Introduction

Boeing is one of the leading aerospace and air transport organizations, with a broad footprint in the global marketplace. More than ten thousand Boeing commercial aircraft, or nearly half of all aircraft in use, are exported worldwide, and about 90% of all air cargo is transported by this particular brand of aircraft (Boeing, 2022a; Boeing, 2022b).

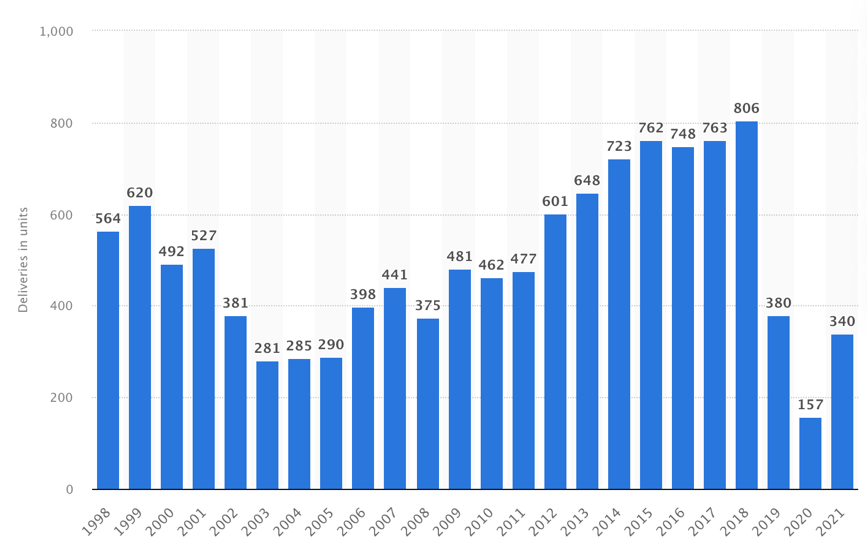

Boeing sells its services in civil aviation, space, defense projects, and extended deliveries worldwide, through Boeing Global Services. The statistics regarding Boeing’s operating performance reveal that the company’s net income increased consistently until 2018, when it experienced a sharp drop; a similar pattern was seen for Boeing’s shipments (Figure 1) (Salas, 2022a; Salas, 2022b). Over the last four years, the company has faced several organizational challenges that impact strategic planning and could lead to long-term development disruptions.

Boeing has a rich history of growing from a small company to one of the industry leaders. Boeing was founded in 1916 in Seattle and was able to launch and build the first military and small postal aircraft in the following decades (Boeing, 2021). The first commercial civilian flight on a Boeing 707 took place in 1958, and the demand for aircraft and equipment has skyrocketed.

However, it is reported that the traditional management values at the company’s foundation began to change with the arrival of new management in recent decades, aiming not to provide high quality but to maximize profits (Kenigsberg, 2022). Thus, one of the central angles of the following sections is to examine the modifications in Boeing’s strategic planning and evaluate the company’s performance.

Background Information

Boeing has several organizational problems that could lead to undesirable consequences in the long run. Increased dependence on global suppliers causes differentiation of operating costs and coverage of more markets. Still, crises can be disruptive for a multinational company. Worsening geopolitical relations and natural disasters can be additional factors, leading to a disruption in logistics and increasing operational risks for the company.

At the same time, the reduction of assets indicates the company’s plight, meeting its inability to meet its obligations (Blessing, 2022). When the company has to sacrifice valuable budgetary areas, including motivating salaries, R&D area, and expansion into new markets, in this case, the company is in a decadent state. In other words, it can be concluded from the proposed scenario that, over the last five years, Boeing’s strategic path has not improved, which may lead to a decline in long-term competitiveness.

An area in which Boeing may be experiencing strategic risks is its investment and public reputation. Boeing’s attractiveness falls after evidence of fraud and corruption among senior management (Segal, 2021). The multiple cases of plane crashes that the investigation revealed were the fault of Boeing’s decision-making leaders (Cruz & de Oliveira, 2020). The company’s credibility is paradoxical and sensitive, and could collapse in the future.

There is a growing public awareness of the ineffectiveness of Boeing’s current management, and the violation of efficiency, transparency, and accountability is causing increased economic and reputational risks, as well as heightened vulnerability to natural disasters (Segal, 2021). The thoroughness of strategic planning is determined by the need to conceptualize the environments that matter to Boeing. For this reason, the following sections provide a detailed analysis of Boeing using several classical models within the proposed thematic scenario.

