Background

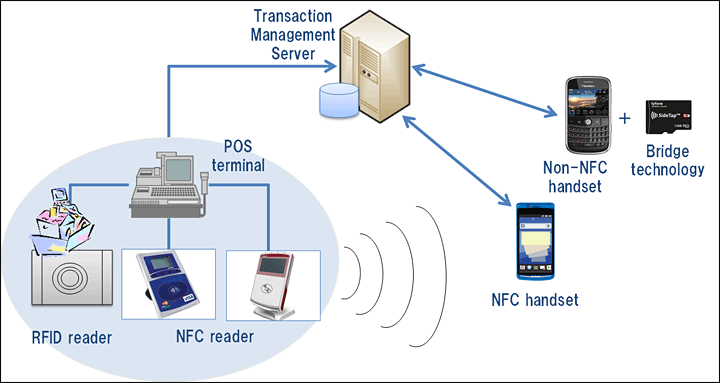

The rapid progress in the development of new technologies over the last three decades such as the Radio-Frequency Identification (RFID) payment technology, which is used in banking and other industries have dynamically shifted to the digitalised systems. For example, in the last few years, Radio-Frequency Identification (RFID) payment technology has widely been integrated into credit and debits cards payment methods (Hossain &Prybutok 2008). The technology has been used in Smartphone retail technologies to enhance payment, which is the next step high-tech’s payment generation. The technology enables a direct interface with a miniaturised chip, which consists of interrogators and tags (Thiesse 2007).

Google Wallet is an example of Smartphone retail payment system and Geld Karte, Oyster and Octopus are prepaid payment cards used in the UK, Germany and Hong Kong respectively. The technology is the latest in the banking system. However, it has spread rapidly and has penetrated different other industries (Shin, 2009). Statistics show that the UK alone has more than 20 million contactless cards. However, the level of awareness of contactless cards is about 80% because of the presence of multinational institutions advocates of the technology. For instance, retailers such as Marks & Spencer, Waitrose, the Co-operative and Boots actively promote the technology to increase awareness (Angeles 2013). In addition, retailers such as, McDonalds and Eat food chains are offering services based on contactless cards. Thus, the acceptance of the technology seems to be progressing every year.

It is worth noting that the level of acceptance of the technology in the UK is considered moderate. Despite the presence of this technology and companies offering its service, it is surprising that the payment method is not the norm in the country. The reliability and performance of the card have been tested and the results show that the card performs twice as faster than the conventional cards (Pramatari&Theotokis 2009). There are more than 20 million contactless cards issued to consumers in the UK and the awareness level of more than 80% has been achieved by 2014, yet little changes in the method of making payment have been observed. Typically, most consumers still prefer to use the conventional cards and cash methods. However, it is interesting to understand the future of this new technology’s product development.

Research problem

The major question in this phenomenon regards the inability of the RFID payment cards to penetrate the market as expected. For instance, it is not clear why the cards have not become a popular method of payment, and this product in future (Lee, Park, Yoon &Yeon 2012). Secondly, various questions have been raised about the privacy as well as security of the RFID card method of payment. Is RFID payment method worth the risks involved?

Evidently, there is inadequate research information available to address these questions. In particular, information regarding consumer behaviour and how they are embracing the new technology in payment system is lacking. In fact, most studies have attempted to determine various aspects of consumer behaviour in embracing other payment methods, which have been enhanced by technology. For instance, consumer behaviour and its impact on acceptance of such payment technologies as online, mobile and Smartphone payment technologies have been studied. Nevertheless, information about the impact of consumer behaviour and trust towards RFID-enhanced contactless cards is greatly lacking (Sarma, Weis & Engels 2013). It is quite possible that the low level of acceptance and embracement of the technology among the consumers in the UK results from inability to consider and address the issues related to consumer trust and behaviour towards the new technology.

Aim and Objectives

The aim of the proposed research study is to understand more clearly the technology adaptation process of product development. The method used is to review different concepts, methodologies and theories from studies that are relevant to the subject within this sector. The aim of this project is to investigate how new technology acquire or adopt product services and the factors surrounding the process. The project also highlights the enablers as well as the inhibitors that affect the change process.

In addition to new-technology adaptation process of products, the study investigates (as a case study) on the phenomenon and novel payment method that has resulted from RFID technology ‘Contactless Payment’. Particularly, contactless payment will be able to increase the likelihood of success in the adoption process. From the review, concepts and perspectives are identified that will help to forecast future of the development of contactless payment based on its lifecycle.

Beside the drivers of technology adoption, many studies have argued that there are other factors that contribute to the adoption process. The key factors that directly contribute to the changes in the organisation are management characteristics and consumer behaviours and trust in the technology. This project does not cover all aspects of the literature and does not claim that the frameworks are relevant for all businesses industries, however the study acknowledges that it depends on the circumstances of the sectors where the technology is applied and will focus on the case study that is ‘’Contactless Payment’’.

The study seeks to achieve the following objectives:

- To review the relevant literature of the adoption of adapted new-tech product towards consumer behaviour of consuming the ‘’Contactless Payment’’ and the relevant issues

- To find consumer trust and behaviour at the moment and in near future with regards to technological changes such as the mobile technology advancements

- To investigate the relevant factors which contribute to new-technology product preferences and its concerns

- To classify prediction of contactless innovation in the future and its lifecycle

- To explore the personal trust and behaviour of the consumers to Contactless payment.

- To understand to what extent consumers use Contactless Payment for their payment and will use in future.

Significance of the Study

The aim is to develop knowledge on the inability of the RFID contactless payment method to achieve wide and massive usage based on a cases study of the contactless payment technology, despite having more gained an 80% awareness regarding its efficiency, quality and security. To address the problem, the research will limit its scope to the nature and impact of consumer trust and behaviour towards technology, focusing on the RFID contactless cards. Therefore, this information will be important in addressing the problem. In addition, it will be useful in both academics and business fields. The RFID card makers, marketers, banks as well as corporations offering the services to their customers will find the information useful in developing effective business strategies. Moreover, the information is expected to act as a part of the guidelines needed in policy making at both the corporate level and the exchequer.

Study hypothesis

This research proposal believes that the problem of low level of acceptance and embracement of the contactless payment cards in the UK is partly caused by various aspects of consumer behaviour and trust towards a new technology, despite the availability of information regarding the system.

Review of Literature

Adoption of adapted new technology towards consumer behaviour and trust

Different studies have attempted to investigate and explain the adoption of adapted product development and the effects on consumer behaviour. This research has attempted to establish an in-depth understanding of consumer behaviour and trust towards various payment methods in various parts of the world (Prahalad & Ramaswamy, 2000). In the UK, adequate information is available to explain the relationship between consumer acceptance of various methods of payment and consumer behaviour and trust. For instance, online payments, mobile and conventional cards and bank-to-bank methods are intensively studied (Lee, 2009).

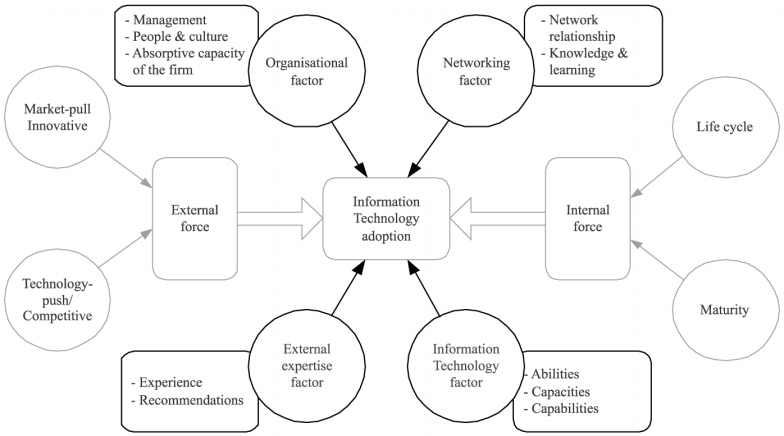

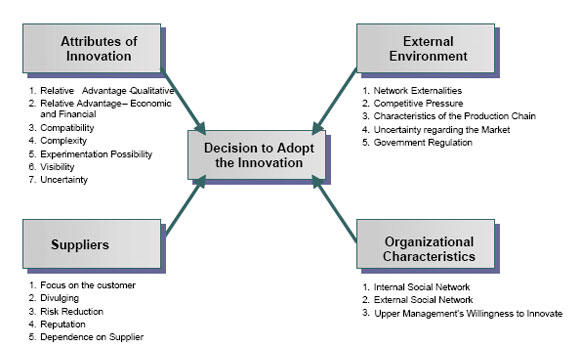

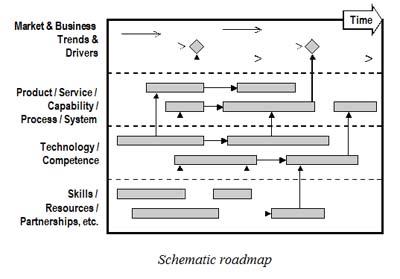

At the root of the new technology adoption process are the drivers of IT. Moreover, technology enhanced methods such as; online payment systems have recently received a lot of attention from researchers. As it can be seen from figure 1, the drivers include technology-push and market-pull, internal pressure and external pressure together with competition and innovation (Citrin, Sprott, Silverman & Stem Jr, 2000). These reasons can be exemplified in an adoption technology model, which was derived from selected sources. Beside the drivers of adoption, many studies have suggested that there are other factors that contribute to the adoption process. The key factors that directly contribute to the changes in the organization are management characteristics and behaviours, the firm’s culture, external network, external resources or professional expertise and the innovation itself. Using the innovation adoption model, the author incorporates the key factors and proposes a framework that conceptualises the IT adoption process (Nguyen, 2007).

