Introduction

Efficiency is a fundamental concept in economics, and it is essential for maximizing the use of available resources in the economy. Allocative efficiency, in particular, is critical in determining the optimal allocation of goods and services in a given market. It is concerned with allocating resources to satisfy consumer preferences while ensuring that resources are utilized most efficiently.

Inefficient allocation of resources can lead to waste and missed opportunities. On the other hand, when resources are allocated efficiently, society optimizes the use of its available resources. Allocative efficiency, therefore, matches the production of goods and services to consumers’ preferences, resulting in a more equitable distribution of resources and promoting economic growth.

Market Efficiency

Market efficiency is a critical concept in economics, and it refers to the ability of a market to allocate resources in a way that maximizes productivity and consumer satisfaction. It is essential to ensure that resources are allocated in the most optimal way possible, leading to maximum social welfare. In an efficient market, prices reflect the value of goods and services, and resources are allocated to their most productive uses (Tripathi et al., 2020). This means that the goods and services produced are of high quality, and they meet the needs and preferences of consumers in the most efficient way possible. When the market is efficient, the prices of goods and services will be stable, and there will be no shortage or surplus.

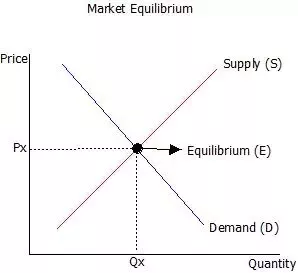

Market equilibrium is one conventional way to measure market efficiency. Market equilibrium occurs when the quantity of a good supplied equals the quantity demanded at a particular price (Murphy et al., 2019). This point is the equilibrium price, which balances the quantity of goods supplied and the quantity demanded. At this point, resources are utilized in the most efficient way possible, ensuring consumers get the products they desire at a price they are willing to pay.

However, in practice, market efficiency is not always achieved as may be thought of theoretically. Islam (2019) establishes that inefficient markets may result from market power, externalities, public goods, and information asymmetries. Market power arises when a single entity or a group of entities can influence the price and quantity of goods and services in the market. This can lead to higher prices and lower output, resulting in inefficient resource allocation.

Externalities refer to the spillover effects of a transaction on third parties, which may not be reflected in the price of the good or service. For example, pollution from a factory may harm the environment and public health, leading to negative externalities. Public goods are goods and services that are non-excludable and non-rivalrous, meaning that they are available to everyone, and their consumption by one person does not reduce their availability to others. This characteristic makes charging a price for public goods difficult, leading to underproduction and inefficient resource allocation. Information asymmetries occur when one party in a transaction has more information than the other party. This can lead to market failure as the party with more information may take advantage of the other party, leading to inefficient resource allocation.

Allocative Efficiency

Allocative efficiency pertains to a form of efficiency attained when the optimal allocation of goods and services is achieved per consumer preferences. The attainment of allocative efficiency takes place at an output level wherein the cost of production is equivalent to the price. As such, consumers are willing to pay for the marginal utility they receive (Dean et al., 2020).

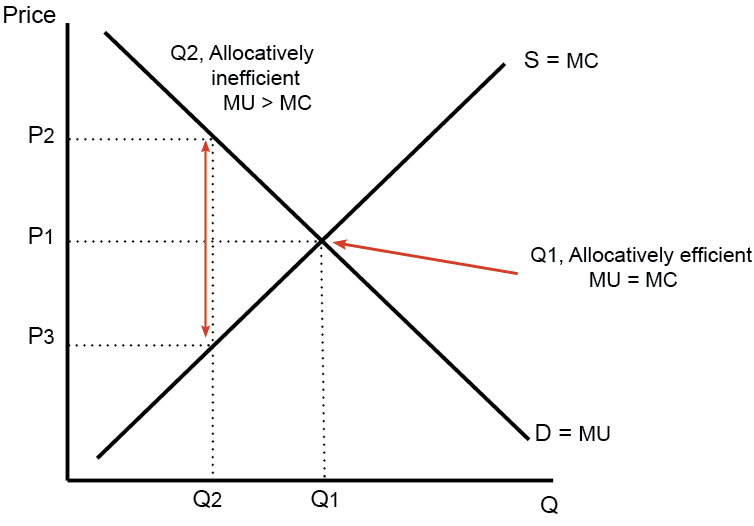

The cost of production for an extra unit of goods or services is the marginal cost. In contrast, the extra satisfaction consumers gain from consuming one more unit of goods or services is referred to as marginal utility. Allocative efficiency is concerned with evaluating the marginal cost of production in relation to the marginal benefit of consumption. The point of allocative efficiency is achieved when the marginal cost of production equals the marginal benefit of consumption (price).

