Introduction

Accounting policies have massive impacts on firm financial statements. Plant, equipment, and revenue are some of the aspects of financial statements often influenced by accounting policies. Indeed, in decision-making, investors are guided by information concerning assets. The guiding principles of accounting are ever-changing, a condition that fueled the introduction of fair value (FV) as a criterion used for evaluating balance sheet items (Mauro, Guido and Elisa, 2017). Unisa’s financial statements can be understood after establishing the basis used in preparing them, identifying and classifying sources of revenue, and determining accounting policies applied.

Basis Used in the Preparation of Financial Statements

The basis of accounting is ideally methods applied in recognizing expenses and revenues in financial statements. Various accounting bases are employed in Unisa’s financial statements, including cash basis, accrual basis, modified cash basis, and FV disclosures. Under an accrual basis, accountants have recognized revenues when earned, along with the expenses upon consumption. Expenses and revenues are jointly called accruals and are recorded regularly. By applying the cash accounting basis, accountants recognize cash received, not forgetting to label bills paid as expenses. In some sections of the financial statements, accountants have varied the accrual and cash accounting bases, especially in recording long-term assets as accruals, as suggested by Octariyani, Gamayuni and Dharma (2022). This method has made it possible for accountants to include loans and fixed assets in the balance sheet.

Accounting tools such as the US generally accepted accounting principles (GAAP) and international financial reporting standards (IFRS) are used in financial statements to define FV. It is the amount for settling liabilities and exchanging assets between knowledgeable parties willing to indulge in orderly transactions (Amel-Zadeh, Barth and Landsman, 2017). Although US GAAP is more prescriptive than IFRS, both principles prescribe hierarchical methodologies using prices, valuation models, model postulations, and observable inputs.

Revenue Classification as Exchange Vs. Non-Exchange and Reasons

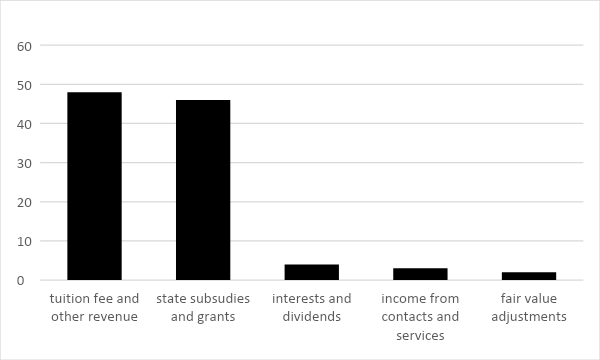

Unisa exchanges its items and services to get revenue in return. It is why such revenue is classified as exchange-based and is obtained through fee collection and sale of goods, winning contracts, and sale of services. In addition, Unisa earns exchange revenue as interest and dividends. The above-stated revenue sources are considered exchanges because Unisa substantially meets its obligations to be entitled to their benefits (Bisogno et al., 2019). On the other hand, non-exchange sources of revenues include fair value adjustments, along with state grants and subsidies. These are non-exchange revenue since Unisa is not involved in any performance obligations or stipulations to obtain them.

Note Accounting Policy for Property, Plant, and Equipment

The policy for property, plant, and equipment is disclosed in note 1. The policy states that the carrying amounts of these assets are determined using significant estimates and judgments—as suggested by Rahman, Hossain and Haque (2021). Decisions are supported by the information available at the end of the financial quarter but may differ from actual results. Ideally, it is a suitable accounting policy because it promotes the disclosure of the asset’s FV. Table 1 in Appendix A shows Unisa’s list of properties, plant, and equipment.

Cost vs. Revaluation Modes

The cost model is commonly used for determining the carrying value of property, plant, and equipment. According to Roda and Garetti (2020), the model is based on the asset’s original cost, less accumulated depreciation and impairment losses. It is easy to determine the carrying value of an asset using the cost model, as all that is required is the asset’s original cost and the accumulated depreciation.

The revaluation model is an alternative to the cost model for determining the carrying value of property, plant, and equipment. The main advantage of the cost model over the revaluation model is its simplicity. Conversely, the cost model is disadvantageous because it does not reflect changes in market value (Kasztelnik, 2020). The revaluation model’s ability to reflect shifts in market value makes it preferred over the cost model, notwithstanding the challenge it has, especially when used in determining the current market value of an asset.

Assessing the Depreciation of Assets

Some assets have depreciated, while others have not (e.g., land). Land cannot depreciate because it has an indefinite useful life (Gissel, 2016). The artwork did not depreciate, but the carrying value of artwork and land is reviewed annually and adjusted for impairment when necessary. Property, plant, and equipment acquired utilizing donations are recorded at nominal value. As explained by Kasztelnik (2020), the depreciation method yields a straight line. The straight-line depreciation method is the simplest and most commonly used. Under this method, the depreciable amount is allocated evenly over the estimated useful life of the asset.

Impairment of Assets Assessment

Unisa assesses its assets for impairment at each reporting date. If there is any indication that an asset may be impaired, its recoverable amount is estimated. The University applies a simplified approach to calculating expected credit losses for student receivables, loans, and other receivables. It does not track changes to the credit risk but instead recognizes a loss allowance based on the lifetime expected credit losses at each reporting date. These loss allowances are recognized in profit or loss statements, indicating compliance with the suggestions of Kasztelnik (2020). Unisa also recognizes an allowance for expected credit losses for all receivables.

Conclusion

Conclusively, Unisa uses various accounting bases, including cash, accrual, or cash-accrual blend. These bases help it categorize its revenue sources as exchange or non-exchange based. Part of its accounting policies requires accountants to determine carrying amounts of assets (e.g., Property, Plant, and Equipment) using significant estimates and judgments. Unisa also applied the cost model and the revaluation model to estimate the value of its assets.

Reference List

Amel-Zadeh, A., Barth, M.E. and Landsman, W.R. (2017) ‘The contribution of bank regulation and fair value accounting to procyclical leverage’, Review of Accounting Studies, 22(3), pp. 1423-1454.

Bisogno, M. et al. (2019) ‘Setting international public-sector accounting standards: does ‘public’ matter? The case of revenue from non-exchange transactions’, Accounting in Europe, 16(2), pp. 219-235.

Gissel, J., L. (2016) ‘A case of fixed asset accounting: initial and subsequent measurement’, Journal of Accounting Education, 37, pp. 61-66.

Kasztelnik, K. (2020) ‘Property, plant, and equipment and IFRS conversion from the U.S. accounting perspective—technical research report’, International Journal of Accounting and Finance Studies, 3(2), pp. 20-26.

Mauro, P., Guido, P. and Elisa, M. (2017) ‘Fair value accounting and earnings quality (EQ) in banking sector: evidence from Europe’, African Journal of Business Management, 11(20), pp. 597-607.

Octariyani, E., Gamayuni, R. R. and Dharma, F. (2022) ‘Implementation of discretionary accrual in local governments and motivation of local government incentives: a literature review’, Asian Journal of Economics, Business and Accounting, pp. 272-279.

Rahman, M., Hossain, S.Z. and Haque, M. (2021) ‘Timing, recurrence, and effects of fixed assets revaluation: Evidence from Bangladesh’, International Journal of Economics and Financial Issues, 11(2), pp.67-75.

Roda, I. and Garetti, M. (2020) ‘Application of a performance-driven total cost of ownership (TCO) evaluation model for physical asset management’, In Value-based and intelligent asset management (pp. 65-78). Cham: Springer.

Unisa., (2020) Rising to the virtual challenge.

Appendix

Appendix A: Table 1 Showing Property, Plant, and Equipment. Source: Unisa (2020)