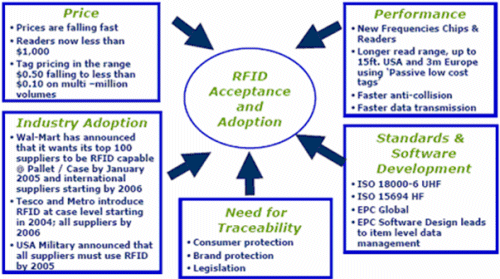

Adhiarna, Hwang, Park and Rho (2013, p.45) views the factors, which influence the adoption of new technology to be within the organisation and among the customers. Within the organisation, internal and external factors play a significant role and within the customers, environmental and individual factors play a significant role. Within the organisation skilled expertise make positive contributions to the adoption process because their skills enhance the adoption process. According to Adhiarna, Hwang, Park and Rho (2013, p.3), the other factors include information technology and its capabilities, the experience people posses in using the technology, market pull and push and the maturity of the technology.

Issues

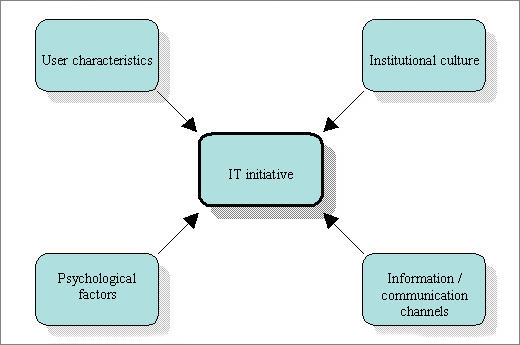

However, the adaptation of the new technology is a critical point of concern by different firms because of different issues that have been raised, which include the specifications of the technology and how it fits into the organisation’s infrastructure (Avoine 2005). In addition, the characteristics of the user, institutional culture, psychological factors, and information technology are other contributing factors to technology adoption (Mukherjee &Nath 2003). On the other hand, the cost of the technology is a significant point because it involves determining the cost benefits of implementing the technology. Other issues include the capability of the organisation to accommodate the new technology.

The new-tech adaptation such as the RFID provides users and the organisation with the ability to enhance the supply chain of the products and services they have to offer to the customers (Boye 2008). Here, the system enables the users to be able to track the movement of products in the provision of services to the customers and to make precise predictions about the future demand for the products and services, the sales levels and to track the inventory levels and establish the tends in consumer behaviour. Here, organisations understand the potential cost implications (Nemoto, Vasconcellos & Nelson 2010). According to Baude, Ender, Haase, Kelley, Muyres and Theiss (2003, p.40), adapting to the use to use contactless payment systems have raised different issues, which include the security of the system, intrusion into the potential privacy of the consumers or the customers, and other relational costs. It has been established that when the financial privacy of the customers is violated, the implications become even more expensive and the resulting implication become even more crucial for the firm in terms of confidence and compensations costs (Ngai, Suk & Lo 2008).

Perceived security

Wal-Mart is one of the examples, which provide a platform for using the RFID system, which raises security concerns, which arise because of the use of the system. One example of concern is the use of the illicit movement and access of RFID tracking tags. Accesses to such tags, which are easily readable, pose serious threats to the security and privacy of personal data (Chen 2008). Google wallet is another example of contactless payments systems, which are vulnerable to brute force attacks. However, standards have been developed to secure applications and ensure that security holes are completely removed. Secure elements make it difficult for applications to be compromised and one example is the SIM Alliance developed the Open Mobile Application Programming Interface (API) (Chen 2008).

The security of the contactless systems such as online systems has been researched on and has been established to be a crucial element of the systems (Prater, Frazier & Reyes 2005). Threats such as unauthorised access to private data and intentional access or modification of network data may lead to the loss of availability, confidentiality, and availability of information (Pramatari &Theotokis 2009). For example it is possible for one making some payment using the online payment system to have their information accessed by a third party such as an hacker using software tools, or someone using phishing to access the credentials of the user by gaining access to an online account (Pikkarainen, Pikkarainen, Karjaluoto &Pahnila 2004).

Security is a major concern in the adoption of the contactless payment systems because the threats negatively influence the perceptions of the security of the payment system (Domdouzis, Kumar & Anumba 2007). Researchers have conducted detailed studies on the perceptions and influence of security and established that “circumstance, condition, or event with the potential to cause economic hardship to data or network resources in the form of destruction, disclosure, modification of data, denial of service, and/or fraud, waste, and abuse” constitute the security of the contactless payment system (Puliafito, Cucinotta, Minnolo & Zaia 2010). If the perceptions that the system is insecure, the use of the system or its adoption is likely to suffer a blow and the consequences, which include financial loss are likely to cause a negative effect on test adoption (Dubinsky 2012).

To address the consumer dilemma on the adoption of the contactless payment system and improve customer satisfaction and acceptance relies on the ability to create positive perceptions about the use of the system and the benefits accruing from its use compared with the risks associated with the adoption of the technology (Dubinsky 2012). In addition, companies such as Wal-Mart use the anti-employee-theft and anti-shoplifting technology to track and items, which are stolen or lost. Once an item has been stolen, it passes through the exit scanners, which raise an alarm if the item was not registered and having existed legally from the system (Dubinsky 2012).

Perceived Privacy

Perceived privacy is the extent to, which a consumer has the right to control the collection and use of his/her personal information via RFID technology. RFID-based application systems pose various threats to personal information privacy (Shin 2009). For instance, it is possible for someone to eavesdrop on the purchasing patterns and behaviour of a customer, and develop a profile of the customer’s private life (Dubinsky 2012). Such profiles can be accessed by a third party, which is directly related with the leakage of private data of a customer (Shin 2009). Privacy issues, which include the ability to track the customer and access to the private information of the customer, contribute to the privacy issues of adopting the new contactless payment system (Henrici & Muller 2004).

Financial implications

A range of financial implications, which have been noted to exist on the use of contactless payment systems have not been documented so far and the relational costs have not been fully documented (Roussos 2006). In additions, the implementation of the contactless payment system is rooted in the relationship between the consumer and the organisation. Here, the issues, which arise, include consumer privacy, the relationship between the consumer and the business organisation offering the products and services, the security of the payment system, and the use of the contactless payment system to financially compensate for the services and products being offered by the companies (Roberts 2006). While the concerns have raised the stakes of the lawmakers to protect consumers and their privacy such as using privacy policies to inform the users of the contactless payment system on their roles and responsibilities to protect the systems and mitigate the perceived threats and adverse effects, which result from the implementation of the system, the use of the contactless system has always been positively perceived (Rogers, Jones & Oleynikov 2007).

Here, it is critical to note that many organisations use the RFID technology to determine the customer behaviour and attitudes towards adopting the use of the technology and to determine the purchasing behaviour of the customers (Reyes & Frazier 2007). In addition, the contactless system enables the consumer based companies to understand the how customers respond to the use of the RFID technology by collecting data from different sources based on market oriented perspectives (Hossain & Prybutok, 2008). Typically, the perceptions of the consumer towards their privacy, the extent the consumer is able to sacrifice their privacy, the level of personal tolerance to exposed data, and the performance of the system to guarantee the privacy to the customer influences the sacrifice a customer can make in adopting the technology (Hossain & Prybutok, 2008).

