Research into Organizational Successes and Challenges

Blizzard Entertainment, Inc. is a US-based video game developer and publisher with headquarters in Irvine, California, and a subsidiary of Activision Blizzard. The company was founded by Michael Morhaime, Allen Adham, and Frank Pearce in February 1991 after all three graduated with their Bachelor’s degrees (“Blizzard Timeline”). It took the company three years, several name changes, and an acquisition by a more prominent brand until its breakthrough product, the World of Warcraft.

The Wow was an instant hit and a trailblazer for real-time strategies in high-fantasy settings. Other main pieces of intellectual property that struck a chord with fans in the decade to follow were StarCraft and Diablo. Following the merger with Activision in 2008, the company faced falling ratings for the World of Warcraft (“Blizzard Timeline”). If in 2010, monthly subscriptions reached the record 12 million, by 2014, they had sunk to 6.8 million.

Blizzard Entertainment was in dire need of another breakthrough project that would solidify its standing on the highly competitive game development market. Initially, the company started working on Titan – a more contemporary or near-future MMORPG that was supposed to coexist alongside the World of Warcraft. The development of the game soon turned problematic, and Blizzard Entertainment reassigned all developers but a few to other projects.

The people left to work on Titan soon transformed the initial idea into Overwatch: a team-based multiplayer shooter. Overwatch was released in May 2016 and turned out to be highly successful: by the end of the year, it had become the best-selling game on PC (“Blizzard Timeline”). The popularity of the game allowed the creators to expand it and launch events such as Overwatch World Cup.

Today, there are no doubts that Activision Blizzard (NASDAQ: ATVI) set the benchmark for video game developers. The company imposed its dominance over PC, console, and mobile games. It has swiftly navigated the ever-changing environment over the past decade to maintain its standing. However, in 2019, Activision Blizzard’s stock for the year 2019 was down 43%, indicating that the company might as well shrink in the years to come (Macrotrends). It seems that it is not just certain contenders such as Fortnite that are eating into the company’s business. The problem is large-scale: the landscape of the industry is presenting new challenges that Activision Blizzard has yet to harness.

Identification and Prioritization of Challenges

The challenges faced by Blizzard can be categorized into two groups: short-term financial challenges and long-term sustainability issues. For the upcoming year, Blizzard seeks to improve its financial standing. Ballard reports that as of now, analysts predict that in 2020, Activision Blizzard will grow revenue by 9% and adjusted earnings by 14%. However, a surge in revenue and adjusted earnings might as well prove to be a fad and fail to start a positive tendency if the company does not take care of its strategy in the long run.

It is essential to address the changing needs of video game consumers that become more complex and refined due to the increased supply and a variety of choices. Another challenge is to decide whether the company will launch new products, which implies some risk, or continue developing beloved franchises such as the World of Warcraft and Diablo.

Identification of Consumer and User Needs

The key to striking a chord with video game customers lies in a deep understanding of human psychology. Morton writes that the most successful, “sticky” games are those that give players a feeling of an emotional, personal experience. The author refers to a popular business book by Nir Eyal, Hooked: How to Build Habit-Forming Products. He explains that video game development should follow the same pattern as the development of any other habit-forming product. In particular, a video game consumer needs routine and positive emotions associated with it. Personalized gaming meets their needs by offering customizable in-game items and vibrant online communities where users can bond over their gaming experiences.

Because consumers are now making more emotional connections to a chosen game, they might want to spend more time playing it. So far, the industry has pushed developers to prioritize output so that consumers could quickly move from the video game of the week to the next big thing (Reid). Perhaps the “one-week shelf life” trend characteristic for many video games is coming to a halt (Wesley and Barszak 104). Consumers might be ready for more immersion and paying more attention to detail as well as interacting with diverse communities of fellow gamers.

Of special note are tendencies that encompass the entire market and, therefore, influence the gaming market niche as well. The defining consumption trend of the last couple of decades has been a strong leaning toward consciousness. Mintel Press Team reports that more than half of US consumers (56%) would stop buying from companies that do not meet their ethical standards. Furthermore, one-third of American consumers go as far as rejecting an unethical brand entirely, even in the absence of a viable alternative. Another finding by Mintel Press Team (2015) that is worth mentioning is that 27% of consumers would switch to another supplier that they consider more ethical even if it meant purchasing goods or services of lower quality.

