Introduction

Ryanair Holdings’ sustained economic results have been driven by its emphasis on administrative effectiveness and minimal expenses. This research examines Ryanair’s monetary health predicated on its financial statements, focusing on five major categories.

Firstly, the report breaks down Ryanair’s financials, such as earnings, sales-related costs, gross margin, operational expenses, and taxable performance. Secondly, the paper assesses Ryanair’s return on investment capital (ROIC) and stockholders’ equity to determine how efficiently the firm utilizes its resources. Thirdly, the report evaluates Ryanair’s liquidity, suggesting how off-balance sheet operations may influence the ratios. Fourthly, the paper examines the sourcing of recent investments in airplanes and other resources, shedding light on the enterprise’s financing approach and capacity to regulate debt levels while funding expansion.

Finally, the report analyzes Ryanair’s financial abilities, shortcomings, and one-year prognosis, incorporating the previously diagnosed sectors, market trends, and rivalry from EasyJet.

Analysis and Discussion of Operating and Pre-Tax Results

The Operating Revenue of Ryanair Holdings

Operational revenue is a firm’s money from basic company activities, such as selling goods and services. Ryanair’s primary source of operating revenue is the sale of tickets to its clients (Ryanair Holdings, 2023). The operating revenue of a firm is computed by subtracting the direct and indirect costs from total revenues. Ryanair Holdings’ operating revenue increased from $1,422 in 2019 to $8,494.8 in 2020 (Macrotrends.net, 2022a; Ryanair.com, 2022). However, the firm’s operating income decreased to $1,635.8 in 2021. In 2022, the firm reported an increase to $4,800.9 from $1,635.8 in 2021 (Ryanair.com, 2022), recording a 193.48% change.

The Operating Revenue of EasyJet

On the other hand, EasyJet decreased its operating revenues from $595 in 2019 to ($1,147) in 2020 (Easyjet.com, 2022). The following year, 2021, was even worse as the company witnessed a further decline to ($1,245), an (8.54%) difference (Easyjet.com, 2022). In 2022, the organization saw an increase to ($35), which was still a loss (Easyjet.com, 2022). Overall, EasyJet experienced negative operating revenues during the four-year accounting period.

Comparison of the Operating Income of Ryanair Holdings and EasyJet

An increase in Ryanair Holdings’ operating income in 2022 was impacted by the business earning more income than operating expenses (OpEx), which is a favorable indicator for stakeholders. This could indicate that Ryanair is properly regulating its payments while establishing solid profitability (Ryanair.com, 2022). The negative operating revenue for EasyJet Corporation was affected by the group’s strategic functions not producing adequate earnings to cover OpEx. This may be a warning that the business is encountering financial issues and may face difficulty in its sector.

The Operating Expenses of Ryanair Holdings

A corporation incurs operating expenses in the course of its usual business activities. OpEx encompasses rent, machinery, stockouts, advertising expenses, payroll, coverage, administrative costs, and monies committed to development and research (Ganat, 2020). OpEx is computed by subtracting the summation of operating income and cost of goods sold (COGS) from revenues. Ryanair’s OpEx decreased from ($6,680.6) in 2019 to ($7,367.4) in 2020 (Ryanair.com, 2022; Ryanair.com, 2019). In 2021, the firm witnessed an increase in its OpEx from ($7,367.4) in 2020 to ($2,475.2) (Ryanair.com, 2022). In 2022, the company saw a decline in its OpEx to ($5,140.5) registering a (107.68%) change (Ryanair.com, 2022).

The Operating Expenses of EasyJet

On the other hand, EasyJet has witnessed a decrease in OpEx over the past four years. The firm registered the following values as OpEx: $3,999 in 2019, $2,561 in 2020, $1,638 in 2021, and $5,804 in 2022, indicating a 254.33% change (Easyjet.com, 2022; Statista, 2021). The high OpEx could be a worrying situation for investors wishing to buy the company’s shares.

Comparison of the Operating Expenses of Ryanair Holdings and EasyJet

A decrease in Ryanair’s OpEx suggests that the airline can sustain earnings while minimizing expenses. This is an excellent indicator for shareholders since it implies the organization is capable and able to face competition successfully. Numerous elements have reduced Ryanair’s OpEx. Ryanair Corporation runs a portfolio of fuel-efficient planes, which can cut fuel expenses and operational expenditures.

