Introduction

Companies face numerous challenges in maintaining a competitive edge and achieving long-term financial success in today’s rapidly evolving corporate environment. One of the biggest financial firms in the United States is BOA. It has five business divisions: consumer banking offers credit, banking, and financial items and services through its savings and consumer loan divisions (“Bank of America,” 2023).

However, the current unpredictability of economic situations, including interest rates and inflation after the epidemic, has caused BOA to suffer. As a result, the company’s existing strategic operations must be thoroughly examined and strategically improved. To assess a company’s financial performance, identify its areas of strength and weakness, and develop effective methods to promote sustainable growth, a thorough strategic analysis of the company’s strategy is essential.

BOA Financial Results

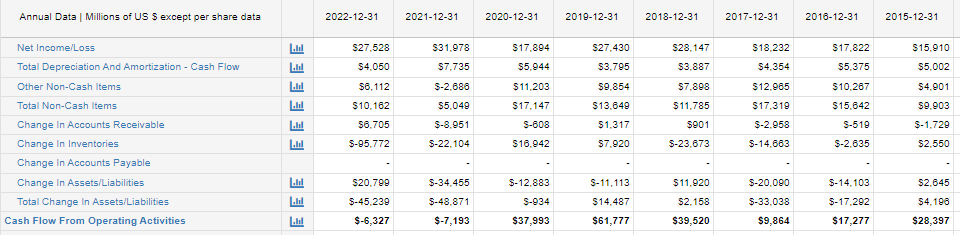

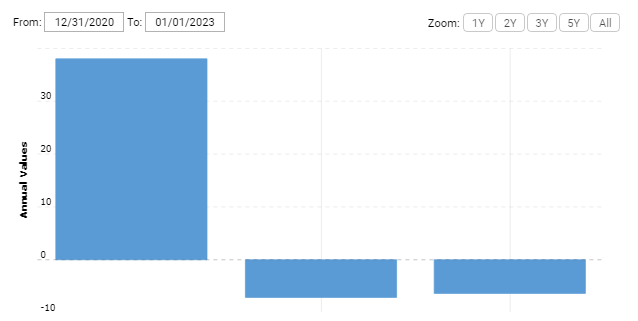

Understanding a company’s financial situation and determining whether it has improved or deteriorated over time requires a close examination of the cash flow statement. Compared to 2021, in Figure 1: BOA’s yearly cash flow from operational operations decreased by 12.04% to $-6.327 billion in 2022 (“Bank of America,” 2023). Additionally, the company’s yearly cash flow from operations in 2021 was- $ 7.193 billion, a 118.93% decrease from the previous year (“Bank of America,” 2023). This suggests that the business’s ability to generate cash from its core operations has declined. In Figure 2, the bank had positive cash flows before 2021; for instance, in 2020, they had $37,993, compared to $-7.193B in 2021 (“Bank of America,” 2023). To stabilize its operations, BOA will need to alter its strategy.

Improvements to Financial Performance Recommendations

Cash Flow Optimization

BOA will require a plan to reduce expenses and increase revenue to enhance its financial performance. For BOA to regain its position and ensure its continued existence, revenue growth is crucial, as it is its most valuable liquid asset. BOA may take specific steps to optimize its cash flow by renegotiating contracts with suppliers, implementing cost-control measures, and exploring the potential for economies of scale (Houston, 2023).

Through cash flow improvement, BOA can take advantage of opportunities and pay suppliers promptly rather than on credit. To identify inventory that is not profitable and other items, BOA needs to focus on this and conduct an analysis. This is because unsold inventory does not improve cash flow; instead, it worsens it. The corporation will continue to attempt to generate cash flow by discounting products from its list of slow-moving inventory.

Scaling Overhead Expenses

Another suggestion for improving financial performance is to scale a few overhead expenses. In this case, they can use technology like holograms to automate and simplify such processes, saving overhead expenses (“Artificial Intelligence,” 2022). It is possible to increase productivity and lessen the need for manual operations by using software solutions for financial management, client relationship management, and logistics management.

