Industry Overview

Cosmetics is one of the industries with the quickest growth. One of the top manufacturers of professional cosmetics is MAC. The well-known Estée Lauder Group businesses include MAC. As a result, the UAE’s considerable youth population is contributing to the fast growth of the cosmetics and beauty industry, which is now greatly influenced by social media influencers and the excellent marketing tactics of practically all top brands in the sector.

The U.A.E. color cosmetics market generated $370.6 million in income in 2020, and it is anticipated to show a significant CAGR of 7.6% during 2020–2030, according to (U.A.E. Color Cosmetics Market Revenue Forecast, 2021). Rising disposable income, rising awareness about appearance, a flood of interest in natural variety corrective items, high interest in publicizing and promoting drives, an expanding number of advanced promotional channels and forces to be reckoned with, and a growing population of working ladies are all contributing to the development of the UAE color cosmetics market.

The coronavirus pandemic has adversely impacted the U.A.E. market for color cosmetics products because of the lockdown in the country, which has affected the labor force, assembly activities, clients, merchants, and providers. It was shut down to fabricate plants, and they are presently working with numerous limitations since the lifting of the lockdowns. This has resulted in a reduction in progress. Furthermore, the closure of actual corrective stores and beauty parlors and the disrupted inventory network of restorative items across the nation have harmed the market.

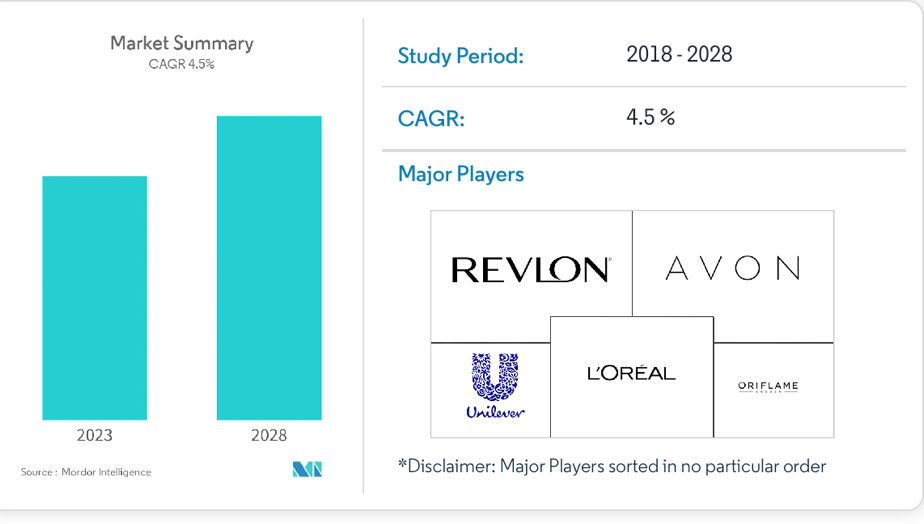

As reported in the UAE color cosmetics market analysis, n.d., the UAE color cosmetics industry is expected to develop at a CAGR of 4.5% over the estimated period (2020–2025). Rising awareness about appearance among the more youthful age group, item upgrades in various beauty care products, developing magnificence, and the individual consideration area, attributable to expanding worries about lessening age-related skin blemishes and working on the nature of ways of life, are driving the market for various color cosmetics products. On the other hand, alluring bundling, expanding customer well-being, mindfulness about private consideration, and developing style are supposed to drive the market for various beauty care products. Besides, deals in color cosmetics products through web-based businesses are additionally expected to observe huge development over the conjecture period.

In this analysis, we are concentrating on lipsticks, and since there aren’t many resources available for this specific product, we chose our competitors by interfering with the data on the color cosmetic market in the UAE. Huda Beauty and Sephora Cosmetics are among the top sellers of lipsticks in the United Arab Emirates, making them direct competitors of Mac Cosmetics (Shams, 2022). Additionally, since Estee Lauder is the first-ranking color cosmetics company in the UAE, Bobbie Brown, owned by Estee Lauder, is a fierce competitor with the second-highest brand share after Mac Cosmetics, making it our third direct competitor. Finally, NYX, which is owned by Estee Lauder, the first leading color cosmetics company in the UAE, is our fourth direct competitor.

In terms of indirect competitors, we focused on lip oils and chose the French cosmetics brands Clarins, Dior, and Gisue because they sell the most lip oils, according to data, and due to another study by Noble (2022), Hourglass made strong sales of its lip oil which makes it our fourth indirect competitor.