Furthermore, Ryanair is renowned for its low labor costs, which result from its business model. The company has kept low worker expenses as shown: (984.0) in 21019, ($690.1) in 2022, ($472.2) in 2021, and ($1,106.9) in 2020 (Ryanair.com, 2022: Ryanair.com, 2019). It utilizes fewer employees per airplane than many other carriers, and its employees work extra hours, which helps to reduce labor expenses.

Conversely, the increase in EasyJet’s OpEx would suggest the business is overspending on day-to-day activities. This could result from several things, including rising personnel costs, higher fuel prices, or developing the firm’s transport system or fleet. EasyJet gives its pilots, cabin crew, and other personnel higher salaries. From its 2022 annual report, the corporation increased its crew’s wages from ($446) in 2021 to ($1,716) in 2022 (Easyjet.com, 2022). Moreover, EasyJet’s fuel prices often account for a substantial amount of its operating expenses. The firm saw its fuel cost rise from ($371) in 2021 to ($1,279) in 2022 (Easyjet.com, 2022). This continued rise would impact the firm’s profitability, like gross profit margin.

EBITDA of Ryanair Holdings

Earnings before interest, taxes, depreciation, and amortization (EBITDA) are an alternative economic metric to net earnings. EBITDA seeks to depict the cash profit created by the enterprise’s activities by excluding non-cash amortization and depreciation expenses and capital structure-dependent levies and debt service obligations (Shared and Orelowitz, 2020). EBITDA is calculated by adding operating income and depreciation and amortization of a firm. Ryanair’s quarterly EBITDA increased from ($77) in 2019 to $381.7 in 2020 (Ryanair.com, 2022; Macrotrends.net, 2022b). In 2022, the business recorded an EBITDA of ($1,059) which increased from ($1,410.4) in 2021, showing a 24.91% alteration (Ryanair.com, 2022).

EBITDA of EasyJet

On the contrary, EasyJet’s annual EBITDA decreased from $1,232 in 2019 to ($505) in 2020 (MarketScreener, 2023). In 2021, the firm’s EBITDA increased to ($425) from ($505) in 2020 (Easyjet.com, 2022). In 2022, the company witnessed a further increase in its EBITDA, registering $539, a 48% change (Easyjet.com, 2022).

Comparison of EBITDA of Ryanair Holdings and EasyJet

The increased EBITDA for Ryanair indicates that the organization is producing more earnings from operations, which could mean a good business model, efficient cost administration, and a powerful marketplace position. Ryanair’s principal revenue source is the sale of plane tickets to passengers. The company sells more tickets or collects more fees, hence improving EBITDA. Income collected from ancillary activities decreased from $2,928.6 in 2020 to $599.8 in 2021 (Ryanair.com, 2022). In 2022, the firm witnessed an increase to $2,148.4 in earnings.

Moreover, economic conditions, fuel prices, and competitiveness all increase Ryanair’s EBITDA. For instance, Ryanair has strived to decrease its fuel expenses for four years. Despite recording an increase in fuel cost from ($2,762.2) in 2020 to ($542.6) in 2021, the firm witnessed a sharp decline in such price to ($1,699.4) in 2022 (Ryanair.com, 2022). The decreased EBITDA for EasyJet Corporation indicates that the business faces decreased earnings and cash flow.

EasyJet Corporation’s lower EBITDA suggests that its cash flow and earnings are declining. Numerous components might have reduced EasyJet’s EBITDA. EasyJet Corporation works in a highly competitive market and intense rivalry from Ryanair results in decreased revenue and profitability. Compared to Ryanair’s operating revenue of $4,800.9 in 2022, EasyJet had a slightly higher operating income of $5,769 in the same year (Ryanair.com, 2022; Easyjet.com, 2022).

Nevertheless, gasoline is a massive cost for carriers, and if the fuel cost rises, this could result in more extraordinary operational expenses and decreased profitability. For instance, EasyJet recorded an increase in fuel expenses from ($371) in 2021 to ($1,279) in 2022 (Easyjet.com, 2022). Finally, EasyJet’s EBITDA is negatively affected by its high labor costs, which include compensation and perks for the flight crew. From its 2022 annual report, employee expenses increased from ($495) in 2021 to ($797) in 2022 (Easyjet.com, 2022). To improve its EBITDA, EasyJet has focused on increasing its operating margin.