Consumer Behaviour of using Contactless Technology now and future

According to Meyer, Germano and Perriard (2010, p.45), consumer behaviour is influenced by a host of factors, among which include the level of acceptance of the technology, market orientation, persuasive communications, privacy expectation, security, trust, commitment, threat severity and susceptibility, positive word of mouth, and repurchase intentions (Rao 2002). However, is crucial to note that the slow rate of adoption of the technology is because companies, which have adopted the technology fail to consider certain aspects of consumer behaviour, which negatively affect their trust in the specific payment method (Zmijewska 2005). For instance, consumers have always known the existence of online and mobile payment methods (Roussos 2006). As large number of consumers decide to go for the technology, but their ability to use or preference on the methods are limiting (Jonker 2007). The primary explanation given by various studies is that consumers have information about the presence, effectiveness or benefits of the methods, yet they lack information on how to use the technique. According to Pikkarainen, Pikkarainen, Karjaluoto and Pahnila (2004, p.7), the customers tend to shy away from applying the method.

The use of external or internal stimuli to motivate and stimulate a certain response in the consumer to use an online payment system depends on learning outcomes of the use of the technology, the perceptions about the technology, and the beliefs and attitudes about the technology (Meyer, Germano & Perriard, 2010). A consumer who has a positive attitude to a technology is likely to be attracted to the use of the technology and one with a negative attitude is likely to shy away from using the technology. Other factors include self concept, occupation, lifestyle, economic status, personality, family, roles, and the social class system (Meyer, Germano & Perriard, 2010).

Perceived cultural influence

Culture is defined as “the beliefs, value systems, norms, or behaviours of a given organisation, or society” (Yagi & Jarvenpaa 2005). The perceived “culture influence on RFID technology is, therefore, the “degree to which an individual believes that his or her society’s beliefs, value systems, norms, or behaviours could influence” (Weis 2003) the use of RFID technology. Culture is seen from the context of the willingness or intention to use the technology. Culture has a strong influence on the perception of the members of a society on the use of the RFID technology (Bandy & Peeters 2006).

Applying the contactless technology into the framework lead to the issue of consumer behaviour and its relationship with consumer acceptance of online payment methods has been studied (Luarn& Lin 2005). According to Wang, Chen, Ong, Liu and Chuang (2006, p.56), most of these studies indicate that consumer trust and behaviour play an important role in determining the progress, acceptance and applicability of any method of payment available in the market.

Environmental Factors

Research has shown that environmental factors have a strong influence on consumer behaviour. Environmental factors, which are relevant to the adoption of the technology, include security issues (Janz, Pitts & Otondo 2005). Securing the system against vulnerabilities and attacks from external sources is an environmental problem that needs to be addressed (Sharma, Citurs & Konsynski 2007). Another environmental factor that influences the adoption of new technology is the technological environment. It has been established that changes in the technology platform and the effectiveness of the technology is another factor that influences the adoption of the new technology (Jaselskis & El-Misalami 2003). It has been demonstrated that when the technology platform is old and incompatible with new technologies the adoption process slows down for both the consumer and the organisation that uses the technology (Jonker 2007).

Cultural factors

Cultural factors have been shown to positively or negatively influence consumer behaviour. According to Jones, Clarke-Hill, Hillier and Comfort (2005, p.49), the cultural factors include the perceptions, values, and beliefs of individuals and their preferences towards the adoption and use of the contactless payment system. Apart from cultural factors, there are cultural trends, which are influenced or affected by social pressure, equally have a distinct impact on the adoption of the contactless payment system. Here, social pressure results from the dynamic changes and the need to change and adopt new and emerging technologies by all people in the society (Ramchand, Devadoss & Pan 2005).

Social factors

According to Jones, Clarke-Hill, Hillier and Comfort (2005, p.34), it has been established that society is always changing with changing technological, social factors, and culture. For instance, if a member belongs to a certain reference group, which adopts the contactless payment system into their financial transactions, it becomes possible for the other members of the reference group to be influenced into adopting the payment system (Schmitt, Thiesse & Fleisch 2007). On the other hand, aspiration groups can influence a person to adopt the technology even if the person does not belong to a reference group (Scharfeld 2001).

The success of the influence by a reference group depends on different people with different characteristics, which include the initiator, who is the person responsible for suggesting to others to adopt the technology (Juban & Wyld 2004). On the other hand, the decision make is a person responsible for influencing the group on the type of contactless payment system to adopt, and the buyer depends on the influence of the two parties to buy and consume the product (Sarma, Weis & Engels, 2013). Other social factors include the family, the social status, persona factors such as income levels, age, lifestyle, psychological factors such as intrinsic and extrinsic motivation, belief and attitudes, perceptions, and self concept (Juban & Wyld 2004).

Relevant factors to new-technology Adaptation

Despite the security issues such as by pass authentication and brute force attacks and other risks and threats of using the contactless payment systems, different firms have gone ahead and adopted different payment methods depending on the underlying needs and organisational goals and business objectives. According to Karygiannis, Eydt, Barber, Bunn & Phillips (2007, p.76),Google uses the contactless NFC system and the e-wallet, which enables people to carry out online transactions and to make payments for the services and products they enjoy by signing in to their online accounts to access and use their credit card information to make the payments.

Organisational factors contribute a significant deal to the adoption of adapted product development based on technology drivers, which are internal to the business environment. Here, the size of the firm, which is n terms of the people who work in the organisation, the culture identity, behaviour, knowledge, and structure of the firm are organisational factors, which contribute to the adoption of adapted technology (Prahalad & Ramaswamy 2000). The adoption of adapted product development is influenced in the organisation by the above factors, which give the organisation its nature. For instance, developing countries use cooperatives to improve the prosperity of the societies and the resulting financial transactions use novel mobile payment systems such as the QR-Pay system to transaction between customers (Yang 2005).

The organisation, which integrates the technology into its operations and the approach the organisation uses to integrate the technology into its operations influence the adoption of the adapted technology into its transactions. Here, the management factors such as behaviour and the type of people who work for the organisation are some of the organisational factors, which affect the rate and degree of adoption of the technology (Yang, 2005). In addition, it has been established that the decisions made by the top management influence the outcome of the adoption process, because the management decisions influence or affect the way organisations make their adoption decisions (Gregory, Kuhn & Sines 2000). In addition to that, other organisational factors that influence the adoption and innovation process include the applied research and the marketing and manufacturing of the technologies (Lin 2009). However, in this study, the focus is on contactless payment card system, which is a technology that has already been created (Yang 2005).

Researchers agree that the involvement and knowledge of employees within the organisation on the current and emerging trends of contactless payment system contribute to the adoption process of the new technology (Ranky 2006). Here, the implementation and adoption of the contactless payment system within the firm becomes successful because the commitment and knowledge of the employees contributes to the generation of new knowledge, which promotes innovation. Management plays a significant role in facilitating the diffusion of innovation within the firm involving the employees of the organisation (Juban & Wyld 2004).

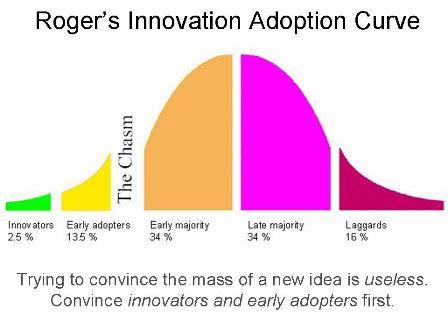

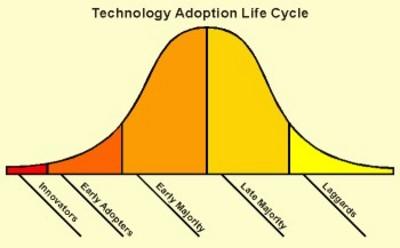

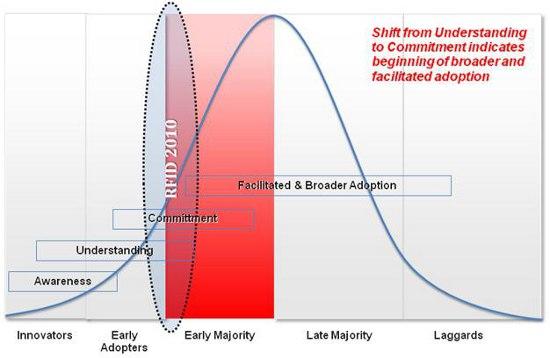

However, it is important for researchers to understand the organisational factors which inhibit the adoption of the new technologies, which include lack of training, lack of understanding, lack of sufficient knowledge and skills on the use of the technology, lack of top management support, and the perceived complexity of the use of the technology (Sorrells 2000). It is important to note that, in the organisational context, users may reject the adaption and adoption of new technology because it is incompatible with their beliefs, values, past experiences, and when the adoption is extended to the consumer, the social systems of the consumers contribute a significant extent to the level of adoption of the new technology, which is demonstrated below by the Roger’s innovation adoption curve (Juban & Wyld 2004).

