Introduction

Regulatory bodies usually strive to ensure that there are no monopolies in any industry. This is because, in a monopolistic market, there is no stiff competition between various companies. Lack of competition does not provide a monopoly with the necessary impetus to improve the quality of its products. TransGlobal Airlines is a government-owned company with a monopolistic status.

The company operates several international and local flights. The company has been profitable in the past since it has enjoyed the goodwill of the government. However, political upheavals threaten the company’s position in the local and international market. The country expects to have a presidential election within a few months. Presidential candidates promise to privatize the airline.

Also, change in government would make the airline lose the goodwill and protection of the government. The government may grant other airlines ‘beyond rights’ permit. This would give other airlines the right to operate within the country. This would increase competition in both the local and international market. Therefore, it is critical for the airline to undertake several strategic changes or face imminent failure.

However, having the support of the government has greatly benefited the company. The airline owns its aircraft and has very little debt. Therefore, the company should use its strong financial position to ensure its survival in a competitive market. The presidential election is the turning point of the airline. Making the right strategic decision would boost the competitiveness of the company.

Profitability

TransGlobal Airline has a strong financial position. Monopolistic status and government support are the main factors that have contributed to a strong financial position. The strong financial position is not due to being the best airline in the market.

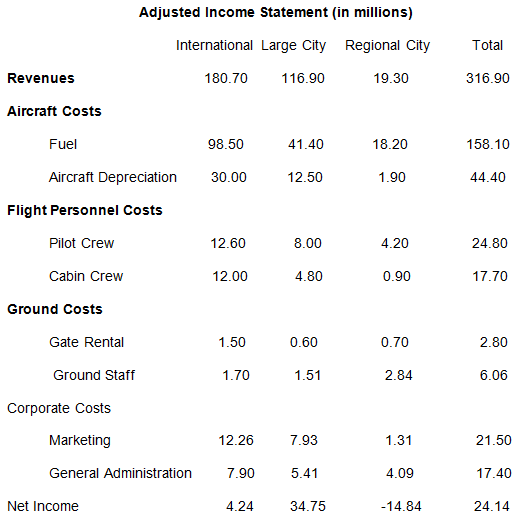

It is evident that change from monopolistic to a competitive market will ultimately affect the financial position of the company. Competition may even lead to the collapse of the company. TransGlobal Airlines has three market segments. These include international destinations, large cities, and regional cities.

Assumptions

TransGlobal airlines use jumbo jets, medium jets, and turboprops for an international, large city and regional city flights. Therefore, the depreciation value of planes used on international flights, large city, and the regional city is Kr 30.0 million, Kr 12.5 million and Kr 1.9 million respectively. The other assumption is that the company allocated marketing expenses according to the ratio of revenue generation of the market segments.

Profitability Analysis

A close look at the net income of TransGlobal Airlines according to the market segment shows that the company made huge losses in the regional city market. However, in the initial income statement, the international destination route was the market segment that was making losses.

The reason why the airline recorded international marketing as a loss-making market segment is due to improper fuel expenses allocation. However, the correct input shows that the international market made a profit of 4.24 million Krevna (Kr).

The regional city market made a loss of 14.84 million Kr. The large city market segment is the most profitable market segment. The market segment made a profit of 34.75 million Kr. The international market segment promises to reap huge financial benefits to the company due to the high growth potential of the market.

Break-even Analysis

In the newly adjusted income statement, the regional market segment is operating at a loss. Therefore, it is vital for the airline to determine the break-even analysis of the market segment. The turboprop, which has a capacity of 25 passengers, serves the regional city route. There are 45 regional round trips daily. Therefore, the airline operates 16,425 round trips annually.

If the airline is operating at full capacity, it would have an annual passenger-miles of 123.1 million. However, the airline currently has 59.1million passenger-miles. Therefore, the airline is operating at a capacity of 48%. The regional city route generates revenue of 19.3 million Kr when the airline is operating at 48% capacity, and charging 49 Kr per passenger.

At the break-even point, the airline should not incur any losses in the regional city route. The company may achieve this by increasing the number of passengers or the price of the regional ticket. To offset the loss, the airline should increase its revenue to 33.14 Kr (19.3+14.84). For the revenue to increase the company should have an average number of passengers per flight to 21.

The company may also increase the ticket price to 85 Kr for a one-way ticket. The best option is for the airline to increase the ticket price to 85 Kr to break even. Therefore, the break-even passenger volume is 21, and the break-even ticket price is 85 Kr. In the above calculations, the general assumption is that the expenses are fixed.

SWOT Analysis

Strengths

TransGlobal Airlines has an excellent security track record. The airline has never experienced any major accident. The airline delays or cancels flights if there is an indication of equipment malfunction. During its existence, the airline has only experienced a minor accident. However, this did not tarnish the image and reputation of the company.

The company only got humorous attention from the media. Also, the accident was not due to1 a fault on the airline’s part. The airport management was at fault for allowing a cow to enter the runway. Therefore, customers feel safe whenever they travel with TransGlobal Airlines.

TransGlobal Airline is financially strong. The company owns its aircraft and has very little debt. The strong financial position of the company is due to the government’s practice of buying aircraft whenever there are enough funds to purchase the aircraft.