Operating Margin of Ryanair Holdings and EasyJet

After variable production expenses such as labor and inputs, the operating margin reflects a company’s profit on each sales dollar before interest and tax payments. It is determined by dividing the total revenue of a corporation by its operating income (Mhalla, 2020).

Ryanair saw a decline in its operating margin from 13.20% in 2019 to 7.5% in 2020. In 2021, the decreasing trend continued as it recorded an operating percentage of (1.95%). In 2022, the company witnessed a further fall to (14.15%) in this value, registering a (6.25%) change. On the other hand, from EasyJet’s 2022 annual report, the firm’s operating margin increased from (1.60) in 2021 to (213.67) in 2022 (Easyjet.com, 2022). EasyJet has maintained high operating revenues to keep the operating margin so high.

Comparison of Operating Margins of Ryanair Holdings and EasyJet

Ryanair’s lower operating margin insinuates that the corporation is not producing as many profits from its activities as it should. If Ryanair’s operating margin is below what was expected, it may be due to several issues that negatively impact the firm’s profitability. For instance, Ryanair may have to reduce its pricing to keep up with rivals, leading to a decline in sales and, consequently, a fall in operating margin. It competes with airlines like EasyJet, which recorded higher revenues of $5,769 in 2022 compared to its $4,800.9 during the first quarter of the same year (Ryanair.com, 2022; Easyjet.com, 2022).

In addition, Ryanair’s operating margin could be negatively affected if its expenditures, like fuel, labor, and maintenance expenses, exceed anticipated. From its quarterly annual report, Ryanair maintenance costs increased from ($256.4) in 2020 to ($206.7) in 2021 and grew to ($255.7) in 2022 (Ryanair.com, 2022). Ryanair has prioritized boosting ancillary income by charging travelers for extras like boarding passes, seat selection, and luggage fees to grow its operating margin.

A higher operating margin for EasyJet implies that the company earns more profit per unit of sales, which is a favorable indicator for stakeholders like investors. This would show that the business is handling its costs effectively and producing robust earnings. Excellent sales growth from $1,458 in 2021 to $5,769 in 2022 has contributed significantly to this increase in margin (EasyJet.com, 2022). Therefore, EasyJet’s strong revenue growth enables it to expand its operating margin by distributing fixed costs over a more extensive revenue base.

Return on Investment Capital (ROIC) and Shareholders’ Equity

ROIC

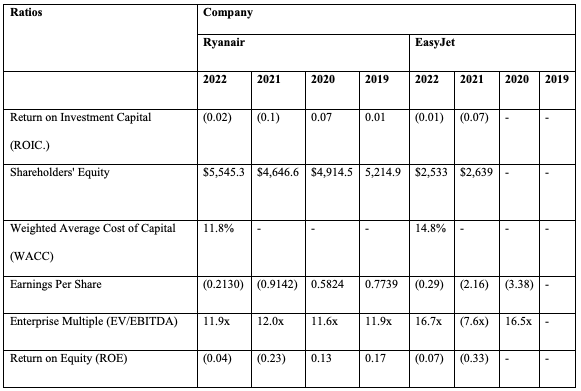

Return on invested capital (ROIC) is a metric used to evaluate a corporation’s effectiveness in distributing wealth to lucrative ventures. By dividing net operating profit after tax (NOPAT) by invested capital, one obtains ROIC. Ryanair’s ROIC increased from 0.01 in 2019 to 0.07 in 2020; however, the firm’s ROIC decreased to (0.01) in 2021 and consequently a further decline to 0.02 in 2022 (Appendix 1).

On the contrary, EasyJet’s ROIC increased from (0.07) in 2021 to (0.01) in 2022 (Appendix 1). A reduced ROIC for Ryanair would show that the business is not producing adequate returns on its invested capital. Ryanair is confronted with fierce rivalry from EasyJet, requiring it to cut prices and give discounts to attract consumers, resulting in decreased earnings and ROIC. In the case of EasyJet, a greater ROIC would indicate that the company is utilizing its funds to produce revenues effectively. This might be a favorable indication for shareholders, meaning that EasyJet is an economically stable brand with promising development possibilities.

