Introduction

Corporate scandals have become the stories behind many a company’s downfall1 and Corporate governance reforms throughout the world were triggered by the scandals which rocked the corporate world (Yang, 2006, p.75).

Corporate crime in UK

On December 23rd, a few activists who were harassing and blackmailing the employees of the Huntingdon Life Sciences, their customers, shareholders and investors were found guilty of ‘conspiracy to blackmail’. They had used hoax bombs, letters with accusations of paedophilia as part of their extremism (Latest News, Corporate watch).

John Rusnal who was a trader in Wall Street joined Alfirst Bank in Baltimore, a subsidiary of Allied Irish Bank. He caused a loss of many hundreds of millions of dollars before he was discovered in 2002. A deficit of 691.2 million dollars was declared by Eugene Ludwig appointed by the Allied Irish Bank to get a thorough report (Leith, The Guardian).

The Maxwell Affair was a spectacular case of company failure and corporate abuse of power. Maxwell stole 727 million pounds from the two public companies which handled pension funds (Yang, 2006, p. 77). The main problem was discovered to be the lack of segregation of power. He was chief executive and chairman of Maxwell Communication Corporation. The second problem found was that the non-executive director did not perform any useful function. Similarly the audit function was not effective. White collar crime was increasing and there was insufficient corporate governance in place.

Definitions

White collar crime

The term white collar crime (WCC) was coined by Edwin Sutherland in 1939. He defined it as a “crime committed by a person of respectability and high social status in the course of his occupation” (Bookman, 2008, p. 355). “Price fixing, price gouging, deceptive advertising, fraud, unsafe products, food pollution, dangerous working conditions, environmental pollution; and on political crimes of bribery in purchasing of military goods and services, illegal usage of public funds, public property, graft of tax assessment and collection, bribery of officials who regulate commercial activities, election fraud, and domestic and international forms of violence” are the various corporate crimes that can occur (Wozniak, 2008, p. 195).

Corporate and occupational crime

Scholars have said that WCC includes corporate crime and occupational crime. Occupational crime is committed by individuals or small groups at their jobs (Bookman, 2008, p.355). Corporate crime is committed by an aggregate group of discrete people. When this corporate official commits violations of the law in the process of discharging his duties in the corporation, it is a corporate crime. If he receives any kickbacks it becomes an occupational crime. However when a crime is committed, it finally rests on some of the influential officials who manipulated the organization for personal benefits. Companies can be led astray by corrupt officials as evidenced by Enron (See Appendix A, p. 18). The Department of Justice in America has tried to draw up new laws on how to prosecute corporation and compile data on corporate crime (Bookman, 2008, p. 356). The efforts have produced the deferred and non prosecution agreements.

Deferred and Non-prosecution agreements

Corporate crime has one difference when compared to other types of crimes. It is never prosecuted. The most common variety is the accounting in the realm of securities (The editorial, 2005). Often prosecutors and corporate bodies ‘connive’ to avoid punishment. These are deferred or non-prosecution agreements. Deferred agreements allow the prosecutor to drop charges if the corporate body abides by the prosecutor’s promises. These agreements show a double standard for criminal justice.

The non and deferred prosecution agreements use three basic defenses. In the first, negotiations avoid prosecution. Corporations are in favor of this method as they can concentrate on detecting the exact personnel who are guilty of a crime. Prosecutors are also interested in exercising this power. This indirectly allows the company to break the law without facing criminal prosecution (The editorial, 2005). Prosecution is reserved for the individuals who cause the issue. The no-prosecute approach also lets go company shareholders and employees who may be innocent in the corporate crime.

Possibility of corporate crime towards the human capital

Issues with employees and occupational hazards if any may be prevented by providing appropriate training to the employees (See tables 1, 2 and 3 on pgs 14 and 15. Training in hazardous material requirements, homeland security issues and custom laws may be imparted (Barrett, 2006). Accurate records of compliance and training may be kept. Policies of the company should reflect what is happening. Drawing up operation manuals and identifying inspiring goals should be credible. Multinational corporate institutions have additional local issues to look out for. Issues of unhappiness among employees must be remedied with care to prevent any of them creating later problems of whistle blowing. This may lead to criminal investigations even if no crime was evident. General turmoil is sufficient to upset an organization (Barrett, 2006).

