Introduction

Bed Bath & Beyond (BBBY) is a retail chain operating in the US, Canada, and Mexico. The main products that the company sells are furniture and other household goods. Over the past few years, BBBY has been gradually losing its profitability, which could result in the company’s final bankruptcy. At the same time, the latest quarterly report indicates that the company has significant losses in all areas of its activities and growing long-term debt. Therefore, it is necessary to develop strategies to help the company stabilize its position in the market and increase its financial performance.

Current Financial Plan

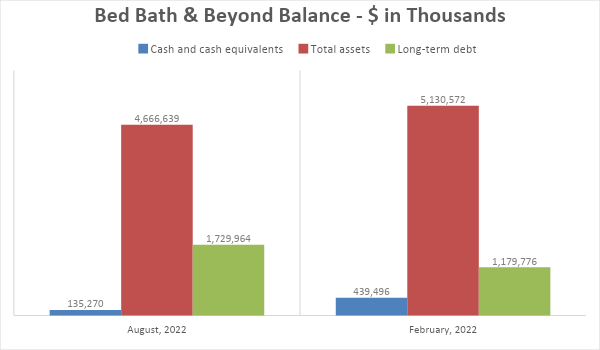

According to the latest quarterly report, Bed Bath & Beyond merchandise sales dropped significantly, resulting in a decline in the company’s assets. While in February 2022, the company’s total assets were $5.1 billion, in August 2022, this figure dropped to $4.6 billion (EDGAR, 2022). Moreover, in August, the company had only $135 million in cash and cash equivalents; in February 2022, this figure was $439 million (Figure 1). Thus, there has been a noticeable decrease in the company’s financial resources and assets over the past six months.

In addition, the company’s long-term debt increased in proportion to the decrease in its assets. In February, the debt was $1.2 billion, while in August, this figure rose to $1.8 billion (EDGAR, 2022). Therefore, one of the main aspects of the company’s financial stabilization should be the repayment of long-term debt, or at least not allowing it to increase. Moreover, the assessment of the company’s assets shows that, at the moment, the company has specific resources that can be transformed into cash and cash equivalents and used to pay off debt. For example, according to the report, the estimated value of property and equipment has increased. In the long run, this resource can be used to pay off debt and avoid company bankruptcy.

Furthermore, it is worth noting that sales in the company have declined significantly. For example, in August 2022, 6 months ended sales were $2.9 billion, while in 2021, the exact figure was $3.9 billion (EDGAR, 2022). At the same time, restructuring and transformation initiative expenses continue to grow. Although these figures are low, it is worth considering that the total liabilities of Bed Bath & Beyond in August 2022 amounted to $5.2 billion (EDGAR, 2022). In this scenario, it becomes evident that more than the company’s sales is needed to maintain its activities.

Thus, a decrease in the company’s sales revenue demonstrates that the company is losing the loyalty of its customers. The field of activity of the company has relatively high competition. In addition, the goods sold by the company, such as furniture and other household goods, are in a reasonably high price segment. This forces buyers to choose other retailers who can provide similar products at a more affordable price. Therefore, developing and implementing strategies for achieving a sustainable competitive advantage in the marketplace and increasing financial performance is necessary.

Strategies

Applying specific strategies can help a company strengthen its position in the market and increase its revenue. The company’s management has developed a reorganization plan that includes reducing the number of stores, laying off employees, and attracting investments that can be used to pay off the company’s debt (Bed Bath & Beyond Inc., 2022). However, after careful analysis of the proposed plan, certain weaknesses and flows of the developed strategy become apparent.

First, the reduction of 20% of the staff will increase the burden on the remaining employees, increase working hours, and, as a result, the need to raise wages. Savings on employees’ salaries, which the company’s management has incorporated into its plan, may not be realized in natural conditions. On the other hand, if a company increases the burden on employees and does not provide adequate wages, there is a greater likelihood of complaints and lawsuits regarding working conditions. In this case, the company may suffer even more significant losses.

Secondly, the complete closure of stores implies losing a certain number of customers who retained their loyalty to the company. It threatens to worsen the company’s reputation and, as a result, significant financial losses due to lower sales. However, one possible strategy to help prevent these adverse effects could be adopting the buy-online-and-pick-up-in-store (BOPS) strategy (Shi et al., 2018). The emphasis on online sales can reduce the staff of offline stores without a significant burden on other employees.

In addition, using such a strategy will help prevent the company from exiting the market in some cities. Stores that can be expensive to maintain can be replaced with warehouses where online shoppers can pick up their merchandise. Shi et al. (2018) note that in some cases, using such a strategy may have an adverse reaction among customers since BOPS deprives buyers of the opportunity to evaluate the product in person. However, e-commerce services are already being used by the company. Therefore, the main task is to focus the attention of buyers on online services through, for example, marketing and sales strategies.

Implementation

Implementation of this strategy demands a thorough analysis of the company’s current online sales. It will help to analyze the model of customer behavior, as well as to identify shortcomings and shortcomings in the online sales system. After that, you can stick to the plan developed by the company’s management to close stores and reduce the number of employees. The financial resources saved from this can be rationally invested in improving online sales services.

Outsourcing companies can be used to regulate the operation of technologies and the online sales system. Often the services of such companies are cheaper than wages for full-time employees. Therefore, this could be another savings item for Bed Bath & Beyond. In addition to developing and implementing new technologies, the saved financial resources must be used to pay off the company’s debt. Full or partial repayment of long-term debt is one of the key aspects to which the company’s activities should be directed at the moment. As long as the amount of the company’s assets does not exceed its total liabilities, the company’s bankruptcy is inevitable.

In addition, to increase the company’s profitability and maintain its competitiveness, it is necessary to understand the needs and demands of customers. Shi et al. (2018) believe that the BOPS strategy allows companies to offer discounts to customers and create a price advantage for the company in the market. Since the company’s field of activity has a reasonably high level of competition, the ability to buy the necessary product at a more affordable price can be a decisive factor for the buyer.

Conclusion

Hence, Bed Bath & Beyond is currently experiencing severe financial difficulties that require immediate solutions. One of the possible strategies could be a partial transformation of the company’s activities with an emphasis on online sales. It will reduce the expenses for maintaining offline stores’ work and employees’ wages. In addition, the buy-online-and-pick-up-in-store strategy allows you to get a cost advantage and consolidate customer loyalty in the market.

References

Bed Bath & Beyond Inc. (2022). Business & Strategy Update. Web.

EDGAR (2022). Quarterly report: Bed Bath & Beyond Inc. Web.

Shi, X., Dong, C., & Cheng, T.C.E. (2018). Does the buy-online-and-pick-up-in-store strategy with pre-orders benefit a retailer with the consideration of returns? International Journal of Production Economics, 206, 134-145.