The concept of allocative efficiency is critical in microeconomics because it ensures that resources are used efficiently and maximizes social welfare. Allocative efficiency ensures that goods and services are produced at the lowest possible cost and sold at a price that reflects the value that consumers place on them. Therefore, allocative efficiency ensures that resources are allocated in the most efficient manner possible, resulting in maximum consumer satisfaction.

Marginal Utility

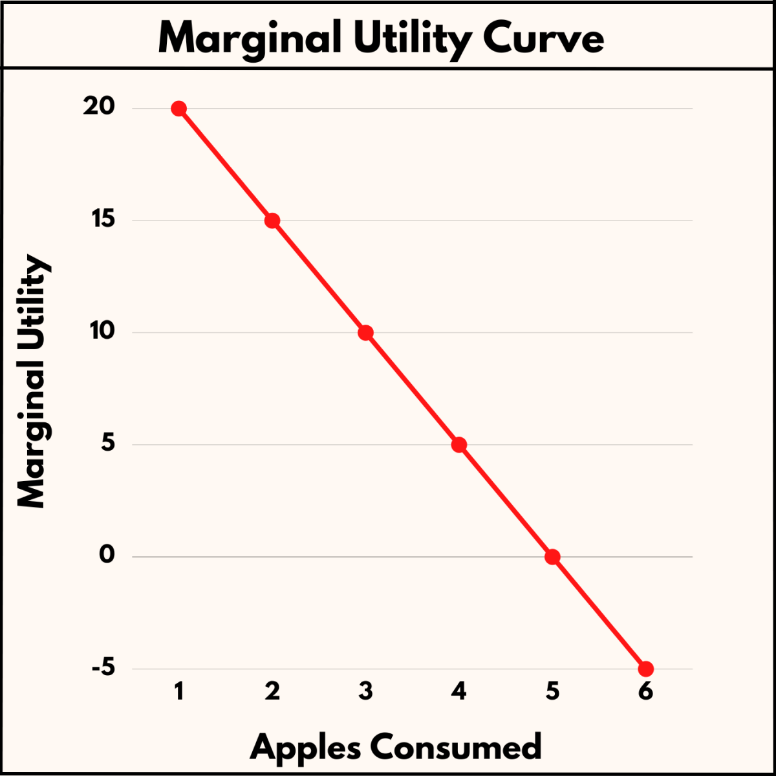

Marginal utility is a critical concept in microeconomics that refers to the additional satisfaction that a consumer derives from consuming an additional unit of a good. Marginal utility is influenced by several factors, including the consumer’s preferences, the price of the good, and the consumer’s income. The Law of Diminishing Marginal Utility states that as a consumer consumes more units of a good, for instance, apples, as shown in Figure 2 below, marginal utility, or the additional benefit, derived from each successive unit diminishes (Castro & Araujo, 2019). This is because the consumer’s needs are satisfied with each additional unit, and the additional benefit from each successive unit decreases as the consumer’s needs are fulfilled.

Marginal utility is important in achieving allocative efficiency because it ensures that resources are distributed optimally. This is because the marginal utility consumers derive from a good reflects the value they place on it. The optimal distribution is achieved when the marginal utility of the good equals the marginal cost. By taking into account the marginal utility of a good, producers and consumers can make informed decisions about the allocation of resources, which can lead to allocative efficiency and maximum social welfare.

Price and Consumer Demand and Why Price Equals Marginal Cost

The relationship between price and consumer demand is essential in achieving allocative efficiency. In a market economy, the determination of the allocation of resources relies heavily on the price associated with the production of goods and services. The intersection of the supply and demand curves is the decisive factor in determining the price of a product or service. The supply curve signifies the cost associated with the production of a particular product, while the demand curve represents the value or benefit obtained from the product or service. The point of intersection between the supply and demand curves is known as the market equilibrium, where the price is equal to the marginal cost of production, and the quantity produced is the optimal quantity demanded by consumers.

