Introduction

The company selected for the analysis is Emirates Global Aluminum (EGA). It is the world’s largest premium aluminum producer (Emirates Global Aluminum, 2021). Moreover, it is the biggest industrial firm in the UAE, not belonging to the oil and gas sector (“Corporate profile,” n.d.). EGA was founded in 1975 by Sheikh Rashid bin Saeed Al Maktoum (“Our history,” n.d.). It is currently owned by Mubadala Investment Company of Abu Dhabi and Investment Corporation of Dubai (“Corporate profile,” n.d.).

In 2022, the corporation produced 40 million tons of metal (“Our history,” n.d.). EGA generated record revenue of $9,4 billion, indicating a 36% increase compared to 2021 (“EGA reports best-ever financial results, with record production across the value chain,” 2023; “Our commercial success,” n.d.). In such a way, the company continues its evolution and focuses on new goals.

EGA’s development is aligned with its vision, mission, and strategic goals. Thus, its mission is “to generate value from mining to metal” (“Our purpose, mission, and values,” n.d., para 1). This statement is central to launching new projects and supporting the existing ones. Furthermore, the firm formulates its purpose in the following way:

“Together, innovating aluminum, to make modern life possible” (“Our purpose, mission, and values,” n.d., para 1).

At the same time, EGA proclaims its focus on meeting the current sustainable goals. It means innovating future production, building deep partnerships to embed sustainability, promoting safety, and delivering competitive returns (Emirates Global Aluminum, 2021). Safety, integrity, teamwork, and innovation are core company values (Emirates Global Aluminum, 2021). The corporation is managed by a Board of Directors comprised of twelve directors and has four committees: audit and risk, technical and projects, human capital, and finance and commercial (“Corporate governance,” n.d.). The CEOs share their values and act regarding the vision and mission.

Industry Overview

The aluminum industry is a highly attractive sector for numerous companies and investors. Thus, the global market size is around $169.8 billion in 2021 and is expected to reach $277.5 billion by 2030 (“Aluminum market,” n.d.). It means that from 2022 to 2030, an annual growth of around 5,6% can be predicted (“Aluminum market,” n.d.). The high speed of the sector’s evolution and the growing demand for the products means that companies operating within the sphere will enjoy numerous opportunities to generate additional income and continue their growth. The world’s leading companies producing the biggest amounts of aluminum include United Company Rusal, Norsk Hydro ASA, Vedanta Aluminum, Saudi Arabia Mining Company, and Rio Tinto Group (Kabir, 2022). These giants determine the development of the industry and rivalry within it.

As for the domestic aluminum industry, it also continues to evolve. Recent reports show that in 2020, around 2.2 million metric tons of aluminum were produced (Puri-Mirza, 2022). Emirates Global Aluminum remains the UAE’s leader in the industry (Emirates Global Aluminum, 2018). It promotes the further evolution of the sphere, its transformation, innovation, and becoming one of the critical sources of income for the state (Emirates Global Aluminum, 2021).

In such a way, the sector is highly attractive and has numerous opportunities for future growth. For companies operating within it, the existing trends create opportunities for development and further transformation. However, it also means that the rivalry will continue growing, and new methods will be required to generate a competitive advantage. In general, EGA benefits from the current processes emerging within the sphere.

Factors Driving the Growth of the Industry

Several essential factors impact the growth of the aluminum industry. First, the demand for the metal continues to grow at the macro level. China’s fast-increasing need for metal impacts the global industry and creates the basis for the future (“Aluminum market,” n.d.). Aluminum is used in construction, transportation, packaging, aviation, and electrical sectors (“Aluminum market,” n.d.).

The development of space and air industries also stimulates aluminum production and the sphere’s growth. In the UAE, the focus on diversifying the economy and reducing the dependence on oil promotes the industry’s rise (Emirates Global Aluminum, 2021). As a result, EGA plays a strategically important role in building a powerful and robust nation’s economy.

