Executive Summary

Theme parks require market information to set and run successful franchises in foreign destinations. This report explores how KidZania Dubai can refine its business model and strategies to compete well in the UAE. KidZania is a leading firm in the indoor edutainment industry, but inadequate information on internal and external environmental dynamics could affect its performance. In this report, an exploratory approach and market analytic tools are used to analyse KidZania’s internal capabilities and threats to its growth. The PESTLE analysis shows that the macro-environmental variables at Dubai are slightly unfavourable (0.31).

KidZania’s ticket sales grew between 2014 and 2015 with the Dubai franchise accounting for 10.8% of the sales. Since it was established, the Mexican company has created core competencies that drive its international expansion. It has strong partnerships with corporate sponsors, a rigorous site selection approach, and over 100 role-playing professions. Its primary target market includes children and corporate sponsors.

A competition analysis shows that KidZania’s only competitor is Ferrari World, which offers a slightly different product (racecar). Its marketing strategy centres on the edutainment aspect of the facility to attract schoolchildren and sponsors willing to support children learning. A SWOT analysis reveals that KidZania’s strengths lie in the uniqueness of its product in the UAE and good infrastructure available in the shopping malls. However, selling an unknown concept weakens the organisation’s competitiveness. There are opportunities in the edutainment sector as indicated by the rising demand and favourable perception of theme parks with an educational component.

Introduction

Effective marketing strategies are required for successful global expansion. KidZania Dubai, a franchise of a Mexican edutainment brand, is the first of its kind in the Gulf area. Its successful entry into the region makes it an ideal company to analyse for global expansion strategies. KidZania Dubai, which was launched in 2010, reached a market share of 8.2% in two years. Its sales (attendance) grew by 10.8% in the 2014/2015 period (Ancona 2008). It offers over 70 real-life occupations in healthcare, media, and hospitality, among others, that children can do in make-believe contexts.

The purpose of this report is to examine KidZania’s competitive strategies in its Dubai market. Its objectives include (1) assessing the macro-environmental factors and (2) analysing its internal and external environments. The study will use an explorative approach based on secondary data to examine the company’s internal and external environments. It will be limited to the children’s indoor entertainment industry in the UAE. Its reliance on secondary information for the analysis may be a limitation of the study. The report provides a PESTLE analysis of KidZania Dubai, an overview of the company, the pertinent corporate social responsibility issues, its target market, the critical success factors, and product perception.

Context and Environments

Edutainment (KidZania Dubai) is a new idea in the region. There is no facility nearby with products based on an entirely similar concept. It offers minors the opportunity to learn and comprehend professions through make-believe contexts. The location (Dubai mall) is strategically allowing the firm to reach young families and corporate sponsors in the metropolis. The growing number of visitors (10.8% in 2012/2013) shows a changing trend in the way citizens spend their leisure time. A PESTLE analysis will reveal the macro-environmental variables affecting KidZania’s performance.

PESTLE Analysis

Political landscape (weight = 0.25)

The UAE is stable politically, indicating a favourable political landscape. However, the lack of universal suffrage reduces democratic space (ranked 18.96% in accountability) (DataMonitor 2015). The country became a member of the UNHRC due to its good human rights record despite the government crackdown on extremists. However, unresolved conflicts with Iran could hamper bilateral relations. The total score is 1.25 (Appendix).

Economic landscape (weight = 0.2)

The UAE stands at 19th out of 148 nations because of its favourable macroeconomic climate. The economic landscape score is 2.0 (Appendix).

Social landscape (weight = 0.2)

The expenditure in healthcare is equivalent to 2.5% of the GDP. The UAE is rated at position 41 in the human development index, indicating that the country invests heavily training and social security (DataMonitor 2015). Its score is 1.2.

Technological landscape (weight = 0.15)

The country was rated 25 globally in the Networked Readiness Index, making it a technological hub in the region (DataMonitor 2015). However, the UAE registers fewer copyrights compared to its neighbour Saudi Arabia (18 vs. 237 in 2013). The total score is 0.75.

Legal landscape (weight = 0.1)

The UAE is considered a free economy with few entry restrictions for foreign businesses. Its freedom index is 71.4, suggesting a favourable place for business. However, the legal requirement to employ Emiratis may limit the number of firms entering the market. This dimension is rated 1.2 (Appendix).

