Introduction

General Electric Company is a multi-industry that focuses on technology and financial services. The company develops products for the distribution, control, transmission, and generation of electrical energy. The products include power generation, medical imaging, media content, security technology, water processing, business and consumer financing, aircraft engines, and industrial products. The company has eight main segments: home and business solutions, transportation, power and water, aviation, energy management, oil and gas, healthcare, and GE capital. The home and business segment focuses on developing products that are differentiated in the market. They are efficient energy solutions tailored to consumers and businesses (“General Electric,” 2022). The products manufactured include consumer lighting and appliances and automation solutions for industrial and commercial services. The transportation segment involves solutions for clients in transit, marine, railroad, power generation, and oil and gas. Furthermore, it offers portfolio services focused on improving the fleet’s efficiency, thereby lowering operating expenses such as modernization, repair costs, services like diagnostics and remote monitoring, and locomotive enhancements.

The power and water segment designs industrial, governmental, and power generation machinery and services aimed at energy production. The aviation segment creates parts for commercial and military aircraft. The parts include turboprop, jet engines, and turboshaft engines. The military engines developed are used in helicopters, surveillance aircraft, fighters, tankers, and bombers. Additionally, the company offers services for both military and commercial aircraft. The energy management segment designs electrical products and systems for energy control, protection, and distribution (“General Electric,” 2022). Products developed include circuit breakers, power panels, lighting, and switch gear for consumer and industrial applications. Oil and gas mainly focus on the gas and oil industries. This involves equipment used in pipeline inspection, petrochemical plants, liquefied natural gas, downstream processing, and drilling and completion. The healthcare segment designs tools used in medical diagnostics, disease research, biopharmaceutical, patient monitoring systems, drug discovery, and information technologies. The segment helps detect and predict an infection, monitoring and providing the necessary information to the physicians to aid in treating patients. The GE capital segment involves leasing, credit cards, personal loans, home loans, and other financial products.

Firm Failing

Since 2017, the company has been experiencing a reduction in its revenue. During this period, the company announced a job cut of 12,000, leading to a reduction in the cost of its stock price by nearly 45%. In 2018, the company reduced its dividend to 1 cent for every share. This also led to the laying of a significant number of General Electric employees (Kilgore, 2021). The company replaced John Flannery with Lawrence Culp as the CEO of the General Electric company. The company’s problem expanded in the wake of the COVID-19 pandemic. The stock price of the company fell to $43.92. The aviation segment was negatively affected as the COVID-19 restriction led to the grounding of commercial planes worldwide.

Table 1.0: General Electric revenue since 2017

From table 1.0 above, the company revenue since 2017 has been declining significantly. This resulted in the continued laying off of General Electric employees. In 2020, the company laid off about 10% of its employees (Kilgore, 2021). Despite changing the company’s CEO, the organization is still failing, and this is a result of the changing business environment. General Electric competitors are striving well in the market, hence the need for business and corporate strategy changes. The company strategy is the one that is making the company not adapt to the changes in the market.