Also, TransGlobal Airline has government support. Therefore, the government restricts competition from other airlines. Also, the airline negotiates the fares it should charge on various routes with the government. The government allows the airline to charge fares that would allow the company to earn a reasonable profit.

TransGlobal Airlines’ financial stability is partly due to the company’s flight plan. The airline operates international flights at near full capacity. The airline’s international flights leave SOF early morning and depart from the international location to SOF at 6 p.m.

This is the rush hours for international flights. This enables the airline to have near full capacity in its international flights. Operating near full capacity increases the revenue that the company earns from international flights. Thus, international flights are the most profitable routes in the company.

Weaknesses

TransGlobal Airlines has very old aircraft. The government only buys aircraft when it has enough funds to purchase new aircraft. Even though this reduces the debt that the airline has, it does not enable the airline to buy new airline that incorporates new technologies. This makes the company unable to benefit from technological advances in new aircraft.

Technological advances may make the aircraft be fuel efficient and improve the comfort of the customers during their flights. Comfort reduces the company’s profitability. TransGlobal Airline charges less airfare in its turboprops since the turboprops are not comfortable. Access to newer aircraft would enable the airline to charge higher airfares as the new aircraft would be more comfortable.

Charging extra airfare would improve the profitability of the airline. Also, TransGlobal Airlines has a monopolistic status in the local market. This makes the airline offer low-quality services due to lack of competition. This may be a major handicap to the company if the election opens up the local and international market to more competition.

Increased competition may reduce the profitability of the airline. This is due to the fat the increased competition would make the market decide the airfares of the company. In the current situation, the government decides the airfares that the airline should charge. In so doing, it allows the airline to make a reasonable profit.

Opportunities

TransGlobal Airline has been in operation for forty years. Therefore, the airline has built its brand name. TransGlobal Airline has a monopolistic status locally. Therefore, customers trust the company in air travel within the country and international destinations. There is an increase in demand for air travel. Therefore, the increase in demand would increase the profitability of the airline as it already has a strong presence in the local market.

The TransGlobal airline has an opportunity for further growth by venturing into the international market. In the current operating environment, the government allows other airlines to serve only SOF. However, change in government would enable other airlines to secure ‘beyond rights’ for other local destinations.

This would allow TransGlobal Airlines to get reciprocal ‘beyond rights’ in the foreign airline’s domestic country. This would increase the international destinations that TransGlobal Airlines would serve. The international market has the potential to reap huge financial benefits to the airline. Creation of new international routes would enable the company to increase its profitability and recognition in the international market.

Threats

The forthcoming presidential elections may destabilize TransGlobal Airlines. Presidential candidates promise to privatize the airline. The government would distribute share ownership of the airline to local government bodies. The percentage of ownership would depend on the volume of service that the airline has in the local governments. The local governments do not have prior knowledge of how to run an airline.

Therefore, they may force the management to make decisions that would hurt the company. The forthcoming election would also lead to loss of the monopoly status of the airline. The government would open the market to other airlines. Therefore, TransGlobal Airline would no longer control the market.

Increased competition may force the airline to reduce the airfares it charges for various local and international flights. Also, increased competition may force the company to discard its old aircraft, which are not comfortable. Increased competition would force the airline to reduce its costs of operation to remain competitive. This may force the airline to acquire newer aircraft, which are more energy efficient.

Recommended Strategies

The regional city market segment is operating at a loss. Therefore, TransGlobal Airlines should strive to increase its profitability in the market segment. This would increase the overall profitability of the airline. Currently, the turboprops that operate in the routes carry an average of 17 passengers per flight. This is a capacity of 68%.

The airline should strive to increase the capacity of the airline to at least 80%. The airline may achieve this by reducing the number of flights that the company operates in the regional city market segment. Reducing the number of flights in the regional market segment would reduce the average costs of operating aircraft in the regional cities.

It would reduce fuel consumption of the aircraft and the number of crew necessary for flights in the regional cities market segment. The company may also increase the fare it charges for regional routes to increase the revenue the airline generates from the market segment. TransGlobal Airline should consider opening small hubs in regional cities.

The average cost of opening small hubs in regional cities is much lower than the cost of operating aircraft in the regional cities. This would reduce the average operating costs of the company. TransGlobal Airline should also device a plan that would enable it to venture into international markets. The airline accepts payments in Krevna. However, other airlines sometimes charge a surcharge for payments in Krevna.

Therefore, the airline has a fair advantage for international flights that depart to and from SOF. TransGlobal Airlines should consider using smaller aircraft in international destinations. This would increase help in increasing the number of passengers that fly via the airline to international destinations. TransGlobal Airlines should have a long term strategy that would enable it to acquire newer aircraft. The newer aircraft should operate in the international market, which has high growth potential.

Conclusion

TransGlobal Airlines is at a turning point. The company faces imminent failure if it does not make the correct decision regarding its future operations. The airline should improve the quality of its services to survive in a competitive market. Also, the company should ensure that it makes a profit on all routes. The regional cities route is currently operating at a loss. Reducing the losses in the regional cities market segment and expanding its reach in the international market segment would increase the profitability of the airline.