Introduction

The rising cost of fuel, global recessions, lack of product differentiation among the airlines, and alteration of the aviation industry have made profitability aloof in the airline industry. To cover this gap, some airlines have looked for ways to generate income outside the traditional sales of airline tickets. The secondary sources of revenue include unbundling airline products, dynamic packaging, retailing, and advertising (O’Connell & Warnock-Smith, 2013).

An airline’s revenues from activities outside the regular service of transporting passengers and goods are called ancillary services. Flight-related and non-flight-related ancillaries generate enormous revenues for airline companies, which have adopted different strategies to gain a competitive advantage.

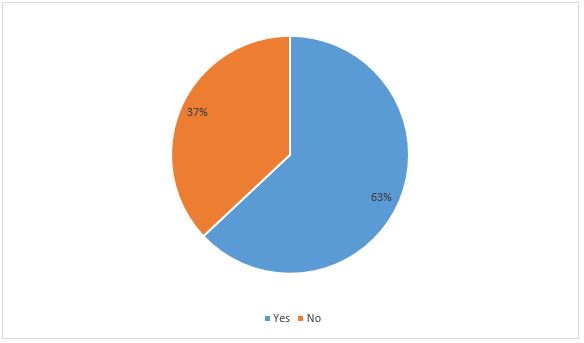

The paper will discuss different ancillaries that commercial airlines have adopted in recent years. A focus will be given on the marketing techniques that the airlines use to convince clients to purchase the goods and services that the transportation service could accompany. An analysis of the importance of ancillary revenues to different airline companies will also be done. The study will prove that for many airlines, ancillary services form a significant share of revenue companies earn, as shown in Figure 1 below. Data indicates that revenues from the ancillary services grew from 4.8% in 2010 to 13% in 2019 (Bas & Aksoy, 2022). This indicates that airlines such as the Asian group have invested in ancillary services.

Types of Flight-Related Ancillaries

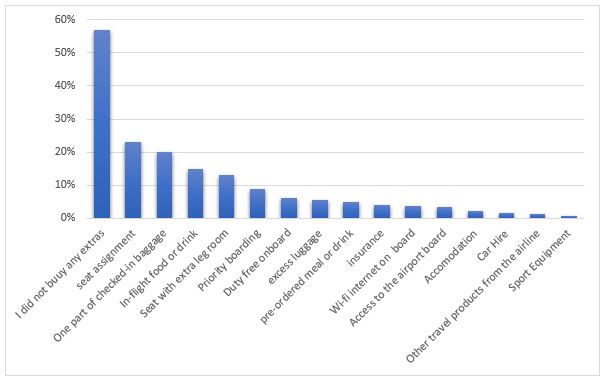

Flight-related ancillaries are those additional products and services outside the typical transportation fare while on the flight. Warnock-Smith, O’Connell, and Maleki (2017) conducted a study where they asked flight clients about the ancillaries they had purchased on their last flight, and the majority had tried at least one. The commonly purchased ancillaries included seat alignment, one piece of checked-in baggage, or an in-flight food or drink, as shown in Figure 2.

One of the most common types of ancillaries provided on planes is baggage fees, which are the extra costs that clients are charged when their commodities exceed a particular volume. Airlines market these services before the flight to increase awareness and boost revenues. The seat alignments are even more popular than the extra checked-in baggage fees, as demonstrated in the study by Warnock-Smith, O’Connell, and Maleki (2017). This option is also marketed during the booking process, where the customers are given the option to select the arrangement of the seats they wish for additional fees.

Extra legroom is also a popular ancillary service in the airplane industry, especially among premium customers. Airplane industries such as the Emirates have found that charging premium fees for the extra spaces could result in more income than increasing the number of customers with limited space (Kuo, 2022). This observation indicates that airlines sometimes forgo traditional fare revenues and opt to increase ancillary incomes.

During the COVID-19 pandemic, customers have realized the importance of keeping social distance. Some customers try to ensure they keep their distance or want space comfort and have opted to purchase the middle seat. This trend is pervasive in Low-Cost Carriers (LCCs) and has earned significant revenues (Shaw et al., 2021). Additionally, the exit row seat in LCCs is considered premium seats and are usually sold at a premium price by many airlines. The variation of seats could also vary based on metrics such as the discussed seat location, seat class, time of booking, and inflight amenities.

The airline industry also leverages the customers’ needs and desires to take snacks and drinks while on the plane. Airlines market these snacks even before the flight commences, where the customers can pay for them alongside the flight fare at a discount or purchase dusting the flight at an additional fee. Many airlines are now providing onboarding services for their customers. These services include providing transportation to and from the airports, including accommodation for their clients at an additional fee. The COVID-19 pandemic negatively impacted the revenues in many airlines from onboarding services, but they are slowly bouncing back to normal.