Company Stock Price History and Competitors

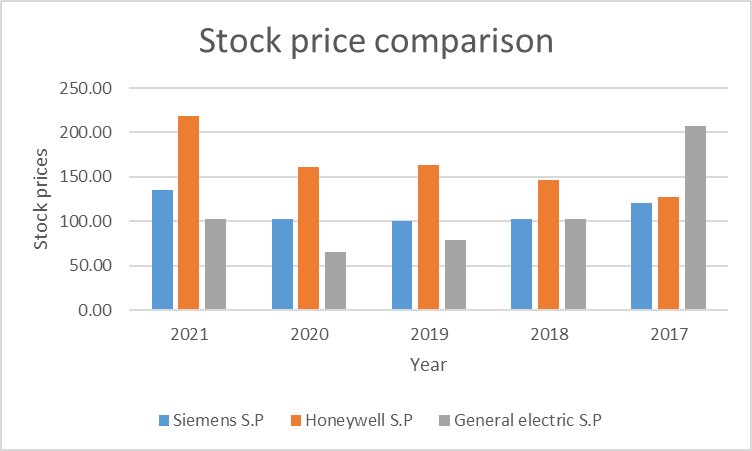

The top competitors of General Electric companies include Honeywell and Siemens. Since 2017, the two competitors have effectively competed with General Motors in terms of quality, prices, and clients worldwide. From table 2.0 below, General Electric company had the highest stock price of 207.772, which was in 2017 (“General Electric – 60 Year Stock Price History,” 2022). Since then, the company’s stock price has been decreasing. This is attributed to the changing business environment the company has failed to adapt to.

Table 2.0: General Electric historical stock price

On the other hand, companies such as Honeywell and Siemens have been gaining popularity, leading to increased stock prices since 2017. Figure 1.0 below shows that in 2017, General Electric had the highest stock price compared to Siemens and Honeywell. However, since then, the two companies have had high stock prices. Honeywell led in 2021 with a stock price of more than 200, almost twice that of General Electric.

Competitive Advantage

General Electric competitive advantage in the market is based on the differentiation strategy. This strategy enables the company to attract clients to unique products compared to other companies. The developed products are special in the market because they are designed through extensive research and development. For instance, General Electric has various development procedures for aviation and healthcare products (Thompson, 2017). The company has most of its patents in the USA through this strategy. Furthermore, the organization has a generic strategy that enables it to offer many types of products in various market segments. Through this method, the company can maximize its large customer base. One objective of applying a competitive differentiation strategy is to use the company’s research and development area (Thompson, 2017). This supports the uniqueness useful in capturing and retaining clients in the organization’s target market. The competitive advantage attained by General Electric enables them to maximize the loyalty of the customers towards their brand.

Value Creation and Capturing in General Electric

The company creates value through home and business solutions, transportation, power and water, aviation, energy management, oil and gas, healthcare, and GE capital. This enables the organization to have various valuable products for the consumers leading to profits. The company also extracts critical information from its products, such as wind energy, turbines, and other equipment, to optimize their maintenance, utilization, and performance (“GE Focuses Portfolio for Growth,” 2022). The company captures values by charging a percentage of the customers’ incremental revenue that has increased performance. The firm’s most important value-creating activity is in aviation, renewable energy, and power. The mission statement and vision of the company are coherent. The company’s mission should be to deliver quality, affordable technology products that help promote a green environment.

Industry Analysis

General Electric Company (GE) has maintained its status in the industry through optimizing strategies that lead to the growth and development of new products in order to remain competitive in the market (“General Electric – 60 Year Stock Price History,” 2022). In any organization, internal and external forces affect the operations and profitability of the organization. In the case of General Electric Company, external forces determine the productivity and profitability of the organization. Among the five forces that affect the external status of General Electric Company, the strongest one is the competitive rivalry. The major competitors of General Electric are Siemens and Honeywell. Siemens was founded in 1847 and is located in Munich, Germany (Cozmiuc & Petrisor, 2020). The company is the largest industrial manufacturing company in Europe, with branches worldwide. The main operations of Siemens revolve around infrastructure and cities, healthcare, industry, and energy. The company is famous for manufacturing unique and high-quality products that pose significant competition to the products manufactured by General Electric Company.

On the other hand, Honeywell International Inc. is based in the United States and specializes in aerospace and automotive products. Although the company has been in operation since 1999, it has specialized in the production of high-quality products that meet the needs and demands of the market. These two competitors aggressively develop new products and ensure customer satisfaction in all their operations. The level of aggressiveness in an industry determines the level of competitiveness that companies in an industry have against each other (Cozmiuc & Petrisor, 2020). Siemens and Honeywell have been aggressive regarding strengthening the quality of their products, which has helped them to perform excellently in the market. Due to the high competition from its rivals, General Electric Company has been forced to indulge more in researching and developing high-quality products. The company ensures that its products are manufactured through in-depth research, which helps them meet its customers’ quality expectations. Therefore, competition has helped General Electric Company to prioritize research and scientific inventions, which ensures a continual production of high-quality products.

