How Companies Can Manage Events with a Global Impact

Global disruptions like the Covid-19 pandemic have a dramatic effect on global trade and often come as a shock to businesses. The appropriate response for companies typically involves building organizational resilience to anticipate current challenges as well as anticipate and address disruptions in the future.

How EasyJet Could Ensure Survival

To ensure its survival during lockdowns and travel bans, EasyJet could take every step necessary to reduce costs, conserve cash burn, enhance liquidity, and ensure it is best positioned for a return to business. For example, EasyJet could shrink its fleet through leases, sell its old assets, and access a government-corporate finance scheme to boost its balance sheet.

Why EasyJet Used Each of the Mentioned Financing Sources

Some of the reasons why EasyJet might have opted to use a government financing facility as one of its financing methods include; lower interest rates, less stringent credit requirements, and more flexibility in paying off the debt (Morrell, 2007). Additionally, tapping shareholders for money (equity financing) does not need to be repaid.

EasyJet Earning Per Share (EPS) and Gearing Ratio

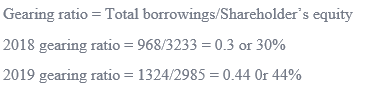

EasyJet’s EPS (Diluted) for the twelve months ended in Sep. 2018 and 2019 were €90.2 and €87.8 respectively. Therefore, each share received 90.2 and 87.8 euros for 2018 and 2019 respectively. This means the company had more profits to distribute to its shareholders in 2018 than in 2019. Financial gearing could be considered the most relevant ratio for stakeholders because it reflects a company’s creditworthiness and financial risk (Mishra, 2019). In 2019, EasyJet’s gearing ratio was 44%, an increase of 14% compared to 2018 (Figure 1). However, since the gearing ratio is under 50%, EasyJet was still considered a lower geared company and depended more on equity. A significant reason for this development is the increase in debt, EasyJet started spending millions to offset its expenses (EasyJet, 2019). A strongly geared corporation is more likely to experience financial difficulties (Männasoo et al, 2018). This would affect several stakeholders, such as shareholders.

EasyJet’s mid-level gearing ratio seems to have provided stability. EasyJet even became an FTSE100 member in December 2019 (Sharemagazine, 2019). On contrary, EasyJet’s decreasing EPS gave a poor indication of the health of the company, which destabilizes shareholders’ returns (Morrell, 2007b). Therefore, this allowed it to review its liquidity position, which confirms its actions in the quarter 3 report.

Reference List

Mishra, S. and Bansal, R. (2019). ‘Credit rating and its interaction with financial ratios: A study of BSE 500 companies’. In Behavioral Finance and Decision-Making Models (pp. 251-268). IGI Global.

Männasoo, K., Maripuu, P. and Hazak, A. (2018). ‘Investments, credit, and corporate financial distress: Evidence from Central and Eastern Europe’, Emerging Markets Finance and Trade, 54(3), pp. 677-689.

Corporate.easyjet.com, EasyJet Annual Report, and Accounts. (2019). Web.

Morrell, P., (2007). ‘Airline finance and aircraft financial evaluation: evidence from the field.’ In Conference conducted at the 2007 ATRS World Conference.

Magazine, S., News, M., and EasyJet could return to FTSE 100 next month, D., 2019. easyJet could return to FTSE 100 next month, Shares Magazine. Sharesmagazine.co.uk. Web.