Introduction

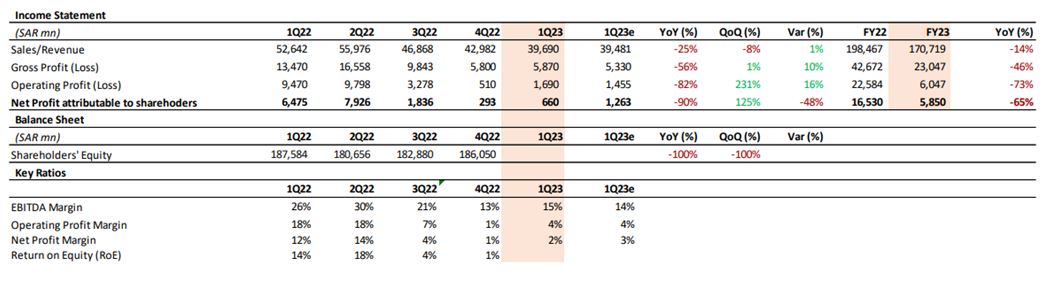

One should highlight that financial growth in business means expanding the company, its market, profitability, and potential, considering several elements. The financial performance of Saudi Basic Industries Corporation (SABIC) over the past three years has been volatile. For instance, according to the official website, in 2021, the EBIT margin was 20%, and in 2022 already 12%. On May 4, Reuters said the company’s net income would fall 90 percent in Q1 2023 and warned that profitability would remain under pressure for some time. Nevertheless, despite such moments, SABIC aims for growth and development, focusing on petrochemical products to improve operational efficiency, create synergies, and strengthen the brand.

Main body

Return on equity (ROE) is the ratio of net income to an organization’s total cost of capital. According to the 1Q23 Results Review, the company’s ROE since 2020 has markedly declined recently, and in Q1 2022, the rate was 14%, whereas, at the end of this year, it showed 1%. In Q1 2023, SABIC’s ROE slightly increased compared to the previous quarter. However, it is too early to expect positive long-term prospects due to high inflation, interest rates, and price pressure from China.

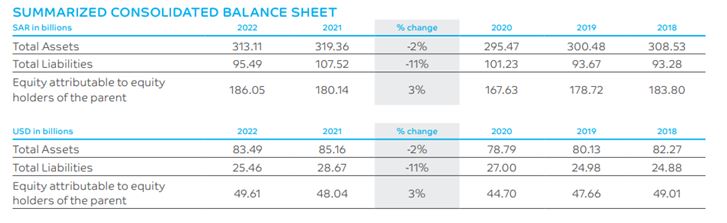

Return on average capital employed (ROACE) is the return on capital employed, a profitability ratio calculated to assess business performance in terms of total capital management. The standard formula must be used to calculate ROACE: ROACE= EBIT / Average Total Assets−L (Average current liabilities). An accurate calculation requires referring to data from the official website. For example, ROACE (in SAR) in 2022 is 178 292 436,3569525: ROACE = 38.57 billion / 313.11 – 95.49 = 38.57 billion / 217,62 = 38,800,000,000 / 217,62 = 178 292 436,3569525. Nonetheless, analyzing SABIC’s annual reports over the past three years, one can conclude that this indicator changes positively and negatively, with no definite direction.

One should note that SABIC’s main drivers are margin and asset turn. Before the global COVID-19 pandemic in 2019-2020, SABIC had relatively stable, measured margins. Over the past three years, however, there has been a gradual decline in profits. At the moment, profit margins remain low due to the global economic downturn and weakening demand for plastics and building materials, according to Gulf Business magazine. Consequently, SABIC’s asset turnover in 2022 was SAR 198.47 billion, an increase of about 13 percent over the previous three years.

In a general sense, SABIC’s gearing and financial structure aim to support strategic plans and pursue continuous growth and development. The primary source of liquidity is cash from operations and borrowings. The company competently and correctly allocates available resources to maintain the efficiency of operations and needs capital expenditures, investments, and dividend distribution. One can read more about the financial indicators mentioned earlier in the following tables.

One should note that SABIC’s main segments are petrochemicals, agri-nutrients, specialties, and metals. These are the different components of the company that are involved in producing a single good or service or group of related goods or services. They are subject to risks and profits different from those of other industry segments. At the segment level, the company gives insights into the organization’s inconsistent results and performance. By and large, SABIC successfully serves all market segments with little threat from new entrants and established production. According to Argaam, segment sales in the aggregate grew in Q2 2022 and showed relatively good results for other years. Nevertheless, Reuters reports that prices for SABIC’s segments have fallen significantly in Q4 of 2022, and margins will remain under pressure for some time in 2023 because of slow demand. Currently, SABIC is experiencing difficult times amidst external circumstances in all segments but strives to solve the problems sensibly, satisfying customers’ needs while improving the organization’s efficiency.

Dow Chemical Company and BASF are the appropriate comparator firms. These are organizations whose shares make up the FT-SE 100 Stock Index. In addition, these are SABIC market comparators whose data should be used to compare products, financial performance, and other aspects. They work in the same industry and have almost the same segments. According to the Comparably website, SABIC outperforms its competitors in product quality, pricing, and customer service. However, these companies make slightly more profit than SABIC. For example, SABIC received revenue of SAR 198.47 billion ($ 52.92 billion) for the entire 2022 year. On the contrary, Dow Chemical Company delivered $56.9 billion in net sales for the 2022 year versus $55 billion in 2021. Consequently, as reported in open sources, Dow Chemical Company’s GAAP net income was $4.6 billion versus $6.4 billion in 2021. Accordingly, BASF generated a revenue of around 87.3 billion euros (equal to 96,152,220,000 USD). If one compares these indicators for the three previous years, it becomes clear that the financial strength of SABIC in certain moments is either inferior to competitors or is about on par with them.

Conclusion

SABIC’s business model is based on value, differentiation, flexibility, sustainability, and speed in meeting unique customer needs. The company appeals to strategic fundamentals like customer and market focuses, operational excellence, technologies and innovations, portfolio management, transformation, localization engine, as well as environmental, social aspects, and governance (ESG). The business model is implemented with some trade-offs between three main pillars: people, planet, and prosperity. According to Porter’s five forces, the industry outlines the average market power of buyers and suppliers, the threats of replacement, and the emergence of new players. The nature of competition in this industry can reach a high level. Generally, the industry structure in which SABIC currently operates is one of the most promising, highly efficient, and competitive. Indeed, SABIC’s business model fits perfectly for this industry, making it an essential player in the global chemical industry with its emphasis on innovative solutions and clear actions that meet every customer’s needs. In the short term, SABIC may face trouble related to operational risks. These include technical failures, equipment malfunctions, unplanned actions, strikes and civil protests, health and safety incidents, and others. SABIC could respond to these disruptions by investing in developing a project to modernize and expand production facilities.