No external financing is available. Consequently retained earnings would be used to finance any expansion. Thus, Gordon’s model confounds dividend and investment policies.

- Constant return: The internal rate of return, r, of the firm is constant. This ignores the diminishing marginal efficiency of investment as represented.

- Constant cost of capital: The appropriate discount rate, k, for the firm remains constant. Thus, Gordon’s model also ignores the effect of a change in the firm’s risk-class and its effect on, k.

- Perpetual earnings: The firm and its stream of earnings are perpetual.

- No taxes: Corporate taxes do not exist.

- Constant retention: The retention ratio, b, once decided upon, is constant. Thus, the growth rate, g = br, is constant forever.

- Cost of capital greater than growth rate: The discount rate is greater than growth rate, k>br= g. If this condition is not fulfilled, cannot get a meaningful value for the share.

According to this model, share price, Po = D/ (k-G)

Here,

Po = Price of the share

D = Dividend per share

K = Company’s cost of debt

G = Growth rate = (br)

Calculation for dividend per share,

Here given that,

Po = Price of the share = 372.5 – (372.5 – 46%) = 201.15 (pound)

D = Dividend per share =?

K = Company’s cost of debt = 8% = 0.08

G = Growth rate = br = (107250/1051165) x (107250/3027689) x 100 = 0.0354

Therefore, dividend per share, D = Po x (k- G) = 201.15 x (0.08- 0.0354) = 8.97

So, under current dividend policy, dividend per share is 8.97 (pound)

Answer to the Question No. – 2(b)

According to the dividend policy assessment of the changing economic environment in the UK

Dividend

Dividend can be defined as a taxable payment that is simply declared by board of directors of a company. It is usually given on quarterly basis to the shareholders of the company from the retained earnings.

The companies that pay dividends normally have higher growth phase & are not sufficiently benefited by their profit reinvestment. For that, they like to pay them out of shareholders, it is called Payout also.

Forms of Dividend Payment

- Cash dividends are paid out in cheque. It is the most popular basis of dividing corporate profits. So, a person having 100 of shares where the DPS (Dividend per share) is £0.50, he will receive £50.

- Stock or scrip dividends are given out as the additional stock shares of the company itself or other subsidiary company.

- Property dividends are paid as the assets from the original corporation or any other; this is simply rare & can other forms, like- products & services.

- Financial assets having market value can also be distributed as dividend. For example- Warranty.

The listed large companies, which have subsidiaries, dividends, can be paid in the form of shares. A common technique is “spinning off” in this regard.

So, the firm’s optimal dividend policy must strike a balance between current dividends & future growth to maximize the stock price. Three theories can be examined in investor’s preference-

- Dividend irrelevance theory: – MM argued that the firm’s value is determined only by its basic earning power & business risk.

- Birds-the-hand theory:- According to Gordon & Linter’s viewpoint, the investors value an amount of expected dividends more highly than an amount of expected capital gains as the dividend yield component, D1 / P0, is less risky than the g component in the total expected return equation, KS = D1 / P0 + g.

- Tax preference theory: – Because of a number of tax advantages, investors may prefer to have companies retain most of the earnings.

Several other factors also affect dividend decision, like-constraints on dividend payments, investment opportunities, availability of cost alternative sources of capital & effects of dividend policy on KS.

The implications of dividend policy, according to Gordon’s model, are shown respectively for the growth, the normal and the declining firms. It is revealed that under Gordon’s model-

- The market value of the share, Po, increases with the payout ratio, (1-b), for declining firms with r>k.

- The market value of the share, Po, increases with the retention ratio, b, for firms with growth opportunities, that is when r<k.

- The market value of the share is not affected by dividend policy when r=k.

Gordon’s model’s conclusions about dividend policy are similar to that of others. This similarity is due to the similarities of assumptions that underline both the models. Thus the Gordon model suffers from that underline as the others.

Answer to the Question No –2 (c)

Estimation the company’s share price at the end of 2007, using the Dividend Growth Model and Capital Asset Pricing Model

Dividend growth model

According to dividend growth model share price, Po = D1/ (k-g)

Where,

D1 = Do x (1+g) = 8.97 x (1+0.0354) = 9.288

K = (D1/Po) + g = (9.288/201.15) + 0.0354 = 0.0816

Therefore, share price, Po = 9.288/ (0.0816-0.0354) = 201.039 (pound)

Capital asset pricing model:

Under capital asset pricing model (CAPM), return on asset, Ri = Rf + (Rm-Rf) x Systematic risk

Where, Rf = Risk free rate of return = 0.0354

Rm = Rate of return on market = 0.0816

Systematic risk = (0.361) ^2

So, return on asset, Ri = 0.0354 + (0.0816-0.0354) x (0.361) ^2= 0.0414 = 4.14%

Answer To The Question. No. – (d)

Criticisms for the actual price differ from the estimate:

- Unrealistic assumptions: For unrealistic assumptions actual price differ from the estimated.

- Testing of CAPM: It is difficult to test the validity of CAPM. For this, estimated price and actual price is different.

- Stability of beta or systematic risk: Beta is measure of a security’s future risk. But investors do not have future data to estimate data. What they have are past data about the share prices and the market portfolio. Thus, they can only estimate beta based on historical data. Investors can use historical beta as the measure of future risk only if it is stable over time. This implies that the betas are poor indicators of the future risk. For all of these, beta is the one of the factor that does not remain stable over time and estimated value is differed from the actual.

Answer To the Question No. – 2 (e)

Discussions of the implications for a under valued company:

An implication envisages the relationship between risk and the expected rate of return on a risky security provides a framework to price individual securities and determine the required rate of return for individual securities. Implications are-

- Market efficiency: The capital market efficiency implies that share prices reflect all available information. Also, individual investors are not able large number of investors holding small amount of wealth.

- Risk aversion and mean-variance optimization: Investors are risk-averse. They evaluate a security’s return and risk in terms of the expected return and variance or standard deviation respectively. They prefer the highest expected returns for a given level of risk. This implies that investors are mean-variance optimizers and they form efficient portfolios.

- Homogeneous expectations: All investors have the same expectations about the expected returns and risks of securities.

- Single time period: All investors’ decisions are based on a single time period.

- Risk-free rate: All investors can lend and borrow at a risk free rate of interest. They form portfolios from publicly traded securities like shares and bonds.

Bibliography

Block, B. S. & Hirt, G. A. (2005), Foundations of Financial Management, 11th ed, McGraw-Hill Irwin, Boston. ISBN: 0-07-111096-a.

Besley, S. & Brigham, F. E. (2007), Essentials of Managerial Finance 13th ed., Thomson South Western, Singapore, ISBN: 0-324-22502-.

Bodie, Z. Kane, A. and Marcus A. J. (2005), Iinvestments, 5th Edition, Tata McGraw-hill publishing company limited, New Delhi; ISBN: 0-07-048662-X.

Kamlet, A. & Carreiro, R. (1997), Stocks – Dividends, The Investment FAQ, Christopher Lott.

Pandey, I. M. (2007), Financial Management, 9th Edition, Vikas publishing house PVT LTD, New Delhi, ISBN: 81-259-1658-X.

RBS Coutts Bank Ltd (2007), Annual Report & Accounts- 2007, Zurich, Switzerland. Web.

Appendix