Introduction

The primary focus for the Appaloosa County Day Care Center, Inc. (ACDC) is to provide child care services to members of the local community. The company offers child care to three main age groups: infants, toddlers, and pre-K children. Each of these services is part of ACDC’s line of business, and should thus be included in the cost and profitability analysis. Additionally, ACDC acts as a landlord by leasing floor space to the Head Start program and the school district (Irwin et al. 2). Since leasing is associated both with profits and with costs for maintenance and utilities, it should also be included in the analysis. The five services or programs that are relevant to the cost and profitability analysis are thus infant care, toddler care, pre-K care, lease to Head Start, and lease to the school district.

Direct costs of organization

Direct costs are the costs that are tied with providing a specific product or service. With regard to child care programs, the company faces direct costs in the form of labor expenses. This is because there are regulations regarding the ratio of children to staff, and thus each program is tied to specific labor expenses. Utilities and maintenance costs could be considered direct costs for lease services, but the company would have been paying a share of these costs even if it was not leasing floor space. Hence, these costs cannot be classified as direct service costs.

Organization-sustaining costs of organization

Organization-sustaining costs are the costs required to run the business. For ACDC, these costs include utilities, maintenance, supplies, depreciation, insurance, occupancy costs, and programming expenses. While these costs are typically not assigned to specific programs or services, they could be, and it would help to perform the cost and profitability analysis for each problem separately. One way to do so is by classifying the costs into different cost pools and determining cost drivers. Using this method, it would be possible to determine the indirect expenses associated with each program or service, thus identifying profitable or loss-inducing areas of business.