The adoption of adapted new product development has enabled firms to make significant investments to align their businesses to their strategic objectives, which enables them to provide extended contactless payment system quality, functionality, development, and to enable innovation, which reflects the changing consumer behaviour and emerging innovations of the payment system (Sorrells 2000). Many of the firms in the UK have realised the benefits of adopting technologies to address the changing needs of the market and consumer behaviour (Kim & Garrison 2010).

Organisational culture

Employees

Employees are the most crucial in the adoption process of firms of the contactless payment system. Employees; contributions to the firm include their skills and knowledge towards the firms. A firm can rise if the perceptions and attitude of employees are positive and make positive contributions to the firms and that results to positive financial contributions to a firm (Konsynski & Smith 2003). When employees have negative attitudes, it becomes difficult for them to make positive contributions and that can result in financial loss to an organisation. Positive or negative financial contributions result from the success of a firm depends on the ability of the firm to integrate the contactless payment system into its day to day financial transactions. Once the contactless payment system has been integrated into the firm’s operations, financial transactions are usually done in real time and the cost implications are low as compared to the use of other payment or financial transaction systems (Konsynski & Smith 2003).

Here, it has been established that when employees are made to feel to be part of the team or family of the adoption process, their contributions to the adoption process becomes significant. Here, employees require clear communication, clear knowledge on their status in the firm, clear knowledge of the firm’s human capital, and need to understand the importance of the adoption and innovation of the contactless payment system in improving the financial system performance of the organisation. It is important to note that involving employees in the change process is crucial in the adoption o adapted technologies and their innovation (Lee & Shim 2007).

Technology Acceptance

Research by Davis (1985, p.34) shows that technology acceptance depends on the perceived ease of use and usefulness, which results to the attitude a person develops towards the technology and the resulting behavioural intentions to adopt and use the technology. New technologies are difficult to introduce into the market and the returns on investment can be slow if the acceptance rate is slow (Venkatesh & Morris, 2000). On the other hand, researchers have realised that effort expectancy, the expected performance of the technology, and the social influence contribute to the degree of acceptance of the technology (Wu & Wang, 2005). According to the research, performance expectancy depends on the perceptions a customer develops that using the technology enables them to perform their business activities effectively (Lederer, Maupin, Sena & Zhuang, 2000).

The expectations facilitate the conditions influence the behavioural intentions, which determine the willingness of the customer to use the technology (Venkatesh & Morris, 2000). Typically, the underlying model that is used to explain the technology acceptance is the technology acceptance model. The model recognises the degree of acceptance to be influenced by age, gender, and social status. For instance, younger people would like to experiment more with new technology than mature people (Wu & Wang, 2005). The studies indicate that younger consumers have a higher level of embracing the technology than the older generations. In fact, the study shows that the most frequent users of the systems are RFID cardholders aged between 18 and 34 years (Venkatesh & Morris, 2000). At least one third of this group of consumers make at least one transaction a week using the contactless card. Moreover, Parry (2013, p.45) reports that lack of information on how the cards are used is responsible for the low level of card usage. This report further asserts that lack of information on how to use the cards is a problem that mainly affects card users in the older generations, especially those beyond the age of 45 years.

This means that despite an individual holding a contactless card, the preference for the conventional cards as well as cash is still high due to lack of information on how to operate and use the card (Mukherjee &Nath 2003). In addition, this is an indication that the 80% level of awareness of the cards has been directed towards increasing the number of card users rather than increasing the rate of knowledge on how to use the cards (Lee, Fiedler & Smith 2008). In fact, this phenomenon has created a problem because the advertisement and awareness campaigns did not consider the aspects of consumer behaviour and trust towards a new technology, especially in payment and banking methods. Most likely, the same phenomenon is affecting the level and rate of acceptance as well as preference of using the contactless cards in the UK. Consumers want to be shown how to operate the cards in making payments, yet few companies have attempted to provide instructional services at the points of payment or through the mass media (Lim 2003). It also seems that this innovative product same as other new innovation need time to be adopted in environments (Wu & Wang, 2005).

Classification and future lifecycle

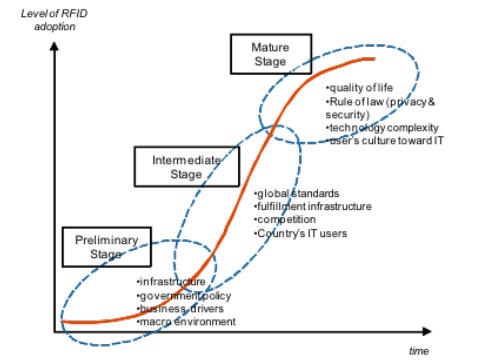

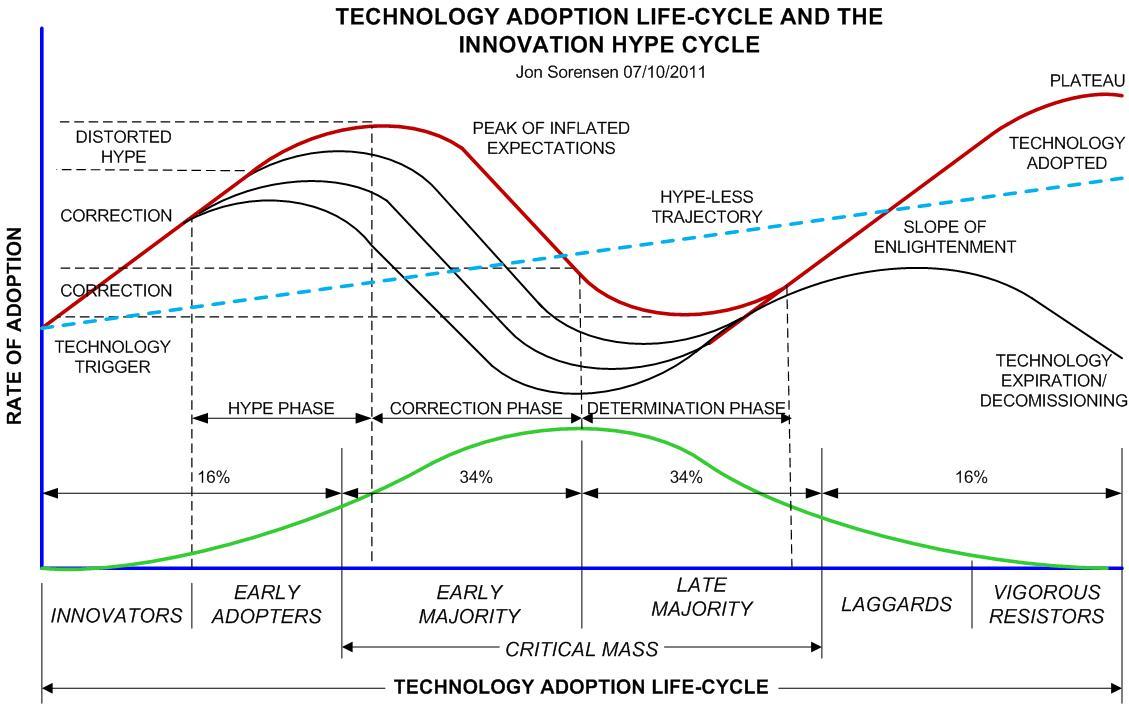

The diagram below shows the lifecycle phases of the adoption of the RFID technology. According to the diagram, the adoption process proceeds through the preliminary, intermediate, and mature stages with time (Lee 2009). The variables of interest are defined at each stage of the adoption process.

Payment Methods

According to Lee, Park, Yoon and Yeon (2012, p.90), different organisations have made significant financial investments in developing and implementing the contactless payment systems because of the business competiveness and financial implications in the business world.

For instance, Google embraces the e-wallet system mobile application that enables customers to conduct their transactions with the company in real time. Another example of the adoption of the new payment system was the Olympic Games in 2012, where the use of contactless payment system was widely adopted (Hua & Ma 2007). The areas of application of the technology included the ticketing, making payments, and venue management offers one of the practical examples of the use of the technology (Lim 2003).

An assessment of the mobile ticketing system, which is in use by different business organisations in Britain, shows that a user could pay for a ticket, validate the ticket, and conduct other financial transactions from different areas or locations without being in contact with the ticketing agency (Dabade, Gawade & Panda 2012). Firms have already realised the importance of the mobile contactless ticketing system based on case studies such as the one used in Brussels (Erickson & Waldner 2006). Brussels uses the MoBIB system, which has a flexible and user friendly interface that allows users to navigate through the city and the system has been shown to work effectively by being adopted to the transport network of the city (Yagi, Arai & Arai 2005).

It was demonstrated that the contactless payment system works in practise and the benefits such as directing the people to their destinations and a significant number of users of the system agree that it is worth using. Here, the technology adoption lifecycle depends on the innovation, early adoption, early majority, late majority, and laggards (Chen, Wu & Crandall 2007).

