Executive Summary

This paper discusses vital components and processes of a risk management structure. The processes are designed for the purpose of helping companies identify and evaluate their susceptibility, enhance their resilience against threats, and augment their ability to resume operations after a man-made, technological, or natural event. This discussion features an organization called Winsome that requires a risk management system to tackle its current and future threats. A brief discussion of risk culture provides the basis for the proceeding section that evaluates Windsome’s existing and potential future threats. The following section exemplifies corporate social responsibility (CSR) approaches to help mitigate some of Windsome’s threats. Then, the investigation goes on to discuss business continuity methods in the context of the company’s risk management. Lastly, the exploration provides a summarized demonstration of how to implement the suggested observations in Windsome’s corporate strategy to ultimately enhance the company’s future response to threats.

Introduction

Hillson and Murray-Webster (2017) identify business risks as key contributors to financial crisis and the subsequent collapse of organisations. The concept of risk culture is shared across industries as it enterprises to develop risk management strategies to mitigate the negative impacts of humans’ decisions that oversee the daily activities of every company. Winsome, an Aberdeen based company, currently faces culture-related risk as a result of decisions made by the managing director. The director has invested heavily by increasing stock and storage, which has led to damaging the company’s reputation. The managing director’s decision to invest heavily for the future has resulted in a list of problems.

In the first section, this paper describes the concept of risk culture to make it comprehensible and relevant to the overall investigation. The subsequent section will discuss the current and future risks faced by the organisation in question. The third section of the paper will evaluate the risk management model currently used by Winsome to identify and mitigate the risks. The fourth section will evaluate the approach towards corporate social responsibility and ethics, while the fifth section will examine the company’s method of ensuring business continuity, taking into account the corporate strategy. Finally, the paper will present a summary plan detailing how the recommendations can be implemented to improve the overall risk management structure.

Risk Culture Perspective

Risk culture is defined as “the individual and group behavioural norms within a company that governs the cooperative effort to identify and comprehend, openly engage in a discussion regarding the current and future risks and engage in actionable efforts to mitigate the risks” (Hopkinson 2017, p. 140). It is necessary for organisations to have a clear and holistic comprehension of risk culture to avoid the traditional tackling of risks with narrow structural methods such as deferring bonus payments.

The global economy is yet to recover from the 2008-2009 financial crises, and due to this reason, many organisations are keen to survive the changing business environment by stemming cost and stabilising the revenue base. Where mitigating risk is a priority, an organisation focuses on enhancing the existing risk management structure instead of dealing with the underlying corporate culture. As such, a successful risk culture model has to prioritise the meaningful interactions within a business, including relationships between groups of people working in teams, along with relations at the strategic level, involving senior supervision and strategic decision-making procedures (Bromiley et al. 2015).

Identification of Current and Future Risks

Current Risks

To begin with, the company currently faces a two folded type of risk that includes customer risk and reputation risk. Winsome is described as failing to meet the needs and desires of its customers simply because the managing director decided to increase stock and storage. This strategic decision leads to an overall increase in expenditure, leaving the company with little or no money to meet its financial obligation to its long-term clients. As a result, the clients opt to stop current projects and terminate the contracts all the same. Cancellation by major clients triggers a stir in the overall industry, causing other firms to question Windsome’s credibility. This negative impact on customer relationship results in the tainting of the organisation’s reputation.

Secondly, the company struggles with the issue of asset risk, which comes to light when a report of theft and criminal damage at the company’s storage facility in Aberdeen surfaces. This incidence is directly linked to the company’s inability to meet its financial obligations. Loss of major clients leads to a decline in returns and the subsequent lack of funds to cater for the security needs of the storage facilities.

Finally, staff morale is significantly low largely due to the company’s lack of inadequate finances. Employee risk hence becomes an issue as depicted in the lessening of productivity and negligence to report “near miss” incidents. Winsome operates in a high-risk industry, and incidence reporting is crucial to helping the company avoid accidental incidences and legal liability. Uncertainty about a company’s future results causes low morale, which makes it difficult to retain key employees and attract new talent (Teece, Peteraf, & Leih 2016). In this regard, Winsome may lose its most important employees.