SE

Shareholder equity (SE) alludes to an institution’s net worth or the total monetary value that would be restored to its stockholders in the event of a liquidation after all debts have been paid. Ryanair’s SE decreased from $4,914.5 in 2020 to $4646.6 in 2021; nonetheless, the figure rose to $5,545.3 in 2022 (Ryanair.com, 2022; Appendix 1). EasyJet’s SE was reduced to $2,533 in 2022 from $2,639 in 2021 (EasyJet.com, 2022; Appendix 1). A rising SE for Ryanair would imply that the corporation’s assets continually expand more than its liabilities, resulting in a rise in the stock price. The decline in EasyJet’s SE may show that the institution is encountering financial troubles or is not making sufficient profit to meet its expenditures. This may suggest a drop in the business’s general economic condition and growth expectations, causing shareholders anxiety.

WACC

The weighted average cost of capital (WACC) is a company’s aggregate after-tax cost from all streams, such as common stock, bonds, preferred stock, and other types of debt. Ryanair recorded a lower WACC in 2022 (11.8%) than EasyJet’s higher WACC of 14.8% in 2022 (Appendix 1). A reduced WACC implies that traders regard Ryanair as a lesser-risk investment, resulting in improved investor confidence and interest in the company’s shares, which can lead to an elevated stock price. In contrast, the increased WACC challenges EasyJet to earn enough returns for its shareholders, decreasing its stock price.

EPS

Earnings per share (EPS) is determined by dividing a business’s gross revenue by the number of outstanding shares of its common stock. The outcome serves as a measure of a firm’s profitability. Ryanair’s EPS decreased from 0.5824 in 2020 to (0.9142) in 2021 and rose to (0.2130) in 2022 (Ryanair.com, 2022). On the other hand, EasyJet’s EPS, though negative, increased from (3.38) in 2020 to (2.16) in 2021 and a further rise to (0.29) in 2022 (Appendix 1). In the instance of EasyJet and Ryanair, the negative EPS indicates that the companies have sustained deficits and negative net earnings. This could result from many circumstances, including rising costs, falling sales, or poor business judgments. It also signals that the organizations are trying to remain viable in their sector or that the whole market is declining.

EM

Enterprise multiple (EM) is a proportion utilized to calculate an enterprise’s value. The EV multiple, corporate value divided by EBITDA, considers a firm’s debt similarly to a prospective purchaser. Ryanair’s EM decreased from 11.9x in 2019 to 11.6x in 2022. The figure increased to 12.0x in 2021 and dropped to 11.9x in 2022 (Appendix 1).

EasyJet’s EM reduced to (7.6x) in 2021 from 16.5x in 2020. However, the ratio increased to 16.7x in 2022, registering a +319.74% change (Appendix 1). The lower EM is viewed as more advantageous because it suggests that Ryanair is undervalued compared to its profitability. In the case of EasyJet Company, the higher EM indicates that the industry considers the corporation to have robust economic prospects or a dominant competitive positioning.

ROE

Return on equity (ROE) is a benchmarking tool determined by dividing net income by SE ROE, regarded as the yield on net assets since SE equals a business’s net assets minus its borrowing. Ryanair’s ROE decreased from 0.13 in 2020 to (0.23) in 2021 and rose to (0.04) in 2022 (Appendix 1). EasyJet’s ROE increased from (0.33) in 2021 to (0.07) in 2022 (Appendix 1). The negative ROEs of Ryanair and EasyJet indicate that neither company is producing a return from the money its shareholders have contributed. This could result from several factors, including high operational costs, decreased revenue, or poor economic governance.

Analysis and Discussion of Solvency Ratios

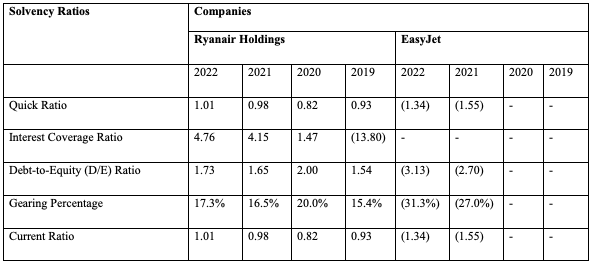

Current Ratio

The current ratio is a liquidity proportion that assesses a company’s capacity to pay its short-term or annual commitments. Ryanair’s current proportion decreased from 0.93 in 2019 to 0.82 in 2020. However, the figure increased to 0.98 in 2021 and 1.01 in 2022 (Appendix 2). Conversely, EasyJet’s current ratio increased from (1.55) in 2021 to (1.34) in 2022 (Appendix 2).