Adoption and future lifecycle

The adoption lifecycle depends on the technology innovations of each firm, early adopters and the majority in that group, the laggards, and the resistors, which follow the adoption curve as shown in the figure below (Bandy & Peeters 2006). The efficient access to the stored in the card and its ease of use, design, and flexibility underlie the future of the contactless payment cards (Wicks, Visich & Li 2006). It has been established that the lifecycle depends on real time access to stored data over computer networks and the security mechanism used to address the access and privacy of data.

The effectiveness of the lifecycle of the product depends on the design issues, the data structures and models, the types of data values, and the capability of the memory tags (Slettemeås 2009). To ensure the product meets the industry standard specifications, the following phases have been conceptualised in the development of contactless payment card (Brady, Duan & Kodukula 2000).

The future of the RFID technology depends on the level and rate of innovation and the underlying variables, which influence the level of innovation (Bandy & Peeters 2006). According to Weis, Sarma, Rivest and Engels (2004, p.89), the attributes of innovation include quality; relative advantage, compatibility of the payment cards; the suppliers, external and organisational factors, and the decision of adopt the technology.

Personal trust and behaviour of the consumers to Contactless

Market Orientation

The market is the sole deciding factor that influences the degree and extends of adoption of new technology (Luarn & Lin 2005).

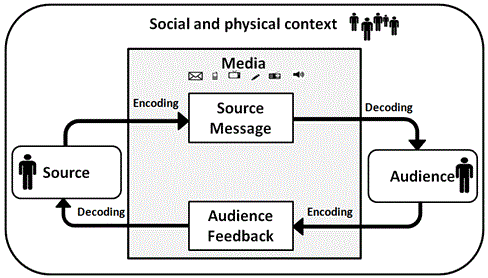

Persuasive Communications

Persuasive communication becomes effective if the marketer understands the market or the audience well (Macaulay & Abeysinghe 2004). For instance, the retailer who benefits from the implementation of the contactless payment system has to appropriately tailor their messages to communicate effectively with the audience to persuade them to adopt the use of the contactless payment approach (Ustundag & Tanyas 2009). Persuasive communication strategies include effectively tailoring messages for communicated about the use of contactless payment methods to persuade the customers buy into the idea, communicating the benefits of using the contactless payment methods, and communicating with a body language that us acceptable to the customer (Bhuptani & Moradpour 2005). For instance when communicating with a frown, the customer is likely to regard the idea of a contactless payment idea being communicated to them negatively and fails to accept the idea (Macaulay & Abeysinghe 2004).

Privacy Expectation

Privacy concerns have been and remain to be the core components that define the level of confidentiality a person develops in adopting any new technology. Of most crucial importance is the assurance a person gets that the privacy of their data is safe and cannot be accessed without their authority (Tuttle 1997). Here, Clarke, Twede, Tazelaar and Boyer (2006, p.45) argue that privacy concerns influence the consumer relationships that users develop towards the adoption of technology. When the trust between the customer and the retailer is high, and the perceptions about privacy are high, the consumer is likely to develop greater attitude towards the adoption of the technology (Biao, Ai-qun & Zhong-Yuan 2006). When the trust is low and the perceptions about the threats are high, the consumer is likely to develop a negative attitude towards the technology and the adoption rate is low. In both circumstances, the perception about the risks of adopting the technology influences a great deal the level of adoption of the technology and the success in using the technology for enterprises (Tuttle 1997).

Security

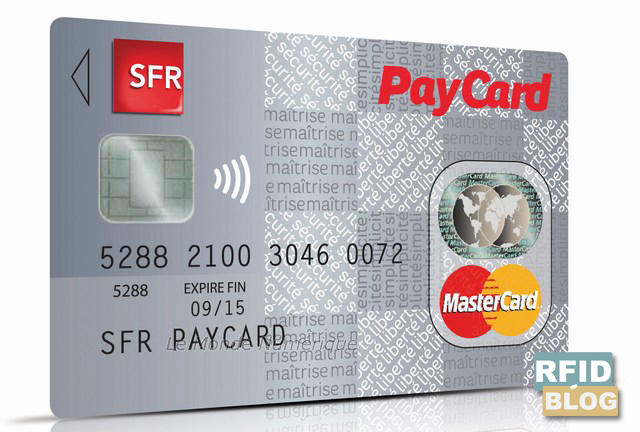

The future of the contactless payment cards are pegged on a secure system, which must guarantee the integrity, availability and confidentiality of information that, is being processed (Thiesse 2007). That implies that when a user wants to performs a transaction using the contactless payment system such as a MasterCard, credit card or visa card, they must be assured that the transaction cannot be modified inadvertently. In addition, if the perceptions about the security of the payment system are negative, it is likely to influence a negative attitude towards the user of the contactless payment system (Thiesse 2007).

Trust

Trust is simply a psychological state of the mind, which drives the consumer to accept the weaknesses or vulnerabilities of a system or a product. When the consumer develops trust or belief in the reliability and use of the technology, they are likely to transact on the technology platform without fear of the vulnerabilities that the system might be exposed to. According to Chen (2008, p.45) and Chen and Crandall (2007, p.34), lack of knowledge on the benefits of a new technology in the financial industry affects consumer behaviour and trust. In previous studies that investigate consumer behaviour and trust towards other methods such as, online and mobile payment and banking, it has emerged that lack of knowledge about the operation of a specific system determines the levels of usability as well as acceptance. Studies have shown that companies tend to create awareness of a new technology and success in convening huge number of consumers to subscribe for the methods (Slettemeås 2009).

In addition to that, trust enables the consumers or the customers to build internal models of the business environment, which enables them to predict the future of the technology. An internal model enables the enables users of the new technology to prepare for unanticipated threats and to be able to develop the confidence to get involved in the valuable exchanges between the retailer and the customer. If trust is low, it is easy for the customer to delay to reciprocate the immediate exchange of services for money (Brown & Russell 2007).

Threat Severity and Susceptibility

The thereat level and the severity and susceptibility of the contactless payment methods have an adverse effect on the perceptions of the user. (Shih, Chen, Chen and Lo (2012, p.45) argue that if the user perceives the threat level to be catastrophic, they are likely to avoid using the technology and that could lead to the retailer losing customers and refection of the contactless payment system.

Positive Word of Mouth

The word of mouth can reinforce a certain behaviour and influence positive attitude towards a person, but if the word of mouth is not used appropriately to appraise a person, the results might be detrimental to the organisation advocating for the use of the contactless payment system (Hunt, Puglia & Puglia 2007).

Repurchase Intentions

According to Parry (2013), the ICM research has carried out intensive studies to determine the current and future states of contactless payment methods in the UK. From these studies, it has been shown that the acceptance and embracement patterns of these payment methods are minimal, despite the fact that various companies have distributed a huge number of contactless cards (Mallat 2007). An important finding from these studies is that a number of factors associated with consumer behaviour and trust influence the level of acceptance by customers in the UK. For instance, the studies have shown that variables associated with consumer behaviour such as, age and level of education play an important role in determining an individual’s behaviour and trust towards the new technology (Hua & Ma 2007).

Extent consumers use contactless payment cards for future

The extent of the use and adoption of the payment cards depends on the production of the cards, the stock levels, the availability of technology infrastructure, and the international cooperation networks. Statistics show that by 2008, 80% of the adults in the UK had debit cards and the trend was improving. Typically, the future depends on the banking infrastructure and other issues discussed below.

Banking

In the UK, “contactless banking or payment” is a relatively new term in the financial sector. It is used in reference to a number of payment methods enhanced by RFID technology, inducing credit cards, debit cards, and smart cards. The payment is instant because the computer system automatically deducts the amounts payable from the consumers total amounts lodged in the card system. According to Dubisky (2010), the card system is believed to have two times the rate of efficiency compared to the conventional cards or cash. In fact, this is true because there is no signature or PIN requirement in the payment for good or services worth less than £20. In addition, research has suggested that the method motivates consumes to spend more money when using these cards than when using the conventional payment methods because RFID makes transactions easy and interesting (Dubinsky 2010).

Acceptance

The RFID technology acceptance model has been used to explain the acceptance of the RFID contactless payment systems and emerging uses for ubiquitous services (Avoine 2005). Here, the technology acceptance model explains the relationship between the behavioural intentions of the users of the system or the user of the technology and the variables, which define the use of the technology. For instance, the perceived usefulness of the RFID system such as the MasterCard or PayPass, which is defined as the “degree to which a person believes that using a particular system would enhance his or her job performance” is crucial for users of the contactless payment system and the acceptance level of the system. Here, the perceived usefulness of the system shapes the need for the users to sign up to the use of the system. In practice, if the user of the PayPass wants to transact 50$ by transferring the amount to another user, the user of the card does not need to sign the card, but simply needs to slide the card into its appropriate slot and transfer the money (Adhiarna, Hwang, Park & Rho 2013). The schematic roadmap shown below provides a guide on the adoption and acceptance roadmap.

