Introduction

The current assignment aims to complete cost analysis for laptops by different manufacturers. This product is chosen because it is an irreplaceable device in everyday life and the professional sphere. That is why customers obligatorily buy laptops, and people typically study the market to find suitable options. This fact makes manufacturers rely on innovation, cost-effective production strategies, and other solutions to provide customers with more attractive products.

In this assignment, Apple (MacBook) and Microsoft (Surface Laptop) will be compared because the former is a well-known leader in the sphere of electronic devices, while the latter underperforms because its laptops are less competitive. The internal and external analyses of the products and manufacturers will highlight the cost performance of Apple and Microsoft, which will result in a brief recommendation for the latter to strengthen its competitive position.

Comparative Analysis of Apple’s and Microsoft’s Products

Since it is necessary to evaluate these organizations’ competitive strengths, the comparison should rely on three specific metrics. Two of them, including revenue generated from the products and net margins, represent the internal analysis, while the external analysis refers to the focus on the products’ prices. There is a sound rationale behind selecting the given metrics.

It is reasonable to consider the product revenue because this indicator demonstrates how successful and attractive the given device is in the market. The net margin is a frequent measure of profitability, and this metric defines the amount of sales revenue that is left for the company after it covers its direct costs, interest, and taxes (Nariswari & Nugraha, 2020). As for the products’ prices, this indicator is informative because it compares the selected devices at the point, which can reveal the customers’ willingness to purchase them.

To make a comparison, I will need to collect the required data. Since the organizations are publicly traded companies, they publish various reports and reviews, and ordinary people can easily access them. For the purposes of this assignment, the annual review and 10-K report can be informative. In addition to that, I will find the necessary information from publicly available sources, including industry-specific websites and reputable articles.

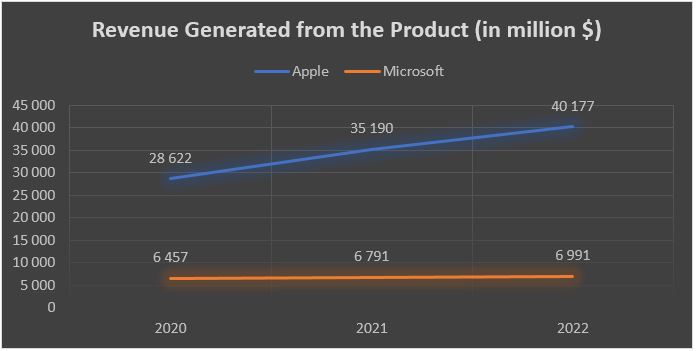

Now, it is reasonable to present the comparison itself and specifically created visuals will make this analysis more valuable. Thus, Figure 1 presents the trends over time and demonstrates that Apple’s MacBook is a more profitable device in the market. According to the organization’s 10-K Form, the product generated $40,177 million in 2022 (Apple, 2022). As for Microsoft’s Annual Review, this document fails to specify the company’s revenue from smaller segments. Figure 1 presents the money that the organization earned from selling all its devices (Microsoft, 2022). This resource additionally stipulated that Surface revenue increased by $226 million or 3% in 2022 (Microsoft, 2022). In any case, it is evident that MacBooks are a more profitable asset than Surface laptops.