Future Risks

Winsome’s future also lies in the balance due to a number of risks. As stated in the case, the company has landed a major deal that entails offshore drilling in Western Australia. Off-shore drilling is a highly political undertaking that can be affected by legislation and political reform. The fact that Winsome has to relocate to a new setting introduces a regulatory risk. Off-shore drilling is a highly regulated operation owing to the financial, environmental, and health effects of hydrocarbons. For example, the 2010 catastrophe in the Gulf of Mexico shows that oil drilling is a risky and messy business (Grayson 2019). Winsome has to adapt to this situation by adhering to the regulatory requirements and lowering cost at the same time.

Next, Winsome will inevitably encounter operational risks while taking part in an offshore drilling exercise. Events such as blackouts and natural disasters could have appalling effects on operations. There may be a compromise on the day to day operations, both at the headquarters and drilling site. While an organisation cannot foresee when a calamitous event will transpire, management can try and prepare for one. Winsome’s operations also carry risks in areas such as compliance with Australian laws and regulations and currency fluctuations, tariffs, or taxes. Fluctuations in any of these categories could adversely affect daily operations.

As a final point, Winsome may face value chain risk. The supply chain plays a fundamental role in ascertaining the success and operational efficacy of a company that strives to create value and maximise wealth for its shareholders (Prajogo, Oke, & Olhager 2016). The case describes Winsome as having a large amount of high-quality equipment in storage. However, offshore drilling is a cumbersome process that will need a considerable amount of resources. Winsome will have to rely on a few external suppliers who pose a high risk of failing to meet supply obligations, ultimately hindering operations at the rig.

Managing the Risks

Winsome has to satisfy the needs and desires of its clients, which will more than likely change on a regular basis in the future. Monitoring changes such as tastes, demands, and habits gives organisations a forecasting edge when buying inventory (Cetin, Demirciftci, & Bilgihan 2016). This action allows the company to avoid surplus inventory. Geographical location and market share are crucial to the success of Winsome considering that clients rely on the company to provide the right tools and equipment whenever needed. Roy et al. (2018) explain that customer convenience is a significant factor in identifying how consumers make decisions regarding what to purchase, whom to engage, and what services to utilise. Understanding a customer’s preference for convenient services and goods has a significant effect on purchasing decisions (Kaura, Darga, & Sharma 2015). Developing relevant customer technology such as phone applications and e-commerce websites is critical to helping Winsome compete and ensure that it can provide convenience to its clients. The data collected from the technology provides useful info to determine customer needs.

The fact that the organisation has managed to survive thus far while a competitor has recently gone into liquidation means that Winsome has superior locations. However, the company currently faces financial problems meaning that it will have to shut down some of the storage facilities in certain countries with low business and further sell some of the excess inventory. This move will reduce the company’s overall costs and raise capital to set up a base in Perth, Western Australia. Investing in IT technology will help effectively manage the remaining inventory and enhance security at the storage facilities.

Management needs to take the necessary steps towards dealing with the problem of employee risk. The company currently has an incentive program, which should be appraised to make sure it remains competitive. Organisations ought to provide employees with information relating to strategies to help the company survive the current turmoil (Mcllwraith 2016). Winsome can educate its employees about the existing preventive practices and further expose how those plans will be executed. This necessitates endorsement of a training exercise and alteration of management to bridge the communication gap between executive and staff.

In dealing with regulatory risks, Winsome has to consider partnering. A partnering strategy allows a company to spread risk through attaining on-time performance, increasing efficiency and quality, preventing disputes, and obtaining a fair return on investment (Børve et al., 2017). The strategy of partnering with the government, NGOs, the local community, and other companies will give Winsome the leverage to deal with regulatory risks, particularly those pertaining to environmental regulation.

Partnering will also help Winsome tackle the impending operational threat in terms of spreading the risk. Also, Winsome can prepare for unpredictable calamities by preparing a draft of plans detailing how vital departments will function should such occurrences take place. Resources ought to be dedicated to the continuous monitoring of trends so the company can have plans to prepare and confront challenges as they occur. Organisations ought to examine the aptitude of their partners and suppliers to tackle risks associated with their ability to deliver (Trkman, Oliveira, & McCormack 2016). Additionally, organisations ought to identify a pull of substitute suppliers to take over in the event of early termination by an existing supplier (Ho et al., 2015). Such an approach can prove beneficial for Winsome.

