Based on the industry report by Gambardella (2020), credit card issuers, in this case, Chase Company, earn revenue from interest income, cardholder fees, and interchange fees. Some of the industry’s costs include purchases, marketing, rent, depreciation, and wages, among others. For instance, Chase generates income from the Sapphire brand through interests, fees, and interchange. Interests are charged on the balances in the cardholder’s accounts, and interest rates also determine how much the company would earn in that line (Grobert, 2016). Interchange fees are charged on every transaction a cardholder makes each day. The payments are significantly higher for premium cards, such as the Sapphire brand, and when used at luxurious shops.

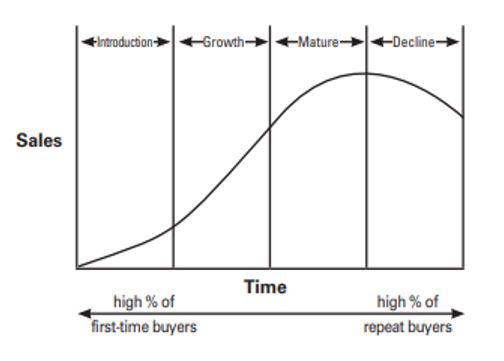

Product Lifecycle Stage

The credit card industry is at its maturity stage in the product lifecycle, subject to the outlook’s information. Hofstrand (2017) defines the phase as one in which the market has saturated (see Figure 1). At this moment, the production capacity meets the client demand as loyal customers continue to purchase products. The competition also stiffens, which prompts credit industry players to launch lucrative promotional and pricing programs to widen their market share. Due to competition, which leads to aggressive pricing programs, small profit margins are obtained as the products’ quality becomes standardized. In a saturated credit card industry, competition has stiffened between the companies targeting maximizing their revenue, such as Discover Financial Services, American Express Company, and Synchrony Financial.

Marketing Strategies

Companies are also devising ways of attracting more customers through perks and services. For example, cardholders get sign-up bonuses, airport lounge membership, dinning and travel points, and security programs among other exciting benefits of the Sapphire Reserve card. Chase also has an effective reward program for its regular customers, unlike its competitors. These plans help to attract more prospective purchasers, hence boosting sales volume. At the time of launching Sapphire Preferred, Chase competitors such as American Express did not offer satisfactory rewards. For example, with the Platinum card a customer could get one point per dollar on non-travel purchases. Therefore, the Chase launched a robust reward program for its customers on each purchase made.

Sapphire Brand Features

One of the Sapphire Preferred card features is its comparatively lower annual fee of $90. Other competitors such as American Express and Citibank charge a yearly charge fee of about $450. This makes some customers choose to apply for the Preferred card due to its affordability. Although the Sapphire Reserve card introduced in 2016 charges $450 as an annual fee like competitors such as American Express, it comes with a set of attractive benefits. The perks include redeemable 100,000 points for signing up, triple dinner and travel points, airport lounge memberships, and credits that can offset the $450 annual fee (Grobert, 2016). It is noteworthy that Chase’s major competitor does not offer most of these benefits to its customers.

Market Dynamics

Although the Sapphire brand was introduced when other elite companies had already launched premium cards, they attracted high fees but no value for money. These cards could not inspire the millennials’ interest since they provided no additional benefits to the young generation. Therefore, the existing premium cards were often used by older customers. When Chase introduced their brand, they targeted to offer value for the money charged as a fee to cater to the younger generation. The Sapphire Reserve card came with a 100,000 points sign-up bonus, travel and dinner credits, club lounge access, among other treats. Furthermore, the company launched a robust reward program for its customers on each purchase made. Indeed, the card became popular among the youth.

Service Extension and Target Expansion of Sapphire Preferred

The Sapphire card offered double points in travel and dinning, and allowed holders to transfer their points to other flier programs such as preferred club lounges. The medium fee and great points made the card more popular, especially among the young and working generation. The semi-metallic Preferred card, which consists of a chip, holder’s name, and branding on the front and card number at the back, was remarkably better than ordinary plastic cards. Because of the qualities, the company made huge sales on the card. In 2016 when they opted to produce the Reserve card, they chose to replicate the Preferred card features based on design, bonus, and fee amounts, objectively to make big sales.

Consumer Adoption and Diffusion of the Sapphire Brand

The early adopter in the Sapphire Reserve adoption was the young working class of individuals who found the card to be of higher quality compared to generic plastic cards. This card would later become part of their lifestyle and a preferred means of payment (Grobert, 2016). Regarding the terms and conditions, this category had a high opinion of the card and adopted it faster than the early majority (Dedehayir et al., 2017). In this scenario, the early majority is represented by the older customers and cardholders who take a significant amount of time to switch to apply for the Reserve card (Dedehayir et al., 2017). Preferred cardholders choose to spend time learning about the new product before deciding to adopt it.

References

Dedehayir, O., Ortt, R. J., Riverola, C., & Miralles, F. (2017). Innovators and early adopters in the diffusion of innovations: A literature review. International Journal of Innovation Management, 21(8), 1-21. Web.

Gambardella, A. (2020). Credit card issuing in the US. S Industry Expert Summaries.

Grobert, S. (2016). How chase made the perfect high for credit card junkies.

Hofstrand, D. (2017). Product life cycle. Iowa State University Extension and Outreach.