Ryanair’s increasing current ratio dictates that the organization can robustly meet its short-term debts using its current assets. This may signal that the corporation has greater liquidity and economic freedom to satisfy its obligations, which is a good indicator. In contrast, the negative current ratio for EasyJet shows that the firm encounters liquidity concerns and lacks adequate short-term resources to cover its short-term commitments.

Quick Ratio

The quick ratio reflects a company’s capacity to satisfy its short-term liabilities through its most liquid resources. Ryanair’s quick proportion was similar to its current ratio despite recording inventories. EasyJet maintained a similar scenario because it did not record lists in its 2022 annual report (EasyJet.com, 2022). The significant quick ratio of 1.01 for Ryanair indicates that the business has considerable potential to satisfy its short-term economic responsibilities by utilizing its relatively liquid assets, such as cash and accounts receivable. EasyJet’s negative quick ratio shows the firm has insufficient liquid assets to fulfill its short-term liabilities.

Interest Coverage Ratio

The interest coverage ratio is a borrowing and performance indicator determining how readily an organization can cover its debt’s interest expense. This percentage is derived by dividing a corporation’s EBIT during a particular time by its interest expense. Ryanair’s interest coverage ratio has increased continuously over the four years presented (13.80) in 2019, 1.47 in 2020, 4.15 in 2021, and 4.76 in 2022 (Appendix 2). EasyJet did not record any interest coverage because no interest expenditures were kept in its 2022 annual records.

Debt-to-Equity Percentage

To analyze an institution’s financial leverage, the debt-to-equity (D/E) percentage is determined by dividing its total liabilities by its SE. Ryanair’s D/E ratio rose from 1.54 in 2019 to 2.00 in 2020 (Appendix 2). The following year, 2021, the proportion fell to 1.65 before rising to 1.73 in 2022 (Appendix 2).

On the other hand, EasyJet’s D/E percentage decreased from (2.70) in 2021 to (3.13) in 2022. The D/E ratio of 1.73 for Ryanair indicates that the firm has more debt than equity, insinuating it depends mainly on borrowed capital to fund its activities and developments. The negative D/E ratio suggests that the business has more equity than borrowing, widely perceived as a positive indicator because it signifies the corporation’s solid fiscal position.

Gearing Ratio

A gearing ratio describes a fiscal proportion that contrasts the firm’s owner equity to its borrowed capital. The best way to calculate the gearing proportion is by converting a corporation’s D/E ratio as a percentage. Ryanair’s gearing percentage increased from 15.4% in 2019 to 20.0% in 2020, then decreased slightly to 16.5% in 2021 before rising to 17.3% (Appendix 1).

On the contrary, EasyJet’s gearing ratio decreased from (27.0%) in 2021 to (31.3%) in 2022 (Appendix 2). The gearing ratio of 17.3% suggests that Ryanair has relatively low monetary leverage, insinuating that the corporation has a reduced debt load compared to its equity. Conversely, the gearing percentage of -31.3% is an unwanted outcome, as it insinuates that EasyJet has a harmful degree of commitment.

Financing of Recent Investments in Aircraft and Other Assets

Like most other airlines, Ryanair supports its airplanes and other properties via loans and equity. Ryanair has engaged in several contracts and related arrangements as a component of Ex-Im Bank’s sponsorship of the Boeing 737 aircraft. As of March 31, 2022, fifty of Ryanair’s fleet planes were funded by loan arrangements, with multiple banks operating in systematic export financing and covered by an Ex-Im Bank loan assurance (Ryanair.com, 2022). Ryanair has a history of arranging to finance similar-sized plane acquisitions. 1998, 2002, 2003, and 2005 Boeing agreements, totaling 348 airplanes, were funded using about 66% Ex-Im Bank loan assurances and capital market funding. Sale-leaseback borrowing accounted for 24%, while Japanese Operating Leases with Call Options (JOLCOs) and business loans accounted for 10% (Ryanair.com, 2022). Moreover, Ryanair has utilized lease funding for aircraft purchases, partnering with third-party leaseholders to rent planes.

