Introduction

Over the last decade, the environmental attributes of the business organization have been outlined as significant in affecting the outcome and general sustainability. The environmental concerns are propelled by the rise in legislation, pollution, and stakeholder pressure. This means that evaluation of environmental performance for a business is an integral part of the general financial, internal process, customer, and learning or growth perspectives of healthy performance (Kaplan & Norton, 1992). Several environmental management modules have been put forward to elevate the performance of companies such as the Environmental Balanced Scorecard (EBSC) to integrate different measured formed from a given strategy (Kim et al., 2014). Thus, this analytical paper performs a comprehensive EBSC modeling for the Everest Retail Company. The company manufactures and retails pharmaceutical products and health equipment. The paper will develop an EBSC for the Everest Retail Company to facilitate business sustainability management.

Development of the Environmental Balanced Scorecard (EBSC)

Overview of EBSC

Created by Norton and Kaplan (1996), the concept of a balanced scorecard is an important tool for measuring and tracking the performance of an organization from financial and nonfinancial fronts. The performance is often interlinked in a web of cause-and-effect that ties the overall objectives to business strategies (Al-Zwyalif, 2017). In the case of the Everest Retail Company, the proposed balanced scorecard will track environmental issues within the financial, customer, internal process, and learning perspectives (Kaplan & Norton, 1993). The financial perspectives will cover measures and objectives that are representational of the ultimate aim of profit maximization in the dynamic and competitive retail business environment. The financial perspective will be used to track the current business strategy on sustainability to improve the shareholder value (Kaplan & Norton, 1996).

The customer perspective will be designed to capture the strategies that the Everest Retail Company intends to implement to differentiate its products from those of the competitors to attract and retain different customer segments (Norreklit, 2000). The internal process perspective will identify vital customer management, operating, regulatory, and innovative processes that must be addressed to ensure that the business is sustainable in terms of profitability, revenue, and customer growth (Zeng & Luo, 2013). Lastly, the learning and growth perspective will be designed to identify and improve the systems, people, and organizational functionality to guarantee long-term improvement (Jassem, Azmi & Zakaria, 2018).

The Proposed Environmental Balanced Scorecard

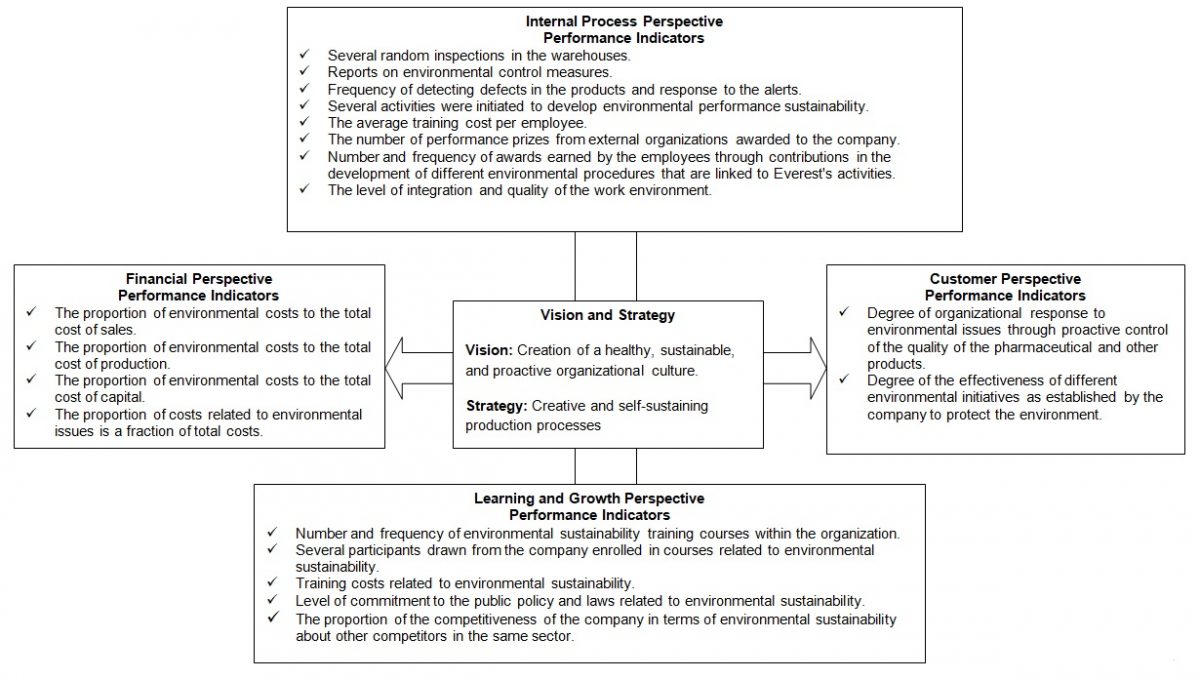

As captured in table 1, the proposed EBSC for the Everest Retail Company consists of internal processes, customer, financial, and learning and growth perspectives. Each perspective has strategic environmental objectives as discussed in the next section.

Table 1. Proposed EBSC for the Everest Retail Company. (Source: Self-generated).

As captured in figure 1, the performance indicators for each perspective were linked to the vision of the Everest Retail Company to facilitate the evaluation of its environmental performance.

Summary and Conclusion

Proper integration of the above EBSC will determine its success and realization of the different objectives for each perspective. In application, the proposed scorecard should be linked with the current performance tracking systems of the company to ensure that the financial and non-financial processes are addressed (Alewine & Stone, 2013). In the case of the Everest Retail Company, the proposed balanced scorecard was created to enable the managers to continuously evaluate the current and predict future environmental performance (Kaplan & Norton, 1993). Moreover, the management of this company is empowered by the proposed EBSC to proactively control different organizational activities while tracking their costs and impacts within the financial, customer, internal and external company perspectives (Jassem, Azmi & Zakaria, 2018). In addition, the above scorecard has the potential of serving as a template for the organization to pursue and create future environmental awareness campaigns or training that directly address the mentioned indicators.

Reference List

Alewine, H. & Stone, N. (2013) How does environmental accounting information influence attention and investment? International Journal of Accounting Information Management, 7(21), 22-52.

Al-Zwyalif, I. (2017) Using a balanced scorecard approach to measure environmental performance: a proposed model. International Journal of Economic and Finance, 9(8), 118-126.

Jassem, S, Azmi, A. & Zakaria, Z. (2018) Impact of sustainability balanced scorecard types on environmental investment decision-making. Sustainability, 10, 1-18.

Kaplan, R. & Norton, D. (1993) Putting the balanced scorecard to work. Harvard Business Review, 71(5), 134-147.

Kaplan, R. & Norton, R. (1992) The balanced scorecard-measures that drive performance. Harvard Business Review, 67(12), 71-79.

Kaplan, R. & Norton, R. (1996) Using the balanced scorecard as a strategic management system. Harvard Business Review, 82(9), 75-85.

Kim, Y, Chung, B, Kwon, K. & Sukmaungma, S. (2014) The application of the modified balanced scorecard advanced hierarchy process extended to the economy, upscale, and luxury hotels’ websites. An International Journal of Tourism and Hospitality Research, 25(1), 81-95.

Norreklit, H. (2000) The balance on the balanced scorecard-a critical analysis of some of its assumptions. Management Accounting Research, 11(1), 65-88.

Norton, D. & Kaplan, R. (1996) Linking the balanced scorecard to strategy. California Management Review, 39(1), 53-79.

Zeng, K. & Luo, X. (2013) The balanced scorecard in China: does it work? Business Horizon, 56, 611-620.