Executive Summary

The report provides a comprehensive overview of Comme des Garçons’ marketing activities. The brand was established in 1969 by Rei Kawakubo and currently has headquarters in Tokyo and Paris. It is a luxury brand that regularly presents collections on the catwalk, yet is also highly appealing to streetwear lovers due to its original avant-garde style. Regardless of limited advertising, it has a large base of dedicated fans. It strives to create unique purchasing experiences for consumers by focusing heavily on the design of its stores. Moreover, Comme des Garçons actively collaborates with other fashion brands and artists, using this approach as a primary promotion tool. Overall, to foster future growth, it is recommended for the brand to digitalize its operations and strengthen its social media presence.

Background

The Comme des Garçons (CDG) label was created by a Japanese designer, Rei Kawakubo, in 1969. The company, with the same name, was then founded in 1973 (The Cut 2015). The brand is characterized by a “radical departure from fashion norms” and a unique “apocalyptic,” grotesque, avant-garde aesthetics (Sunnucks 2017, para. 1). A strong accent on the creative and artistic side of clothing differentiates Kawakubo’s work from others in the luxury fashion sector. The brand competes with such names in the world of fashion as Alexander McQueen and Yohji Yamamoto. One of the company’s main aims is to maximize positive purchasing experiences and produce extra value for its customers (Yuen 2017).

Current Performance

CDG experienced a significant profit growth of 30% in 2017 and is enjoying rapid global growth mainly triggered by high consumer demand. For instance, the brand’s CEO, Adrian Joffe, stated that they are continuing to expand into the Asian markets, including Singapore because the brand is particularly popular among local buyers (Yuen 2017). Significantly, new CDG locations usually emerge as part of the multi-retailer store, Dover Street Market (DSM), owned by Kawakubo (Yuen 2017). CDG currently has a presence in Tokyo, New York, London, Beijing, Singapore, and Los Angeles. In addition to this, the brand has independent outlets across many countries and works with retail distributors from different regions, including Europe, Africa, and the Middle East.

Target Market

Geographics

The brand’s style is more relevant to large urban areas with well-developed art scenes, nightlife, and other platforms for self-expression and where non-orthodox lifestyles are welcomed and accepted. The climate does not matter since CDG produces summer, winter, as well as midseason collections.

Demographics

CDG customers tend to range in age between 15 and 35 and are any gender. The brand is more oriented towards single individuals or socially and professionally active couples from the middle or upper class. In terms of occupation, the brand’s customer may be either a student or employed as a creative artist, designer, fashion journalist, or musician, for example.

Psychographics

A person buying from CDG has an active lifestyle, is focused on self-development, and values self-expression and creativity. They are open-minded, innovative, and are always willing to explore and try new things.

Behavior

The potential customer has divided brand loyalty and mixes CDG clothes with other similar brands, including Yohji Yamamoto, Rick Owens, and Vetements. They regard the purchase of a garment as an investment and do not come to a store frequently. They prefer visiting offline stores as they seek socialization, fulfillment of aesthetic needs, and so forth. They are technologically savvy and use social media as one of their primary communication tools.

Pen Portrait

- Age: 27

- Work: Illustrator

- Style: Creative and eccentric

- Favorite brands: Yohji Yamamoto and CDG

- Hobbies: Art collecting

- Leisure: Travelling / Partying

- Favorite Cities: New York and London

Competitors

Table 1: Summary of CDG and its main competitors’ features.

Macro-Environment Analysis

Table 2: PESTEL Analysis for Global Luxury Fashion Industry.

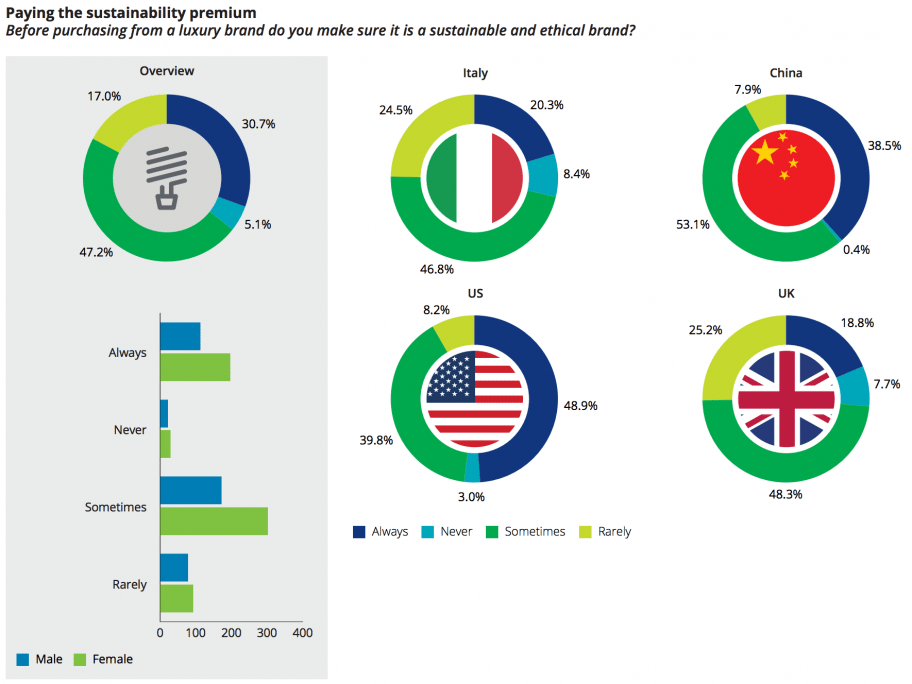

It is clear from this analysis that changes in the technological environment and consumer tastes are among the most influential in the industry. A significant percentage of people are now evaluating luxury brands in terms of ethics and sustainability (Figure 1) and, as this trend is expected to rise over time, brands considering these concerns will gain significant competitive advantages. Additionally, economic turbulences may considerably affect sales of CDG and close assessment of economic factors should thus drive its further international expansion decisions.