Many people who have accepted the use of the contactless payment systems such as credit cards, MasterCard, and PayPass systems have been identified as effective methods of making payments and facilitating the speed of conducting transactions between the retailer and the consumer. In this model, the perceived ease of use directly influences the attitude towards the technology, which depends on the behavioural intentions of the user and the practical use of the system. Another element is the perceived ease-of-use, which is defined as the “degree to which a person believes that using a particular system would be free from effort”. In that context, the users of the MasterCard or any payment system becomes rapidly accepted by the users because they perceive the technology to be crucial in assisting them perform their transactions quickly (Bandy & Peeters 2006). The perception by the retailer of the attitudes of the users of the contactless payment systems has influenced retailers to invest in the technologies by purchasing and integrating the systems into their operations. For instance, EZ-Pass is a toll collection system, which is rated as one of the most successful technologies in the area of contactless payment systems. The reasons for the acceptance of the system in its perceived ease of use, which makes the consumers of the products readily, accept its use.

Advantages and Disadvantages

Advantages

Studies on the advantages of RFID technology have shown that the RFID tags are easy to install and can easily be used for tracking purposes when the target element being tracked is within the frequency range of the chip. In addition, RFID can be used to track multiple items at the same time (Thiesse 2007). For instance, it is possible to use the technology to track incoming and outgoing goods from and into a supermarket or a store and that makes the technology convenient for use in the retail industry. Another research has shown that the technology is highly efficient and that makes it possible to use used from an out-of-site range and can be used in the human body and on wood. A cost benefit analysis of the technology shows that it is less vulnerable and susceptible to damage and makes good returns on investments. Because the tag can be embedded in a system without getting damaged, the technology can be used in harsh environments such as regions with elevated temperatures and moisture. According to (Shih, Chen,Chen and Lo (2012, p.34), RFID technology provides enhanced service delivery and lowers the costs of transactions, which is a crucial cost benefit to the organisation

Disadvantages

It has been established that the cost of the RFID technology is high and that has restricted the broad adoption and use of the technology. In addition, it has been established that the technology has scanning issues, which are associated the scanning of metallic elements and those components that are in water. In practise, it is possible to scan multiple objects at the same time, but research shows that it is not possible to achieve multiple scans because the RFID can malfunction (Tracy, Lutgen-Sandvik &Alberts 2006). The malfunctioning includes tags collisions, side channel attacks, reader collisions, vulnerability to information access by the use of unauthorised devices, and ability to eavesdrop on the passwords of the card holder..

Innovation and Lifecycle

The innovation and the lifecycle of the contactless payment technology are based on the rate and level of adoption and the challenges and issues arising from the use of the technology. It has been predicted that the future of retail trading will be cashless and the adoption of the contactless payment technology will underlie and facilitate the process (Given 2008). However, it has been established that the payment cards pause certain security risks, which include cyber attacks, and the need to use encryption technology, which cannot be decrypted (Goshey 2008). Other issues include fraud and the possibility of several hacks, which can be used to exploit the vulnerable areas of the contactless payment technology. Francis, McGee, Sainati, Sheehan Jr, and Tong (2003, p.67) argues that the adoption trend and product lifecycle are increasing positively.

Commitment

Commitment in theory is a behavioural situation, which influence positive affect and attitude towards an object, which in this case are the contactless payment cards. Once the customers buy in into the idea of the contactless payment system their level of commitment or restriction to the use of the cards increases, which increases their loyalty levels (Loebbecke Fujita & Huyskens 2007). For instance, if someone finds that using a contactless payment card enables them to carry out different transactions effectively and in real time, their level of commitment to the system increases significantly and the net results are positive effects on the retailer (Hunt, Puglia & Puglia 2007).

.

Methodology

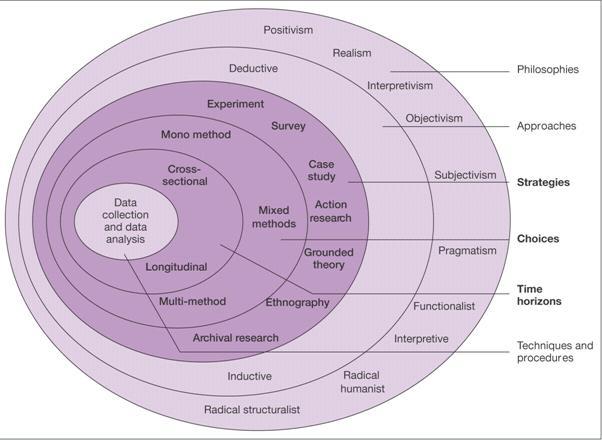

Evaluation of the research methods

The study was conducted using the generic onion research methodology, in which the researcher evaluated different research methods to arrive at the right research method for the current study as proposed by (Lewis &Thornhill 2009). The following research methods were evaluated to determine the appropriate research method for the current study (Given 2008). Among the research methods evaluated was the opinion based research method, the observational and experimental research methods. The most important features, which were considered in the research, were the ethics, time, budget, and the research questions (Odendahl & Shaw 2002). It is crucial to note that observational research could not fit into the study because it could involve a large number of people to be subjected to observations. Here, making observations could involve intruding into the people’s privacy and the ethical issues involved required that different people with different ethical considerations be integrated into the research study.

The resources required and the response rates could be low because of privacy and security issues. Therefore, the nature of the study cannot be accommodated by the use of observations. Another approach, which was evaluated, was the experimental method (Lewis &Thornhill 2009). The appropriateness of the research method was based on an inquiry into how well the method fits into the ethical issues surrounding the study. The approach was deemed possible and appropriate because it was established that the costs were low and could be achieve by the researcher. In addition, it was possible to administer a questionnaire interview to the respondents without intruding into their privacy and raising security issues and concerns (Lewis &Thornhill 2009). Because of the concerns and issue raised from the different research approaches, it was crucial to use interview groups and the most appropriate approach to conduct the study and gather the required data to answer the research questions (Nachmais & Nachmais 2008). The research model used is the onion research method, which consisted of peeling all research approaches, evaluating their benefits and suitability of the methods and selecting one approach, which is the most appropriate for the study (Odendahl & Shaw 2002). A graphical representation of the onion research method is shown below.

The onion research approach includes elements such as data analysis, which was done by using the SPSS program. Here, data was collected through interviews and administration of questionnaires for analysis (Campbell & Stanley 2009).

Secondary Research

The secondary research was conducted by administering questionnaires to the respondents to gather data that could be used to answer the research questions on the adoption of new product development and its effects on consumer behaviour. Secondary research relied on the use of documentary evidence and the use of sources of literature on the adoption of adapted new technology and the effects such adoption has on the behaviour of consumers (Harding 2013).

It was deemed appropriate to conduct in-depth interviews to provide the required information from the respondents about the adoption of adapted technology and the effects they have on the behaviour of consumers.

Primary Research

The main objectives of the study were considered crucial in determining use of the primary research and to answer the research questions. The primary research provides data, which was aligned with the research objectives of investigating the relevant factors which contribute to new-technology product preferences and its concerns, to explore the personal trust and behaviour of the consumers to Contactless payment, and to focus o the extent consumers use Contactless Payment for their payment and will use in future. Typically, the questionnaires focused on the use of questionnaires and data analysis to determine the factors underlying the three research objectives.

Investigating Procedure

The procedure consisted of choosing focus groups on whom to administer questionnaires and some to be interviewed. To ensure equal and fair representation, the different people from different age groups who are of the age that can transact financially were selected randomly. Random sampling was used because the method was deemed appropriate to provide fairness in distribution of the questionnaires to different audiences.

One the sample population was identified; questionnaires were given to each participant to answer the questions. However, some important aspects of questionnaire administration issues such as the response rate and delay in answering or responding to the questions were identified. The contingency plans, which were put in place to address the problems included issuing new questionnaires on the sport and requesting the respondents to reply immediately. In addition, the response rate was increased by educating the respondents on the importance of the questions and the responses. Another approach to ensure that the response rates were increased was to use the management of organisations to urge employees to respond to the questionnaires.

Method of Data Analysis

The data was collected from the customers and the interviews were recorded and assigned numerical values to seek for the relationship between technology adoption and consumer behaviour.

Data analysis

Data was collected, cleaned for any errors and inconsistencies, and entered into the SPSS software and run to determine the correlation coefficients between adoption of new technology and consumer behaviour as the key variables. The results are tabulated in the appendix.

Ethical Consideration

The ethical issues, which arise when conducting research were identified and listed as follows:

- Plagiarism-To avoid plagiarism, the researcher used appropriate referencing of text to ensure due credit was given to the original authors.

