Introduction

Tesla Company was set up in 2003 by engineers whose focus was to prove the efficiency of electric cars compared to fossil fuel vehicles. Currently, the company has diversified its activities into various sectors, such as creating green energy generation programs such as solar cells and solar panels and building energy storage products. It believes that it is important for the global community to end the usage of fossil fuels and sort for green energy as they are environmentally friendly. Vehicles from the company’s largest sector and are manufactured in its main factory in California. Additionally, it is where most of the Tesla vehicle parts are manufactured. For the company to attain its safety goal, various safety measures have been enacted, such as employee training and tracking of daily performance to enable changes whenever necessary. This has made the company’s safety increase in the current years. The paper investigates various potential risks that Tesla Company is prone to experience.

Risks

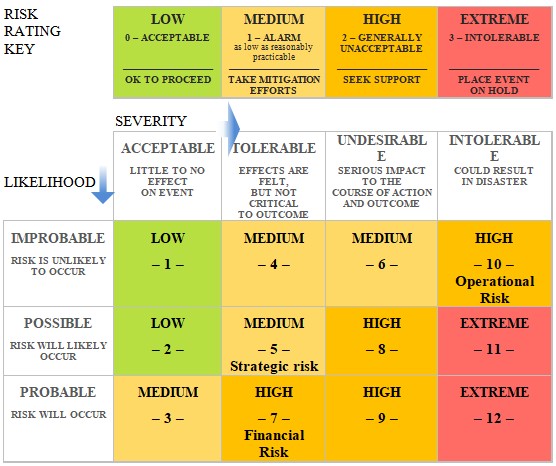

Operational Risks

- Product quality: the company is under pressure to maintain the quality of its products (Perkins & Murmann, 2018).

- Availability of raw materials: Tesla must monitor its inventory and have a variety of suppliers to ensure that they have access to the raw materials.

- Transportation risks: it uses third-party delivery services to deliver its cars to the clients, leading to delays.

- Expansion delays on the ramp operations: the company manufactures car batteries that are not meeting the set demand, leading to operational risks.

Financial Risks

- Competition: the company is facing enormous competition from other car manufacturing companies, which forces it to lower the vehicle’s prices, that in turn affects its budget and production process.

- Investment risk: it allocates huge funds to the research and development areas, making it vulnerable in future forecasting if the projects fail or encounter defaults (Chen & Perez, 2018).

- Interest rate risk is a risk manifest because of the difference in the currency’s value from one country to another. Tesla operates in a global environment, making it vulnerable to this risk. The changing policy on the exchange rates has an adverse effect on the company.

- Equity price risk: this is due to the competition arising from raw materials suppliers and other car manufacturing industries, as it leads to financial problems that later affect the budget.

Strategic Risks

- Innovation risk: the company must ensure that its vehicles’ technology is significantly tested for safety issues. This is because any failure leads to safety problems which may cause casualties (Chen & Perez, 2018).

- Political risks: the company is hugely dependent on the laws and policies that the government enacts, and any changes in these regulations may lead to financial problems. For example, when the government changes subsidies on electric vehicles, the prices shoot up, making consumers divert their attention to the product.

- Brand image maintenance: Tesla is under pressure to maintain its position and reputation in the market as they are the pioneer in the electric vehicle industry. This makes them invest hugely in research and development (Thomas & Maine, 2019).

Risk Treatment and Mitigation

The company requires an effective mitigation strategy to prepare them if the risks occur. Below are various methods that help solve the company’s experiences.

Difficulty in Attaining Target Manufacturing

The company has an issue in achieving this goal because of the fewer materials necessary for manufacturing the vehicle. There is an increase in the price of main raw materials such as aluminum, nickel, and lithium. The company should do the following to mitigate these issues.

- Introduction of strategic planning in the collection of raw materials and production.

- Having several suppliers to handle the issue of raw materials.

- Development of quality training programs that will improve the employees’ skills in the industry.

- Creation of a strategic budget plan that will help minimize the cost of raw materials (Biswas & Mukhopadhyay, 2018).

- Producing vehicles that are mainly booked by the clients, such as model 3.

Expansion Delays on the Ramp Operations

Tesla model 3 uses lithium-ion battery cells, and the company has a plan to manufacture the batteries for these vehicles. The company has been producing fewer types of this battery, making it difficult to attain the required number. The company should do the following to mitigate this problem.

- Manufacturing of batteries on time with affordable prices.

- The hiring of skilled individuals in this sector (Saidon et al., 2020).

- Setting a unique zone for lithium-ion cells to increase their productivity.

Performing Less Than Expected

The company has various models that have integrated modern technology. These car models include Model S, Model X, and Model 3. The operation of these vehicles is dependent on the software configuration that they have been installed. The software has various latent errors and defects that make it vulnerable to external attacks. The following are the mitigation strategies.

- Development of automated technology that inspects production quality at every step.

- Evaluating the long-term performance of the vehicle before bulky production.

International Operations

The company operates globally, making it prone to various regulatory frameworks. The region’s social and economic condition is also a significant factor impacting its performance. To mitigate these conditions, the company has to incorporate the following.

- Involve locals in its business environment.

- Make suitable agreements with multiple governments to prevent regulatory clashing.

- Making strategic agreements, which include tariffs, trade restrictions, and contract rights (Saidon et al., 2020).

Rules and Regulations

The company is subjected to privacy laws which, when breached, the company has to face various consequences with the federal or state government. The company should do the following to mitigate such issues.

- Develop security strategies that prevent a data breach.

- Create an awareness program that educates the consumers regarding company policy (Saidon et al., 2020).

Financial Risk

Financial risks are considered vital as they determine the performance of the company. The company can either grow or fall depending on its financial performance. The company should consider the following mitigation strategies.

- Risk diversification.

- Hedging strategies.

- Asset allocation.

- Portfolio diversification.

- Insurance.

Conclusion

The risk assessment above has shown that the company has various risks that require prior preparedness. These risks include operational, strategic, and financial risks. Financial risk is the worst of the three risks as it determines the organization’s sustainability in managing its assets and liabilities. Therefore, the organization must take possible actions as the automotive industry is fragile since quality and price determine the market share.

References

Biswas, B., & Mukhopadhyay, A. (2018). G-RAM framework for software risk assessment and mitigation strategies in organizations. Journal of Enterprise Information Management, 31(2), 276-299. Web.

Chen, Y., & Perez, Y. (2018). Business model design: lessons learned from Tesla Motors. Towards A Sustainable Economy, 53-69. Web.

Marker, A. (2022). Download Free, Customizable Risk Matrix Templates. Smartsheet. Web.

Perkins, G., & Murmann, J. (2018). What does the success of Tesla mean for the future dynamics in the global automobile sector?. Management and Organization Review, 14(3), 471-480. Web.

Saidon, Marzita, I., Said, & Roshima. (2020). Ethics, governance and risk management in organizations. Accounting, Finance, Sustainability, Governance & Fraud: Theory and Application, 1-8. Web.

Thomas, V., & Maine, E. (2019). Market entry strategies for electric vehicle start-ups in the automotive industry – Lessons from Tesla Motors. Journal of Cleaner Production, 235, 653-663. Web.