PESTEL Analysis: General Electric Company

Political Factors

Political factors entail the influence of the government and government policies that affect the operations of companies in an industry. The major sections of General Electric Company most affected by political factors are the aviation and electric lighting industries. There are several considerations that GE must consider in its decision-making in order to match the government’s demands. First, the government supports the digitization of industries, which is an opportunity for GE to increase its productivity and profitability in the industry (Bakhat & Marroun, 2022). Secondly, the government advocates for renewable energy in order to save the environment. Although this might be viewed as a threat to moat companies, it is an opportunity for General Electric Company because it prioritizes producing electric energy to save the environment. Thirdly, the government supports global trade because it impacts the country’s economy. Therefore, General Electric Company’s operations are favored by the strategies employed by the government to support global trade (Bakhat & Marroun, 2022). The company has a significant opportunity to expand its operations to new markets to overcome the challenges affecting its operations. Fourthly, the government has increased measures to support intellectual property protection. The move by the government to support intellectual property protection is an opportunity for GE to expand its operations with minimal challenges and threats from the external environment.

Economic Factors

The trends and economies of the world economies affect the profitability of industries. The economic factors of the United States have a significant impact on the well-being of General Electric Company. For instance, the market in developing countries offers an excellent opportunity for GE to expand its operations and invest in the developing countries markets. The markets in the developing countries, for instance, the Asian and African countries, have wide market opportunities for GE to expand its operations (Bakhat & Marroun, 2022). The other economic factor entails increasing disposable incomes that increase the probability of customers purchasing products manufactured by the company. When the chances of customers purchasing certain products are increased, the number of sales and profits increase. The other economic factor entails expanding global trade for business companies in developed countries. However, expanding global trade for companies in developed countries would be a threat for GE because competition in the market will increase. The developed countries have saturated markets that are fully occupied; thus, penetrating in them would be a significant challenge to business companies.

Social/Sociocultural Factors

People’s behaviors towards certain changes in the market are vital in determining the profitability of a business. People’s behavior is a macro-environment factor that affects the performance and productivity of a business entity. There are several social factors that GE should account for in the market to overcome the challenges that might arise due to the customers’ social behaviors towards certain aspects. First, the increase in green lifestyle popularity is an opportunity for GE to engage more in activities that promote green lifestyles (Bakhat & Marroun, 2022). As a result of promoting green lifestyles, the company will realize more sales and higher demand for its products. Secondly, modern lifestyles are embedded in technology. Technology use has become a daily routine for accomplishing many activities in people’s lives. Since GE prioritizes operations that utilize modern technology, their operations align with the social needs of their customers, which increases their viability in the market. Thirdly, the demand for renewable energy has increased in modern society because it positively impacts the social aspect of people’s lives. Therefore, adopting strategies to prioritize the use of renewable energy is an opportunity for GE to succeed in the market by attracting more customers and increasing the demand for its products. Any strategy that impacts the social well-being of customers positively helps business companies to expand and realize more profits from their operations.

Technological Factors

Technological advancement has become phenomenal in daily operations in industries. Adoption of modern technology is becoming increasingly important and a way of achieving more sales and attraction for customers. Technology is used in all aspects of production, marketing, and delivery of goods and products ordered by customers. Besides, technological advancement and technology use has led to faster production and accomplishment of tasks in industries and in the market. There are several technological factors that General Electric Company should consider in the modern business world. First, most industries have increased technology adoption in operations (Simões, 2020). Since GE deals with technological productions, this is an opportunity for the company to expand its sales and become more profitable in the industry. Secondly, online mobile services are increasingly adopted in a modern business environment. The adoption of online mobile services aligns with the technological advancements of General Electric Company and will lead to increased sales and customer satisfaction. Thirdly, there has been increased advocacy for the utilization of renewable energy technology. Renewable energy technology leads to environmental conservation and conserves the habitats for living organisms. Since GE has been at the forefront of promoting the production of renewable energy technology, the company has better opportunities of increasing its sales and reliability in the market (Simões, 2020). Relying on renewable energy technology will increase the demand for products manufactured by General Electric Company among its customers and the global market.