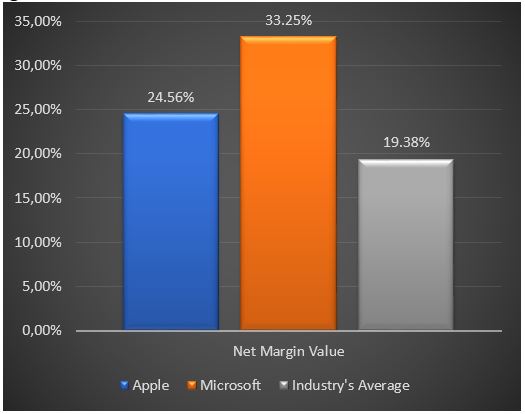

The net margin shows the percentage of money that the organization has after covering its costs. Figure 2 reveals that the two manufacturers impress with net margins that are higher than the industry’s average value. According to Macrotrends (2022a), Apple’s net margin is 24.56%, while Macrotrends (2022b) indicates that the metric of 33.25% refers to Microsoft. Since the industry’s average value is 19.38 as per the CSI Market (2022), the two companies have higher revenues after they cover their costs. According to this visual, Microsoft is in a more profitable position because it can use more financial resources to motivate its further growth.

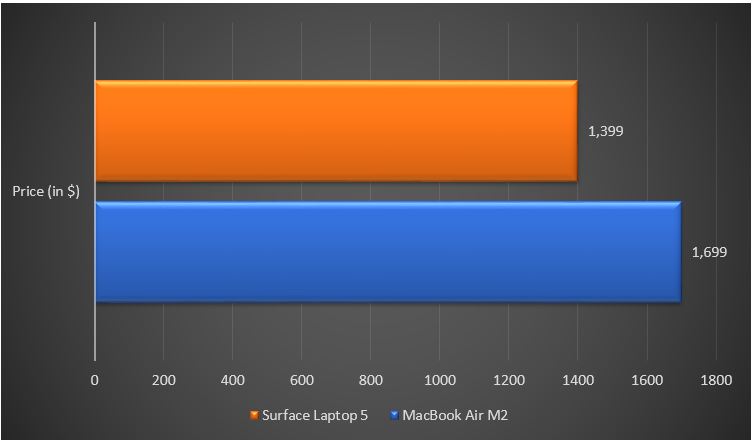

Furthermore, the current comparison focuses on the prices of the selected products. Moorhead (2023) offers a comprehensive analysis of the Apple MacBook Air M2 and Microsoft Surface Laptop 5, as these are among the most current devices by the manufacturers. According to the author, it is possible to purchase an Apple device for $1,699 (Moorhead, 2023). It is seen in Figure 3 that the Surface Laptop 5 is cheaper, but Moorhead (2023) clarifies that this price includes a $300 discount. This information demonstrates that Microsoft introduces additional incentives to motivate customers to purchase its devices. However, evidence from Figure 1 reveals that these efforts do not generate significant results because the organization does not witness significant sales growth.

Conclusion

According to the given analysis, it is evident that Microsoft has a competitive disadvantage because its Surface laptops are not popular in the market. That is why one should offer specific recommendations for operational improvement. First, Microsoft should take advantage of its higher net margin. This fact denotes that the organization has relatively much money after paying for its costs, interests, and taxes. A suitable suggestion is to invest a portion of these resources into research and development, innovation, and marketing. This step can help the organization equip its devices with new or better software and hardware, which will make the product more competitive.

Second, one should remember that Apple has a powerful and reputable brand image, which explains the high cost of its services and products. Since Microsoft does not occupy this niche in the electronic device market, it is not reasonable for the organization to set high prices. A suitable operational strategy is to focus on low-cost leadership. This suggestion stipulates that Microsoft can benefit from providing users with significantly cheaper products of decent quality to target a particular customer group.

References

Apple. (2022). Form 10-K [PDF document]. Web.

CSI Market. (2022). Computer hardware industry profitability. Web.

Marotrends. (2022a). Apple profit margin 2010-2022. Web.

Marotrends. (2022b). Microsoft profit margin 2010-2023. Web.

Microsoft. (2022). 2022 annual report. Web.

Moorhead, P. (2023). Microsoft Surface Laptop 5 versus Apple MacBook Air experience showdown. Forbes. Web.

Nariswari, T. N., & Nugraha, N. M. (2020). Profit growth: Impact of net profit margin, gross profit margin, and total assets turnover. International Journal of Finance & Banking Studies (2147-4486), 9(4), 87-96. Web.