Instances of corporate crime

Securities fraud and insider tradings are very common as a result of the Sarbanes-Oxley Act coming into existence in US (Delinsky, 2006). Health care fraud is another area. Business-related fraud is the third area where misrepresentations and untruthful business-to-business dealings occur. Fourthly industrial espionage cases are found. These deal with the theft of intellectual property and the government is especially concerned with these.

Securities fraud prosecution is to examine whether the companies’ financial statements are true and they are reporting the financial condition truthfully. The government begins its investigation with the accounting department employees and then goes higher to the Chief Financial Officer and then to the head of the company (Delinsky, 2006).

Improper marketing of drugs and medicines to hospitals and physicians are the main fraudulent cases in the Health Care (Delinsky, 2006). The pharmaceutical companies do not look upon the kickbacks like free samples, sponsorship of educational seminars or donations given to doctors to motivate them to purchase certain medicines as violating Government laws. However the Government uses this point for prosecution. The definition of kickback is ambiguous (Delinsky, 2006).

The KPMG which was one of the America’s greatest auditors engaged in tax shelter fraud in massive proportions of 2.5 billion (Bookman, 2008, p. 347). However a fine of $456 million will help them escape even criminal proceedings for conviction (The editorial, 2005). The people who should rightly be brought to book are not punished. Corporate bodies in the course of making decisions scrutinize their accounts with extreme caution to calculate their costs and benefits.

Freddie Mac, a dealer in mortgage-backed securities, has huge accounting irregularities (Bookman, 2008, p. 347). The Enron implosion was the most dramatic of the corporate fraud cases. After this a task force was set up for detecting fraud and implementing successfully the existing legal infrastructure. Soon after, the Sarbanes-Oxley Act of 2002 was passed in the Congress. This act had many provisions for improving corporate governance (Bookman, 2008, p. 347). This along with the US Sentencing Guideline Amendments and the Department of Justice Principles of Federal Prosecution of Business Organisations aims to implement effective compliance and ethics programs (Imperato, 2005, p.11).

Measurements

Business is crime

Edwin Sutherland was the main American Sociological criminologist in the twentieth century (Bookman, 2008, p. 357). Data collection on corporate crime is one area which has not produced any results. How much corporate crime there is in America or the level of growth of corporate crime is not known. Sutherland tried to include the data from 200 corporate institutions over a period of 25 years (Bookman, 2008, p. 357). He found that nine-tenths of the companies broke some law in their daily business like advertising, trade, labor, patent and other issues. He believed that all business is crime. More recent research by Etzioni had said that 62% of the Fortune 500 companies over a nine year period were involved in corrupt practices like price-fixing, bribery and violations of environmental laws (Bookman, 2008, p 357). An in-depth study by Clinard showed that 45% of the corporations had been involved in wrongdoing.