Additionally, BOA must recognize and simplify ineffective procedures that raise overhead expenses. Workflow simplification, eliminating unnecessary stages, and automating manual tasks can increase productivity and reduce labor costs. Bank of America may enhance cash flow and resource allocation by deploying frameworks and actions to minimize overhead expenses, boosting its profitability and sustainability.

Sustainable Competitive Advantage Strategies

Competition is a significant aspect that directly threatens BOA’s success. Along with conventional retailers, these rivals include high-end and low-end financial entities. BOA and other merchants from other corporations share the market. The existence of cryptocurrency exchanges, such as Binance, and payment processors like PayPal, poses a threat to BOA.

Customers are highly drawn to seamlessness in services since these platforms provide ease, flexibility, and expedited payment procedures (Cowell, 2023). As a result, they have created dangers. Additionally, tech giants like Google, Amazon, Apple, and Facebook have entered the financial services market with products such as loan services, payment systems, and digital wallets. These businesses can disrupt the traditional banking sector and capture market share due to their sizable user bases, massive data sets, and established digital ecosystems.

To maintain its position in the evolving financial landscape, BOA must closely monitor these competing dynamics, adapt to shifting consumer demands, and embrace innovation. Utilizing AI in their mobile banking platform is one method to develop a competitive edge (“Artificial Intelligence,” 2022). Due to the increasing consumer traffic, implementing this technique will strengthen BOA’s competitive edge. As a result, the business has the opportunity to generate larger profits and the possibility of winning back clients by offering a more luxurious shopping experience.

BOA should nevertheless develop and operate a client loyalty program. Customers participating in this program are often awarded points for their purchases, which they can accumulate and redeem later. Users who qualify for the scheme should receive perks including higher interest rates on savings accounts, multiplied credit card incentives, and lower fees at various branches (Hurd, 2023). This straightforward compliment may increase and maintain client loyalty. Additionally, this tactic offers extra advantages because the program can be used to gather client information that can then be analyzed to detect behaviors and provide a more personalized user experience.

Strategy Implementation Plan

Executive Level

The strategies will be translated into initiatives to accomplish the targets and strategic objectives during implementation. Senior executives are essentially in charge of the strategic plan; however, the CEO should evaluate it before approving its execution, unless some components are deemed particularly challenging. Next, the top management team will develop the vision for strategy implementation. The insight will help identify realistic time and resource requirements by providing an understanding of the program’s successes and failures (Miller, 2020). Thus, the objectives of the new strategy are identified by this visionary approach.

Expert Level

The next stage in implementing the strategy is the selection of an expert within the marketing group, who will also identify any potential implementation issues. It will also be crucial to schedule frequent meetings to review and debate success reports. Team members responsible for strategic planning will be present at these sessions. This informs the team of any alterations, successes, the current timetable, and the implementation situation, such as on track, ahead of schedule, or behind schedule. As such, this fosters healthy connections by directing how individuals engage with one another and holding decision-makers accountable for every action (Miller, 2020). Conversely, BOA should also improve its social media marketing strategy to reduce production expenses. The company may utilize trends and current events to generate online interest.

Conclusion

From a strategic perspective, BOA can enhance its financial performance and gain a competitive market edge. Economic vibrancy can be achieved by lowering overhead expenses and enhancing income generation. As a result, this enables the organization to renegotiate contracts with suppliers, introduce cost-cutting initiatives, and explore opportunities for economies of scale.

BOA should also examine consumer loyalty programs and utilize cutting-edge technologies, such as AI, for long-term viability. To obtain excellent outcomes, BOA should implement a strategy plan that includes all corporate stakeholders. In this way, the financial body may secure the market position it had in the past.

References

Artificial Intelligence…is intelligent! (2022). Bank of America. Web.

Bank of America cash flow statement 2009-2023 (2023). Macrotrends. Web.

Cowell, J. (2023). Challenger banks vs. crypto institutions: The battle for the future of finance. Cointelegraph. Web.

Houston, M. (2023). 5 Ways business owners can manage the high cost of inflation and keep debt under control. Forbes. Web.

Hurd, A. (2023). Bank of America preferred rewards program review. Forbes. Web.

Miller, K. (2020). A Manager’s guide to successful strategy implementation. Harvard Business School. Web.