Environmental landscape (0.1)

Dubai has a modern garbage disposal system that involves tracking waste transportation. The UAE lies at position 25 globally in the environmental performance index for its conservation efforts. The total score is 1.0.

Quantification of the Trends

The weighted scores for each of the environmental dimensions are as follows: political = 1.25, economic = 2.0, social = 1.2, technological = 0.75, legal = 1.2 and environmental = 1.0. Therefore, the index (N = P+E+S+T+L+E) is equals to 7.5, which gives a ratio of 0.31 (7.5/24). The UAE’s macro-environment could be considered slightly unfavourable because N/24 is below 0.45.

Overview of the Organisation

KidZania Dubai is a large indoor edutainment facility attached to the Dubai Mall. It is a franchise of the Mexican KidZania that is being run by the Emaar Retail in Dubai. The organisation offers kids an opportunity to become role-play as doctors, nurses, fashion models, broadcasters, artists, and chefs, among other occupations. The combination of entertainment and education in a reality-based context is meant to help children comprehend various professions, develop intellectually, and nurture their talents. Its key features include neat streets, gas pump, roads, eateries, theatre, and other amusing facilities. The kids earn an income (in kidZos currency), which they can use to purchase merchandise or save in a bank.

Analysis of the Mission Statement

KidZania’s mission is to “inspire children and youngsters by providing education and entertainment under one roof” (Ancona 2008). According to Kotler et al. (2012), a link exists between the contents of a mission statement and firm performance. Companies with detailed mission statements perform better compared to those with undefined statements. KidZania’s mission captures the products offered, i.e., education and entertainment, target clientele (children), and philosophy (to inspire). Therefore, KidZania focuses on improving customer service as a competitive strategy. However, the organisation’s financial goals, location, and values are not clear from the mission statement.

Organisational History and the Development of Core Competencies

Xavier Lopez Ancona established KidZania in 1999 as an indoor amusement park to meet the entertainment needs of Mexican children. The market trends that inspired its establishment were informative entertainment, family involvement, and cooperation. The first KidZania facility was built in Mexico City, but franchises have been put up in other cities globally, including Dubai. Over the years, KidZania has continually refined its business model and expanded its range of professions to 100, which has shaped its core competencies in many ways.

First, the organisation engages many sponsors and partners (e.g. Coca-Cola) that finance kid’s activities through their CSR budgets. Second, each park is strategically located within a city with many young families and corporate sponsors. Third, the company has developed a separate adult lounge equipped with films and the internet for the waiting parents. Also, parents can watch over their children using a special wristband.

A Review of the Organisation’s Performance

Since 1999, KidZania has pursued a robust international expansion strategy. Currently, the sales from international franchises account for a third of the organisation’s revenue. Its main performance indicators are sales (tickets) and market share. KidZania’s sales grew by an average of 16.0% between 2014 and 2015 as indicated by the growing number of visitors (Rivera & Cacho-Elizondo 2015). Over the same period, the number of visitors grew by over a million to 6.5 million globally. The parks that experienced a surge in attendance included Cuicuilco, Kuala Lumpur, Dubai (10.8%), and Santiago, among others. Its relative market share in the Dubai market dropped to 8.2% from 8.6% between 2013 and 2014 (Coy 2015). Globally, KidZania attracts over 20 million visitors annually, including children and parents.

KidZania’s Present Marketing Goals and Objectives

KidZania aims to attract more children by promoting its product through media advertisements, banners, social media promotion, and broachers. First, KidZania runs value-added promotions after school hours to attract children who benefit from the educational element (Prado & Castorena 2013). Second, each park offers an interactive experience aimed at creating brand loyalty and recognition globally (Rivera & Cacho-Elizondo 2015). The organisation also collaborates with leading firms to strengthen its competitive position in the edutainment sector. Partners receive a platform to hold events, free tickets, and sales promotion from KidZania.