External Environmental Analysis

Demographic Environment

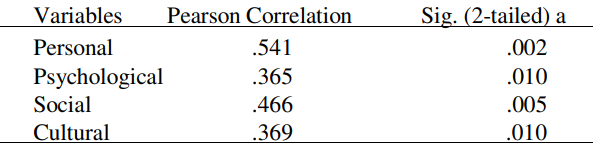

Personal and social factors play a crucial role in female purchasing behavior of beauty products in the UAE, as can be seen in Table 1. It is a THREAT to the local color cosmetics industry. It complicates customer behavioral analysis and the development of strategies for product promotion (Chaturvedi & Purohit, 2020). It may lead to higher marketing costs, reduced advertising effectiveness, and lower overall sales and buyer growth. Moreover, the positive effect of color cosmetics on the quality of life is limited to people in the UAE (Mohammed et al., 2022). Color cosmetics boost attractiveness and self-confidence but do not influence other spheres of QoL. The impact of these is reduced if the user has a dark skin tone and dry skin, which is a THREAT to the industry. It may cause the market’s growth in new customers to stall.

Economic Environment

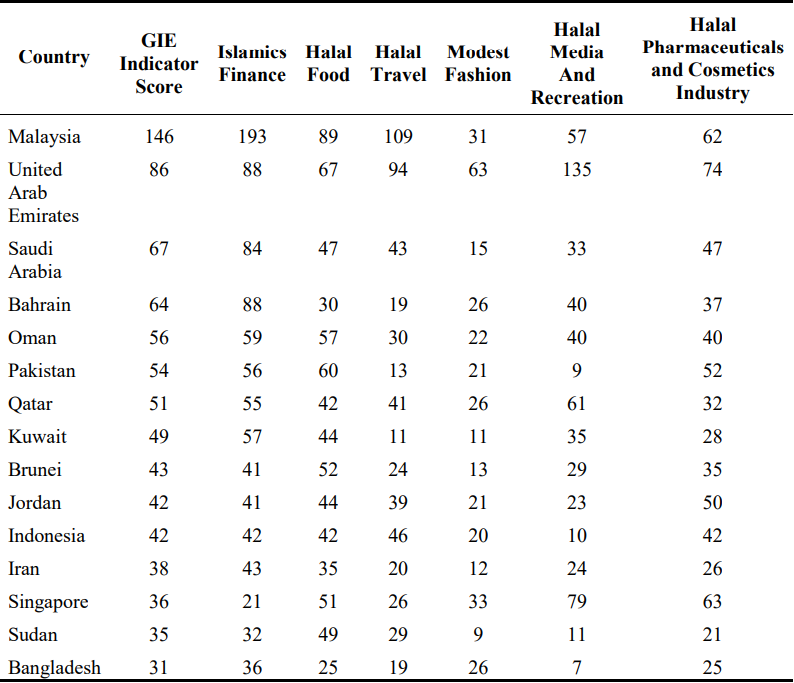

The UAE is a country where the halal cosmetics industry is very competitive globally (Ernawati, 2019). According to Table 2, provided by Ernawati (2019), the UAE is placed second in the world in terms of halal industry competitiveness. It can be interpreted as an OPPORTUNITY as it protects the local market and the industry from the aggression of multinational companies. Additionally, the UAE’s economy has been expanding rapidly and continuously for decades (Staff Writer, 2022). Every year, the OPPORTUNITY for businesses to increase their operational efficiency becomes more accessible as the number of positive processes constantly increases.

Cultural Environment

A cultural beauty trend that is becoming more and more popular in Muslim nations is the use of cosmetics that contain prophetic foods (Rahim, 2019). It represents food and ingredients mentioned in the Quran, such as “barley, milk, dates, figs, honey, olive, grapes, vinegar, cucumber, and pumpkin” (Rahim, 2019, p. 10). It diversifies the industry and poses an OPPORTUNITY for cosmetics firms operating in Muslim countries to develop a new personal care product line. In addition, UAE female citizens are the leading consumers of personal care goods and services (Maceda, 2020). This wealthy customer base provides an OPPORTUNITY for commercial organizations to launch frequent new luxury product lines and makes the development of the industry fast and constant.

Political Environment

The UAE government has signed numerous new trade agreements with both developed and emerging countries throughout the last six months (Zineldin et al., 2023). For instance, the Expo 2020 Dubai international trade event received significant attention and contributed to the growth and substantial partnership expansion of more than 75% of Dubai companies (Zineldin et al., 2023). It gives an OPPORTUNITY for vast multinational cooperation and reduces supply chain expenses for the entire industry. However, regulations for personnel care products for importers are still strict (Parker, 2018). These laws are of a protective nature, and they create a safe window of OPPORTUNITIES for the development of domestic firms.

