Introduction

EasyJet Airline Company Limited is an airline that is part of a large holding EasyGroup. This British company, which has existed since 1995, at present is one of the largest and most influential corporations in the airline industry in the category of low-cost flights (Anderson 2014). EasyJet serves both domestic and international flights to over 300 destinations and operates in about 30 countries. It is essential to analyze the company’s strategic capabilities and the external environment in which it operates to be able to assess which entrepreneurial opportunities will be the most effective for it.

Analysis of Strategic Capabilities and External Environment

The core capabilities of the company can be limited to the main three aspects that contribute to the preservation of the competitive edge: efficiency, speed, and flexibility. The airline does not have business class offers to boost the aircraft’s volumes and use the vehicles more effectively (Bader 2015). Also, EasyJet outsources all the possible activities, and it has modernized its procedures.

Sources of Competitive Advantage of the Company

Value Chain

The value chain analysis is a method that allows assessing the way the combined products create more value to the customer rather than considered separately (Davila et al. 2013). This method enables rationalizing added value and categorizing the operations according to the effects they produce.

Table 1. EasyJet Value Chain.

Table 1 pieces of evidence how the company has been able to deliver value to the customers in an effective way through consolidating the inbound logistics, applying the Lean approach to eliminate wastes, utilizing effective marketing tools to address the target audience (EasyJet annual report and accounts 2015). There are issues to consider such as customer service and feedback; however, the company’s competitive advantage emerges from the analysis of the value chain.

VRIN

The VRIN method allows analyzing the company’s competitiveness in terms of resources (Evans 2013). The method allows reducing the list of all the resources in the enterprise to those that explain the difference between the work of the enterprise and the competitors. Table 2 describes the resources of EasyJet:

Table 2. VRIN.

VRIN reveals that the company is valuable. It has reduced its operational costs, eliminated wastes, and has been able to increase the market share.

External Environment Impact

To analyze the external environment impact, it is essential to utilize Porter’s five forces and the PESTEL method.

Five Forces

The threat of substitutes is the first category to consider. The rail services imply lower prices and fast reaching of the destination, and they will be able to challenge the EasyJet’s propositions. The second category is represented by the threat of new entrants. However, the UK market is close to reaching saturation especially considering the low-cost carriages (Fleisher & Bensoussan 2015). The third category is the bargaining power of suppliers. Airbus is the major supplier of the enterprise. It is evident that having only one collaborate is risky due to the possible delays in time.

The fourth force is the bargaining power of buyers. The company carries out various promotions to attract more clients. It sells tickets through the Internet, which allows decreasing the prices and lets the clients compare the prices of different airlines. The fifth force is the rivalry among existing firms. In the global market, EasyJet is not the leader; however, it is one of the leaders in the UK market together with Ryanair, which is also a low-cost carrier (Bader 2015).

PESTEL

As per EasyJet, the environment requires advanced technological growth and the boosted applicability of Internet resources. Environmental awareness is increasing, and companies should pay attention to environmental aspects (McManners 2014). In addition, low-cost carriers face customer dissatisfaction due to unideal service. Thus, EasyJet should concentrate on customer retention and safety as well as further technological development.

Unlike its competitors in the price segment, the company carries out the landing in major ports such as Gatwick port in London, from which it is easy for the customer to get into town. The wide margin (which is approximately 80% over the previous year) allows EasyJet to resist price increases from suppliers, which contributes to the long-term preservation of their loyalty (EasyJet annual report and accounts 2015). This combination of low prices and focus on the customer segment allows the company to sustain its competitive advantage.

According to the company report, their main goal is to ensure security and provide excellent customer service, which is not characteristic of other low-price carriers like Ryanair (EasyJet annual report and accounts 2015). The fleet strengths are its practicality and expandability. In addition, the company has a dense route network, high flight frequency, and dynamic tariffs. Moreover, unlike Ryanair, EasyJet does not pay a commission to intermediaries.