Social Responsibility and Marketing Ethics Issues

The pyramid of corporate social responsibility (CSR) identifies four distinct responsibilities, i.e., legal, ethical, charity, and economical (Kottler et al. 2012). Besides meeting legal and economical requirements, a firm must operate ethically and give corporate contributions to society. The ethical issues relevant to KidZania edutainment product include advertising to children and environmental protection. It collaborates with firms that sponsor various activities. Since the sponsors, e.g., Coca-Cola and Proctor & Gamble, are companies operating in other industries, it raises the issue of advertising to children using KidZania as a platform. A second issue relates to the environment. KidZania encourages children to commit to the Green World Pledge on environmental conservation.

The company has established 16 ethics that guide its partnerships with sponsors. It requires the firms to provide reality-based content that emphasises on learning activities like hand washing and production line as opposed to influencing the children to use the products. Also, KidZania ensures that parents monitor the learning of their children via a worn wristband. Although these strategies mainly address the ethical issues raised, they might not be foolproof in discouraging advertisement to young children. A requirement to exclude product identifying information from the activities could be more efficient. Further, the firms should expand its philanthropic efforts to volunteerism and human welfare.

The Key Target Market

The primary target market for KidZania is schoolchildren (4-12 years). It offers a theme park customised for role-playing as doctors, nurses, and broadcasters, among others. The facility achieves its B2C marketing through social media promotion, advertisement, and banners. Besides children, KidZania other potential clients include corporations and eateries in Metropolis complexes. KidZania obtains industry sponsorship for children’s activities from the B2B segment that includes companies such as Coca-Cola and Proctor & Gamble.

Needs and Benefits Sought

KidZania was established to meet the children’s need for edutainment, interactional system, and parental involvement. It is a replica of a city scaled down to suit professional role-playing tasks by kids. The key benefits sought include boosting the children’s knowledge of professional roles, enhancing intellectual and physical development, and nurturing young talents.

Principal Competitors and Their Characteristics

KidZania Dubai has no direct competitor in the region. Ferrari World, which focuses on themed experience, indirectly competes with KidZania in Dubai. Motiongate, Legoland, and Bollywood are set to launch their products in Dubai in 2016. Ferrari World on Yas Island was launched in 2010 with an indoor space of 2,152,000 square foot, making it the second-largest park globally (Rivera & Cacho-Elizondo 2015). Its products include racing tracks and simulators. Ferrari World ranks as one of the fastest-growing theme parks globally. KidZania, Ferrari World, and iPlay America constitute 53.8% of the market share in the entertainment industry.

Factors that Contributed to its Success

Ferrari World is attached to a resort on Yas Island. This location is important for Ferrari World’s success because the hotel resort is already a renowned brand with state-of-the-art facilities. Besides, most resorts require entertainment for kids and adults. Therefore, the facility’s location has contributed to its success in this market.

Major Strengths and Weaknesses

Ferrari World’s strength lies in its strategic location, large indoor space (2,152,000 sf), and high-speed roller coasters (148 mph). Its location has excellent infrastructure and connectivity. However, the park lacks edutainment activities for schoolchildren.

The Organisation’s Competitive Strategy

Ferrari World’s competitive strategy relates to its indoor space and location. It boasts of a large indoor area and simulations designed to resemble the Ferrari racecar. Also, the park is attached to a hotel with a good brand name and infrastructure.

Market Position and its Implications

Ferrari World is a market leader in the themed experience segment being the first of its kind in the UAE. As a market leader, Ferrari World can engage in price competition with new entrants. However, KidZania dominates the edutainment sector since Ferrari World does not offer a similar product.

Critical Success Factors in this Market

The crucial success factors (CSFs) in the edutainment market include location, industry sponsorship, and adaptability to local market needs. First, the parks, e.g., KidZania, are attached to big shopping malls (Dubai Mall) and hotels with good infrastructure. The approach reduces costs and enhances access to young families in urban centres. Second, industry sponsors (real-world brands) are needed to teach the children different professions. Third, choosing sponsors within a country helps develop activities suited to local contexts.

New entrants have to do exceptionally well in selecting a location and sponsors. Finding a metropolis with a large number of young families in need of indoor entertainment is crucial. The metropolis must also be home to the headquarters of big corporations. Exceptional persuasion is also required to secure sponsorships from the firms. The sponsors, e.g., Coca-Cola, would put up role-playing establishments within the facility to promote children learning. In this view, an organisation can underperform if it is not strategically located to access young families and corporate sponsors.