Shocking statistics in the US & UK

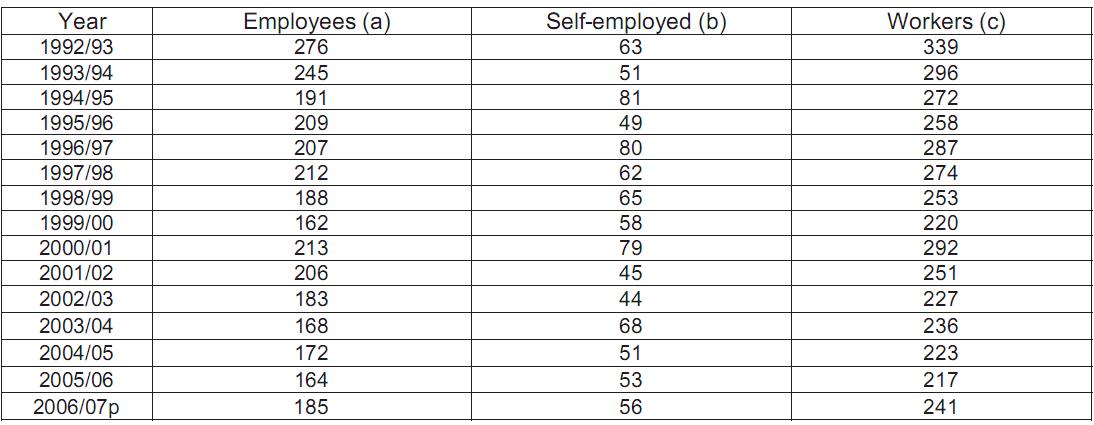

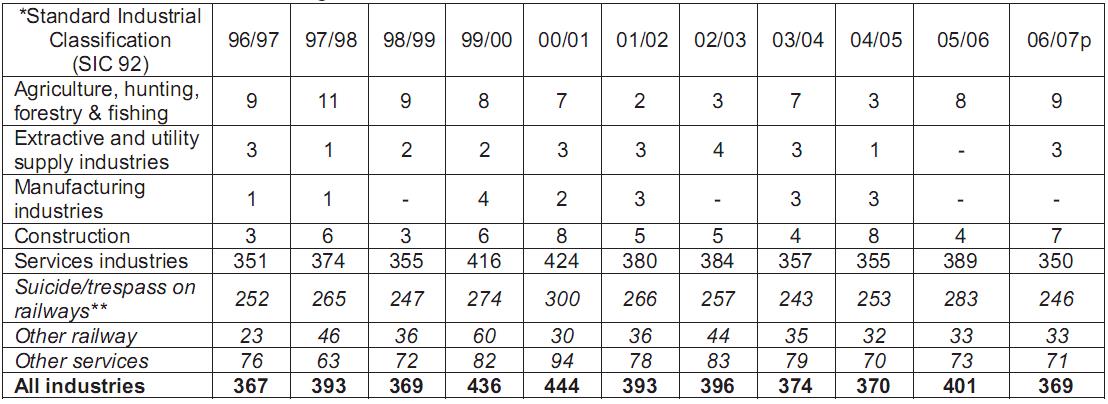

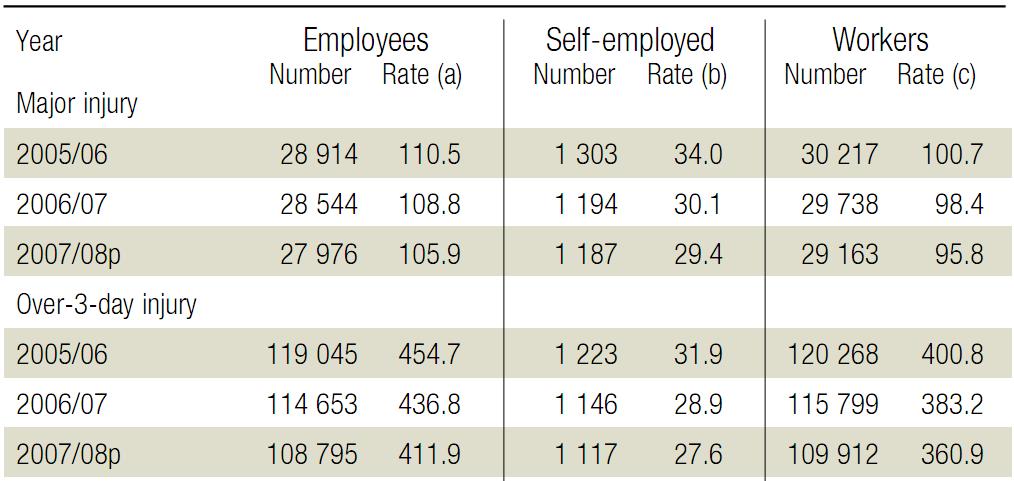

The police and the Home Office in the UK are responsible for recording and reproducing crime data, while Health and Safety Executive( HSE) is in charge of occupational safety data in which the data are collected under the Reporting of Injuries, Disease and Dangerous Occurrences Regulations 1995 (RIDDOR ,1995). Crimes are committed towards employees when they are exposed to preventable hazards in their occupation and they do not get compensation as they should. Table 1 on page 14 shows the number of fatal injuries suffered by employees in the course of duty for the years from 1992-1993 to 2006-2007 and numbers 9753 (HSE, UK Gov.). Table 2 on page 14 shows the number of injuries that affected the general public from the industries coming to 4312 numbers (HSE, UK Gov.). Table 3 on page 15 shows the major injuries numbering 89118 suffered by employees in two years of 2006-2008. 