Analysis of Strategic Choices for the Company

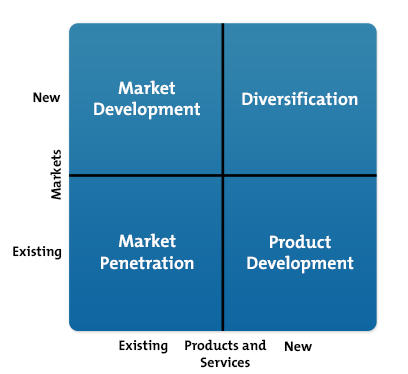

The strategic choices for EasyJet should be based on the current situation in the market, the company’s capabilities, mission, vision, and resources. The Ansoff matrix represented in Picture 1 was applied, and the strategies were evaluated with the SAFE criteria: suitability, acceptability, and feasibility (The Ansoff Matrix n.d.).

The two strategic choices offered include 1) expanding into new market segments and 2) modernization of brand image. The first strategy is believed to enable EasyJet to attain the student segment of the market and the second one should help to boost brand awareness (Bader 2015). The two approaches are aimed at reaching better market penetration through diversification and differentiation.

Strategic Option One (Expanding into New Market Segments)

The orientation on the students as prospective customers will enable the enterprise to compete with the main rival, which is Ryanair, and attain a competitive edge (Bader 2015). Regarding the SAFE framework, the suitability can be revealed in several aspects. The strategy implies targeting the price-sensitive group of customers and improving the customer experience. The proposed segment may bring profit to the company, and the key stakeholders may find this approach progressive and stimulating to meet the rivalry.

In terms of acceptability, boosting brand awareness is one of the objectives of the proposed strategy. Furthermore, the current promotional measures can be applicable and will support the current company activities. The company can utilize its IT business model to meet the aims of this strategy, and feasibility is likely to be achieved since the proposal is measurable. The enterprise has sufficient resources that can be allocated to implement the strategy.

Experts in the industry stated that Easyjet’s shares began to lose its activity after a long period of high profitability (Pratley 2016). The company’s revenues dropped due to terrorist attacks in Europe and the falling value of sterling (Martin 2016). The airport disruptions and the presence of military coups in Turkey also impose a threat. Therefore, the company needs to continue to improve the flight volumes on the existing routes to achieve greater efficiency.

This method of growth is associated with the lowest risk (Pratley 2016). Also, it should introduce flights to intermediate points on the existing routes. Since these routes have been mastered and the interaction with consumers has been established, it will be easier for the company to reach a wider audience and win a competitive advantage. Finally, the company needs to expand the spectrum of its services and related activities following the example of Virgin.

Strategic Option Two (Modernization of Brand Image)

EasyJet is considerate about brand image, environmental issues, and social responsibility. The modernization of the brand image can enhance the company’s visibility. The suitability is ensured by the fact that contemporary customers are increasingly environmentally aware. EasyJet emphasizes its objective to reduce carbon emissions, and the increased environmental awareness accounts for the sustainability of the market share.

The acceptability of the approach is evidenced by the PESTEL analysis discussed above. The intention of being an environmentally friendly response to the current social request and addresses the EasyJet’s corporate social responsibility (Bader 2015). Also, such practices imply value-added activities, which are beneficial for the firm. However, the feasibility of the proposal is relative. If the company fails to meet the claimed awareness of the environmental issues, EasyJet might face public debates.

To diversify through the proposed strategy, EasyJet needs to consider its environmental strategy. It should make efficient use of their aircraft and useless equipment when operating on the ground. It is essential to keep wastes to the minimum through sustainable development and green initiatives that can contribute to the company’s brand image and corporate social responsibility. The orientation at societal marketing through the concerned attitude toward air and environment will allow the company to lower its cost of operation as well (Mayer, Ryley & Gillingwater 2012).

It can be implemented with the help of greener technology and fuel-efficient engines. Moreover, EasyJet can advertise through green groups and attain higher customer loyalty through increased environmental awareness. Thus, EasyJet should not lean on low pricing exclusively but retain loyalty by differentiating from such rivals like Ryanair or Virgin through cost savings from fuel efficiency and greener policies.

The strategies could be referred to as the company’s objectives in a variety of ways. For instance, these approaches ensure higher sustainability and a focus on the long-term impact on the industry performance. The enhanced service provision means higher loyalty to the enterprise (Bader 2015). The minimization of environmental impact promotes green business features without the possibility of greenwashing. All of the mentioned is concerned with ethical liability, which is one of the leading objectives of the airline’s corporate responsibility.