Airlines also generate revenues from upselling, where the services offered by the airline are differentiated into different classes, such as the regular and the premium. Clients could also upgrade from economy to business and finally first class at an additional cost. Airlines leverage their social media platforms and websites to inform clients about what they should expect from each class.

Another ancillary service that is increasingly becoming popular is priority onboarding, where clients are given a chance to book the plane before the rest of the passengers at an additional fee. Airlines’ frequent flyer programs also ensure that they maintain their top clients and encourage people to travel more (Reales & O’Connell, 2017). When integrated with the ones mentioned in the paper, this ancillary service would result in increased incomes.

The airlines allow their customers to cancel their flights at an extra fee. This ancillary service is called a refund fee, and although it is costly to the customer, it satisfies them since they do not lose all their fare. Organizations are also leveraging credit card payments to charge customers who use the cards a commission.

Additionally, inflight ancillary services, such as allowing passengers to access movies and enjoy TV shows and music during the flight, are helping drive additional revenues and profits. The airlines have also provided lounge access where clients can relax and enjoy before beginning their journeys. Many clients are usually persuaded to subscribe to this service, thus increasing the airline’s revenues. The airlines could also provide a fast track where their clients are excluded from making long cues to get security and passport checks. Additionally, the airlines provide WIFI services to their clients in the lounges and during the flight for an added fee.

Types of Non-Flight-Related Ancillaries

Airline industries are diversifying into industries other than those related to the flight industry. These services, however, cater to customer needs and preferences and could result in additional profits for aviation companies. Companies have started offering car rental services and using brand recognition and loyalty to promote this service.

Today, companies offering car rental ancillary services include the Emirates and Delta (Shaw et al., 2021). Clients can rent these cars using the company’s website and enjoy discounted benefits and loyalty programs. The applications also allow the clients to book hotels and lodgings. British Airways, Emirates, and Lufthansa are some of the known airlines in the industry. Providing cars and hotels may not be directly linked to the flights, but it has been profitable for many airline organizations.

Airline companies provide clients with travel insurance measures to safeguard them from any accidents during the flight. Although the main reason for the insurance policies is not to make profits but to spread risks, many airline companies have been able to generate profits from the premiums paid. The insurance policies can be purchased through the companies’ websites or mobile apps. Offering insurance policies also serves to be complimentary to the frequent flyer programs for the members discussed previously.

Delta, JetBlue, and other airlines have opted to offer ground transportation services in addition to their flights. These airlines have partnered with transportation companies such as Uber and Lyft to offer customers transportation to their destinations as an ancillary. The transporters also offer the companies commission fees for marketing their products on their websites and social media pages. Customers who book ground transportation services, in addition to the airline fares, enjoy discounts. Customers also seek a special airline request to have their care packed in a secure environment.

In effect, some airlines strategically offer clothing brands with the company’s logo or otherwise to gain a competitive advantage. The brands, which include clothes, shoes, and watches, can be marketed through the company’s website, which could also act as an online store. Examples of commercial airlines that have effectively adopted this strategy are Emirates and Singapore Airlines (Raynes & Tsui, 2019). Clothe brands have numerous benefits, such as maintaining brand loyalty to their clients.

The airline also offers points based on the number of times a client has used a particular airline and could redeem the points for free transportation services. The companies also offer their clients complex dynamic packaging systems where products such as hotels, care rentals, and insurance services are offered together. Both non-flight-related and flight-related ancillary services provide significant revenues for their clients, which could range billions of dollars. Figure 3 below shows how the ancillary industry has been growing and how the COVID-19 pandemic has impacted it.

Promotion and Sale of Ancillary Services

Airline companies use different techniques to market and promote their ancillary services. Some good channels the companies have discovered are pre-flight emailing clients, seat-back literature, and leveraging social media and websites. The airlines have discovered that an airline’s previous data could be used to set personalized recommendations to the client and incorporate perfect bundles for different customers. Many airlines also use onboard announcements and magazines, which are now available online, to advertise their products.

Revenue is also higher in airline industries that incorporate good marketing techniques and strategies. These strategies include offering seasonal discounts for its goods and services, using loyalty points to reward regular flyers, and providing exclusive benefits such as affordable insurance packages for its clients. The airlines have also mastered dynamic airplane pricing techniques to understand when to increase prices and reduce them using demand and supply analysis or other metrics. Forming partnerships and collaborations with other organizations that are more experienced in offering particular ancillary services has helped the organizations to offer high-quality products and services. The services provide additional revenues and ensure customer satisfaction by offering a hassle-free service when boarding a particular flight.

Organizations improve their marketing and selling strategies by analyzing the successful organizations offering such ancillary services. For instance, Delta partnered with Airbnb, where Delta customers can access accommodations at discounted costs (Lee & Yu, 2020). This partnership benefited Delta as it enabled its customers to enjoy hassle-free accommodation services and enabled Delta to understand critical strategies used by the accommodation company. Personalized marketing, dynamic pricing techniques, and collaboration with third-party organizations help airline companies promote and sell their products.

