Case Information

Torrey Nano is an upcoming biotechnology firm mainly engaged in pharmaceutical research. In 2017, the firm’s CEO, Jack Heiner, had to decide on the option to introduce a new product called Nano-4. The decision centered on the manufacturing route to adopt for the product that would have significant implications for the company’s future (pg. 48).

Ordinarily, the company’s product formulation process evolves in four phases: Phase I (assess safety), II (examine efficacy), and III (large scale testing and commercialization) (pg. 48). In the case of Nano-4, the management had identified five critical scenarios that form the basis of analysis in this paper. The Net Present Value (NPV) approach is applied to assess the best scenario the manager can adopt based on the projected cash flows and rate of return provided.

Manufacturing Strategies for Nano-4 in Clinical Trials

Given that Nano-4 is the first product the company expects to launch for human testing, it would be advisable for the company to put up its pilot facility. The approach will ensure it maintains control over the manufacturing process, especially for phase I and II clinical trials (pg. 48). The company will be able to control production and adherence to quality and regulatory standards. Additionally, investing in its pilot facility allows Torrey Nano to build the necessary infrastructure and expertise for future manufacturing projects, setting a solid foundation for growth.

The company has no experience in marketing and commercializing pharmaceutical products. It would be appropriate to outsource these services for phase III trials and commercialization (pg. 48). However, this depends on the viability of the option based on the NPV analysis. If the company has adequate resources, it can still opt to build the manufacturing to gain from the product’s profitability and better control the supply chain. Furthermore, this option allows Torrey Nano to quickly adapt and respond to changes in demand or regulations, providing a competitive advantage in the market. Despite the higher upfront costs, Scenario 1 is the most practical choice for the long-term success of Torrey Nano’s Nano-4 product.

Evaluation of Scenarios: Strengths, Weaknesses, and NPV Calculation

NPV is calculated using the formula: total present value (TPV) – Initial investment. The total present value is given by ![]() where CFt is the cash flow at time t, r is the discount rate, and t is the time.

where CFt is the cash flow at time t, r is the discount rate, and t is the time.

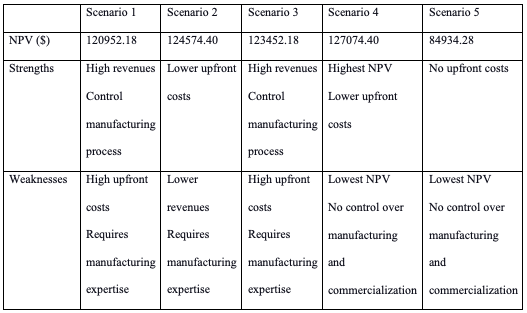

The discount rate for the scenarios is based on the royalty paid, which is 40%, 10%, 40%, 10%, and 5% for scenarios 1 to 5, respectively (pg. 50). Table 1 below shows the NPV for each scenario with the total present value calculated in excel and attached in appendix 1.

- Scenario 1: NPV = TPV – Initial investment = 161952.18 – 41000 = $120952.18

- Scenario 2: NPV = TPV – Initial investment = 135574.40 – 11000 = $124574.40

- Scenario 3: NPV = TPV – Initial investment = 161952.18 – 38500 = $123452.18

- Scenario 4: NPV = TPV – Initial investment = 135574.40 – 8500 = $127074.40

- Scenario 1: NPV = TPV – Initial investment = 84934.28 – 0 = $84934.28

Recommendation

Based on NPV calculations, strengths and weaknesses analysis, and long-term strategic considerations, Scenario 4 emerges as the most viable option for Torrey Nano due to the highest NPV. The option has the least upfront costs, as the company will contract phase I and II and license phase III for the new product. Despite having lower revenue, savings on costs will result in higher earnings in the long term.