Competitive Landscape and Market Opportunity Analysis

Strengths

Blizzard’s greatest strength lies in its ability to draw an audience and build an expansive customer base. Over the last three decades, one fact that stands out about Activision is its consistent production of hit games: World of Warcraft, StarCraft, Diablo, Hearthstone, and Overwatch. The majority of these games rank among the top ten most popular games on Twitch and YouTube, proving that they are as entertaining to watch as they are to play. This leads to another inarguable strength: a customer base of 374 million monthly subscriptions, each of which spends at least an hour a day playing one of Blizzard’ games (Gough).

Another strength that is worth mentioning is Blizzard’s ability to foresee trends such as esports market growth. For a number of years, Blizzard games such as Starcraft and Call of Duty have been staples for gaming competitions. In 2016, the US-based company took it up a notch with starting Overwatch league after the massive success of the game (“Blizzard Timeline”). In summation, the company singled out a product that had already been enjoying a great deal of popularity and with its help, capitalized on a rising trend.

Of a special note is Blizzard’s commitment to corporate social responsibility. The company does not solely pursue profits: it gives back to the community. For example, Blizzard’s Call of Duty Endowment helped 40,000 veterans find good jobs (“Blizzard Timeline”).

In May 2018, the US company supported breast cancer research. Game developers created a paid character skin for the most popular character in Overwatch designed in pink shades. The upgrade cost $15, and all profits went to the Breast Cancer Foundation. As a result, the organization received $12.7 million, the largest single corporate donation in its history (Lanier). Community work and humanitarian initiatives help Blizzard build a positive image.

Weaknesses

For all its advantages, Blizzard has its set of internal challenges. Firstly, several years ago, the company faced charges for patent infringement, which hurt its corporate reputation (Frank). Texas-based Virtual Gaming Technologies, LLC, sued Activision for illegally owning “real-time interaction systems” that are most commonly used in fantasy sports games. The technology employed in these systems allows fantasy sports players to update information about their players’ performances during live, ongoing competitions.

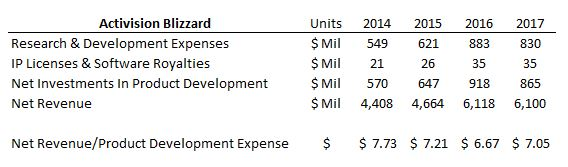

Another issue is Blizzard’s internal finances management: since 2015, the company’s investment into research and development has not been paying off. Ideally, research and development expenses should correlate with net revenue, but it does not appear to be the case (see Table 1) (Gough). Since 2015, revenue generated per dollar spent on product development related expenses took a nosedive. In 2016, it declined even further and only mildly recovered in 2017.

Opportunities

The biggest opportunity for Blizzard is to keep capitalizing on the growing esports market. Esports and gaming are overwhelmingly becoming mainstream, turning from a niche to one of the essential forms of entertainment in the world. Previously, esports were seen as nothing more than an outlandish subset of sports culture. However, today, it has grown into a full-fledged industry with major market players and a vibrant consumer base.

The main indication of esports’ shift to the mainstream was the support from celebrities such as Michael Jordan, Drake, and DJ Marshmello as well as extensive press coverage. It is projected that in 2020, the esports ecosystem will generate more than $1 billion in revenue for the first time in the history of the industry (Reyes). From there on, revenue is expected to only increase and reach $1.8 billion by 2022.

If Blizzard stays on the market and develops its esports products, it opens opportunities to gain profit from media rights, ticket sales, merchandise sales, in-game purchases, and sponsorships. Besides, Blizzard will strengthen its presence on three key esports markets: Asia-Pacific (APAC), North America, and Europe. The market with the most potential is APAC: it is projected that in 2019, it will account for 57% of global esports following (Reyes). North America is expected to generate $300 million in esports revenue next year, while for Europe, the estimate is at $138 million.

