Introduction

The global insect protein market is expected to develop over the next few years. According to the case study, the sector is projected to experience an annual growth rate of about 28%, generating sales of $213 million by 2023 and $8 billion by 2030 (Goode and Emily 2). This increase has been attributed to various organizations, including the United Nations (UN), advocating for the consumption of insects or entomophagy as a sustainable solution for meeting the high demand for protein rather than depending on conventional livestock protein. Some of the companies in this sector of edible insects include Exo and Aspire, which are small but have a significant potential for growth.

Exo’s Brand Equity

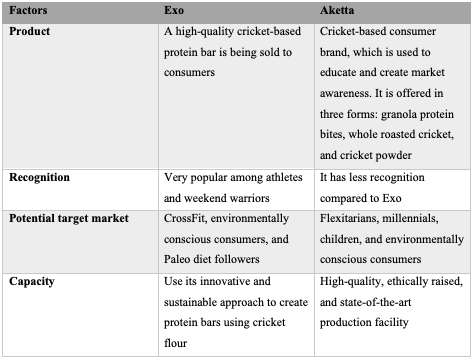

The acquisition is expected to help both firms leverage their resources and capabilities, including existing portfolio, Exo protein bars, and Aketta, to gain competitiveness in the market. The table below highlights the equity of Exo and Aspire’s Aketta.

Based on the chart, equity, in this context, is the value or worth of both brands. It includes recognition, production capacity, market potential, and revenue growth strategies. Therefore, the similarities between these brands are their focus on using cricket flour as a sustainable protein source and their emphasis on eco-friendliness. However, the main difference here is that Exo has a superior market reputation for high-quality protein bars. Conversely, Aketta’s brand equity is not as established since its main objective is to build marketplace awareness and gain traction.

Segmentation, Targeting, and Positioning

Positioning strategy includes mechanisms that can be employed to create a unique image and identity for Exo in the minds of consumers. As Spire’s Chief Executive Officer (CEO), some of the positioning strategies that would be employed include using product attributes. In this case, differentiating features, such as a high-quality protein source, unique flavors, clean ingredients, and packaging, can help emphasize and promote Exo’s superior quality (Goode and Emily 5).

For example, Aketta can help the market distinguish carefully sourced cricket protein from a wider group of insects and increase the attractiveness and acceptance of Exo protein bars. Exo has positioned itself as an excellent source of protein that can help athletes perform better. However, to increase the market reach and include other market segments, this newly acquired brand must be positioned to evoke emotions in consumers (Saqib 142). In this context, Exo must position itself as a brand that promotes a healthy lifestyle and reduce negative climate change associated with using unsustainable animal-based protein. These approaches can help increase the attractiveness and acceptance of Exo as an edible insect product in the market.

Regarding the question about Exo’s most attractive consumer segments, the most suitable market for this brand would include customers with dietary restrictions or those needing high-protein diets. For example, these may consist of customers with food sensitivity issues or looking for viable options. Such consumer groups can benefit from Exo protein bars, which are free from significant allergens like soy, gluten, and dairy, except for nuts (Goode and Emily 7).

Another segment that can be targeted is professional athletes or those practising amateur sports, who require high maximum nutrition for improved performance goals (Małecki et al. 9). Sports and gym enthusiasts may also be a lucrative market because some are likely to be influenced and be more inclined to start using insect protein. The last group would be health-conscious individuals who prioritize sustainability and the environment.

Although insect protein food is a nascent market, the competition originates from two categories of entrepreneurs: wholesale farmers and brand manufacturers. In this case, Exo’s market share can be directly affected by operations from brands such as Chapul, Landish, Näak, Eat Grub, and Wholi, which are currently competing in this industry (Goode and Emily 5). In addition, these start-ups are competing not only among themselves but also with an established brands such as Cliff Bar.

Despite these companies delivering their products in similar formats, especially the bar category, Exo’s unique value proposition is its use of ethically raised, high-quality crickets since the brand was acquired by Aspire. With more firms entering the insect-based food space, this will help Exo to differentiate itself from competitors who do not have the same standards. According to the case study, ingredient sourcing is a major problem, creating incompatibility with supply and lower quality concerns (Goode and Emily 5). Thus, this unique value proposition is crucial in building customer trust and establishing the brand as a reputable source for insect-based food products, which is essential as this sector continues to grow.

The final positioning strategy for Exo would be to position it as both as a high-end and a low-cost brand. In this case, the product portfolio should be placed as a brand offering high-quality and sustainable options to various market categories willing to pay premium prices (Tavares et al. 12). These individuals include athletes, environmental and health-conscious consumers, and outdoor enthusiasts, and adventure seekers with substantial disposable income.

However, Aspire’s business strategy is to make profits while improving the lives of millions of people by fighting food insecurity. For this reason, the sub-brand should be created to target price-sensitive consumers. These strategies would enable the firm to maintain its premium image while still appealing to a broader market base and increase loyalty to the brand due to the viable options it provides.

Marketing Mix

According to Exo’s positioning, the most appropriate marketing mix for the brand would include the 4Ps of marketing. In this context, the product would consist of a wide range of protein bars made with cricket flour that aligns with Exo’s brand values of high-quality ingredients, sustainability, and environmental safety. In regard to the place, these offerings would be available in health food stores, gyms, shopping malls, and online platforms and provide in-store pickup options to provide convenience to customers.

Exo’s products would be priced at both premium and low prices in various categories to reflect the values of both Exo and Aketta. Promotion methods would include social media, influencer marketing, advertising, in-store displays, and sales promotions and creating partnerships with fitness studios and healthy food outlets.

Conclusion

In conclusion, although the insect protein food industry is in its early stages, Aspire and Exo have positioned themselves as the most sustainable and eco-friendly as the sector is expected to continue growing. The acquisition of the latter by the former is expected to give both companies a competitive edge by leveraging resources and capabilities to offer both high-end and low-cost products to expand their market share.

Works Cited

Goode, Miranda, and Emily Moscato. Aspire Food Group: Marketing a Cricket Protein Brand. Ivery Publishing, 2020, pp. 1-11.

Małecki, Jan, et al. “Physicochemical, Nutritional, Microstructural, Surface and Sensory Properties of a Model High-Protein Bars Intended for Athletes Depending on the Type of Protein and Syrup Used.” International Journal of Environmental Research and Public Health, vol. 19, no. 7, 2022, pp. 1-15.

Saqib, Natasha. “Positioning – A Literature Review.” PSU Research Review, vol. 5, no. 2, 2020, pp. 141–169.

Tavares, Pedro Paulo Lordelo Guimarães, et al. “Innovation in Alternative Food Sources: A Review of a Technological State-of-the-Art of Insects in Food Products.” Foods, vol. 11, 2022, pp. 1-29.