Background

Deliveroo is a food delivery service that allows users to order food and drinks from many local restaurants, bars, and cafes through its official website and iOS and Android apps. The purpose of this portfolio is to conduct a comprehensive analysis of the company’s existing marketing strategies. In addition, attention is paid to the segmentation, targeting, and positioning of Deliveroo in the UK market.

Segmentation, Targeting and Positioning of Deliveroo

Segmentation

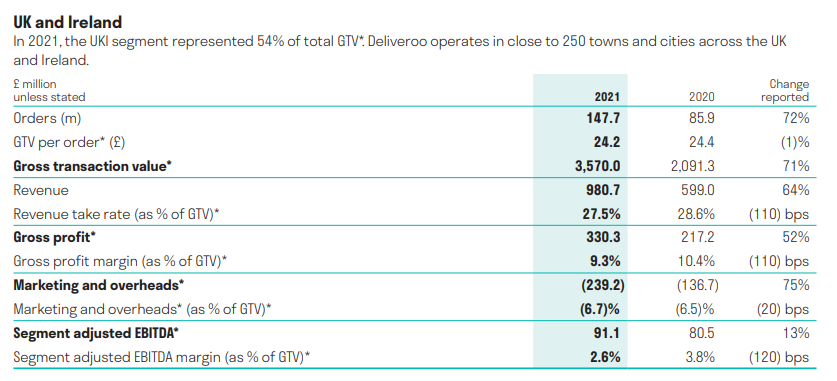

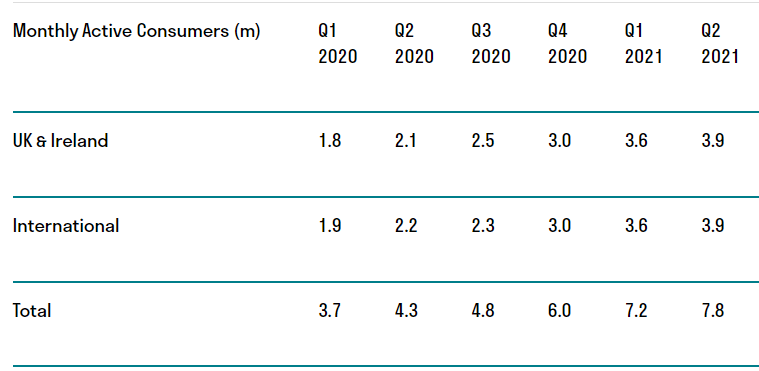

Instead of managing its business by focusing on the product or market segmentation, Deliveroo does so on a geographic basis. The UK and Ireland (UKI) and the international segment, which includes the remaining Company markets, are the two operating sectors of the company. The geographical segmentation of the market refers to categorizing all market buyers into groups based on geographical grounds, including geographical location and living conditions. Accordingly, market segments, in this case, are groups of consumers (real and potential) united by the same or similar consumer preferences, which are determined by the community of residence in a particular territory.

The basis of geographical market segmentation is the community of residence within a particular territory. For food delivery services like Deliveroo, geographical segmentation is a priority, as operational activity depends on this aspect. This is evident in the need to consider the availability of restaurants and grocery stores, ensuring that delivery takes the shortest time and does not increase the final cost for the consumer. In addition, it is essential to recognize that different standards govern Deliveroo’s activities abroad, as distinct approaches are required to introduce it to the market in competitive conditions. Thus, geographical segmentation determines how Deliveroo organizes and manages its organizational and logistical activities.