78% of the deaths and injuries at work are due to managerial and systematic faults in operations. Sufficient training of employees would help reduce their occupational hazards. Methods of reducing their exposure to dangers should be instituted to further reduce the number injured.

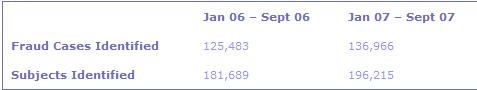

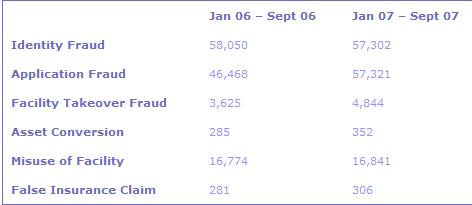

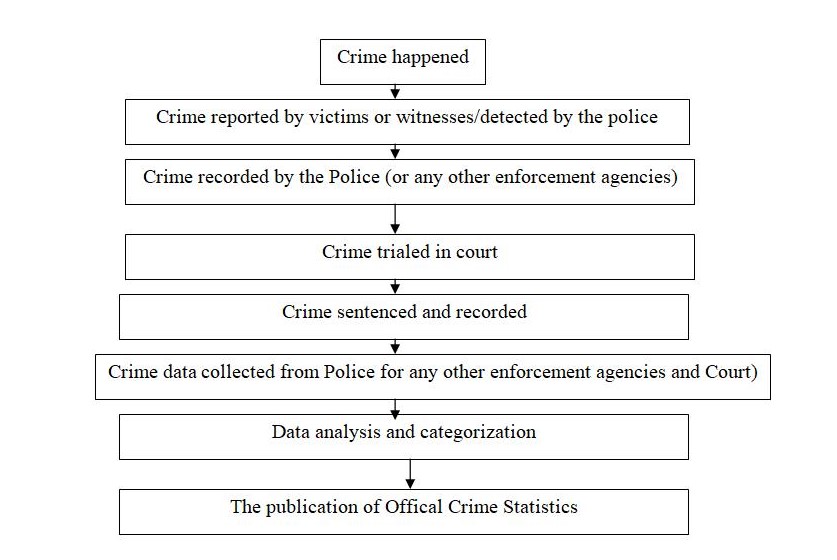

The annual estimated cost of WCC in US is $415 billion compared to the annual estimated cost of street crime, $13 millions2. The data shows the CC cost much higher than street crime in US. Table 4 on page 16 shows the number of fraud cases recorded by Home Office in UK. More than 120000 cases have been recorded in 2006-2007. Identity theft alone costs £1.7 billion annually and it can cost a victim of identity theft up to £8,000 and over 200 hours of their time to restore their reputation in extreme cases (Home Office Identity Fraud Steering Committee). The sequence of crime recording and statistics collections and publication is shown in the Diagram 1 on page 16 of this paper. However, the figures are all officially assigned ones which are affected at every stage cause unfaithful number.