When the price is set at the market equilibrium, the allocation of resources is considered optimal since the marginal benefit of consuming the good or service is equal to its marginal cost. This means that the resources used in producing the goods or services are being utilized in the most effective way, and consumers are getting the most satisfaction from their money. However, if the price of the goods or services is too high, the quantity demanded will decrease, and resources will be wasted on producing goods that are not in high demand.

On the other hand, if the price is too low, the quantity supplied will decrease, and resources will be underutilized since insufficient goods are being produced to meet the demand. Therefore, setting the price at the market equilibrium ensures that resources are allocated efficiently and consumer demand is met in the most optimal way possible (Jackson & Jabbie, 2020). This leads to allocative efficiency, where the resources used to produce the good or service are used most efficiently, and consumers receive the maximum satisfaction for their money.

Case Studies on the Nature of Inefficiency

An arrangement that offers relatively little coffee and much tea to people who prefer coffee and that accomplishes the reverse for tea lovers.

In this case, there is an inefficiency in the resource allocation because the arrangement does not reflect consumer preferences. There is a mismatch between the production and the preferences of the consumers. Allocative efficiency requires resources to be distributed in a way that maximizes consumer satisfaction. If people who prefer coffee are given more tea, and those who prefer tea are given more coffee, then there is a mismatch between what people want and what they receive. This mismatch results in a decrease in consumer surplus, which is the difference between the amount consumers are willing to pay for a good or service and the price they pay. When consumers do not receive the goods they want, they are less satisfied and less willing to pay for them, decreasing consumer surplus.

An arrangement in which skilled mechanics are assigned to ditch digging and unskilled laborers to repair cars.

In this case, there is an inefficiency in the allocation of resources because skilled mechanics are assigned to a task that does not require their skills, while unskilled laborers are assigned to a task that requires more expertise. This results in a mismatch between the workers’ skills and the task’s requirements. Allocative efficiency requires to allocate resources in a way that maximizes productivity. When skilled mechanics are assigned to ditch digging, they are less productive than they would be if they were repairing cars. Similarly, unskilled laborers may not be as productive when repairing cars as skilled mechanics would be. This inefficiency decreases overall output, as resources are not used in the most productive manner possible.

An arrangement that produces a large number of trucks and few cars, assuming both costs about the same amount to produce and to run, but that most people in the community prefer cars to trucks.

Since truck manufacturing does not take customer preferences into account, there is inefficiency in the way resources are allocated in this situation. Allocative efficiency requires that resources be allocated to maximize consumer satisfaction. If the majority of the community favors cars over trucks, producing more trucks than cars does not reflect their preferences. This mismatch decreases consumer surplus, as people are less satisfied with the goods they receive. Additionally, it may decrease overall output, as producers have used resources to produce goods that are less in demand.

Conclusion

In conclusion, allocative efficiency is an essential economic concept that maximizes social welfare by optimally allocating resources. It helps ensure that resources are not wasted, and society gets the most out of its available resources. Therefore, policymakers and market participants must consider the various concepts of allocative efficiency when making decisions that affect the allocation of resources. As a result, they can help to create a more efficient and equitable society where everyone can benefit from the proper allocation of resources.

References

Castro, L., & Araujo, A. (2019). Marginal utility & its diminishing methods. International Journal of Tax Economics and Management, 2(2). Web.

Dean, E., Elardo, J., Green, M., Wilson, B., & Berger, S. (2020). How a Profit-Maximizing Monopoly Chooses Output and Price. Principles of Economics: Scarcity and Social Provisioning (2nd Ed.). Web.

Islam, M. T. (2019). Market Failure: Reasons and Its Accomplishments. International Journal of Economics and Financial Research, 5(12), 276-281. Web.

Jackson, E. A., & Jabbie, M. (2020). Understanding market failure in the developing country context. In Decent Work and Economic Growth (pp. 1095-1105). Cham: Springer International Publishing. Web.

Murphy, F., Pierru, A., & Smeers, Y. (2019). Measuring the effects of price controls using mixed complementarity models. European Journal of Operational Research, 275(2), 666-676. Web.

Tripathi, A., Vipul, V., & Dixit, A. (2020). Adaptive market hypothesis and investor sentiments: global evidence. Managerial Finance, 46, 1407-1436. Web.