Ecological/Environmental Factors

The external environment in terms of the availability of resources used by General Electric Company determines the company’s economic status. Business organizations must adhere to the environmental laws set in the various markets in order to avoid colliding with the governments. Business organizations that adhere to the environmental laws realize profits for their operations. There is a threat of resource scarcity that might affect operations in the company negatively. One ecological factor affecting operations in GE is limited oil reserves. The company’s oil and gas section is affected by limited oil reserves. Scarcity of oil reserves can be a threat and opportunity, depending on the market status, because the company can either hike prices for its oil products or lower them to match the market needs and demands (Bakhat & Marroun, 2022). The other ecological factor is the increasing availability of recyclable material. The availability of recyclable materials is an opportunity for General Electric Company because it leads to environmental conservation and an increase in the demand for its products. There is global growing energy consumption, which is an opportunity for GE to expand its operations to meet the rising demand. As the company increases operations to meet the global demand for energy consumption, the company should promote operations that ensure environmental conservation.

Legal Factors

There are numerous laws that govern the usage of energy and resources extracted from the environment. In order to maintain safe operations and sustainability in the market, industries must adhere to the legal guidelines set by the government. The first legal factor that affects GE’s operations is the law governing intellectual property protection. The government has heightened laws governing intellectual property protection; thus, General Electric Company has a better opportunity to deter property theft from its competitors. The second legal factor affecting GE operations entails the laws instituted to guide waste disposal. The disposal laws are a threat to the operations of GE because hefty penalties are imposed when waste is inappropriately disposed of. The waste disposal laws are also an opportunity for the company because they help it to adhere to environmental demands (Bakhat & Marroun, 2022). The company is guided by the waste disposal laws to ensure environmental conservation on their premises. The third legal factor that affects operations in General Electric Company entails the online product regulation. The online product regulation laws help the company increase its market competitiveness through online advertising and selling of products. However, the use of online services to advertise and sell products can be a threat to the company if it is not used properly. Legal factors have played a vital role in determining the efficacy of business organizations in the market and continue to remain instrumental globally.

Firm’s Resources

GE’s Core Competencies

General Electric Company has several resources and capabilities that determine its strength in the market. The first core competence of GE is technology and innovation. General Electric Company has fully integrated technology in its operations, which helps the company to manufacture high-quality products. The company has research centers and more than 37000 technology experts working in the research centers. The increased use of technology helps the company be innovative and develop new and unique products. The second core competence of GE is customer service (Sheth, 2020). The company prioritizes customers’ needs and demands concerning the products manufactured by the company. The company has implemented several skills acquisition programs to help equip its employees with the skills needed to meet the company’s customer needs and demands. Besides, the company ensures the quality of products manufactured remains high to increase customer retention. The third core competence of GE is global presence. General Electric Company is globally recognized for producing high-quality products that meet its customers’ needs. Global recognition is an opportunity for the company to expand and occupy more markets globally.

GE’s VRIO

General Electric Company uses resources that are valuable to manufacture its products. The value of the resources utilized by GE helps the company to easily penetrate the new market because of the high demand for its products. Besides valuable resources and products, General Electric Company has unique and valuable employees who accomplish their duties effectively. The company outsources for the best talent in the market to ensure high-quality of the products manufactured and customers’ satisfaction (Kim & Makadok, 2021). The patents used by the company are also valuable, which enable the company to sell its products in the market with minimal interference. Following the value of the resources and products manufactured by GE, the company implements unique and valuable distribution channels and costs for its products. Utilizing valuable distribution and cost strategies helps the company realize more value for its sales. The quality of research conducted by GE before manufacturing new products is valuable and helps the company to remain competitive in the market.