How to improve data collection

The presently existing cases of fraud, forgery, counterfeiting, bribery and embezzlement must be first recorded. These data can be separated into corporate and personal lines (Bookman, 2008, p. 388). CC cost more than individual crimes. Reformulation of federal reporting guidelines may be necessary. The classification could include the nature of corporate crime. If it comes under economic crime, cyber crimes and property crimes could be smaller divisions. Fraud can be divided into “false pretenses/swindle/confidence games, credit card/ATM fraud, impersonation, welfare fraud and wire fraud” (Bookman, 2008, p. 389). Fixing corporate crimes should become easier and subjected to appropriate penalties. The different categories are best identified through a multi-agency committee process (Bookman, 2008, p. 389). Seriousness rankings is another possible classification. This hopefully would give a clearer picture of the scandals and whether there is a deeply ingrained problem with society itself (Bookman, 2008, p. 290). Federal law enforcement agencies could be guided to channel cases according to category and ranking. This could potentiate future legislation. Resources, prosecution decisions and organizational approaches would be duly influenced.

Theories

The Millsian theory

The Millsian perspective may explain the growing decline of ethics in corporate bodies (Wozniak, 2008, p.189). Wozniak believes that general sociology theories like “functionalist, symbolic interactionist, exchange, Marxist and feminist” could better explain white collar crime. C. Wright Mills believed that “every human being is shaped by the societal context in which he lives” (Wozniak, 2008, p. 191). Each body and mind is shaped by the society it comes to experience. Symbols like languages, gestures and objects determine how personality is developed. A sense of self is formed by learning to share the meanings of these symbols. By recurrent interactions, patterns of mutually oriented behaviors result. Social groups and organizations are involved with various roles (Wozniak, 2008, p. 192). Millsian theory involves the concept of institution. The five central social institutions of “political, economic, military, kinship (family) and religion”combined with education constitute the core social structure of society. Economy, military and the political order influence the other institutions of family, education and religion. The individual manages to fit himself in this unbalanced social structure. Different eras had different institutions dominating (Wozniak, 2008, p. 193). Crime occurs in the top level in society in relationship to the economic and political institutions (Wozniak, 2008, p.195). Mills believed that when institutions are corrupt, many of the people who live or work there would have similar practices. Criminal behavior, unethical practices and social harms can be traced back to the social environment the individuals have come from. Crime is to be viewed through a peacemaking criminology perspective (Wozniak, 2008, p. 200). Five levels of peacemaking are shown by the pyramid model of Hunter and Dantzker : social justice to bring about harmony, inclusion of both victim and offender in dispute resolution, correct means of attaining justice, ascertaining criteria to make justice understandable to all concerned and decisions or outcomes being based on moral reasoning universally applicable to all (Wozniak, 2008, p. 200).

Micro-level analysis

This theory takes into consideration the individual personality and characteristics of the executives of the corporate. The rank of the individual in the hierarchy, age, gender and ethnicity influences the tendency to commit crime. The higher the rank, the more willing to commit crime (Box, 1983, p. 38). Personality traits are important in the decision for crime. Career failure could be a motivation for crime.

Meso-level analysis

Organizational structure, its internal lines of decision-making, accountability and also its culture together determine the outcome of the corporate body finally. Sloppiness of management can occur at any level.

Rational choice theory

All above analysis can be explained by rational choice theory in which the offences made are “purposive”. It is unlikely that most individuals are in a position to calculate rationally the benefits and costs of offending. This is what Corporation, or their directors and managers, actually do. The existence of relatively weak regulations produces exactly the combination of factors that provides a fertile ground for criminality.

Business schools: the site of origin of corporate officials

Ethical standards are being taught in business schools. Do these lessons really change the students if they already nurse the tendency to cheat? Observers have ruled out this chance. Ethical standards are formed in early life under parental influence. It cannot be taught successfully in a business school (Pfeffer, 2007). Researchers like Don McCabe and Linda Trevino have shown that cheating has increased to shocking proportions in schools and colleges. Such incidents are hardly met with by forceful punishment and the involved students are usually let off with a warning. Pressure from peers, parents, schools and the highly competitive environment have probably triggered them into cheating with the notion that the end justifies the means (Pfeffer, 2007). The lax enforcement of the standard of ethics in schools has probably given rise to the evolution of corporate criminals.