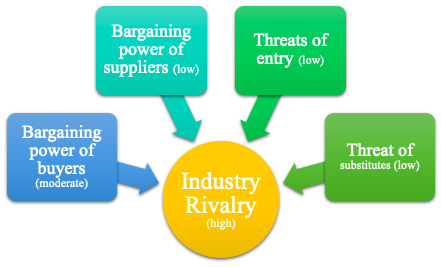

Furthermore, the industry’s main growth factors and peculiarities can be analyzed using Potter’s 5 Forces model.

First, suppliers’ bargaining power is low as numerous firms can provide raw materials. It is possible to find multiple suppliers in the global market to ensure the needed amounts of the product are acquired. Furthermore, the threat of new entry remains comparatively low as the initial investment is high and requires numerous resources and facilities to create the basis for future evolution (Emirates Global Aluminum, 2018). The bargaining power of buyers remains moderate as they are located in various countries, and it is easy to find the market to distribute the produced goods.

Finally, there is a low risk of substitutes as, at the moment, aluminum is used in numerous spheres (Emirates Global Aluminum, 2018). Although many attempts exist to find new materials with similar qualities, aluminum cannot be replaced. In such a way, all these factors explain the gradually increasing industry rivalry. At the same time, it serves as the growth factor, demonstrating the high speed of its evolution as the key players attempt to hold their leading positions and avoid losses.

The industry’s competitive environment is complex overall; however, it continues to grow because of a combination of various factors. The continuously growing demand for aluminum impacts the global markets and companies’ readiness to pay for the final product. For this reason, EGA can benefit from the current conditions and introduce strategies for further development and growth.

Strategy Management

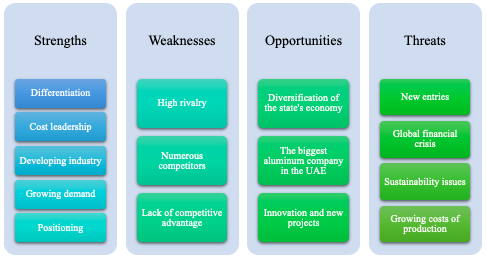

The mission and vision formulated above impact the company’s strategic vision. It focuses on promoting positive change within the industry and, at the same time, promoting the creation and integration of sustainability practices (Emirates Global Aluminum, 2021). For this reason, EGA has corporate strategies aimed at creating and accepting sustainability-linked decisions (Emirates Global Aluminum, 2021). The sustainability manager reports directly to the Director board, simplifying decision-making and making it more effective. Furthermore, at the business level, the company implies three major strategies: differentiation, focus, and cost leadership (Emirates Global Aluminum, 2021). The first one means that the company produces numerous products to meet the needs of central clients and overcome rivalry (Johnson et al., 2020). The value-added aluminum is recognized by partners from various states, meaning they are interested in cooperating with the brand (Emirates Global Aluminum, 2021).

Second, the cost leadership approach allows EGA to produce high-quality products at a reasonable cost (Johnson et al., 2020). It is attained by implementing innovative solutions and sustainable methods, reducing the price of final products (Emirates Global Aluminum, 2021). Finally, the focus strategy helps concentrate on the product that the partners require globally (Johnson et al., 2020). It helps to avoid overspending and achieve existing goals. Thus, EGA’s strategy management is linked to its current vision of the market and industry and to the company’s internal environment. Thus, the SWOT analysis below justifies the choice of the measures mentioned previously.

The SWOT analysis shows that the company’s internal environment is mainly positive. EGA correctly realizes its current strengths and uses them to create and manage its strategy. The focus on producing premium aluminum leads to the diversification of the client base and creates the basis for successful interaction with numerous global partners. Furthermore, the growing demand for the material due to other spheres’ development allows EGA to continue its growth (Emirates Global Aluminum, 2021). The corporation positions itself as an international player, focusing on numerous regions that need aluminum (Emirates Global Aluminum, 2021). As a result, it can focus on the three strategies mentioned above: cost leadership, differentiation, and focus.