- Fabrication and modifications were avoided by following appropriate academic procedures and processes.

- Poor data storage was avoided by ensuring appropriate data storage and analysis tools were used.

- Faulty data gathering methods were avoided by using questionnaire tools, which have been proved to work effectively.

- Other ethical issues include privacy; copyright laws and regulations, protection of human integrity, right to privacy, anonymity, and the right to confidentiality were appropriately considered and addressed.

Research Findings and Disscusion

General Information

The satirical tables on the findings are in the appendix. In general, the adoption of the contactless payment technology has been growing at a rapid rate and many retailers have been persuading customers to adopt the technology because of its convenience and use in the many transactions. The technology is based on the use of smart tags which are attached with transponders and the transceivers respond by identifying information that is stored in the microchip. Several issues have been identified, which influence the adoption level and rate of the technology are discussed according to the following objectives.

The table below provides the number of people who participated in the study to determine the adoption of adapted technology for retails companies, which have integrated the contactless payment cards in to their retail transactions. This is a statistical SPSS report that was run to determine the variables and have the impact on the behaviour of the consumers and the future adoption of the technology.

Findings on the 1st Research Objective

This objective is to establish the relevant factors, which contribute to new-technology product preferences and its concerns of the adoption of the contactless payment technology. It was established from the literature review that the adoption of the contactless payment technology is influenced by several factors, which include the organisational factors, organisational culture, payment methods, and network adaptation. On the other hand, the issues affecting the adoption of the technology include the technology platform of the firm adopting the technology, privacy, and the cost of the technology.

Discussion on the Research Objective

According to the review of the literature on the adoption of the contactless payment technology, the literature shows a strong relationship between the adoptions of the technology in terms of organisational factors because they are internal to the business organisation, which influence the organisation the adoption process of the technology by the customers. Factors such as organisational management, the leadership and managerial styles, the top level decisions, employee knowledge and commitment to the use of the technology contribute positively to the adoption level of the payment card technology. If the management decisions do not reflect the changes in technology and cannot accommodate the dynamism experienced with the use of the new technology, the customers cannot be wooed to accept and use the technology. The management style is crucial because the messages and impression created about the management about the technology has a crucial impact on the success rates of influencing people to adopt the technology. Here,

Another crucial element is the employee. The behaviour and attitude of employees and the approach they use to sell the new technology to the customers provides the influences the rate of adoption of the technology and the acceptance level of the customers. For instance, if the management does not create appropriate messages to be communicated to the customers, the customers might not perceive any value in the technology. Messages must be tailored to reflect the values and beliefs of the customers and must be communicated effectively. Here, the management style, the messages communicated to the customers, the ability of the firm to adopt the technology, the infrastructure to adopt the technology influence the acceptance behaviour of customers.

The payment methods influence to a significant extent the level of adoption of the technology because customers could like to use a payment method that is convenient, flexible, and easy to use. It is cruel to note that the perceptions developed about the technology in terms of the privacy and security provides the basis for accepting the technology. However, certain issues need to be addressed by the clients, who are the service providers, which use the contactless payment technology. Among the issues include the cost of the technology. If the customer perceives that the cost of transacting on the platform is reasonably higher than the cost of carrying out the same transaction on other platforms, the customers could easily shy off using the technology. In addition, the supply chain of the technology affects the adoption rate and behaviour of the customers in adapting to the technology. For instance, if a customer looses their contactless payment car, and if they are sure of a quick replacement, they could develop a positive attitude towards the adoption of the technology. Other issues include the ability of the customer to use the card to track their transactions, the ability of the retailer to compensate the customer for any losses that are incurred because of the use of the card. In addition to that, the behaviour of the consumers is crucial in determining the adoption of the technology.

Findings on the 2nd Research Objective

The research objective is to explore the personal trust and behaviour of the consumers towards the Contactless payment technology, which include trust and behaviour. The cultural factors, which contribute to personal trust and behaviour, include cultural issues, social classes, sub-cultures, social classes, cultural trends, purchasing trends, post purchase behaviour, personal factors, technology acceptance, and social factors. Other issues include psychological factors, personal factors, and perceptions about the new technology. The issues which affect the future of the contactless payment methods include the creation and secure customer base, and a reduction in the cost of the technology will facilitate the growth rate of the technology.

Discussion on the 2nd Research Objective

According to the study, consumer behaviour is one of the antecedents to the personal factors, which influence the rate and level of adoption of the technology. Here the factors which influence consumer behaviour for the adoption of the adopted new technology include cultural factors. Certain cultures are difficult to accept new introduction and adoption of technologies and certain cultures are open to new technologies. Depending on the cultural settings of the retailer, it might be easy or difficult to accept the technology. Culture in this context is about the way if life of the people. People are influenced by family members, friends, and other close associates. If someone finds the new payment method attractive, they are likely able to tell the next customer about the new method and influence their perceptions about the technology. It is important for the retailer implementing the technology to be able to understand the cultural values and beliefs of the people to be able to develop strategies for the adoption of the technology. Typically, each market segments have their own values and beliefs and adopting new technologies can be affected by their cultural influences.

The study established that sub-cultures exist within the society in different forms, which include religious, ethnic groups, nationalities, gender, and age groups. In addition to that social groups exist in social hierarchies, which have different tastes, attitudes, and beliefs. The social groups are classified into lower class, middle class, and upper classes. Each social group and sub culture influence the orientation of the customers towards adopting new technologies. According to the study, it is not easy to create new cultures for new brands, but once the culture of consumption has been created, it is easy to set a trend for the consumption of the new technology. The critical factors within a reference group include the initiator who is the person who has been influenced been influenced by the adoption of the new technology. Here, one customer within a group can influence others who have not yet adopted the technology to adopt the technology. Others within the group can play the role of the influencer and the decision maker, and the buyer who is the consumer of the technology.

Findings on the 3rd Research Objective

The third objective was to classify prediction of contactless innovation in the future and its lifecycle. The findings show that the security of the contactless payment cards, the level of commitment, trust, the severity levels, the word of mouth, and the purchase intentions influence the innovations of the contactless payment technology.

Discussion on the 3rd Research Objective

From the study, it is possible to note that the future of the adoption of the contactless payment technology is on the upward trend and more people and retailers are adopting the technology for future use. However, the security issues, the customer buyer behaviour, security threats, risks, and vulnerabilities are the drivers of innovation, which have caused manufacturers to introduce new contactless payment cards. Studies show that new contactless cards have been created, which include the e-wallet, the m-wallet, and the Master card, and other payment methods have been developed. The applications have been integrated into the mobile phones such as Samsung, Google and LG have manufactured contactless enabled mobile phones, which is an alternative method of payments. It has been established that counties such as the UK have experienced a rapid uptake of the contactless payment methods.

Findings on the 4th Research Objective

The findings show that contactless payment cards can be classified into:

- Communication protocols

- Technology

- Physical representation

Discussion on the 4th Research Objective

Those cards, which were established to belong to different categories include:

- Zip-Discover

- E-wallets

- MasterCard

- Visa Cards

- American Express

- Plastic cards

Findings on the 5th Research Objective

Personal issues that affect the adoption of adapted payment cards include:

- Organisational behaviour

- Cultural issues

- Organisational capacity

- Social factors

- Physiological issues

Discussion on the 5th Research Objective

Organisational behaviour of a crucial factor in the adoption of the contactless payment method because it can impact either positively or negatively on behaviour. In addition, the values and beliefs of the factors influence the perceptions of the adoption of the technology. Other factors include social factors, which are critical in acceptance level of the technology, the psychological factors, which are personal, the cultural issues, which affect communities and their attitude towards new technology.

Findings on the 6th Research Objective

- Adaptation capacity of the firms

- Networking

- Diffusion

- Acceptance

- Innovation

- Commitment

Discussion on the 6th Research Objective

The adoption and growth in the use of the technology could only become a reality of forms have the underlying infrastructure to adopt the technology, and have a network of users on which the technology can grow. In addition, the diffusion mechanism and growth rate influence the adoption rate and the future growth is influenced by the acceptances rate and innovation to address consumer issues such as security and the commitment to the technology.

Summary

In summary, the contactless payment cards belong to a technology, which has emerged and is new in the business industry. In addition, the several factors have been identified as crucial to the “New-Tech Adoption of Adapted Product Development and its effect on Consumer Trust & Behaviour towards Technology Innovation: The case study in: ‘’Contactless Payment’’. Here the crucial factors include the trend and behaviour of the organisation, the behaviour of employees and their ability to influence the adoption of the technology. In addition, the networking, diffusion, adaptation technology, technology specifications, costs, organisational technology, and the supply chain of the payment cards influence the consumer’s perceptions and adoption of the technology. Other issues include the future demand of the products, privacy and intrusion of the technology, consumer behaviour, and the ability to track the inventory level of the products. In addition, the consumer trust and behaviour are addition al factors, which influence the product lifecycle and the adoption trend of the contactless cards.