Solutions

Corporate social responsibility

Corporate social responsibility is the framework to structure the responsible use of corporate power and social involvement (Turker, 2008). It shows the positive impacts of businesses on their stakeholders. The different corporate social activities have limitations. The legal dimension to this corporate social responsibility has been established in Turker’s study.

Risk assessment in the UK

G4 Security services have revealed that 75 % of the corporate companies are situated in the high risk areas (Sims, 2008). This highlights the importance of risk mapping when companies look for areas for setting up their headquarters. The risks were assessed for “violence, sexual offences, robbery, burglary, theft, fraud, criminal damage, crimes against property and drugs-related activities” (Sims, 2008). Terrorism is an added factor. The maximum risks were for the telecommunications, retail, general finance, tobacco and oils and gas production. Corporate establishments should take caution and select areas of low risk to start off. Appropriate measures to lessen the risk may also constitute the safety precautions in whichever site they are (Sims, 2008).

Corporate governance became a hot topic after the Maxwell case in the UK.

The policy makers first response came in the form of the Cadbury Report (Yang, 2006, p. 77). The board of directors, shareholders and the auditing were scrutinised. It was opined that the board of directors needed constant monitoring and assessment. The accounting and auditing were to be perfect and emphasise transparency. Focus was placed on the institutional investors as the largest and most infliential of the shareholders (Yang, 2006, p. 77). After the fall of the major bank of Barings (See Appendix C, p. 19), the Turnbull Committee studied the weakness of corporate governance structures. The strength of corporate governance needs to be ascertained and brought above board (Yang, 2006, p. 77).

The Corporate Manslaughter and Corporate Homicide Act 2007 in the UK is the current act dealing with corporate crimes which have come into force on 6th April 2008. The new statutory offence applies to crown bodies, partnerships and some other organization. Also, it has new tests to assess the guilt of the company which uncovers a serious management failure within the organization. However, although the government has introduced a new act to combat corporate crime, it is argued that crime cannot be completely destroyed because of its characteristics where we cannot easily define who should be prosecuted and who are the victims.

Generally, the penalties on the conviction of a corporation are divided into two categories: regulation & punishment (such as economic control) in which the current act favours punishment. Both penalties have advantages and disadvantages (See Appendix E, p. 20-21). In the case of Microsoft (New York Times, 2007) it shows that it is workable (Appendix B, p.18). However, for economic control, an organization may behave rationally and use cost-benefit analysis. Fines are seen by offence corporations as a ‘risk add-on cost’ as in the case of Exxon Corporation (see Appendix D, p. 19) (Slapper and Tombs, 1999). It is crucial to note that a small fine on a corporation is inefficient and may have no impact. However a large one might simply be passed on to the shareholder or customers, acting as an add-on cost, causing injustice. The current penalty is not comprehensive to tackling the CC in short term. Therefore we have the following strategies:

First level – the Public Influence

The government and legislatures have to ensure that their policies are attuned to public concerns, especially when there is a view that offenders are insufficiently punished and their behaviour is inadequately controlled. Under pressure from the media, the general public, trade unions and lobby groups for legal reform, New Labour made the gesture of bringing out a proposal, to assure public confidence and, more importantly, votes for the Party.

Proposed bills and government statements were made when an election loomed in the horizon. The recent re-regulation of corporate manslaughter (The Corporate Manslaughter and Corporate Homicide Act 2007) is further testimony to this. As a result, the first solution is we should draw more public attention to the corporate violence, put more pressure on the government and combat corporate crime. Once the election was over and the public’s trust and confidence gained, the Labour government toned down its stance against corporations in order to deal with another influential actor in the policy arena: business groups.

