Key Financial Statements and Their Role in Business Decision-Making

The financial position of any business is communicated using three critical financial statements. The cash flow statement shows the cash movement inside and outside the business. The balance sheet, commonly known as the statement of financial position, shows the liability, assets, and owner’s equity. Finally, the income statement comprehensively summarizes the company’s investments, expenditures, and profits.

Business decisions are made based on the analysis of data to determine whether the venture is profitable or not. Income statements and statements of financial position are the most fundamental elements in making business decisions because they help reveal whether a business is profitable or not and whether the venture is worthwhile.

Income Statement

Wales Plc Income Statement for the Year Ended December 31, 2022.

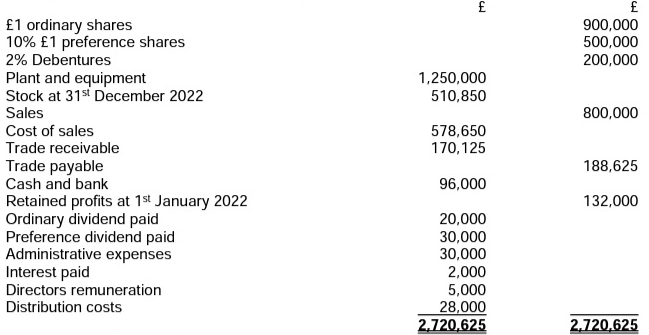

The income statement, commonly known as the trading, profit, and loss account, shows the financial transactions that take place in an organization. Wales Plc operates in the UK, which is subjected to a corporation tax calculation based on the provision of the nation’s law, assuming that it is a local company subjected to a given relief. The revenue is the most crucial part as it explains all the money the company receives through sales. The income statement for the year ended 31st December 2022 and the statement of financial position as at that date for Wales PC are based on the known balances provided. A detailed table outlining these balances can be found in the appendix at the end of this document.

In the year ending December 31, 2022, Wales plc received revenue worth 800,000. The gross profit is obtained by subtracting the cost of goods sold from the revenue to obtain the net profits from the goods. The cost of goods sold includes all the expenses that are incurred in the process of producing the goods for sale. In the case of Wales plc, for the year ending December 31, 2022, the cost of goods sold, or the cost of sales, was 578,650. Gross profit is therefore given as revenue-cost of sales as shown in the table above.

Once the gross profit has been determined, the next step is to determine the net profit by deducting all the costs incurred in the production process. In Wales plc, the cost of the expenses was an addition to the distribution costs, administrative expenses, and directors’ remuneration. If any other value is included which helps in the production process, such as electricity and gas, it will be added. The net profit remains for the organization to use and is also taxed. In the case of Wales plc, the corporation tax is given as 100,000, subject to relief and other reviews by the UK government and tax policies. After the deduction, the remaining amount is available for the organization to spend. Decisions made using the income statement may include reducing the cost of goods sold and the operational expenses (Aifuwa and Embele, 2019). Further, advocating for a better tax policy to lower the deduction is critical to making a business thrive because of the higher rate of income.

Statements of Financial Position

Wales Plc Statement of Financial Position as of December 31, 2022.

A balance sheet is another important statement that shows an organization’s financial status. The three essential components in a balance sheet must be considered when making a decision. The assets, liabilities, and equity are compared to determine the company’s liquidity (Setiyawati et al., 2020). In a typical company operating effectively, the assets must equal the sum of the liabilities and the equity. It is important to note that each category has different sub-sections and must all be considered. For example, under the assets, current and fixed assets must be added to get the total resources available for use by the company.

Liabilities are also divided into current or long-term liabilities depending on the repayment period of loans. Finally, equity includes all the shares in the organization and what the owners have invested and is always paid in the form of dividends. From the given balance sheet, there are more assets than liabilities, which means that the business is sustainable and can pay all its loans and maintain sustainability. The ability to pay off all the debts without bankruptcy means that the business is sustainable. Therefore, the management of Wales can use the information to make financial decisions such as borrowing more for investment.

Reference List

Aifuwa, H.O. and Embele, K., (2019) ‘Board characteristics and financial reporting.’ Journal of Accounting and Financial Management, 5(1), pp.30–44. Web.

Setiyawati, H. et al. (2020) ‘The factors that affect the quality of financial reporting.’ International Journal of Economics and management studies, 7(1), pp.33–39. Web.

Appendix

The following information is relevant:

- Corporation tax for the year is estimated at £100.000.

- Salesmen are owed commission of €3,000 in respect of December sales. It will be paid on 31st January 2023 and has not been recorded in the ledger accounts yet.

- Goods valued at £980 were sent to customers on 31st December 2022. Payment is due on 28 February 2023. This has not been recorded in the ledger accounts yet.

- The preference shares should be included within equity.