Core activity categories

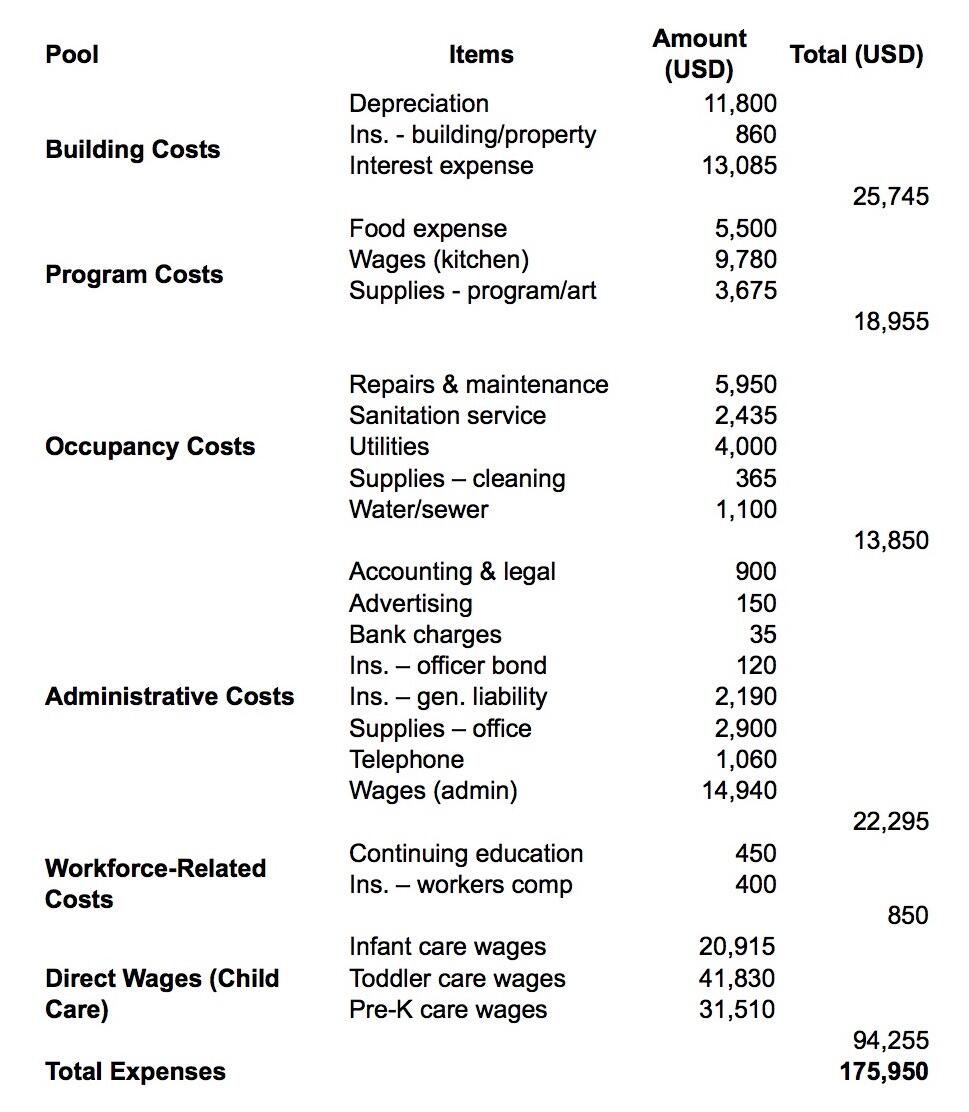

There are five core activity categories that are evident in the case, each one associated with a specific expense pool. First of all, the company faces expenses related to its property, including interest, insurance, and depreciation. Secondly, the company faces program costs that arise from program-specific needs, including food and supplies. Thirdly, the company is required to pay for building usage through utilities, repairs and maintenance, and other related expenses. The fourth activity category involves administrative and general tasks that require some expenditure.

Finally, ACDC also incurs workforce-related expenses, such as workers’ compensation insurance and continuing education. In addition to this, there is a category of direct employee costs (wages) tied to programs. These costs are not included in the pool of workforce-related expenses because they are direct and depend solely on the number of employees required. Table 1 presents all the expense pools identified in the analysis and the associated costs.

Cost drivers

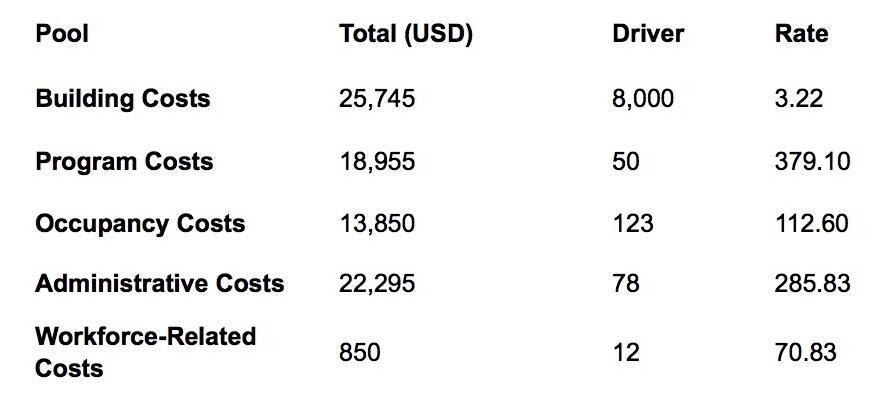

Cost drivers are the factors that influence the costs assigned to a particular activity or category. Since there are five cost pools identified in Table 1, there are also five primary cost drivers. For the Building Costs, the cost driver is the number of square feet, as it affects the value of the building and the insurance. For the program costs, the cost driver is the average number of children in attendance because it influences the needs in terms of resources and food. With respect to occupancy costs, the core driver is the average number of people in the building, except for the one administrative worker.

The more people visit the facility daily, the more maintenance will be required, and the higher the utility bills would be. Administrative costs, in turn, are driven by the number of children enrolled overall. This is because having more children enrolled would require more paperwork, accounting, and legal procedures, as well as other administrative activities. Workforce-related costs are driven by the number of employees involved in child care. This excludes the number of other staff due to differences in activities and expenses.

Determination of the activity

In order to determine the activity or cost-driver rates for each cost pool, it is essential to divide the total costs of each pool by the quantity of the appropriate cost driver. For example, to determine the activity of the cost driver in the pool of administrative expenses, it is essential to divide these costs by the total number of children enrolled. To determine the cost driver rate of employee costs, it would be necessary to divide employee costs by the number of employees, except for the one administrative worker and one kitchen worker. The results of the calculations are presented in Table 2.