Second level -Business and Economy

For the business and economy, some socialist academics such as Slapper and Tombs, Box, and Carson suggest that much of the law and policy relating to safety enforcement is influenced by the interests of business and industry. And some other non-socialist scholars such as Clarke (1990), Gobert, and Punch (2003) also recognise that the representatives of business and industry are powerful actors in controlling the content of legislation due to their connections with Parliament, including their occupancy of seats in Parliament.

Another predominant factor in determining law and policy is the economy. Academics like Carson (1982), Box (1983) and Marx before them have illustrated how economic concerns override moral and public ones in legislation. Even the judiciary, Justice Stanwick for example, has recognised that economic considerations are important elements in determining the nature and extent of some legal duties (Slapper 1999).

Third level – Government’s Attitude

The importance of the economy in influencing legislation cannot be denied. However, another reason for the lack of strategy on dealing with corporate crime is the government’s attitude towards the crime of corporate violence. The government spent much time discussing and legislating the Crime and Security Act, Anti-terrorism Act and Police Reform Act 2002, which mostly relate to conventional crime and enforcement, while there was only one Act relating to the regulation of railways and transport. This suggests that the government is still unable to see the seriousness of corporate violence or treat it as a real crime that needs to be addressed by legislation immediately. Therefore, the final solution is to change the government attitude on corporate crime and pressure the parliament to discuss and fight against it seriously.

Appendix

Enron cases

According to Enron’s 2000 Annual Report (2000), the company mainly provided transportation and distribution; wholesale service: futures including natural gas, electricity, oil sales and risk management, and energy sources exploitation and investment; energy services including selling the products of natural gas, electricity, oil product and other sources of products; broadband services including developing, producing, and selling optical fiber broadband service, providing broadband relay station, and information transaction, company investment and others transfer investment services. The visions of Enron projected it as one of the huge companies in the world. In 2002, Enron finally became ‘popular’ since the company bankruptcy. At the end of 2002 it was revealed that its reported financial condition was sustained substantially by institutionalized, systematic and creatively planned accounting fraud.

Case of Microsoft

One notable example in effective punishment is Microsoft that yielded in the European antitrust fight (New York Times, 2007). Microsoft had to pay nearly 1 billion euros in fines since it defied the commission’s initial ruling of sharing technical information freely with other corporations. If not, it could face fines of up to 1.6 billion euros that began accumulating in December 2005 after Microsoft did not share technical information as freely as the European Commission had demanded. The fines forced Microsoft to open-source its technical information to prevent further monopolization. In the case, European regulators and some software groups in Europe hailed and greeted the deal as a breakthrough that should open the door for more free competition, especially in the market for the server software. Apart from large fines that Microsoft had to pay, adverse publicity that was published by most of the media, like New York Times, created a large informal social pressure that forced Microsoft to reveal its internal policy goal and procedure to share its technology on fair terms, so competing software companies could work smoothly.

Bank of Barings

Bank of Barings was once the oldest British merchant banks. In order to survive in the fierce competition in the financial sector, it recruited a number of young people including Nicholas Leeson. He was promoted very fast because of outstanding performance and became a representative in Singapore’s company. Afterwards, Leeson did false bank statements and confirmation letters for derivatives trading, unauthorized trading and risk-gambling, using customers’ account for covering lost trading money and avoid reputation damage. In February, 1995, he traded a large number of Nikiei futures and thought that the Japanese stock must rise, but unfortunately Japan’s stock market plummeted following the 1995 Kobe earthquake. On 26th February, Barings folded, with debts of $1.4 billion. Leeson escaped after the bankruptcy but finally was extradited to Singapore for a jail sentence for fraud of six and a half years.