Differences in Ancillaries Between Airlines

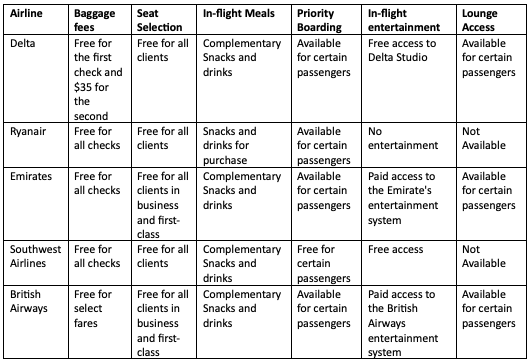

The highly competitive nature of the airline industry has made companies formulate different strategies based on their strengths and weaknesses. Some airlines like Ryanair, EasyJet, and Southwest Airlines offer low-cost ancillaries (Ahmed et al., 2019; Chiambaretto & Combe, 2023). Others, including Emirates, Qatar Airways, and Singapore Airlines, offer premium ancillary services (Chiambaretto & Combe, 2023). Some airlines, especially the premium ones, provide complimentary meals and drinks, while others need customers to purchase their meals onboard. The options for seat arrangements and the provided leg spaces vary by airline. Figure 4 below is a table that shows the different ancillaries provided by specific companies.

Delta Airlines has implemented premium airline services such as Delta Comfort and Delta One, offering better services than its competitors. Ryanair, a low-price airline, has ensured that it offers its clients free luggage space, which has helped the company retain its clients. The Emirate is a premium carrier with luggage fees above a specific volume and a well-paid entertainment system. Southern Airlines tries to provide premium ancillary services to its clients at a low cost since it is a budget airline with different classes. Finally, the British airline has an excellent lounge for only select clients at a fee.

Conclusion

Airline companies generate substantial revenues from both flight-related and non-flight-related ancillary services, employing various strategies to secure a competitive edge. Profitability in the airline industry is negatively affected by the global recession, lack of product differentiation, rising costs for fuel, and increasing governmental regulations. Therefore, many companies have found that offering unique ancillaries is the only way to differentiate themselves from their competitors.

Some companies have decided to allow their clients to go for extra seat space, seat location, means, and inflight entertainment. Although COVID-19 has affected some ancillary services, the air travel industry is recovering slowly. Therefore, airline companies should continue researching ways to implement effective, personalized, and profitable ways to generate revenues other than the standard fare fees.

Reference List

Ahmed, J.U. et al. (2019). Ryanair: A low-cost business Model in the European Airline Industry. In SAGE Business Cases. SAGE Publications: SAGE Business Cases Originals. Web.

Bas, O. and Aksoy, T. (2022) ‘Examining the impact of cargo and ancillary revenues on net profit for full-service carrier airlines’, International Journal of Business Ecosystem & Strategy (2687-2293), 4(3), pp.48-72. Web.

Chiambaretto, P. and Combe, E. (2023) ‘Business model hybridization but heterogeneous economic performance: Insights from low-cost and legacy carriers in Europe’, Transport Policy, 136, pp.83-97. Web.

Kuo, C.W. (2022) ‘Taiwan passengers’ willingness to pay for air sleeper seats’, Journal of Advanced Transportation, pp.1-11. Web.

Lee, C.W. and Yu, H.Y. (2020) ‘Examining cross-industry collaboration in sharing economy based on social exchange and social network theories’, Advances in Management and Applied Economics, 10(6), pp.29-41. Web.

O’Connell, J.F. and Warnock-Smith, D. (2013) ‘An investigation into traveler preferences and acceptance levels of ancillary airline revenues’, Journal of Air Transport Management, 33, pp.12–21. Web.

Raynes, C. and Tsui, K.W.H. (2019) ‘Review of airline-within-airline strategy: Case studies of the Singapore Airlines group and Qantas group’, Case Studies on Transport Policy, 7(1), pp.150-165. Web.

Shaw, M. et al. (2021). Third-party ancillary revenues in the airline sector: An exploratory study. Journal of Air Transport Management, 90, 101936. Web.

Statista. (n.d.). Airline industry – ancillary revenue 2018. Web.

Reales, C.N. and O’Connell, J.F. (2017) ‘An examination of the revenue generating capability of co-branded cards associated with Frequent Flyer Programmes’, Journal of Air Transport Management, 65, pp.63–75. Web.

Warnock-Smith, D., O’Connell, J.F. and Maleki, M. (2017) ‘An analysis of ongoing trends in airline ancillary revenues’, Journal of Air Transport Management, 64, pp.42–54. Web.