Conclusion

The present analysis involved several frameworks, including Porter’s five forces and PESTEL, the application of which was guided by their specifics. Both approaches are well-established and have a history of successful application (Tassabehji & Isherwood 2014). However, Porter’s five forces analysis has hidden challenges: the common mistakes of researchers include the lack of depth and analysis, which mimics the initial representation of the method (Dobbs 2014; Vining 2011). In the present paper, the difficulties were managed by embedding the analysis into strategy development.

Apart from that, Porter’s work is relatively generic; as a result, Vining (2011), for example, suggests adapting it to a particular company type if necessary, but the current paper did not demand customization. Concerning PESTEL, it is a very comprehensive tool, but this advantage also has drawbacks: in particular, an environment can include elements that belong to more than one category, causing confusion and what Kremer and Symmons (2015) have termed as a “labyrinthine” analysis (p. 139). In the present paper, the problem was solved by avoiding the strict categorization of the elements.

Of the most widely used strategic tools (that also include, for example, SWOT or BCG matrix), PESTEL and five forces are unique in their specific application. PESTEL is used for the environmental scan that is more detailed than the external elements of SWOT; the five forces method is meant to perform the industry analysis in greater detail than PESTEL (Tassabehji & Isherwood 2014). In other words, while other tools could have been employed in the paper as well, the needs of the analysis required specific tools, and as a result of their application, the following conclusions can be made.

The proposed strategies aim at customer satisfaction, securing the competitive advantage, and strengthening of the brand image. The mission statement of the company is supported by a strong focus on these three objectives and encourages stakeholders to have future-oriented visions (Bessant & Tidd 2011). It will be viewed as a viable enterprise that addresses acute environmental issues and reflects on its values.

The implementation of the strategies will allow delivering the vision of the company in an accurate and specific matter and stressing out its cost-efficiency. The consideration of customer’s perceptions ensures that EasyJet responds to their needs of clients and the society and adapts its strategy to bring the value in the most effective way.

Reference List

Anderson, T 2014, EasyLand – how easyJet conquered Europe, Grosvenor House Publishing Limited, Guildford.

Bader, M 2015, Quantitative and qualitative analysis of Easyjet’s annual report 2013, GRIN Verlag, Munich.

Bessant, J & Tidd, J 2011, Innovation and entrepreneurship, 2nd edn, Wiley, Hoboken.

Davila, T, Epstein, M, Shelton, R, Cagan, J & Vogel, C 2013, How to become innovative, FT Press, Upper Saddle River.

Dobbs, M 2014, ‘Guidelines for applying Porter’s five forces framework: a set of industry analysis templates’, Competitiveness Review, vol. 24, no. 1, pp. 32-45.

EasyJet annual report and accounts. 2015. Web.

Evans, V 2013, Key Strategy Tools, Pearson, London.

Fleisher, C & Bensoussan, B 2015, Business and competitive analysis, FT Press, Upper Saddle River.

Kremer, P & Symmons, M 2015, ‘Mass timber construction as an alternative to concrete and steel in the Australia building industry: a PESTEL evaluation of the potential’, International Wood Products Journal, vol. 6, no. 3, pp. 138-147.

Martin, B 2016, EasyJet shares drop as revenues tumble. Web.

Mayer, R, Ryley, T & Gillingwater, D 2012. ‘Passenger perceptions of the green image associated with airlines’, Journal of Transport Geography, vol. 22, pp.179-186.

McManners, P 2014, Corporate strategy in the age of responsibility, Gower Publishing, Farnham.

Pratley, N 2016, EasyJet shares come down to earth after years of stratospheric returns. Web.

Tassabehji, R & Isherwood, A 2014, ‘Management Use of Strategic Tools for Innovating During Turbulent Times’, Strategic Change, vol. 23, no. 1-2, pp. 63-80.

The Ansoff matrix, n.d.. Web.

Vining, A 2011, ‘Public Agency External Analysis Using a Modified “Five Forces” Framework’, International Public Management Journal, vol. 14, no. 1, pp. 63-105.