Introduction

In the United States, expanding healthcare access and raising the standard of care has been a significant accomplishment. Ongoing differences hinder access to essential medical care in health insurance coverage. Understanding the status of healthcare insurance coverage in Alaska is essential since the state experiences special healthcare issues due to its remote geography and high healthcare expenses. To improve health insurance coverage in the state, this paper will review significant results on health insurance coverage in Alaska, identify primary payers and uninsured people, and offer policy recommendations.

Key Insurance Findings and Primary Payers

Recent modifications in healthcare insurance coverage have significantly affected the provision of healthcare services to the inhabitants of Alaska. The most recent statistics that depicted health insurance availability can be found in Frerichs et al. (2022). According to the data, Employer-sponsored health insurance covered 41.3% of Alaska’s population (Frerichs et al., 2022).

This suggests that employer health insurance is the preferred payment method for health insurance in Alaska (Frerichs et al., 2022). Medicaid coverage, which is most common among Alaskans at 17.8%, is followed by Medicare, used by 12.2% of the population (Grant et al., 2022). Additionally, fewer people bought individual market policies than those who purchased military insurance.

Alaska has a variety of significant health insurance payers, including Medicare, Medicaid, individual market plans, and insurance through the military. At 41.4%, employer-sponsored insurance covers the most significant share of Alaskans, with Medicaid, Medicare, and the military covering the remaining percentage (Grant et al., 2022). Even though many people subscribe to various health insurance plans that fit their budgets, 14.0% of Alaskans lacked health insurance in 2021 (Grant et al., 2021).

This shows that Alaska’s 8.3% national average of those without health insurance coverage was nearly 5% higher (Grant et al., 2022). The option of insurance coverage has also undergone noteworthy adjustments each year. The number of people covered by employer-sponsored insurance has decreased, while those enrolled in Medicaid have been increasing. While the state’s decision to increase Medicaid eligibility in 2015 is a contributing factor, the findings suggest the requirement for all-inclusive policy measures to enhance health insurance coverage in Alaska.

Uninsured and Underinsured in Alaska

People with insufficient or no health insurance may be unable to get the care they require, which could severely impact their health and increase healthcare expenditures. Despite Alaska’s expanding Medicaid program, the state’s uninsured rate increased from 11.8% in 2018 to 14.0% in 2021. In 2020, 14.0% of Alaskans lacked health insurance, more than the 8.3% national average. The large number of uninsured and underinsured Alaskans severely hampers the state’s ability to offer adequate healthcare at a fair price. Due to the high cost of healthcare in Alaska, many state citizens do not have health insurance.

Lack of insurance or inadequate insurance can limit access to healthcare in Alaska, especially for those with low incomes or who reside in rural areas. Underinsurance, which occurs when insurance coverage is insufficient to cover a person’s medical needs, is a problem for many Alaskans. Lack of insurance is associated with a decreased likelihood of receiving preventative care, which could lead to higher costs for medical services or unfavorable health outcomes (Sommers et al., 2017).

Similar barriers keep those with inadequate insurance from seeking care, raising their out-of-pocket costs and reducing their usage of medical services. Even though the Medicaid expansion in 2015 was a good step, more has to be done to enhance coverage and reduce financial burdens on Alaskans (Sommers et al., 2017). To address the issue of uninsured and underinsured individuals in Alaska, policy measures are required to improve coverage and reduce cost barriers to care. Authorities must, therefore, continue to consider fresh ways to improve Alaskans’ access to healthcare and health insurance.

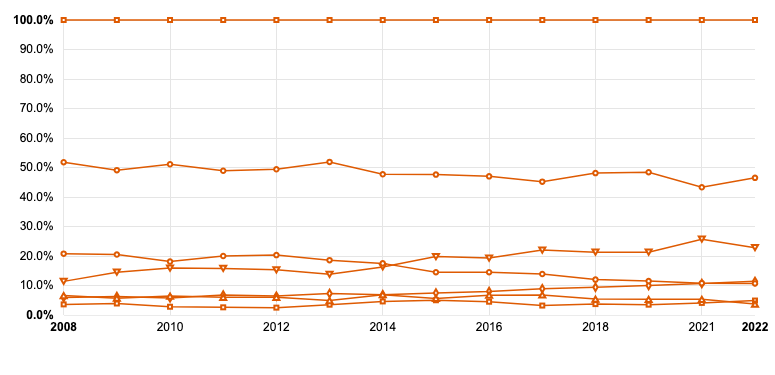

Trend Graph Analysis

The graph shows a rising trend in Alaskans enrolled in Medicaid and a falling trend in Alaskans covered by employer-sponsored health plans between 2016 and 2021. Over this time, the proportion of persons without health insurance has slightly increased (Kaiser Family Foundation, 2019). The availability of alternative coverage alternatives and Alaska’s escalating healthcare costs are two potential contributors to the trend. The state’s Medicaid expansion influenced this increase in 2015 (Pullman Regional Hospital, 2017).

As demonstrated by a 20% decrease in Alaska’s uninsured rate when the state extended Medicaid, policy changes may drastically alter insurance coverage rates(US Census Bureau, 2018). The need to continue efforts to increase access to health care coverage is shown by the fact that Alaska has a higher percentage of uninsured residents than the rest of the country. The findings emphasize the need for comprehensive policy measures, such as reducing healthcare costs and increasing health insurance coverage in Alaska (Frean et al., 2017). Despite ACA’s Medicaid expansion improving Alaska’s healthcare insurance coverage, the state still needs to find new ways through policies to assist in lowering the proportion of uninsured people.

Conclusion

Due to its distant location and high healthcare expenses, Alaska has particular healthcare insurance issues. Despite the Affordable Care Act contributing towards expanding Medicaid, most people in Alaska, up to 14%, still need to be covered by insurance. The problem major problem that has led to this issue is the costly healthcare within the state, which most low-income people find challenging. However, such an obstacle can be solved by making healthcare insurance coverage among the top priority projects within the state.

References

Frean, M., Gruber, J., & Sommers, B. D. (2017). Premium subsidies, the mandate, and Medicaid expansion: Coverage effects of the Affordable Care Act. Journal of Health Economics, 53, 72-86. Web.

Frerichs, L., Bell, R., Lich, K. H., Reuland, D., & Warne, D. K. (2022). Health insurance coverage among American Indians and Alaska Natives in the context of the Affordable Care Act. Ethnicity & Health, 27(1), 174-189. Web.

Grant, W. B., Al Anouti, F., Boucher, B. J., Dursun, E., Gezen-Ak, D., Jude, E. B., & Pludowski, P. (2022). A narrative review of the evidence for variations in serum 25-hydroxyvitamin D concentration thresholds for optimal health. Nutrients, 14(3), 639-640. Web.

Kaiser Family Foundation. (2019). Health Insurance Coverage of the Total Population. KFF. Web.

Pullman Regional Hospital. (2017). Healthcare Finance 101 with Steve Febus. Web.

Sommers, B. D., Gawande, A. A., & Baicker, K. (2017). Health insurance coverage and health—what the recent evidence tells us. N Engl J Med, 377(6), 586-593. Web.

US Census Bureau. (2018). Health Insurance Coverage in the United States: 2017. Census.gov. Web.