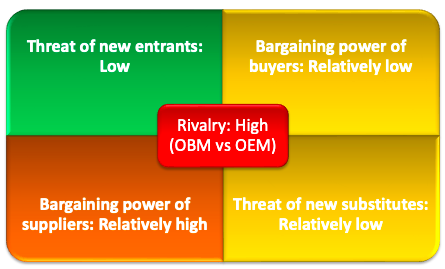

Porter’s Five Forces Analysis

Galanz has a long history of growing from small production to a global brand, but despite its success, it still faces several challenges. Regarding the situation with the US market, it is necessary to analyze the external environment, which can be reflected in the competitiveness indicators according to Porter’s five forces model.

Threat of New Entry

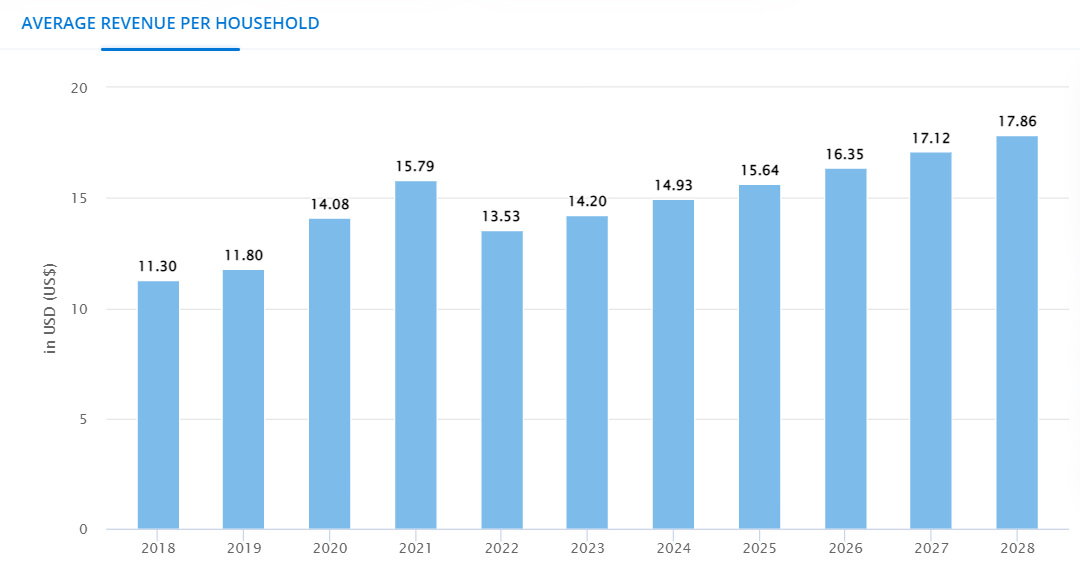

New players in the market are doubtful – they have a reasonably high entry threshold due to the need to create mass production due to the large-scale demand for this type of goods, despite its decline in 2022 – forecasts are steadily going up in the short term, as shown in Figure 1 (Statista, 2023). Moreover, competitors are present in all possible planes – from premium brands to budget versions, including imports.

Threat of Substitution

The threat of product substitution with microwave ovens is relatively low due to the relatively low cost of this product category. Still, in general, consumers are not inclined to such changes. As a rule, the purchase of new small household appliances by current customers occurs as depreciation and breakdown of the old one, and quite often, consumers resort to buying a model of the same brand due to familiarity with the specifics of control, power, and other characteristics (Sheth, 2020).

Buyer Power

Buyer power in this regard is low, despite the exact low cost per transition, and is primarily driven by price sensitivity, product quality, and brand marketing presentation. The target audience of Galanz more often does not buy expensive premium household appliances, where the struggle for this relatively small segment is fought at more subtle levels of competitive supply. On the contrary, the critical factor is the value of money.

Competitive Rivalry

The critical moment for this model lies in the competition with the current market representatives in the same budget segment. Here, the conflict between OBM and OEM approaches is visible: the advantage of one of them somehow captures the audience of the other (Zhu et al., 2019). If China, where the production is located and the market in which the company operates, has been studied directly over a long historical development period, then foreign markets, including the United States, had already been developed and filled by the time the new brand appeared. Galanz does not have enough brand strength to provide other determinants of competitive advantage. Budget but high-quality equipment is already sold in America under other trademarks, some of which are customers of the company’s OEM. In addition to this fact, Galanz does not have key distinguishing features, unlike, for example, the well-known Panasonic and Toshiba or Amana ACP, which has its own support and warranty network since the production is located directly in the USA (ACP, 2023). Consequently, the company enters a highly competitive market without providing a unique proposition.

Supplier Power

On the background of this issue, Galanz has immense supplier power for this model due to the constant need to increase the production of magnetrons. Other vendors are uncooperative in increasing their presence, and given the scale of Galanz’s sales, the organization is in a difficult position (Ng et al., 2010). Even though the activity of any international business sooner or later implies horizontal development, this company is already represented in the US market. The combination of these approaches is destructive, as proved by the conflict of interest between OEM clients and OBM methods. The general picture of the model is shown in Figure 2.

Therefore, concerning the US market, Galanz must maintain and develop the OEM customer base, which has already gained an audience and particular brand strength and recognition through marketing campaigns on its own. At the same time, the availability and high quality of products manufactured by Galanz also play a vital role in the success of the implementation of this approach.

OBM should be reduced as soon as possible and developed exclusively in well-known markets where Galanz brand products are recognized, such as China and nearby regions. The differentiated approach of combining OBM and OEM is most profitable if not combined simultaneously in the same markets. Yet, Galanz does not diversify its line for different target audiences so as not to cause a conflict of interest.

NPV Analysis

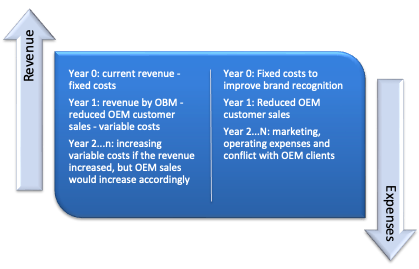

Finally, applying the potential NPV analysis in the most approximate calculations while maintaining the presence of both approaches of the company in the US market, the dynamics can be approximately the following: fixed costs for deploying large marketing campaigns to increase brand awareness will require high costs, while revenue growth may be insignificant.

However, even if revenues grow commensurately, OEM customers, the largest of which are also represented in the US, such as Wal-Mart, are at significant risk (Ng et al., 2010). This project risks not paying off or returning costs relatively slowly due to low margins while disrupting relationships with existing customers. Figure 3 is a schematic representation of the NPV analysis for Galanz in the US market.

References

ACP. (2023). Service and support. Web.

Ng, S., Li, B, Zhao, X., Xu, X., Lei Y. (2010). Operations strategy at Galanz. Harvard Business Review.

Sheth, J. (2020). Impact of Covid-19 on consumer behavior: Will the old habits return or die? Journal of Business Research, 117, 280-283. Web.

Statista. (2023). Microwave ovens – United States. Web.

Zhu, H., Xu, F., & He, Q. (2019). Moving from OEM to OBM? Development with Global Value Chains: Upgrading and Innovation in Asia, 247.