KidZania business model resonates with the identified CSFs. It earns up to a third of its revenue from marketing deals with sponsors drawn from different industries. Besides, the company seeks strategic metropolis locations (e.g. Dubai Mall) frequented by young families. The shopping centres also have the appropriate equipment and a positive brand image.

SWOT Analysis

The edutainment product is the first of its kind in the UAE. Its location enhances access and provides good infrastructure. However, selling an unfamiliar concept is a weakness of the company. KidZania has a refined business model for international expansion (Prado & Castorena 2013).

Therefore, it can open franchises in other cities to meet the demand for edutainment. However, the organisation must address the threats of rejection and disapproval in new markets. It could adapt the product to a region-specific context and involve local sponsors. KidZania should emphasise on the intellectual development aspect of edutainment to turn its weakness of being a new concept into a unique selling point. Its international expansion objectives are realistic considering the growing demand for education and entertainment in urban centres. However, it faces the challenge of preventing direct marketing to children by corporate sponsors.

Product Perception

KidZania Dubai wants to inspire creativity in children by providing an edutainment product. It projects itself as an attractive family-friendly establishment where kids can work as pretend doctors, pilots, and nurses, among others. According to Kottler et al. (2012), consumers prefer a beautifully designed product to a less attractive substitute when the price is the same. KidZania ads feature beautiful streets, kids adorning professional uniforms, make-believe facilities, and a parental lounge. In contrast, Ferrari World projects itself as a theme park where children could ride a Ferrari or roller coasters.

Consumers perceive KidZania as a place for both entertainment and learning, which is a unique selling point. Its rival (Ferrari World) is recognized as a park for entertainment. The KidZania has a strong brand association with edutainment globally. The product is unique in the industry in the sense that it involves entertainment activities that promote intellectual growth. The strong brand association favours KidZania marketing and expansion strategies.

Positioning Map

KidZania places its edutainment product at a higher position than competitor products as shown in figure 1 below. The product is its unique selling point.

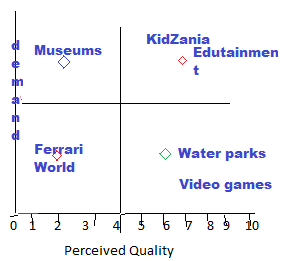

Perceptual Map

The perceptual map defines an organisation’s positioning strategy in the market (Kotler et al. 2012). KidZania strives to offer quality to increasing demand for its edutainment product.

References

Ancona, X 2008, ‘KidZania Entertainment Anchor Beyond Borders’, Research Review, vol. 15, no. 1, pp. 53-56. Web.

Coy, J 2015, ‘Major Theme Parks Are Going Indoors Anchored by Shopping Malls, Hotels, Waterparks & Casinos; KidZania is fastest-growing in edutainment. Web.

Datamonitor 2015, The United Arab Emirates: Pestle Analysis. Web.

Kotler, P Keller, KL, Hassan, S Baalbaki, I & Shamma, H 2012, Marketing Management, Pearson, London, England. Web.

Prado, J & Castorena, D 2013, ‘A Mexican edutainment business model: KidZania’, Emerald Emerging Markets Case Studies, vol. 1, no. 1, pp. 131-157. Web.

Rivera, M & Cacho-Elizondo, S 2015, ‘Going Global: Key Insights from Two Mexican Companies’, Management Dynamics in the Knowledge Economy, vol. 3, no. 4, pp. 693-715. Web.

Appendix

Table 1: Political landscape.

- Score = (+4x.25) + (+3x.25) + (-1x.25) + (-1x.25) = 1.25

Table 2: Economic landscape.

- Score = (+4x.2) + (+4x.2) + (+4x.2) + (-1x.2) + (-1x.2) + (0x.2) = 2.0

Table 3: Social landscape.

- Score = (+4x.2) + (3x.2) + (-1x.2) + (-1x.2) = 1.2

Table 4: Technological landscape.

- Score = (+4x.15) + (3x.15) + (-1x.15) + (-1x.15) + (0x.15) = 0.75

Table 5: Legal landscape.

- Score = (+4x.1) + (+4x.1) (+4x.1) + (+2x.1) + (-1x.1) + (-1x.1) = 1.2

Table 6: Environmental landscape.

- Score = (+4x.1) + (4x.1) + (+3x.1) + (-1x.1) = 1.0