SWOT Analysis

One of the standardized tools for ongoing critical assessment of a company is the SWOT analysis, which enables simultaneous evaluation of the organization’s internal and external resources. The analysis reveals that the strengths, both quantitatively and qualitatively, outweigh the weaknesses. However, it is not unlikely that Boeing’s well-being will be in doubt if the weak points remain viable.

Strengths

One of the company’s key strengths is its well-established reputation, which has led to numerous commercial and government orders worldwide. High brand recognition benefits the company’s strategic development and fosters customer loyalty in advance, establishing a firm that inspires trust. Boeing has often been called the most innovative player in the industry market (Figure 2).

The company surpasses Airbus; its high commitment to R&D is a reason for increased brand loyalty and sets the standards for competitors (Wang, 2021). From an operational standpoint, Boeing has developed product differentiation, which is realized in its ability to work with small private and large-scale customers. An expanded supply chain can also be seen as an advantage in reducing costs and increasing global presence.

Weaknesses

The company’s main weakness is the sensitivity of its public reputation, which can be disruptive to brand image perception and Boeing’s market value. There are instances in which the value of the company’s tradable stock has fallen by more than 10% following news of another crash (SkyNews, 2022). There is also evidence that the company’s internal environment is dysfunctional and associated with inept human resources and poor management (Wang, 2021). At the same time, an extended supply chain emphasizing outsourcing can also be seen as a Boeing negative and unsustainable in the face of global crises.

Opportunities

One of Boeing’s key opportunities in the current agenda is to increase R&D spending to maintain its image as an innovative leader in the aircraft industry. Boeing can utilize the intensification of private and national space programs worldwide to enhance its presence and strengthen its position in the aerospace development niche (Wang, 2021). In addition to maintaining customer loyalty and facing the environmental agenda, Boeing may be interested in transitioning to more eco-friendly fuels and building a market image as a socially responsible market participant.

Threats

Threats to Boeing include external factors that the company cannot control directly. Consequently, threats such as market share and revenue growth can negatively impact the company’s profitability scope. If not addressed satisfactorily, Boeing faces several threats that may hinder its general business strength (Wang, 2021). For example, the company faces increasing and stiff competition within its external and internal markets. In essence, Boeing’s competitors, such as Airbus, Embraer, and Bombardier, strive to expand their market occupation and influence to enhance their market share. Boeing also faces threats of negative impacts from a budget cut that can diminish its revenue.

The company’s defense sector revenues are primarily generated from the United States government; thus, cutting the US defense sector budget will have a direct and devastating impact on the company’s revenue (Wang, 2021). The corporate value chain has remained stable over the past few years. Commercial aviation disruptions are beginning to drive up costs and could slow the aerospace industry’s recovery from the COVID-19 pandemic. As private aviation volumes have surpassed 2019 levels this year, some corporate aircraft builders and suppliers at this week’s flagship business jet show in Las Vegas noted warning signs about supply chain and pricing glitches (Wang, 2021).

Until now, the company has avoided the massive value-chain problems that automakers and machine builders face. However, it is producing fewer planes than before the pandemic. Tensions in the supply chain are becoming more pronounced for the production of narrow-body jets, as demand for which has increased due to the recovery of short-haul flights. Thus, the pandemic caused disruptions to the stability of value creation.

Porter’s Five Forces Analysis

The Threat of New Entrants

Boeing faces a low threat of new entrants as the entry requires an intensive billion-dollar investment to establish adequate operational facilities. Moreover, a new entry into the airline industry requires substantial fixed development and research costs. For instance, Boeing’s total research and development costs between 2011 and 2014 were 13.34 billion USD (Naimzade, 2018). Therefore, new market entrants must receive substantial orders to justify such a massive investment. In terms of margins, it is relatively impossible for new entrants to undertake such risks.

Woo et al. (2021) also report that the Boeing-Airbus duopoly will dominate if the Commercial Aircraft Corporation of China (COMAC) attempts a market break-in. COMAC experiences huge entry barriers from Airbus and Boeing, besides the tendency of new entries to require an established and trusted name to break in and attract customers. Therefore, it is conclusive to ascertain that Boeing Company faces low threats of new entrants.