Approach to Corporate Social Responsibility and Ethics

Corporate social responsibility (CSR) is a business’s response to environmental, social, ethical, and economic issues (Crowther & Seifi 2018). As such, positive actions that mitigate the negative effects of a company provide an opportunity for risk management. In order to protect Windsome’s reputation, the company has to come to terms with the perceptions and influences that determine reputation. Hence, establishing a productive operational relationship with external stakeholders becomes a priority in CSR programs (Lins, Servaes, & Tamayo 2017). The company operates in a high-risk industry, and for this reason, it is crucial to devote time and energy towards stakeholder engagement as a fundamental constituent of risk management. For instance, urban freight transport companies in the U.S employ transparent, compliant, and systematic methods to stakeholder engagement (Marcucci et al., 2017).

Also, developing productive relationships with the local community plays a fundamental role in avoiding conflict with locals (Cooper 2017). Investing in biodiversity and environmental protection programs provides Winsome with the benefit of protecting sensitive habitats and building goodwill with the host country. Similarly, there is the option of investing in the development of a healthy and skilled local workforce through sponsoring educational programs for local communities and building local infrastructure. Considering the stringent requirements imposed on companies by host governments, training locals seems a viable approach (Supanti, Butcher & Fredline 2015). Nonetheless, workers are likely to strive for safe and healthy work areas. Finally, Winsome has the option to invest in enhancing governmental transparency and further commit resources to security and human rights.

In the absence of government regulation, companies pledge to uphold global environmental principles such as the ISO 14000 environmental management system (EMS) (Kirton & Trebilock 2017). An environmental performance survey by the World Bank found widespread adoption and adherence to EMSs to supplement government regulations (Spence 2011). In regard to human rights and workplace safety, Winsome should comply with the International Labor Organisation’s (ILO) standards. ILO exists to promote the interests and rights of workers in the absence of government regulation (Epstein 2018).

Business Continuity in the Context of Strategy

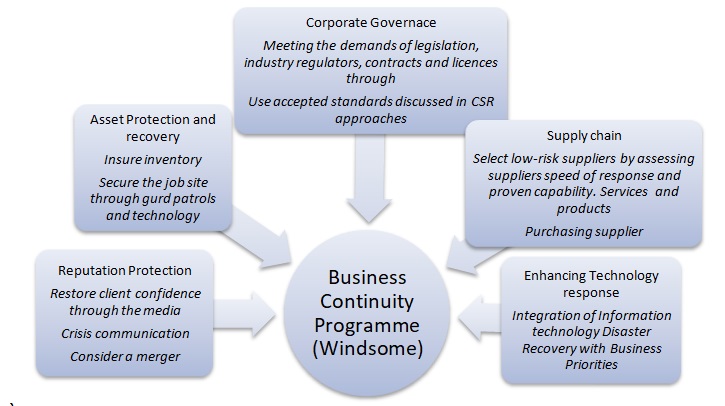

Business Continuity Management (BCM) plays a fundamental role in an organisation’s risk management program. BCM is a means by which companies design, create, implement and preserve response and recovery procedures that are critical to keeping an organisational operational (Graham & Kaye 2015). From this perspective, a BCM strategic approach is implemented when a risk materialises.

Crisis communication is pivotal to protecting a company’s reputation as it allows for the conveying of information following an emergency (Frandsen & Johansen 2016). Precise and relevant information is crucial for organisations to maintain credibility and trust for customers, employees, and vendors. Winsome currently struggles with employee risk taking into account that staff morale and overall productivity have considerably reduced. Crisis communication is essential to communicating to both employees and clients to restore confidence and ensure that accurate information gets conveyed before and after interference, reducing problems caused by misleading and untimely communications (Kruis & Keller 2018). Hence, crisis communication plays an important role in helping Winsome uphold its good reputation and provide practical information to employees in regards to when and where the company will be open for business.

Also, Winsome has suffered damage to its reputation. It is a well-known fact that reputational damage can quickly bring down the mightiest of corporates. Developments like the 24/7 news cycle and social media allow news to reach all corners of the earth within minutes. Winsome is currently struggling with reputation risk, which raises concern on how the company can salvage its name. A solution to this problem, as identified in the BCM model above, entails using the global appetite for media and developing positive messages about the company. Before taking such an approach, the company would have to consider merging with another organisation in the same industry, then rebrand and make use of the media to salvage its image. After merging with a different organisation, the company would also have to fulfil its pending obligations to its clients, given that a merger provides an opportunity to solve the current financial problems. Moreover, communication plays a critical role in the entire reputation recovery process.

Windsome’s problem of asset risk revolves around the recent theft and damage incidence report at the Aberdeen storage facility. Going forward, asset protection and recovery measures will help the company recover from such an incidence in the future. Securing the facility using a combination of two options including; security guards to patrol the premises and technology solutions such as real-time exception alerts and map visualisations to help recover stolen assets. Branding assets with serial number and insuring them further helps in recovery.