Threats

Activision Blizzard is at risk of having its content pirated: a threat that the company has so far been addressing by filing lawsuits. Another danger to be considered is the rise of low-graphics low-technology mobile games that might be luring away the subscriber base. Staying on the topic, of the special note are independent game developers and small studios who offer unique and entertaining titles at lower costs. Lastly, other large companies such as Ubisoft and Electronic Arts may launch a product whose popularity will surpass that of Blizzard games.

Strategic Analysis

Based on the SWOT analysis presented above, a possible strategy may encompass the following key ideas:

- building a strong and ethical brand image by committing to corporate social responsibility. This stands especially true given young consumers’ inclination and intention to buy ethical products and services. Blizzard has already given a lot of resources back to the community, and it is only reasonable to continue doing so. What is worth appraisal and continuation is the company’s ability to strike a balance between entertainment and charity. The customized character skin revenues from which funded breast cancer research was attractive and well-designed. Not only was the call to action non-aggressive but it also proposed value to customers;

- promoting and stimulating long use and emotional attachment to products. As it has been mentioned earlier, consumers no longer seek a quick relief: they want to interact with a game (Egenfeldt-Nielsen 108). What might help them do so is a strong community, events, and daily rituals that would turn Blizzard games into a habit;

- following and predicting trends. The eSports market is showing a promising dynamic that is likely to yield the companies that can harness its potential new customers and bigger revenues. Blizzard has so far been leading the change and transition from ordinary gaming to eSports. However, soon it will suffice not: to outdo newcomers, Blizzard will need to expand and diversify its offer;

- considering a new financial model. One of the main issues that Blizzard Entertainment is experiencing is the risk of investing vast amounts of money into a game that might as well fail in sales. Another problem is the paywall that discourages many gamers from purchasing products, especially when low-cost games are abundant on the market. Blizzard might want to take lessons from Epic Games that made over $1.2 billion in ten months thanks to its smart strategizing with Fortnite. What made Fortnite so attractive is the micro transactional nature of payment: while the game itself is free, many in-game items are not. In essence, anyone can join the game without investing their money and then deepen their relationship with it once they realize its actual value;

- retaining old fans and expanding the customer base. Over the course of more than two decades, Blizzard has launched a plethora of iconic products such as Diablo and the World of Warcraft. The franchises are still outstandingly successful, boasting big numbers of subscribers and steady sales. These facts make it reasonable for Blizzard entertainment to continue with the franchise by developing new sequels and satisfying old fans. As much as this strategy presents its own advantages, Blizzard should not ignore the interests of the new customer base. Younger consumers might not understand the appeal of the cult game titles and be on the search for new products.

List of Questions to Bridge Identified Challenges with Identified Opportunities

- Who is the typical consumer of Blizzard games?

- Which video game industry trends do you find threatening and which do you find promising?

- How would you describe the proposed value that Blizzard games have for fans now?

- What can you learn from your contenders? What do they do right?

Final Problem Statement

The final problem statement can be formulated as follows: “How can Blizzard Entertainment harness the ever-changing tendencies of the gaming market, retain loyal fans and reach out to younger consumers?”

References

Blizzard Timeline. Web.

Egenfeldt-Nielsen, Simon et al. Understanding Video Games: The Essential Introduction. Routledge, 2019.

Frank, Allegra. Activision Sued for Patent Infringement over Fantasy Sports Software (Update). Web.

Gough, Christina. eSports Market – Statistics & Facts. Web.

Lanier, Liz. Blizzard Makes Record-Breaking Donation for Breast Cancer Research. Web.

Macrotrends. (2019). Activision Blizzard Revenue 2006-2019 | ATVI. Web.

Mintel Press Team. 56% of Americans Stop Buying from Brands They Believe Are Unethical. Web.

Morton, Derrick. 3 Trends that Will Reshape how Consumers Interact with Video Games. Web.

Reid, Leya. 5 Consumer Trends for the Video Gaming Industry in 2020. Web.

Reyes, Mariel Soto. Esports Ecosystem Report 2020: The Key Industry Players and Trends Growing the eSports Market which is on Track to Surpass $1.5B by 2023. Web.

Wesley, David, and Gloria Barczak. Innovation and Marketing in the Video Game Industry: Avoiding the Performance Trap. CRC Press, 2016.