Industrial Rivalry

Due to competition from other companies such as Airbus, Embraer, and Bombardier, Boeing faces numerous industrial rivals. Despite establishing itself among the leading aerospace companies, Boeing does not have a substantial advantage and domination over Airbus as a commercial jet engine builder (Woo et al., 2021). Additionally, Boeing faces aggressive and intense international competition from Bombardier, Airbus, and Embraer.

In the defense sector, Boeing must compete and overcome intense competition from Lockheed Martin, General Dynamics Corporation, Raytheon Company, and Northrop Grumman Corporation. In the United States, Northrop Grumman and Lockheed Martin earn above 80% of their revenue from the American market (Woo et al., 2021). Therefore, companies invest massive amounts of money to earn defense contracts. Boeing’s rivalry can be catastrophic during challenging economic periods like bank runs.

Bargaining Power of Supplier

Boeing is diversified; about 60% of its revenue comes outside the United States. Therefore, the company has global suppliers, and it is undoubtedly fragmented. Consequently, Boeing can negotiate lower prices for its manufacturing materials. For instance, the company reports that it has hundreds of suppliers for a single 16 Boeing 737 aeroplane (Naimzade, 2018).

Boeing Company and Airbus dominate the commercial airline industry, thus limiting Boeing’s suppliers’ power. Additionally, Boeing Company’s bargaining power is illustrated through accounts receivable and payable days, whereby the company has substantial power over its suppliers. At the same time, its payable days are almost double its receivable days (Naimzade, 2018).

Bargaining Power of Customer

With the Boeing Company and Airbus duopoly, bargaining might be absent. However, the two companies aggressively compete with each other in attempts to sell more commercial and defense aircraft and jet engines and to capture a larger market share. Moreover, the revenues of security and defense space divisions are mainly from the United States government, thus raising the customers’ bargaining power. Conclusively, Boeing’s customers’ bargaining power is intense to moderate (Woo et al., 2021).

Threat of Substitutes

The unique nature of the airline developers industry’s products and services renders the threat of substitutes shallow (Woo et al., 2021).

Recommended Strategies

Vision

Boeing’s vision statement is “designed to inspire and focus all employees on a shared future and to reaffirm that, together, we can meet the challenges that lie ahead” (Boeing, 2022, p. 2). The vision statement focuses on the company’s role in influencing its workforce. Boeing has set its 2025 goals, published on its official website. The Boeing goals for the next 10-15 years include market leadership; productivity-fuelled growth; accelerated innovation; top corporate citizen; top-quartile performance and returns; best team, leaders, and talents; global scale and depth; and design, manufacturing, and service excellence (Boeing, 2022).

Mission Statement

Boeing’s mission statement is “People working together as a global enterprise for aerospace industry leadership” (Mission Statement Academy, 2019, 4). The company’s mission statement depicts its critical elements, illustrating that it not only focuses on producing mechanical products but also emphasizes and values the development of everlasting relationships between people and the stakeholders in contact with the company. Boeing’s mission statement reveals several components: improving human lives, high-quality products, global reach, and people empowerment (Mission Statement Academy, 2019).

Values

Boeing’s values include starting with engineering excellence, accountability, the application of lean principles, eliminating traveled work, rewarding predictability and stability, leading on safety, quality, sustainability, and integrity, fostering a just culture based on humility, transparency, and inclusivity, trust and preference, and importing best leadership practices (Boeing, 2020).

Strategy Implementation Plans

Boeing’s current strategic line focuses on differentiation, concentrating on specific markets and niches: commercial airlines and the defense sector. According to an analysis of the corporation’s environment, Boeing’s products are specific and tailored to customer requirements and needs, as evidenced by the volume and order list (Ravi, 2020). These products are for business or government agencies in space programs and military applications.

For example, air carriers expect massive, modern, fuel-saving, varied in configuration, and practical aircraft. At the same time, governments require rugged and reliable equipment that can be trusted with the security of the country. Therefore, by using efficient strategies and maintaining the quality of its products and possible costs, Boeing manages to meet its customers’ needs while considering the price value (Ravi, 2020).

Thus, the company has the attributes to maintain differentiation as it continues to improve its services by developing new ones. Moreover, Boeing invests in innovation, new technology, and research and development (R&D), focusing on paramount issues such as quality improvement as it relates to other critical components of the industry, such as safety.

However, Boeing has manageable new orders and backlogs to secure the company’s funding for about a decade. The most viable strategy should concern product diversity, environmental sustainability, and innovation to strengthen the company’s market position. It presumes several steps:

- It is enhancing its aerospace programs and products to secure additional contracts with NASA, increasing its product varieties and profits.