Corporate governance has grown popular in the U.S and the U.K as legislations, external standards, and regulations require companies to show proof of compliance to external auditors (Graham & Kaye 2015). In the business continuity context, corporate governance does more than just protecting shareholder interests. Windsome faces future regulatory risks because it plans to set up in Western Australia having landed a new deal. In the event that a regulatory risk materialises, corporate governance mechanisms aimed at sustainable business continuity, will help the business emerge from the threat. In addition, the CSR approaches analysed in the previous section of these papers will play a critical role in emerging from a regulatory risk.

Information Technology Disaster Recovery (ITDR) is at the core of business continuity in matters pertaining to operations risk. Recovering from an operational disaster requires a backup plan in case of data loss caused by a hardware failure, malware, or hacking. Enhancing Windsome’s technology response and restoring of vital data will help recover vital information after natural tragedy such as tsunami or manmade disaster such as blackouts.

There is a growing awareness about the supply chain’s vulnerability to disaster-caused interruptions and that supply chain continuity plays a pivotal role to the all-inclusive enterprise-wide business continuity (Scholten & Schilder 2015). The primary objective of continuity in the supply chain requires keeping the business operational amidst threats. For instance, Windsome’s suppliers may fall victim to man-made or natural disasters. Supply chain continuity requires Windsome to partner with suppliers and helping them develop and execute risk mitigating measures. However, this approach necessitates the selection of capable suppliers with the financial resources to hastily recover from a disaster. Under certain circumstances, acquiring suppliers and taking over their operations may become necessary to ensure business continuity for Windsome.

Summary Plan of Implementation

Information gathering – All stakeholders ranging from company executives, management, staff and external stakeholders such as clients have the right to know about an existing or imminent risk. As such, gathering accurate facts about a particular risk means that all stakeholders receive accurate information about a situation. In the asset protection and recovery approach, business continuity requires gathering accurate info from the theft incidence at the Aberdeen storage facility. Company executives would then use this information to make accurate decisions regarding whether or not to enhance security at the site. Information gathering is thereby necessary to stakeholders because it prepares psychologically, in the eventuality of a risky occurrence. Windsome has to salvage its reputation for business continuity reasons, and doing so will require gathering enough info for both internal and external stakeholders.

Establish communication channel – Establishment of an appropriate channel of communication allows all stakeholders to know when to act, and in doing so, pursue the right course of action. In the Windsome case, an efficient communication channel allows the company to regularly communicate with clients and employees, to restore confidence. For example, in the eventuality of a supply risk occurrence, an efficient channel of communication allows for business continuity by facilitating smooth communication between the supplier and the organisation to mitigate or recover from the risk at hand.

Training – Implementing a business continuity strategy is an impossible task without the presence of a trained staff. Windsome failed in its efforts to manage the risk of losing its employees because it had not previously trained its employees on how to react to financially risky situations. Employees need to undergo thorough training to help them understand that risk is an inescapable aspect, faced by all organisations. Similarly, for the case of a company emerging from an operational risk, integrating disaster recovery technology with business priorities, cannot work without having a trained staff to implement the methodology.

Monitoring and evaluation – Business continuity management integrates almost all departments within an organisation as well as company executives and external stakeholders. Successful implementation of such a rigor process needs constant monitoring, lest the company finds itself facing a new set of risks. An oil and gas company may fall victim to an environmental risk pertaining to a spillage, while still dealing with the aftermath of a Tsunami. The board of directors can endorse the setting up of a special team to evaluate and keep a close eye on the progress of a continuity program.

Conclusion

When a company fails to deliver terms as per the contract, consequences can be dire. All organisations, just like Windsome, face potential disaster when they fail to prepare. By having the close intertwinement of risk management, CSR approach, and the business continuity plan, Windsome is able to pinpoint and actively pursue new growth opportunities. Identifying the risks is critical to helping Windsome develop strategies to manage the current and future risks. CSR on the other hand offers the company the chance to adopt environmentally, and socially sound methods of dealing with risk. Finally, the business continuity plan offers the organization a way of moving past existing risk and setting up measures to avoid similar threats in future.

Reference List

Børve, S, Ahola, T, Andersen, B & Aarseth, W 2017, ‘Partnering in offshore drilling projects’, International Journal of Managing Projects in Business, vol. 10, No. 1, pp. 84-108.