Technological Environment

Virtual makeup try-ons are becoming incredibly popular among users of cosmetics among other digital applications (Euronews, 2023). This technological trend is an OPPORTUNITY for all industry participants to increase their target customer base, as these apps are effective advertising platforms. The UAE is also experiencing the emergence of many sustainable technology start-ups in the beauty business that focus on “clean/organic/sustainable/cruelty-free products” (RetailME Bureau, 2021, para. 2). It is a THREAT and an OPPORTUNITY; they can grow into severe competitors for current actors or profitable acquisitions and heat the market.

Natural Environment

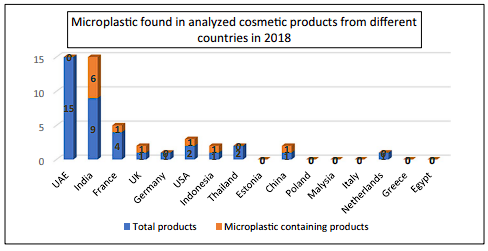

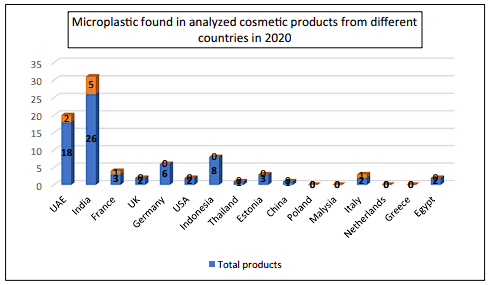

The UAE’s populace, particularly those who use color cosmetics, is growing increasingly conscious of the usage of microplastics in these (Fig. 1-2) (Habib et al., 2022). It could lead to environmental protection laws, a ban on importing many categories of personal care products, and the withdrawal of foreign companies, making this trend a THREAT. This hypothetical sequence of events could strengthen the beauty industry’s home sector due to the departure of larger competitors, which is an OPPORTUNITY. The players in the UAE beauty sector would have to pay more in both situations to switch suppliers and production techniques.

The quality and safety of skin care products using cannabis in their composition are poorly controlled by UAE manufacturers (Jairoun et al., 2021). It is an OPPORTUNITY for the beauty industry to step up and propose adequate quality control methods and procedures. By doing this, companies would avoid future fines and improve institutional relationships with legislatures and regulators in the UAE.

Distribution Strategy

MAC Cosmetics utilizes a direct distribution strategy, which implies they assume the role of a distributor and all associated activities. First, and a main implication of direct distribution, there are no intermediaries between the company and its customers (Deepak & Jeyakumar, 2019; Wei & Dong, 2022). Moreover, MAC Cosmetics has to recruit and manage internal sales teams (Gillespie & Swan, 2021). Overall, it results in relatively higher margins since the company serves as its own sole wholesaler and retailer and, thus, does not have any expenses associated with the distributor hiring process (Mkansi et al., 2020). However, it has a negative effect on marketing and sales costs, both of which cannot be delegated to other parties, given the direct nature of the distribution.

The majority of cosmetics and toiletries in the UAE are offered at shopping malls. Mainly, the beauty brand products produced in mass quantities to be sold in the malls’ supermarkets and hypermarkets tend to be the most popular (Randeree, 2019). The popularity of these distribution channels is a result of regional customer preferences: not only do shopping malls serve as a place for leisurely shopping, but they also provide cover from the hot weather (John & Dani, 2021). According to Chaturvedi and Purohit (2020), more than a third of all cosmetics sales are conducted in shopping malls, with specialized salons in second place with their 15% contribution. Aside from shopping centers and salons, commercial products are additionally distributed through standalone and convenience stores, marketplaces, pharmacies, spas, and clinics.

MAC Cosmetics uses both virtual and physical distribution channels. Physical retail stores of MAC Cosmetics are present in numerous places, including the above-mentioned shopping malls (Benoit, 2019). However, their products are unlikely to be found alongside other mass-produced brands in supermarkets or hypermarkets. This is why MAC Cosmetics has to additionally support e-commerce: it allows the company to strengthen its competitiveness in the market due to increased market penetration and customer reach (De Regt & Barnes, 2019; Nascimento et al., 2020). Apart from that, the company places a strong emphasis on ensuring a positive retail experience in case customers decide to visit their physical stores by applying marketing tools such as a unique atmosphere and customer-oriented store layout.

Being a part of Estée Lauder Companies, MAC Cosmetics utilizes it as its manufacturer and supplier. This also implies that warehousing and transportation to physical stores also belong among the services Estée Lauder provides to MAC Cosmetics (Makeup Art Cosmetics, n.d.). On the other end of the distribution chain is a specialized shipping company determined by the region of operation that delivers the goods bought online. In the UAE, MAC Cosmetics works with Alshaya Company to ensure the best delivery service possible (Makeup Art Cosmetics, n.d.). Considering reverse channels, the company manages complaints and returns by itself. Namely, it transparently establishes regulations for the return process, such as the return being applicable only for the goods ordered online or the need to be physically present in the MAC Cosmetics store and present a paycheck.