Case of Exxon Valdez

In 1989, an oil tanker Exxon Valdez ran into a reef in Alaska and dumped 11 millions gallons of oil into the sea, with devastating consequences for wildlife, the environment, and the economy of coastal cities. The cause was attributed to the Exxon Corporation ignoring the drinking problem of the ship’s captain. The size of the tanker’s crew was reduced leaving them fatigued in order to save cost. In 1991, the corporation was found guilty in the criminal litigation. It paid USD between one hundred million to one billion as civil compensations and USD 5 millions to the affected people. Besides the serious impact of the crime, the point to observe is that the result didn’t generate any big negative impact to the operating profit and the stock of that corporation (Cohen, 1998).

Comparing the Strategies tackling corporate crime

Bibliography

Barkan, S. (1997) Criminology : A Sociological Understanding. Upper Saddle River, NJ

Bookman, Z. (2008). “Convergences and Omissions in Reporting Corporate and White Collar Crime”. De Paul Business and Commercial Law Journal., Vol 6. De Paul University College of Law, Pgs 347-392

Box, S. (1983), Power, Crime and Mystification, London: Tavistock

Carson, W. G. (1982), The Other Price of Britain’s Oil, Oxford: Martin Robertson

Clarke, M. (1990), Business Crime: Its nature and control, Cambridge: Polity

Delinsky, S.R. (2006). “White Collar Crime-An Overview”. in “The New Perils of White Collar Crime: Leading Lawyers on Mitigating Liability in a post Sarbanes-Oxley era” Aspatore Inc. HSE. “Statistics of Fatal Injuries 06-07”.

Imperato, G.L. (2005). “Corporate Crime, Responsibility, and Compliance and Governance”. Journal of Health Care Compliance, 2005, Aspen Publishers Inc.

Latest News, 2008. “State repression of the anti-corporate dissent” Corporate Watch.

Leith, W. (2002). “How to lose a billion”. 2002. The Guardian, Guardian News and Media Ltd.

Mokhiber, R. (2008). “20 things about corporate crime”. MultiNational Monitor, 2007. Corporate Accountability Research

New York Times (2007). “Microsoft is yielding in European Antitrust Fight”. 2007.

Pfeffer, J. (2007). “Stopping corporate misdeeds-How we teach the wrong lessons”.Chapter 28 of “What were they thinking? Unconventional wisdom about management”. Harvard Business Press,

RIDDOR (1995), Doing Criminological Research, London: SAGA Publications Slapper, G. and Tombs, S. (1999), Corporate Crime, London: Longman

Sims, B. (2008). “G4S report reveals UK corporate crime hot spots”. Info4Security

Stone, CH. D. (1975), Where the Law Ends, New York: Harper and Row

The editorial. (2005). Multinational Monitor, 2005.

Turker, D. (2008). “Measuring Corporate Social Responsibility: A Scale Development Study”. Journal of Business Ethics, 2008 DOI 10.1007/s10551-008-9780-6

Wiles, J. and Reyes, A. (2007). “ Computer forensics in today’s world” Chapter 1 in “The Best Damn Cybercrime and Digital Fornesics Book period” Syngress publishing.

Wozniak, J.F. (2009). “C. Wright Mills and higher immorality: implications for corporate crime, ethics, and peacemaking criminology”. Crime Law Soc Change (2009) 51:189–203 DOI 10.1007/s10611-008-9151-3 Published online: 2008

Springer Science + Business Media B.V. 2008

Yang, L. (2006). “Corporate Scandals and Corporate Governance Agenda”. US China Law Review, Vol 3, No. 4, Pgs 75-78

Footnotes

- Accounting frauds at Enron, Cendant, Health South and Informix form some of the biggest stories of the corporate world (Pfeffer, 2007). Backdating of stock option grants at Brocade Communications, Comverse Technology and Apple Computer gave rise to another variety of corporate crime. ImClone indulged in the trading of inside information. India-based Satyam Computers is the latest in the list of companies with accounting frauds. These frauds have accumulated over the past few years to a level where they had to be divulged to the management, stakeholders and its employees.

- The $415 is made up of losses from corporate crime ($200 billion); health care fraud ($70 billion); employee thief ($45 billion), and non-corporate tax evasion ( $100 billion) ( Barkan , 1997).