The financial resources of GE are rare and cannot be easily copied by other companies. However, the local food products manufactured by the company are not rare because other companies easily produce them and avail them in the market. The employees, distribution channels, and patents utilized by GE are rare and give the company a competitive advantage over other companies in the industry. The financial resources utilized by General Electric Company cannot be imitated because they are unique (Kim & Makadok, 2021). However, the local food products are imitable because they lack unique features or manufacturing specifications. The employees’ expertise, distribution channels, and patents used by the company cannot be imitated by other companies because of their unique features. Concerning organization, the financial resources are strategically organized to bring value to the company. However, the patents used by the company are not well-organized because they do not fully meet the company’s expectations. The distribution channels are well organized and ensure timely delivery of products to customers, helping the company to feature well in the market.

The BCG Matrix

Investment and Management of Strategic Resources

General Electric Company’s main investment and management strategy is differentiation. Differentiation helps the company identify the needs and demands of its various customers to manufacture products that meet the identified needs and demands. Therefore, differentiation assists in products’ specifications and the development of strategies to manufacture products that fully satisfy all the customers (Wise, 2020). Differentiation in General Electric Company is achieved through in-depth research, where researchers identify unique ways of manufacturing to match the needs of the market and their customers. Research also helps the company to identify its customers’ needs; hence, adjust its production strategies to fully meet the customers’ needs.

Solutions

The major General Electric Company’s opportunities include stable financial services and high-quality products. The company enjoys stable financial services that enable it to fund research and other operations in the company. As a result, the company manufactures high-quality products that meet customers’ needs in the market. Although the company’s stock value has drastically dropped since 2017, the company has maintained the production of high-quality products (Kilgore, 2021). The company’s stock value decline can be solved through increasing research and differentiation of products. If research is enhanced in the company, the company will be able to manufacture products of better quality that will attract more customers; thus, increasing profits and stock value for the company. The main generic strategy that the company should concentrate on is differentiation. Differentiation will help the company to identify the market needs and manufacture products that fully meet the market needs. Therefore, the company should concentrate on a proactive innovation strategy, which encourages research and development of new products in the market.

Research and differentiation will enable General Electric Company to develop high-quality products to attain a higher market demand for its products (Kilgore, 2021). The company should allocate more funds to enable its research department to carry out its activities effectively to enhance product quality. As the quality of products increases, the company will gain a competitive advantage over its main rivals in the market, thus, regaining its stock and profit values.

Strategic Implementation Part 2

Source of Funding

The funding source for the new developments is from sales made by the company and funds raised by the company’s stakeholders. Although the Covid-19 pandemic affected operations and the profitability of most business organizations, General Electric Company has a better chance of reviving its stock status by maximizing the quality and value of its products. The quality of products manufactured by General Electric has remained, and the company has unique distribution channels. Therefore, the company should utilize the profits realized to fund research activities that enable differentiation and production of products that meet customers’ needs effectively. The company’s stakeholders also have a role to play in funding research activities initiated by the company. The stakeholders should be at the forefront of sourcing funds that should be used to meet the needs and demands of the researchers and research activities. That way, the company will be able to manufacture products of higher quality than their competitors, becoming most preferred in the market. Thus, the company will be able to regain its stock value in the market.

Necessary Vertical Integration Adjustment

The vertical integration adjustment necessary for the research and differentiation strategy is the production stage. The production stage of General Electric is the most important because it determines the quality of products that are released to the market. The production stage’s efficacy should be enhanced by encouraging the research team to develop outstanding production strategies that will enable the company to outdo its competitors. The company should acquire more employees with outstanding expertise in production to take on duties in the production department (Tamas & Murar, 2019). Besides, the company should have skills acquisition programs to ensure that employees in the production department are regularly equipped with the necessary skills to continue producing high-quality products. The production department should be the most concentrated and equipped because customers’ satisfaction equates to increased productivity and profitability.