Micro-Environment Analysis

Table 3: SWOT Analysis for CDG.

Marketing Mix 7 P’s

Product

Currently, CDG offers a great variety of products produced under a plethora of sub-brands (Figure 5). At the primary stage of brand development, Kawakubo created clothes for strong, independent women. Later, she added basic items and male attire to her collections. When designing for men, Kawakubo pays attention to the originality of the cut and the overall look as well (Figure 3). Along with this, she creates experimental collections in which innovative materials, such as aluminum pipes and fabrics that glow in the dark, are utilized (The Cut 2015).

Moreover, the brand sells unisex fragrances with unconventional compositions, featuring notes of “burnt rubber, lettuce juice, and dust on a lightbulb” (The Cut 2015, para. 17), and offers a multitude of accessories, bags, wallets, cases, and other similar items. It is also worth noticing that CDG continuously collaborates with numerous brands working in distinct niches of the fashion industry from the mass market to luxury, sports, and streetwear (Figure 4).

Price

The pricing for different items and sub-brands varies significantly. For example, original avant-garde pieces (Figure 5) may cost within a range of a few thousand US dollars, while basic pieces (Figure 6) may cost around the US $300. Thus, the products are affordable to an extended group of consumers. It is also worth noticing that Black CDG was specifically created in response to the 2008 financial crisis and prices in that line are 60% of the main collections (The Cut 2015). Such an approach indicates that the company adjusts its marketing practices to environmental changes.

Place

Products are mainly sold through DSM stores and CDG boutiques. Additionally, the brand works with multi-retail stores to sell some of its items, including perfumes and accessories. Online sales are extremely low and limited to the PLAY collection. They are carried out through the DSM website where garments by other brands are also sold.

People

The brand’s founders emphasize the significance of customer experiences (Yuen 2017). However, users’ feedback regarding their experiences in DSM London on Facebook is controversial. Some customers praise the friendly and quick-responding staff, while others complain about employees’ negative attitudes and other problems, including delayed refunds and delivery of products ordered online (Dover Street Market 2019). It means that the company still has a lot to improve regarding customer service.

Processes

Production processes are mainly located in Japan, especially for the couture collections. Moreover, several items are sewn by hand to control the quality of clothes. At the same time, casual items are produced in other countries such as Turkey and Spain. While it is noted that the CDG senior managers often use their gut feeling to make strategic decisions and do not compose long-term business plans (Yuen), their approach to production is still very controlled and value-driven, which results in the avoidance of unnecessary waste.

Physical Evidence

The brand puts a lot of effort into designing the physical spaces of its outlets. For instance, DSM “is known for its innovative visual merchandising and in-store art installations” that are redesigned every second year (Lieber 2017, para. 27). Moreover, when it comes to CDG pop-up stores, they are designed even more creatively and freely than permanent locations and are turned into artworks (Figure 7). This approach helps to achieve positive impressions on visitors and increase customer satisfaction.

Promotion

Table 5: DRIP model.

Recommendations and Conclusion

The low levels of online activity, combined with highly visible negative feedback regarding customer services in the brand’s outlets, are the primary areas of concern for CDG, while digitalization and increased social media presence would certainly open up opportunities for attracting new consumers. Even though the brand aims to be unique, it could implement further innovation capacities to engage in online marketing more actively.

For instance, CDG can collaborate with artists to create digital art and, in this way, greater value will be added for the targeted consumer group. As for the issue of poor customer service, it seems that the organizational culture of CDG is insufficiently human-oriented. It is important to find the right balance between accessing the aesthetic side of the purchasing experience and improving the quality of human interactions in stores. Thus, more attention should be paid to the organization-wide culture and value of development activities.

Reference List

Comme des Garçons 2019. Web.

Dover Street Market 2019. Web.

Farfetch 2019, Farfetch UK Limited, London, UK. Web.

Gerlach, B 2016, ‘How Comme des Garçons changed retail with its pop-up stores’, FIB. Web.

Lieber, C 2017, ‘The vast, mysterious empire of Comme des Garçons’, Racked. Web.

Pratap, A 2018, ‘PESTEL/PESTLE analysis of the fashion retail industry’, Chestnotes. Web.

Shankman, S 2017, ‘5 Factors That Influence Millennials’ Luxury Spending Habits’, Skift. Web.

Sunnucks, J 2017, ‘Everything you need to know about Comme des Garçons’, Dazed. Web.

The Cut 2015, ‘The Comme des Garçons empire in chart form’, The Cut. Web.

Yuen, S 2017, ‘Comme des Garçons CEO: Others may like 5-year plans, but I don’t’, CNBC. Web.