Bromiley, P, McShane, M, Nair, A & Rustambekov, E 2015, ‘Enterprise risk management: Review, critique, and research directions’, Long range planning, vol. 48, No. 4, pp. 265-276.

Cetin, G, Demirciftci, T & Bilgihan, A 2016, ‘Meeting revenue management challenges: Knowledge, skills and abilities’, International Journal of Hospitality Management, vol. 57, pp. 132-142.

Crowther, D & Seifi, S 2018. Redefining Corporate Social Responsibility, Emerald Group Publishing, London.

Cooper, S 2017, Corporate social performance: A stakeholder approach, Routledge, London.

Epstein, M 2018, Making sustainability work: Best practices in managing and measuring corporate social, environmental and economic impacts, Routledge, London

Frandsen, F & Johansen, W 2016, Organizational crisis communication: A multivocal approach, Sage, Los Angeles.

Grayson, D 2019, ‘Beyond BP: The Gulf of Mexico Deepwater Horizon Disaster 2010’, Managing Sustainable Business, Springer, Dordrecht, pp. 21-33.

Graham, J & Kaye, D 2015, A Risk Management Approach to Business Continuity: Aligning Business Continuity and Corporate Governance, Rothstein Publishing, Brookfield.

Hillson, D & Murray-Webster, R 2017, Understanding and managing risk attitude, Routledge, London.

Hopkinson, M 2017, The project risk maturity model: Measuring and improving risk management capability, Routledge, London.

Ho, W, Zheng, T, Yildiz, H & Talluri, S 2015, ‘Supply chain risk management: a literature review’,International Journal of Production Research, vol. 53, No. 16, pp. 5031-5069.

Kaura, V, Durga, C & Sharma, S 2015, ‘Service quality, service convenience, price and fairness, customer loyalty, and the mediating role of customer satisfaction’, International Journal of Bank Marketing, vol. 33, no. 4, pp. 404-422.

Kirton, J & Trebilcock, M 2017, Hard choices, soft law: Voluntary standards in global trade, environment and social governance, Routledge, London.

Kruis, A & Sneller, L 2018, ‘Business Continuity Management put to the test: a drama in two acts’, Journal of Information Technology Teaching Cases, vol. 8, no. 1, pp. 24-28.

Lins, K, Servaes, H &Tamayo, A 2017, ‘Social capital, trust, and firm performance: The value of corporate social responsibility during the financial crises’, The Journal of Finance, vol. 72, no. 4, pp. 1785-1824.

Marcucci, E, Le Pira, M, Gatta, V, Inturri, G, Ignaccolo, M & Pluchino, A 2017, ‘simulating participatory urban freight transport policy-making: Accounting for heterogeneous stakeholders’ preferences and interaction effects’, Transportation Research Part E: Logistics and Transportation Review, vol. 103, pp. 69-86.

McIlwraith, A 2016, Information security and employee behavior: how to reduce risk through employee education, training and awareness, Routledge, London.

Prajogo, D, Oke, A & Olhager, J 2016, ‘Supply chain processes: Linking supply logistics integration, supply performance, lean processes and competitive performance’, International Journal of Operations & Production Management, vol. 36, no. 2, pp. 220-238.

Roy, S, Shekhar, V, Lassar, W & Chen, T 2018, ‘Customer engagement behaviors: The role of service convenience, fairness and quality’, Journal of Retailing and Consumer Services, vol. 44, pp. 293-304.

Scholten, K & Schilder, S 2015, ‘The role of collaboration in supply chain resilience’, Supply Chain Management: An International Journal, vol. 20, no. 4, pp. 471-484.

Spence, D 2011, ‘Corporate social responsibility in the oil and gas industry: The importance of reputational risk, Chicago-Kent Law Review, vol. 86, p. 59.

Supanti, D Butcher, K & Fredline, L 2015, ‘Enhancing the employer-employee relationship through corporate social responsibility (CSR) engagement’, International Journal of Contemporary Hospitality Management, vol. 27, no. 7, pp. 1479-1498.

Teece, D, Peteraf, M & Leih, S 2016, ‘Dynamic capabilities and organizational agility: Risk, uncertainty, and strategy in the innovation economy’, California Management Review, vol. 58, no. 4, pp. 13-35.

Trkman, P, Oliveira, MPVD & McCormack, K 2016. Value-oriented supply chain risk management: you get what you expect. Industrial Management & Data Systems, vol. 116, no. 5, pp. 1061-1083.