Advantages of Internationalization or Offshoring

Internationalization or offshoring will have several benefits for General Electric Company. The first advantage of internationalization for GE is entry into a new market. The company will be able to penetrate new markets, which will increase sales for the company. As the company enters a new market, it will realize more profits for its products; thus, it will gain a competitive advantage over its major rivals in the market. The second advantage of internationalization is enabling access to local talents. As the company penetrates a new market, it will encounter people with talents that might increase the productivity of the company.

The availability of local talents will also assist the company in closing the gap of employees’ scarcity, leading to higher production and the realization of profits (Podrecca et al., 2021). The third advantage of entering into new markets is increased business growth. Generally, the new market will help GE grow in its various production, distribution, and sales sectors. Therefore, the company will be able to stay ahead of its competitors in the market. The fourth advantage of offshoring is staying ahead of the competition. Offshoring helps business organizations increase operations and ties with international markets, thus easily overcoming most of the challenges that deter companies from succeeding.

Role of Strategic Alliances/ M&As in The New Strategy

The strategic alliance is essential in the business world because, if implemented properly, it increases sales and profits. Strategic alliances help the merging companies share costs incurred in the company’s various sectors. The sharing of costs increases profits for each company because production is increased, as well as sales. Strategic alliances begin with strategy development, where the companies merging identify their goals and targets and the direction they wish to move to achieve the identified goals and targets (Kiessling et al., 2019). The companies also evaluate the values they will get from the merging and the funding strategies to rely on to ensure success. The companies engage in in-depth negotiations and weigh options to avoid taking actions that might be costly for them. The companies only settle for options with a high probability of success in the market. Therefore, General Electric Company should consider the costs of merging and the benefits that will be realized before settling for one.

Strategic Implementation Part 3

The organizational structure of a business organization has a significant influence on the performance of employees. There are various organizational structures that can be utilized in the modern business world. Some of the organizational structures are productive, while others are unproductive. Concerning General Electric Company, the team-based organizational structure should be implemented to help the company overcome its challenges and regain its stock value. The team-based organizational structure disrupts the traditional hierarchy structure and focuses on problem-solving, unity, and cooperation, allowing employees to control most of the operations in the organization. The team-based organizational structure has been proven to increase productivity by motivating the employees to perform as expected. Besides, the team-based structure promotes interaction between the employees and administrators and encourages unity during decision-making processes. Therefore, the team-based organizational structure is the most effective for General Electric because it will enhance performance and increase productivity, which will assist the company in regaining its stock value in the market. Since the team-based organizational structure promotes unity and teamwork, the employees will be organized and motivated to invent and manufacture unique products that will positively impact the company’s growth and development.

The fall of General Electric Company was more profound during the 2008 great recession. The CEO of General Electric Company was Jeff Immelt during the great recession. There was a managerial crisis among the top management team and the CEO, which deterred the company from preparing adequately to overcome the great recession. As a result of the top managerial crisis that existed, the company experienced huge financial losses during the 2008 great recession, which threatened to sink the company completely. The company should adopt a team-based organizational structure in order to promote unity among all the employees. There should be unity among the company’s top management so that decisions can be made with ease to enable the company to overcome the financial crisis it is currently facing.

The top management team, led by the CEO, should involve employees in the decision-making process to encourage inclusivity in matters affecting the organization (General Electric, 2022). The company should have reliable employee motivation programs to attain high production in the company; when employees are encouraged and motivated to perform, productivity and profitability in a business organization increase. Maintaining employee motivation is also a competitive advantage that General Electric should rely on to stay ahead of its major competitors in the industry.

