Introduction

Financial crises have the potential to disorient business performances and increase chances of bankruptcy. Organizational leaders should apply appropriate strategies to meet their financial obligations and maximize profits. Challenges emerge when corporations’ assets and financial instruments lose their value. The occurrence of this predicament makes it impossible for the affected companies to pursue their goals. Revlon, one of the leading corporations in the American cosmetic sector, is presently struggling financially and incapable of managing the recorded debt load. Revlon needs to improve its cash flows, restructure current debts, and cut operational costs to get rid of the current problems. The inclusion of cost and focus competitive advantages will help transform its business performance.

Revlon’s Financial Plan

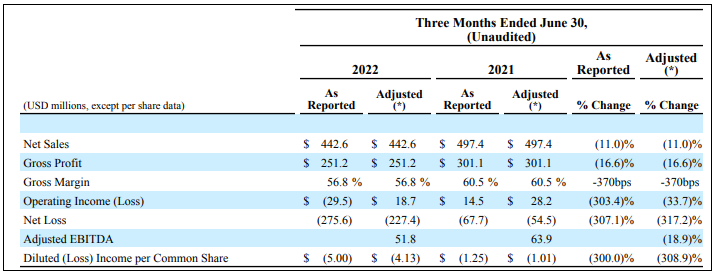

Revlon presents a perfect example of a large corporation struggling financially. In the second quarter of the year 2022, the company reported sales amounting to 442.6 million US dollars (Citybiz, 2022). During the same quarter in 2021, the net sales stood at 497.4 million US dollars (see Table 1). Its operating loss has increased during the second quarter of this year to stand at 29.5 million US dollars while the recorded amount for the second quarter of 2021 was 14.5 million US dollars (see Table 1). The company adjusted EBITDA declined by around 12.1 million US dollars (63.9-51.8) in the second quarters of 2021 to 2022 (see Table 1).

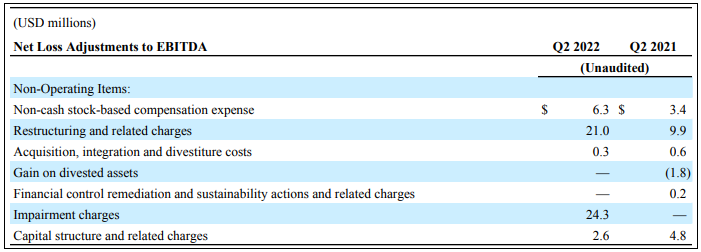

In terms of net loss, Revlon reported a figure of 275.6 million US dollars in the second quarter of 2022. Some of the possible explanations behind this figure include reducing operating capital, increasing losses in the reported foreign currency, tax requirements, and changing interest rates in the American economy (Citybiz, 2022). By June 30th, 2022, Revlon reported a liquidity of 311.2 million US dollars. This amount includes unrestricted funds amounting to 312.5 US dollars and equivalents (see Table 2).

Revlon identifies EBITDA as all forms of income gained from ongoing business operations before taxes and application of interests. From the reported document, it becomes clear that the company has been operating at a loss in the recent past. In the presented table, the reader is able to analyze the company’s non-operating items that are usually not outlined in the adjusted EBITDA for two years (see Table 2). This statistical evidence shows conclusively that the selected organization has been performing dismally.

Revlon’s predicaments could be largely attributed to the issues recorded due to the ongoing COVID-19 and its subsequent impacts on supply chain distributions and sales. The complexity of these issues, compounded with inflation and increasing interest rates, have made it impossible for Revlon to control, predict, or even manage its debts and operations (Citybiz, 2022). The company’s inability to identify, target, and attract younger individuals to become customers has led to additional challenges. Most of the initiatives undertaken in the past failed to deliver positive results. Consequently, the leadership chose to file for bankruptcy, according to Chapter 11, in June 2022 (Citybiz, 2022). Such an effort has been critical since Revlon was facing numerous challenges capable of resulting in total closure.

Recommendations for Improvement

The current situation at Revlon means that the leaders can consider a number of evidence-based approaches to restructure operations and implement proper mechanisms to continue pursuing its business aims. The move to file for chapter 11 bankruptcy means that the board at Revlon has acted in the best interests and expectations of all creditors. This reality means that the organization should consider various initiatives and changes that will eventually result in improved financial performance (Farida & Setiawan, 2022). When done correctly, chances are high that such initiatives will result in positive outcomes and make it possible for the company to continue meeting the demands of its key shareholders and stakeholders.

The first recommendation that can guide Revlon to get out of the current financial dilemma entails the introduction of new strategies capable of improving the organization’s current cash flow. The relevant leaders company can study the current dynamics of the cosmetics market if it is to attract more customers (Farida & Setiawan, 2022). Following the issues revolving around COVID-19, businesses are focusing on new approaches to acquire revenues by introducing better marketing strategies and identifying new potential customers. This approach can make it possible for Revlon to increase its sales. The realization of such a goal could be enhanced by providing additional incentives to new customers and making timely financial forecasts.