Nevertheless, some weaknesses and threats are typical for the industry. These include intense rivalry, many competitors, and the overall financial crisis caused by the destruction of traditional supply chains in the global economy (The Express Wire, 2023). EGA acknowledges the problem and focuses on measures to address it. These imply the flexibility of the accepted strategy and readiness to adapt it to new demands.

For instance, the company cooperates with clients from around 60 countries as part of its global strategy (Emirates Global Aluminum, 2021). It guarantees numerous channels for product distribution and differentiation (Emirates Global Aluminum, 2021). At the same time, the current sustainability strategy considers all environmental issues to avoid deteriorating relations with local communities or similar claims. In such a way, EGA’s strategic management process is aligned with its internal environment and considers external factors.

Current Actions, Moves, and Incentives

The effectiveness of the company’s strategy and incentives is evidenced by its financial success and evolution. Thus, the firm’s focus on increasing the local workers’ presence is essential for improving its outcomes and, at the same time, empowering the UAE’s economy. Recent reports show the industry’s indirect GDP impact is around $2.59 billion (Emirates Global Aluminum, 2018). Furthermore, it creates around 38,050 jobs crucial for the state’s functioning and evolution (Emirates Global Aluminum, 2018).

Moreover, GDP’s Emiratization strategy, supported by EGA, has led to outstanding results. Currently, 15,6% of the company’s workforce is represented by locals, much higher than other companies or the rest of the UAE economy (Emirates Global Aluminum, 2018). It helps resolve existing issues and guarantees that communities support the brand and want to continue interacting with it.

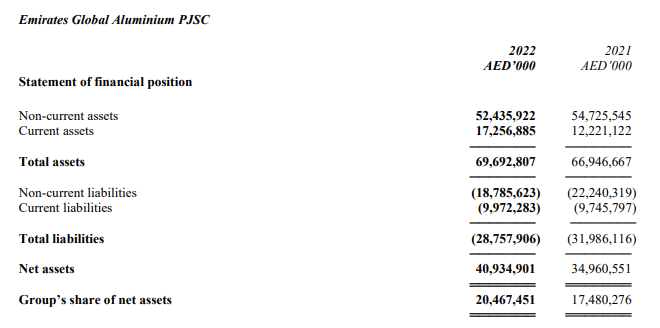

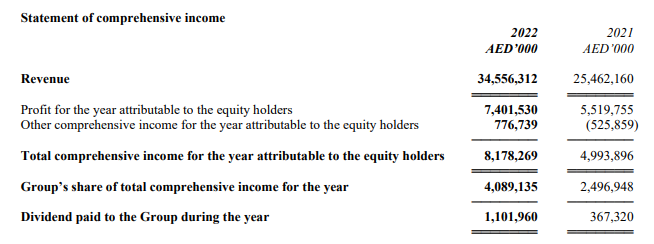

The financial data also evidences the effectiveness of measures employed by the top management. For instance, compared to 2021, in 2022, EGA managed to increase its net assets (from 34,960 AED to 40,934) (see Figure 1 in Appendix). In 2022, it reported record showings and net income (see Figure 3 in Appendix). Its share in the Investment Corporation of Dubai’s income increased and became more significant (see Figure 2 in the Appendix). Furthermore, the contribution to global production increased significantly since 2020, and in 2022, it comprised 4% of the global output (Investment Corporation of Dubai, 2021). This means that the current income statements provided by the EGA’s owners, specifically the Investment Corporation of Dubai, prove the fast evolution of the corporation. It is a result of the current actions and wise strategic approaches.

Furthermore, following its attempts to become one of the global leaders in the sphere, EGA performs specific actions as part of its strategic plan. First, it continues to find new partners and announced cooperation with Abu Dhabi National Energy Company to expand clean energy development (Mansoor, 2022). As part of the plan, EGA focuses on increasing recycling for most UAE operations to reduce the negative environmental impact and create the basis for new projects (Emirates Global Aluminum, 2021). In such a way, the current actions are wise and effective enough to ensure that EGA will preserve its competitive advantage and continue its evolution.

