Introduction

Home Depot and Lowe’s are American corporations selling various repair products. The companies occupy leading positions in the construction materials market in the USA, being direct competitors for each other. Both Home Depot and Lowe’s demonstrate high growth in revenue, EBITDA, and cash flows.

These organizations are similar in several financial indicators, and it is sometimes difficult to single out one of them as the best investment option. Nevertheless, Home Depot has the most significant potential compared to its opponent, and analysts predict positive results when supporting this business (Zettler, 2023). As an investor, I prefer to sponsor Home Depot instead of Lowe’s.

Analysis

As an investor, I would prefer to invest money in Home Depot. Home Depot’s net profit is primarily almost double that of Lowe’s (Saibil, 2023). Home Depot is gradually opening new stores and expanding its unique product range. Notably, the possibility of such development is associated with minimal risks since expected cash flows practically pay off the costs of building a new shop, meaning there are more sales for the company (Kumar et al., 2022).

Home Depot, as the most significant player in the segment, is well-positioned to increase market share due to purchasing prices and good offers, the commissioning of a new infrastructure that supports the development of online commerce, and the B2B direction. To see a clear difference in incomes, it is enough to look at the following relatively new cash flow indicators in Figures 1 and 2. It is becoming evident that Home Depot stands out, especially in terms of sales volume, compared to Lowe’s.

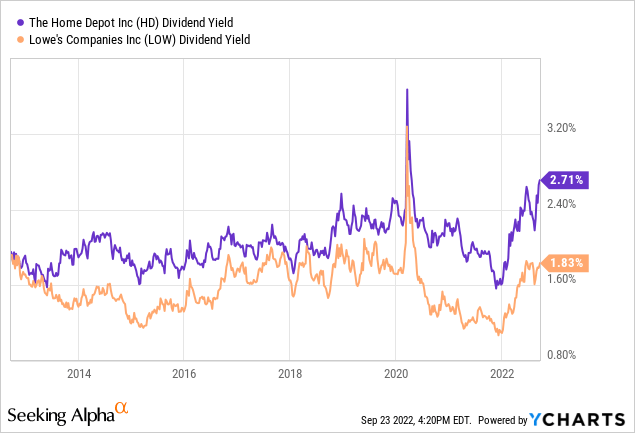

Home Depot mainly receives revenue from professional customers, who usually include electricians, plumbers, installers, technicians, and other representatives of professions engaged in home improvement (Patel, 2022). This is important because professionals visit such stores more often and spend more, while DIY buyers mainly visit local stores twice or thrice a year. However, the following investment valuation ratios chart (Figure 3) will show a significant difference between the companies’ revenues. Home Depot and Lowe’s have been raising their dividends for decades, but Lowe’s significantly higher forward yield is only associated with a 31% increase in dividends at the beginning of 2022 (Jessen, 2022). Home Depot is satisfied with high financial indicators, while Lowe’s continues to try to catch up with its competitor.

Home Depot shares reached historic highs at the beginning of 2022 on the wave of euphoria from the impressive business growth during the pandemic quarantines, then moved to decline on the market drawdown and the revaluation of the growth rates of retailers of household goods and repairs. Stocks can be an attractive investment to deepen the drawdown. In brief, Home Depot surpasses its competitors in terms of the number of retail outlets and goods sold. Moreover, Home Depot focuses more on selling home repair and construction tools to DIY buyers and professional repairers through retail chains and online stores. The firm additionally provides services for installing household goods and rents instruments and equipment. However, Home Depot’s marketing strategy has recently shifted toward the Internet.

Home Depot significantly benefits from implementing the “One Home Depot” investment plan, which aims to expand supply chain capabilities and transition to digital technologies. The firm actively supports its goals of accelerating growth, strengthening its position in the segment of inexpensive goods and services for homes, and providing exceptional shareholder value. Furthermore, over the years, Home Depot has created one of the fastest and most efficient delivery networks for home improvement with the help of BOPIS (“Buy Online, Pick Up in Store”) and online delivery from the stores, express delivery by car or van, and pick-up.

This company, unlike Lowe’s, is generally more tech-savvy and innovative. Usually, it finances omnichannel IT technologies and encourages consumers to shop online through some incentives (Luo et al., 2020). As one knows, after some external events like COVID-19, people began to shop online more, and this approach is considered an excellent option to increase the efficiency of the business. Home Depot generally strives to allocate resources to develop online and B2B directions, optimize the product route from a warehouse to a client, and improve customer experience, positively impacting the corporation’s market share in the fragmented market.

Conclusion

Summing up, choosing between Home Depot and Lowe’s, I prefer to invest my money in Home Depot as an investor. The comparative analysis of these companies demonstrated that Home Depot shows a higher return on sales and earns comparatively more, considering the many points across the country. Home Depot is continuously growing and developing, introducing new technologies and unusual solutions to meet the target audience’s needs, which allows it to reach a new level of sales management compared to Lowe’s. However, it should be recognized that I will not lose a large percentage of the invested funds by buying Lowe’s shares, but by supporting Home Depot, I will receive even more benefits.

References

Jessen, C. (2022). Home Depot vs. Lowe’s: Which stock would the dividend growth investors choose? Seeking Alpha. Web.

Kumar, A., Tiwari, R., & Alam, M. (2022). The application of real option theory in enterprise risk investment evaluation. Business, Management and Economics Engineering, 20(2), 1402-1413. Web.

Luo, X., Zhang, Y., Zeng, F., & Qu, Z. (2020). Complementarity and cannibalization of offline-to-online targeting: A field experiment on omnichannel commerce. Mis Quarterly, 44(2), 957-982. Web.

Patel, N. (2022). 1 critical advantage Home Depot has over Lowe’s. The Motley Fool. Web.

Saibil, J. (2023). Better buy: Home Depot vs. Lowe’s. The Motley Fool. Web.

Zettler, B. (2023). Lowe’s vs. Home Depot stock: Which is the better buy? Seeking Alpha. Web.