The second one revolves around the process of cutting operational costs. All financial challenges experienced in a company are associated with unsustainable cash flows (Farida & Setiawan, 2022). The move to minimize expenses at Revlon could present additional opportunities whereby key departments will be in a position to achieve their goals. Some of the best initiatives to achieve such a goal include reducing all unnecessary organizational expenditures and reducing the current number of staff members (Farida & Setiawan, 2022). While this approach might be unprecedented or unfavorable, it delivers a better chance of improving the company’s financial outlook. Consequently, Revlon will be able to get out of the current operational mess and consider new ways to reemploy some of its former workers.

Before filing for bankruptcy, Revlon had experimented with different initiatives to improve its performance and meet the demands of key shareholders. For example, the organization had partnered with Citigroup as a loan agent and agreed to receive funding amounting to 8 million US dollars (Citybiz. (2022). However, Citigroup mistakenly sent 900 million US dollars to some of the company’s lenders. These developments show conclusively that Revlon could consider the idea of debt restructuring as the third recommendation if it is to record noticeable improvements. This initiative means that Revlon will devise a new plan with key lenders to change interest rates and make repayment procedures flexible. The strategy will give Revlon additional time for reinventing its operations.

Achieving Sustainable Competitive Advantage

The success of any business entity is founded on the leaders’ ability to support marketing procedures. These initiatives are essential since they attract customers who eventually make the required purchases. The acquired financial resources are used to support all aspects of business strategy. Based on this understanding, it is agreeable that Revlon needs to consider practical strategies to achieve sustainable competitive advantage in the region’s cosmetics industry. Such efforts need to be informed by the company’s competitive brand name and positive reception in the American market (Cegliński, 2017). The introduction of additional measures will help mitigate most of the issues affecting performance, tackle the threat of new entrants, and take it closer to its goals.

The idea of value advantage presents the first strategy that Revlon could employ to achieve competitive advantage. With younger customers focusing on style and e-marketing efforts, Revlon should differentiate most of the current products and ensure that they are capable of meeting the needs of this untapped population. The acquired resources from sales should support the process of differentiation if Revlon is to become a brand associated with superiority. The second strategy for this company to take into consideration is that of focus advantage (Farida & Setiawan, 2022). Under this approach, Revlon will identify an existing market niche. This initiative will be followed by the provision of cosmetic products tailored to empower members of this population. A good example would be individuals aged 18 and 35 who might be in constant demand of beauty products available online and in nearby local stores. This knowledge could inform the best model that can deliver positive outcomes and make Revlon more competitive in the sector, thereby increasing its overall financial performance.

Implementation Plan

A simple approach is recommendable for Revlon to introduce focus and value competitive advantages and eventually make the sustainable. This idea is guided by the fact that the company is experiencing various challenges, such as bankruptcy and losses (Cegliński, 2017). A practical implementation plan has the potential to encourage all stakeholders to be part of the process and eventually make the new strategies part of the organization. Kurt Lewin’s change theory becomes the best plan since it allows leaders to implement transformations swiftly and within the shortest time possible.

Refreeze

During this phase, the involved professionals will educate and inform key players about the financial issues affecting Revlon. They workers and shareholders will appreciate the fact that the filed bankruptcy is indicative of the company’s poor performance. The stage will present additional opportunities for outlined some of the possible initiatives and how they could be customized to support the current business strategy (Hussain et al., 2018). The professionals could use this phase to identify opportunities and resources for introducing the identified strategies.

Change

This stage will allow all agents, employees, and leaders to introduce the outlined competitive advantages. Specifically, recruited employees will support the procedures by ensuring that Revlon continues to produce quality cosmetics capable of meeting the needs of the targeted customers. The focus attribute will guide the workers to identify better ways of personalizing products and marketing them directly to the intended customers (Hussain et al., 2018). The use of online business practices will become common and increase chances of recording positive results.

Freeze

This phase will allow the involved agents at Revlon to align new competitive advantages to the existing operations. They will encourage all workers to remain supportive and promote the established activities. The professionals could go further to embrace the idea of continuous improvement and borrow emerging attributes from other companies (Hussain et al., 2018). The emerging norms would guide employees to focus on changing customers’ preferences and expectations. If done correctly, this plan will ensure that Revlon introduces and relies on the proposed strategies to achieve competitive advantages and eventually improve its overall financial outlook.

Conclusion

Revlon has been struggling financially within the past three years. This predicament compelled the organization to file for Chapter 11 bankruptcy in June 2022. Such a decision reveals that the company’s top leadership should apply evidence-based strategies to overcome the current problems. Some of the reasonable approaches to consider include improving cash flows, cutting costs, and restructuring its debts. The consideration of focus and cost competitive advantages could guide the company to attract more customers, perform positively in the market, and eventually improve its overall financial outlook. The end result is that Revlon will become competitive again, attract more customers, and meet the changing needs of all key stakeholders.

References

Cegliński, P. (2017). The concept of competitive advantages. Logic, sources and durability. Journal of Positive Management, 7(3), 57-70.

Citybiz. (2022). Revlon reports second quarter 2022 results.

Farida, I., & Setiawan, D. (2022). Business strategies and competitive advantage: The role of performance and innovation. Journal of Open Innovation: Technology, Market, and Complexity, 8(3), 163-178.

Hussain, S. T., Lei, S., Akram, T., Haider, M. J., Hussain, S. H., & Ali, M. (2018). Kurt Lewin’s change model: A critical review of the role of leadership and employee involvement in organizational change. Journal of Innovation & Knowledge, 3(3), 123-127.