Identification of the most and least profitable programs

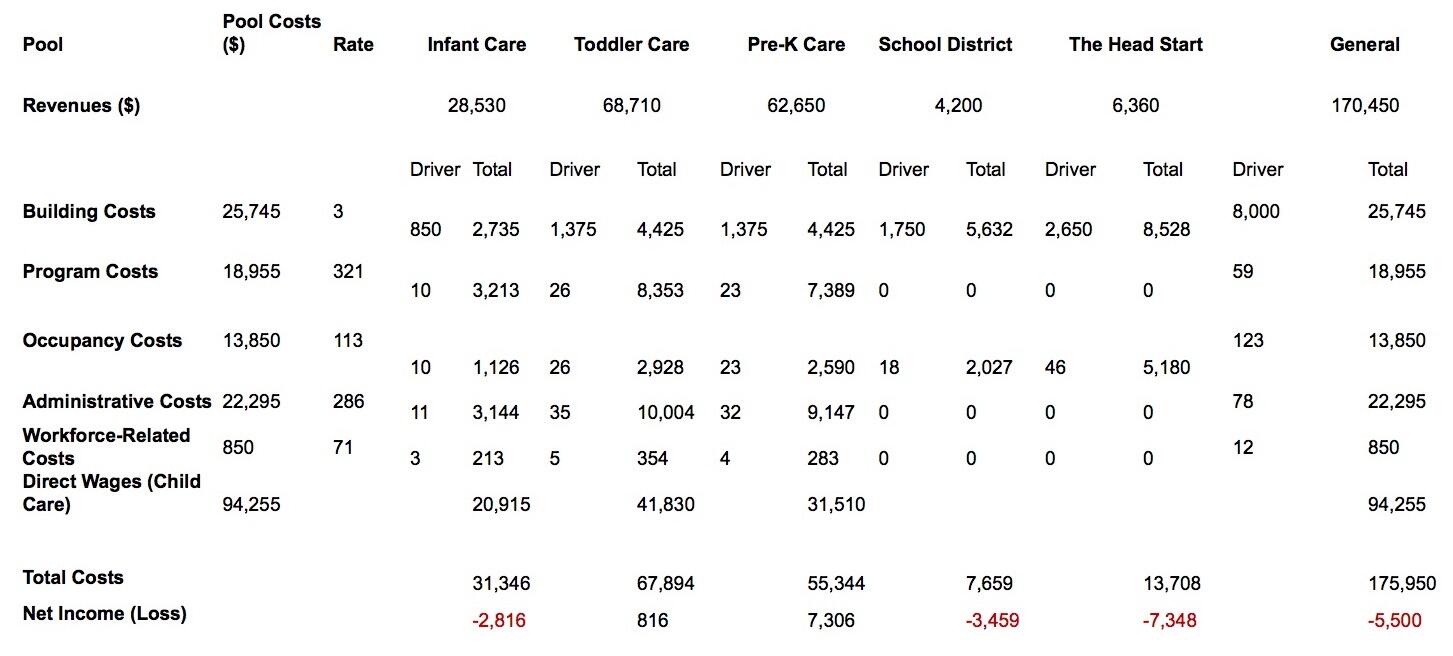

Using the combined data analyzed in previous questions, it is possible to identify the most and least profitable programs and services provided by ACDC. Table 3 shows the results of calculations with a focus on total costs, revenues, and net income or loss. The calculations highlight the losses incurred as part of specific programs, although some programs still bring profits to the company.

Pre-K care program

The most successful program offered by ACDC is the Pre-K care program, which brings a net income of over $7,300. The other program that could be considered profitable is the toddler care program, although the net income from it is meager, at just $816. The rest of the programs and services bring significant losses to the company, ranging from $2,816 to $7,348. The general net loss after accounting for all programs and services is $5,500.

It appears that the determining factor that affects the profitability of ACDC’s programs are the direct wages. With regard to lease, building costs and occupancy costs far outweigh the revenue gained from the school district and Head Start. Therefore, it can be said that the management’s failure to account for direct and indirect costs while setting program and service prices was the ultimate factor affecting ACDC’s success.

Opportunities to improve profitability

There are many opportunities for ACDC to improve its profitability and avoid losses in the future. First of all, the Center could raise the prices of its Infant care program, since it is currently the only care service that brings losses. Secondly, it would also be possible to increase the rate of Toddler care program, which appears to be bringing the most revenue to the organization at the moment. A small increase in the fee is unlikely to affect customers, but it could bring significant profits to the organization. The third possibility would be to raise rent prices for both of ACDC’s tenants.

This would help to cover the losses incurred as a result of leasing at least partly, thus achieving better profit margins. Finally, it would also be beneficial for the company to make changes to the lease contract and require tenants to pay their own occupancy costs, including maintenance, utilities, and water/sewage. This would cover a significant part of the expenses associated with leasing, thus allowing ACDC to make profits.

Work Cited

Irwin, Kristen, et al. “Appaloosa County Day Care Center, Inc.” IMA Educational Case Journal, vol. 3, no. 4-3, pp. 1-5.