References

Benoit, A. (2019). Viva MAC: AIDS, fashion, and the philanthropic practices of MAC Cosmetics. University of Toronto Press.

Chaturvedi, N., & Purohit, H. (2020). Exploring the factors affecting buying behavior of women in UAE. International Journal of Scientific Research and Engineering Development, 3, 1210-1221. Web.

Deepak, R. K. A., & Jeyakumar, S. (2019). Marketing management. Educreation Publishing.

De Regt, A., & Barnes, S. (2019). V-commerce in retail: Nature and potential impact. In M. Claudia tom Dieck & T. Jung (Eds.), Augmented reality and virtual reality: The power of AR and VR for business (pp. 17-25). Springer.

Ernawati, E. (2019). The global competitiveness study of halal pharmaceuticals and cosmetics industry. Mega Aktiva: Jurnal Ekonomi dan Manajemen, 8(1), 51-61. Web.

Euronews. (2023). Art, technology and innovation behind beauty in the UAE. Euronews. Web.

Gillespie, K., & Swan, K. S. (2021). Global marketing. Routledge.

Habib, R. Z., Aldhanhani, J. A., Ali, A. H., Ghebremedhin, F., Elkashlan, M., Mesfun, M., Kittaneh, W., Al Kindi, R., & Thiemann, T. (2022). Trends of microplastic abundance in personal care products in the United Arab Emirates over the period of 3 years (2018–2020). Environmental Science and Pollution Research, 29(59), 89614-89624. Web.

Home | Passport. (2017). Oclc.org. Web.

Jairoun, A. A., Al-Hemyari, S. S., Shahwan, M., Ibrahim, B., Hassali, M. A., & Zyoud, S. E. H. (2021). Risk assessment of over-the-counter cannabinoid-based cosmetics: Legal and regulatory issues governing the safety of cannabinoid-based cosmetics in the UAE. Cosmetics, 8(57), 1–10. Web.

John, R., & Dani, A. (2021). Influence of mall shopping culture on online shopping preferences: An emerging economy perspective using the technology acceptance model. Transnational Marketing Journal, 9(1), 17-32. Web.

Maceda, C. (2020). UAE, Saudi women are world’s biggest spenders on beauty products – report. Zawya. Web.

Make-Up Art Cosmetics. (n.d.). Beauty and Makeup Products. Web.

Mkansi, M., de Leeuw, S., & Amosun, O. (2020). Mobile application supported urban-township e-grocery distribution. International Journal of Physical Distribution & Logistics Management, 50(1), 26-53. Web.

Mohammed, A. H., Hassan, B. A. R., Wayyes, A. M., Al‐Tukmagi, H. F., Blebil, A., Dujaili, J., Nasr, M. H., El Hajj, M. G., Malaeb, D., Alhija, S. A., Kateeb, E., Amro, A., Al-Taweel, D., A., Al Juma, M. A., Al-Ani, O. A., Farhan, S. S., Darwish, R. M., & Al‐Zaabi, A. T. (2023). Exploring the quality of life of cosmetic users: A cross‐sectional analysis from eight Arab countries in the Middle East. Journal of Cosmetic Dermatology, 22(1), 296–305. Web.

Nascimento, T. C. D., Campos, R. D., & Suarez, M. (2020). Experimenting, partnering and bonding: a framework for the digital influencer-brand endorsement relationship. Journal of Marketing Management, 36(11-12), 1009-1030. Web.

Noble, A. (2022). Get nourished, glossy lips with the 13 best lip oils makeup artists swear by. InStyle. Web.

Parker, J. (2018). Distributing cosmetics and perfumery products in the UAE. Gowling WLG. Web.

Rahim, N. (2019). Prophetic food-based cosmetics: A segment of halal beauty market. Ulum Islamiyyah.

Randeree, K. (2019). Challenges in halal food ecosystems: The case of the United Arab Emirates. British Food Journal, 121(5), 1154-1167. Web.

RetailME Bureau. (2021). Beauty tech boom: A look inside the future of the $32 billion Middle East beauty industry. Images RetailME. Web.

Staff Writer. (2022). UAE’s strong economy to pull in ‘more foreign investments.’ Zawya. Web.

P&S intelligence. (2021). U.A.E. color cosmetics market revenue forecast, 2030. Web.

Mordor intelligence (n.d.). UAE color cosmetics market analysis – industry report – trends, Size & Share. Web.

Wei, Y., & Dong, Y. (2022). Product distribution strategy in response to the platform retailer’s marketplace introduction. European Journal of Operational Research, 303(2), 986-996. Web.

Zineldin, S., D’silva, H., & Hasan, F. (2023). Importing into the United Arab Emirates: Overview. Thomson Reuters Practical Law. Web.