Many modifications have been made to the corporation’s loan and share issue to reflect its purchasing activity. With a BBB (stable) credit grade from Standard & Poor’s and Fitch Ratings, Ryanair issued €850 million in 1.875% unsecured Eurobonds with a 7-year maturity in June 2014 (repaid in June 2021) (Ryanair.com, 2022). In addition, it issued €850 million in unsecured Eurobonds at 1.125% with an 8-year maturity in March 2015 and €850 million in unsecured Eurobonds at 2.875% with a 5-year maturity in September 2020 for the procurement of Boeing airliners (Ryanair.com, 2022). The company did not record long-term and short-term debts in its 2022 quarterly report.

Conclusion

Ryanair’s lower OpEx is a strength since it is a low-cost carrier with a business plan prioritizing cost savings and effectiveness. By maintaining a low OpEx, Ryanair can offer cheaper tickets than its rivals, which draws price-conscious consumers and assists the airline in expanding its client base. Ryanair’s Operational Expenses (OpEx) are anticipated to decrease dramatically in 2023 due to its use of a specific aircraft type, the Boeing 737, which saves maintenance and training expenses. Moreover, the higher operating revenue of $4800.9 in 2022 would generally be considered a strength for Ryanair because it allows the company to achieve economies of scale, which helps drive costs even further. With its operating expenses, such as fuel and maintenance, decreasing, Ryanair’s operating income is expected to continue growing in 2023.

On the contrary, Ryanair’s lower operating margin (14.15%) in 2022 shows that the firm generates less income per sales unit. This indicates that the company’s OpEx is considerably higher than its earnings. This statistic is expected to remain low in 2023 since Ryanair works in a sector characterized by severe rivalry and slim margins.

Consequently, Ryanair’s D/E ratio of 1.73 is considered high, insinuating that the firm has taken on substantial debt to fund its operations, expansion, or investments. Ryanair relies significantly on debt to support its activities, which can heighten its financial burden. While debt can be beneficial for sustaining growth and investment possibilities, Ryanair’s D/E ratio is expected to continue rising in 2023 due to the company’s long-term commitments to fleet procurement.

References List

Easyjet.com. (2022). Web.

Ganat, TAAO (2020) ‘Capex and OpEx expenditures,’ in Ganat, T. A (ed.) Technical Guidance for Petroleum Exploration and Production Plans. New York: Springer, Cham, pp.53-56. Web.

Macrotrends.net. (2022a). Ryanair Holdings revenue 2010-2022 | RYAAY. Web.

Macrotrends.net. (2022b). Ryanair Holdings EBITDA 2010-2022 | R.Y.A.A.Y. Web.

Macrotrends.net. (2022c). Ryanair Holdings current ratio 2010-2022 | RYAAY. Web.

Macrotrends.net. (2022d). Ryanair Holdings debt to equity ratio 2010-2022 | RYAAY. Web.

Macrotrends.net. (2022d). Ryanair Holdings quick ratio 2010-2022 | RYAAY. Web.

MarketScreener (2023). EASYJET PLC: financial data forecasts estimates and expectations | EZJ | GB00B7KR2P84 | MarketScreener. Web.

Mhalla, M. (2020) ‘The impact of novel coronavirus (COVID-19) on the global oil and aviation markets.’ Journal of Asian Scientific Research, 10(2), pp.96-104. Web.

Ryanair.com. (2019). Ryanair | Annual report 2019. Web.

Ryanair.com. (2022). Ryanair | Results Centre. Web.

Shared, I. and Orelowitz, B. (2020) ‘The airline industry and COVID-19: saving for a rainy day.’ American Bankruptcy Institute Journal, 39(5), pp.36-58.

Statista. (2021). EasyJet plc: operating expenses 2009-2021 | Statista. Web.

Appendix 1

Appendix 2

Ryanair Holdings and EasyJet Solvency Ratios (Macrotrends.net, 2022c; Macrotrends.net, 2022d; Ryanair.com, 2022; Easyjet.com, 2022; Macrotrends.net, 2022d).