- Investing in cost reduction innovations, such as manufacturing lines and robotized assemblies.

- Establishing and enhancing its technical support facilities to increase customer satisfaction values.

- Investing in environmental sustainability and innovation is the main way to succeed and increase loyalty.

- Strive to become the benchmark company for aircraft production to establish its undisputed dominance.

Business Life Cycle

Like any other business, Boeing Company undergoes four phases of the business life cycle: startup, growth, maturity, and rebirth or decline (Dempsey, 2018). Boeing’s startup entailed networking, developing new and innovative selling and marketing methods to boost revenues, and consistently implementing new ideas. The company had limited processes and thus tweaked its business model to grasp and integrate the market and generate profits (Lee, Li, and Song, 2019).

On the other hand, in its growth phase, Boeing managed to integrate and familiarize its business model with its customers. It kept its pricing levels alongside the rises for its new clients while establishing mature relationships with its existing customers. Moreover, it significantly decreased its turnover and overcame the doubt and uncertainty of keeping its employees and generating payroll.

Boeing also established investments by turning its profits into growth funds. Boeing’s maturity is characterized by its business security and professional management, as well as the company’s market predictability. The company also enjoys smooth operations with solid cash positions and experiences growth from its acquisitions and new product lines (Lee, Li, and Song, 2019).

Competitive Advantage

Boeing’s main advantage lies in its global sales and production facilities, thus a solid international presence. It has good relationships with several companies, including its competitors, whereby it deploys several joint programmes, such as Boeing’s United Space Alliance with Lockheed Martin and the joint missile programme with Northrop Grumman (Petrescu, 2019). Moreover, Boeing possesses an extensive product line, including Boeing Business Jet and the Boeing 717, 737, 747, 757, 767, and 777 jetliner families, besides its Dreamliner, which caters to niche divisions and major markets (Woo et al., 2021).

Therefore, Boeing boasts 75% of the global fleet, with approximately 13,000 Boeing-built commercial jetliners distributed in the global airline network. This dominance is supported by the company’s strategic, solid global distribution methods, which, due to its advanced digital systems, facilitate effective spare parts production and delivery. Boeing’s strategies are so efficient that they give the company an advantage over its competitors.

Reference List

Blessing, E. (2021) Asset deficiency. Web.

Boeing (2020) Boeing: values. Web.

Boeing (2021) Boeing history chronology. Web.

Boeing.com. (2022) Boeing: vision. Web.

Boeing (2022a) Boeing in brief. Web.

Boeing (2022b) Fact sheets. Web.

Cruz, B.S. and de Oliveira, M. (2020) ‘Crashed Boeing 737-Max: fatalities or malpractice’, Global Scientific Journals, 8(1), pp. 2615-2624.

Dempsey, B. (2018) ‘Council post: business life cycle spectrum: where are you?’, Forbes. Web.

Kenigsberg, B. (2022) ‘Downfall: the case against Boeing’ review: behind two fatal crashes’, New York Times. Web.

Lee, M., Li, L.K.B. and Song, W. (2019) ‘Analysis of direct operating cost of wide-body passenger aircraft: A parametric study based on Hong Kong’, Chinese Journal of Aeronautics. Web.

Mission Statement Academy (2019) Boeing mission statement 2019 | Boeing mission & vision analysis. Web.

Naimzade, K. (2018) Case study: the Boeing company strategic analysis. Web.

Petrescu, R.V. (2019) About Boeing X-32. Web.

Ravi, A.K. (2020) ‘Reinventing strategic management: an evolutionary perspective’, Asian Journal of Management, 11(4), pp.429–433. Web.

Salas, E. B. (2022a) Boeing’s aircraft deliveries 1998-2021. Web.

Salas, E. B. (2022b) Boeing — worldwide revenue 2007-2021. Web.

Segal, E. (2021) ‘Boeing faces new challenges to image, reputation and credibility’, Forbes. Web.

SkyNews (2022) Boeing’s share price slides following crash of 737-800 in China. Web.

Wang, J. (2021) ‘Company internationalization strategy evaluation-take Boeing as an example’, International Journal of Frontiers in Sociology, 3(17). Web.

Woo, A. et al. (2021) ‘An analysis of the competitive actions of Boeing and Airbus in the aerospace industry based on the competitive dynamics model’, Journal of Open Innovation: Technology, Market, and Complexity, 7(3), pp.1–18. Web.