The current leadership in General Electric Company is characterized by a team of experts with the necessary skills and knowledge to help the company recover in the market. The Current CEO is H. Lawrence Culp Jr., who has outstanding leadership skills to steer the company towards achieving its goals and targets. The company needs to devise unique operation strategies to overcome the financial crisis that has affected it since 2008. The competition in the industries has heightened in the current business world. Therefore, modern operation and leadership strategies are required to help the company remain relevant in the market. H. Lawrence Culp Jr. is described as a focused leader, consistent in his operations, and ready to follow up operations in the organization to ensure that they meet the company’s operation standards (General Electric, 2022). With those leadership qualities, Culp Jr. is expected to impact other top management officials and the employees towards achieving a common goal and growth for the company. Jack Welch is also described as a leader with deep knowledge in industrial management and is therefore expected to help General Electric Company to regain its stock value in the market.

Conclusion

The business world is characterized by uncertainties that affect operations in business organizations and might deter the business organizations from achieving their goals and targets. There are many business organizations that have suffered due to the uncertainties in the market. One of the major companies affected by certainties in the market is General Electric Company, which was adversely affected by the 2008 great recession. The company realized a significant drop in sales and stock value that almost sank it. Every sector in the company was affected by the turmoil that affected the company to the extent that the leadership of the company was proven to be ineffective. The company needed leadership reshuffling and prioritization of research and differentiation in order to regain its stock and market value. The company also needed to prioritize production to meet the needs and demands of its customers. As the company increased production, it needed to venture into offshore markets that offer better opportunities for trade and the acquisition of new customers.

References

Bakhat, R., & Marroun, S. (2022). Investigating the viability of implementing electric freight vehicles in Morocco: Using an integrated SWOT PESTEL snalysis in combination with analytic hierarchy process. In Optimization and Decision-Making in the Renewable Energy Industry (pp. 126-152). IGI Global.

Cozmiuc, D. C., & Petrisor, I. I. (2020). Innovation in the age of digital disruption: the case of Siemens. In Disruptive Technology: Concepts, Methodologies, Tools, and Applications (pp. 1124-1144). IGI Global.

GE focuses portfolio for growth and shareholder value creation | GE News. Ge.com. (2022). Web.

General Electric – 60 Year Stock Price History | GE. Macrotrends.net. (2022). Web.

General Electric. CompaniesHistory.com – The largest companies and brands in the world. (2022). Web.

Kiessling, T., Vlačić, B., & Dabić, M. (2019). Mapping the future of cross-border mergers and acquisitions: a review and research agenda. IEEE Transactions on Engineering Management, 68(1), 212-222.

Kilgore, T. (2021). GE has nearly halved its U.S. workforce in 3 years, with more job cuts likely. MarketWatch. Web.

Kim, J., & Makadok, R. (2021). Unpacking the “O” in VRIO: The role of workflow interdependence in the loss and replacement of strategic human capital. Strategic Management Journal.

Podrecca, M., Orzes, G., Sartor, M., & Nassimbeni, G. (2021). Manufacturing internationalization: from distance to proximity? A longitudinal analysis of offshoring choices. Journal of Manufacturing Technology Management.

Sheth, J. (2020). Business of business is more than business: Managing during the Covid crisis. Industrial Marketing Management, 88, 261-264.

Simões, E. N. (2020). A decision support system application module-for PESTLE analysis-competitive intelligence algorithm (Doctoral dissertation).

Tamas, L., & Murar, M. (2019). Smart CPS: vertical integration overview and user story with a robot. International Journal of Computer Integrated Manufacturing, 32(4-5), 504-521.

Thompson, A. (2017). General Electric’s (GE) Generic Strategy & Intensive Growth Strategies – Panmore Institute. Panmore Institute. Web.

Wise, G. (2020). Willis R. Whitney, general electric and the origins of US industrial research. Plunkett Lake Press.