Conclusion

Recommendations

The study shows that many business organisations have adopted the contactless payment cards because of the various advantages the business organisations gain from the use of the contactless payment cards. However, a study of the literature review shows that the adoption rate of the adopted contactless payment technology is influenced by several factors, which are organisational, cultural, technological, psychological, and behavioural in nature. Here, the organisational factors include leadership and management styles, employee commitment to serving the customer, the capacity of the retailer to adopt the technology because it is relatively new, the ability to create a reliable network on, which the technology can be used. Another element is diffusion, which enables the technology to be adopted and to grow within and outside of the organisation and among the customers. Here, it is crucial to note that consumer behaviour is a crucial component in influencing the customer to adapt to the new technology. Typically, the adoption of the technology is based on the behaviour of the consumer, the technology platform, and the security of the system. That makes it crucial for the study to establish several recommendations, which might be of value in the research study.

One of the recommendations is for organisations to establish the trend in the behaviour of the customers in adopting the technology by establishing the key factors, which influence the behaviour of the customers in the consumption of the technology. In addition, it is recommended from the study that different technologies be developed and integrated and customised to address the varied needs of the customers to influence the adoption rate. One of the essential issues that were established, which has a crucial impact on the adoption rate of the technology is privacy. In addition to that, the security of the contactless payment technology is crucial in influencing the adoption of the technology. It is recommended that the technology can be adopted and integrated into the payment system by integrating secure encryption techniques, which have been tested and proved to be secure and of industry standards. Issues such as technology specification, supply chain systems, costs, and future demand of the product contribute to the successful integration of the contactless and its level of acceptance as a payment method. By combining those factors, it becomes possible for an organisation, which is interested in integrating the contactless technology into its payment method and to make it accepted by different customers.

Research Limitation

In this study some limitations were experienced, which include the inability to gather complete and comprehensive market intelligence information on the adoption rate and security of the payment technology. In addition, some of the technologies have not been tested exhaustively, which adversely affects consumer trust in the payment technology. In addition to that the security of the payment card technology has been shown to be subjected to fraud and security holes, which have not been proved to be reliable.

Future Research and Development

There is need for future research in the security of the contactless payment technology and the approaches, which can be used to secure the technology and increase consumer trust in the payment card technology.

Appendix

Table 1: Statistical table of the findings.

The following statistical table shows the reliability analysis of the findings on the adoption of adapted technology. It shows that the value is above 0.7 showing that the factors have a positive influence on the behaviour of customers on the adoption of technology.

References

Adhiarna, N, Hwang, YM., Park, M J & Rho, JJ 2013, ‘An integrated framework for RFID adoption and diffusion with a stage-scale-scope cubicle model: A case of Indonesia’, International Journal of Information Management, vol. 2, no. 33, pp. 378-389.

Angeles, R, 2013, ‘An empirical study of the anticipated consumer response to RFID product item tagging’, Industrial Management & Data Systems, vol. 107, no. 4, pp. 461-483.

Avoine, G 2005, ‘Adversarial Model for Radio Frequency Identification’, IACR Cryptology ePrint Archive, vol. 2, no. 33, pp. 49.

Boye, N 2008, ‘Pervasive healthcare: Problems and potentials’, Human, social, and organizational aspects of health information systems, vol. 45, no. 23, pp. 84-102.

Bandy, W R & Peeters, JP 2006, U.S. Patent No. 7,148,803. U.S. Patent and Trademark Office, Washington, DC.

Brady, M J, Duan, D W & Kodukula, V S 2000, U.S. Patent No. 6,100,804. U.S.Patent and Trademark Office, Washington, DC.

Baude, PF, Ender, D A, Haase, M A, Kelley, T W, Muyres, DV & Theiss, S D 2003, ‘Pentacene-based radio-frequency identification circuitry’, Applied Physics Letters, vol. 22, no. 8, pp. 3964-3966.

Bhuptani, M., & Moradpour, S 2005, ‘RFID field guide’, deploying radio frequency identification systems, vol. 11, no. 125, pp. 18-26.

Biao, L, Ai-qun, H & Zhong-Yuan, Q 2006, ‘Trends and brief comments on anti-collision techniques in radio frequency identification system’, ITS Telecommunications Proceedings, 2006 6th International Conference, vol. 2, no. 33, pp. pp. 241-245.

Brown, I & Russell, J 2007, ‘Radio frequency identification technology: An exploratory study on adoption in the South African retail sector’, International Journal of Information Management, vol. 34, no. 27, pp. 250-265.

Clarke, RH, Twede, D, Tazelaar, J R & Boyer, KK 2006, ‘Radio frequency identification (RFID) performance: the effect of tag orientation and package contents’, Packaging Technology and Science, vol. 1, no. 19, pp. 45-54.

Campbell, DT & Stanley, JC, 2009, Experimental and Quasi-Experimental Designs for Research, Rand McNally, Chicago.

Chen, CC, Wu, J & Crandall, R E 2007, ‘Obstacles to the adoption of radio frequency identification technology in the emergency rooms of hospitals’, International journal of electronic healthcare, vol. 3, no. 2, pp.193-207.

Chen, LD, 2008, ‘A model of consumer acceptance of mobile payment’, International Journal of Mobile Communications, vol. 6, no. 1, pp. 32-52.

Dabade, TD, Gawade, SU & Panda, AC 2012, ‘Radio frequency identification (RFID)’, International Journal of Research in Computer Application & Management, vol. 2, no. 3, pp. 21

Domdouzis, K,Kumar, B & Anumba, C 2007,’Radio-Frequency Identification (RFID) applications’,A brief introduction. Advanced Engineering Informatics, vol. 4, no. 21, pp. 350-355.

Dubinsky, Z, 2012, New credit cards pose security problem, OUP, London.

Erickson, D P & Waldner, MA 2006, U.S. Patent No. 7,132,946. U.S. Patent and Trademark Office, Washington, DC.

Francis, RC, McGee, JP, Sainati, RA, Sheehan Jr, RL & Tong, SKK 2003, U.S. Patent No. 6,600,418, Patent and Trademark Office, Washington, DC.

Given, LM, 2008, The Sage encyclopedia of qualitative research methods, Sage Publications, Los Angeles.

Goshey, M 2008, Radio Frequency Identification (RFID). In Encyclopedia of GIS (pp. 943-949). Springer, Los Angeles.

Harding, J, 2013, Qualitative Data Analysis from Start to Finish, SAGE Publishers, London, UK.

Gregory, RA., Kuhn, M J & Sines, RD 2000, U.S. Patent No. 6,165,069. U.S. Patent and Trademark Office, Washington, DC.

Henrici, D & Muller, P 2004, ‘Hash-based enhancement of location privacy for radio-frequency identification devices using varying identifiers’, in Pervasive Computing and Communications Workshops, 2004. Proceedings of the Second IEEE Annual Conference on, Massachusetts institute of Technology, city campus, pp.37.

Hossain, MM, &Prybutok, VR, 2008, ‘Consumer acceptance of RFID technology: an exploratory study’, Engineering Management, IEEE Transactions, vol. 55, no. 2, pp. 316-328.

Hua, RC & Ma, TG 2007, ‘A printed dipole antenna for ultra high frequency (UHF) radio frequency identification (RFID) handheld reader’, Antennas and Propagation, IEEE Transactions, vol. 12, no. 55, pp. 3742-3745.

Hunt, VD, Puglia, A & Puglia, M 2007, RFID: a guide to radio frequency identification. John Wiley & Sons, New York.

Janz, BD, Pitts, M G & Otondo, RF 2005, ‘Information systems and health care-II: Back to the future with RFID: Lessons learned-some old, some new’, Communications of the Association for Information Systems, vol. 15, no. 1, pp. 7.

Jaselskis, E J & El-Misalami, T 2003, ‘Implementing radio frequency identification in the construction process’, Journal of Construction Engineering and Management, vol. 6, no. 129, pp. 680-688.

Jonker, N, 2007, ‘Payment instruments as perceived by consumers–results from a household survey’, De Economist, vol. 155, no. 3, 271-303.

Jones, P, Clarke-Hill, C, Hillier, D & Comfort, D 2005, ‘The benefits, challenges and impacts of radio frequency identification technology (RFID) for retailers in the UK’, Marketing Intelligence & Planning, vol. 4, no. 23, pp. 395-402.

Juban, RL & Wyld, DC 2004, ‘Would you like chips with that? Consumer perspectives of RFID’, Management Research News, vol. 27, no. 11, pp. 29-44.