Recommendations

The previous analysis shows that EGA is a successful and fast-evolving company. The strategies implemented at both the corporate and business levels contribute to establishing a crucial competitive advantage for the firm. EGA’s focus on diversification, cost, and sustainability issues is central to its ability to continue its evolution and remain the most significant aluminum producer in the UAE. However, the constantly growing rivalry and the high number of competitors acting at both local and national levels required new actions and measures that enhance outcomes and generate a competitive advantage. For this reason, specific recommendations can be offered.

First, EGA’s focus on diversifying its products and interacting with numerous partners is one of the company’s leading threats. For this reason, it is necessary to support it and focus on this aspect. EGA has subsidiaries in projects such as the facilities in Guinea (Emirates Global Aluminum, 2021). It helps to struggle with rivals at the interactional levels. Thus, enhancing cooperation with the interactional partners and finding new locations where facilities can be built can be recommended. It would lead to a significant increase in the effectiveness of most operations and contribute to the diversification of products.

Second, EGA employs generic strategies to ensure it effectively uses its strengths and competes with its closest rivals. These approaches should continue to be supported and focused on diversification. The constant increase in the demand for aluminum and its products means that the diversification and creation of new offerings will help the brand remain attractive to potential partners and avoid the critical deterioration of its showings.

Moreover, the rich choice might serve as a competitive advantage and impact the decision-making of investors and foreign companies. In such a way, the following recommendations help EGA presser its leading position within the state and simultaneously become more powerful internationally. New facilities that diversify the economy will strengthen the corporation’s position and make it a strong player globally.

Conclusion

Altogether, Emirates Global Aluminum is one of the biggest premium aluminum producers in the world. Being supported by the government and powerful investment groups, it continues evolving to play an essential role internationally. The company operates within a highly attractive though competitive industry. The constantly growing demand for aluminum means EGA can benefit from new opportunities.

At the corporate level, the corporation focuses on cultivating sustainability issues and promoting the broader involvement of Emirati workers and specialists. It revitalizes the local economy and helps it to evolve. Thus, at the business level, the correctly chosen generic strategies contribute to the faster firm’s growth and transformation into one of the most potent players globally. The possible recommendations include preserving the focus on the diversification strategy and opening new facilities abroad. This will lead to increased attractiveness for the brand.

References

Aluminum market. (2022). Precedence Research. Web.

Corporate governance. (n.d.). EGA. Web.

Corporate profile. (n.d.). EGA. Web.

EGA reports best-ever financial results, with record production across the value chain. (2023). EGA. Web.

Emirates Global Aluminum. (2018). The impact of the aluminium sector on the UAE economy. EGA. Web.

Emirates Global Aluminum. (2021). EGA 2021 sustainability report. EGA. Web.

The Express Wire. (2023). Aluminum market size, share, growth statistics by top key players | Emirates Global Aluminium, Alcoa Corporation, Norsk Hydro ASA. Digital Journal. Web.

Investment Corporation of Dubai. (2021). Annual report. ICD. Web.

Investment Corporation of Dubai and Its Subsidiaries. (2022). Consolidated financial statements. ICD. Web.

Johnson, G., Whittington, R., Scholes, K., Angwin, D. & Regnér, P. (2020). Exploring strategy: Text and cases (12th ed.). Pearson.

Kabir, U. (2022). 15 biggest aluminum companies in the world. Yahoo!finance. Web.

Mansoor, Z. (2022). UAE’s Emirates Global Aluminium reports $1.6bn in net profit for H1 2022. Gulf Business. Web.

Our commercial success. (n.d.). EGA. Web.

Our history. (n.d.). EGA. Web.

Our purpose, mission, and values. (n.d.). EGA. Web.

Puri-Mirza, A. (2022). Annual production volume of aluminum in the Middle East and North Africa in 2020, by country. Statista. Web.

Appendix

Figure 3. Financial highlights (“EGA reports best-ever financial results,” 2023).