Targeting

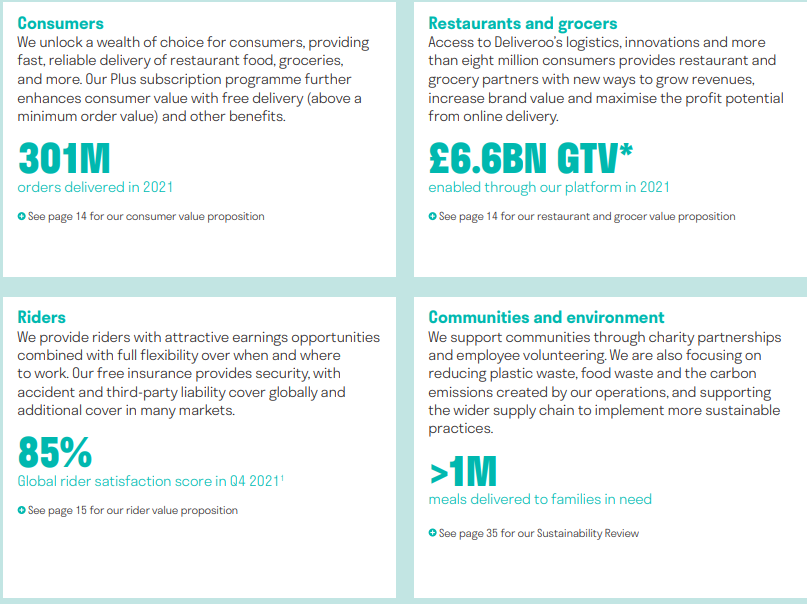

It is worth noting that Deliveroo, as a food delivery service, caters to a broad audience. The essence of the application and the website is designed so that people will always have the opportunity to independently choose the necessary restaurant and food in a specific price category that suits them. Consequently, the coverage is extensive since the service is necessary for various citizens. They are often students, busy people, businessmen, and others (Deliveroo Team, 2021). Indeed, because the commission is included in the price, the final cost of the order may be expensive, which reduces the audience of customers with a low level of affluence.

However, the service’s growing popularity allows Deliveroo to expand its geography and audience. A key feature of the company’s targeting strategy is its support for families in need. Thus, Deliveroo enhances the trust of potential customers by organizing various events tailored to support different categories of the population (Deliveroo Team, 2021).

Additionally, they aim to minimize food waste and carbon emissions (Deliveroo Team, 2021). This approach is designed to attract a younger and more environmentally conscious audience. Deliveroo continually strives to expand its user and customer base by implementing various marketing strategies.

Positioning

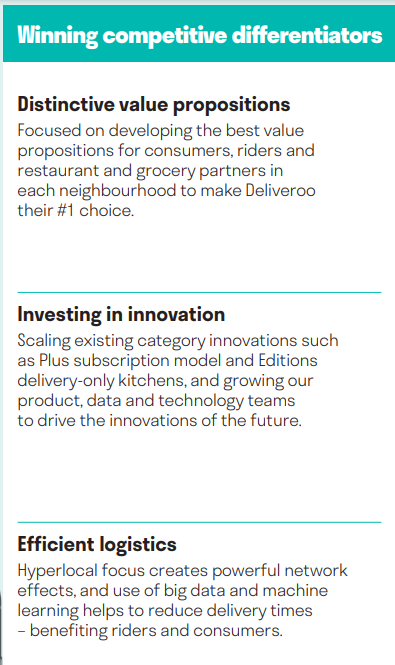

Deliveroo continually strives to enhance the functionality of its application and web service, providing users with a seamless and unique experience. As noted in the company’s report, they rely on innovations to simplify the user experience and logistics solutions for partner restaurants. Brand positioning is a marketing strategy that ensures the company stands out among competitors and that consumers perceive the brand as exceptional and trustworthy (Kotler et al., 2019). That is why Deliveroo needs to meet the expectations of all stakeholders as they perform connecting functions between partners and customers.

Thus, improving functionality and operational activities should occur in both directions, as the significant success of implementing a competitive advantage depends on it. With a penetration rate of just 4% for restaurants and 3% for groceries, online food ordering is still in its infancy compared to many other online categories (Deliveroo Team, 2021). Online and on-demand services remain in high demand among consumers, and the pandemic’s effects have further amplified this trend. Aside from product pricing, e-commerce customers are concerned about transparency and control over delivery.

Deliveroo’s massive real-time logistics infrastructure is helpful for much more than just food delivery. In a virtual franchise, restaurants may outsource their concept and use platforms like Deliveroo for sales and delivery. Virtual restaurants can use well-maintained commercial kitchens and storage facilities for much less than they would pay in restaurant overhead (Deliveroo Team, 2021).

Thus, Deliveroo has significant innovative potential, which can provide opportunities to implement new types of virtual businesses. This approach is a critical aspect of the company’s positioning as it strives to expand its activities and provide opportunities to simplify the operational activities of its partners. All this leads to a reduction in the cost of ordering and delivery, which benefits the attraction of additional customers.

Marketing Mix Ps

Product

Deliveroo is the intermediary connecting restaurants, grocery stores, and other businesses with customers. Consequently, their primary product is the application and website that users interact with when ordering food. The primary branding of the company is located on bags or delivery vehicles; therefore, it also works like outdoor advertising. However, it is worth noting that by performing intermediary services, Deliveroo assumes responsibility for the quality of products (Deliveroo Team, 2021). Consequently, having no restaurants or food available, they are indirectly responsible for meeting customers’ expectations.

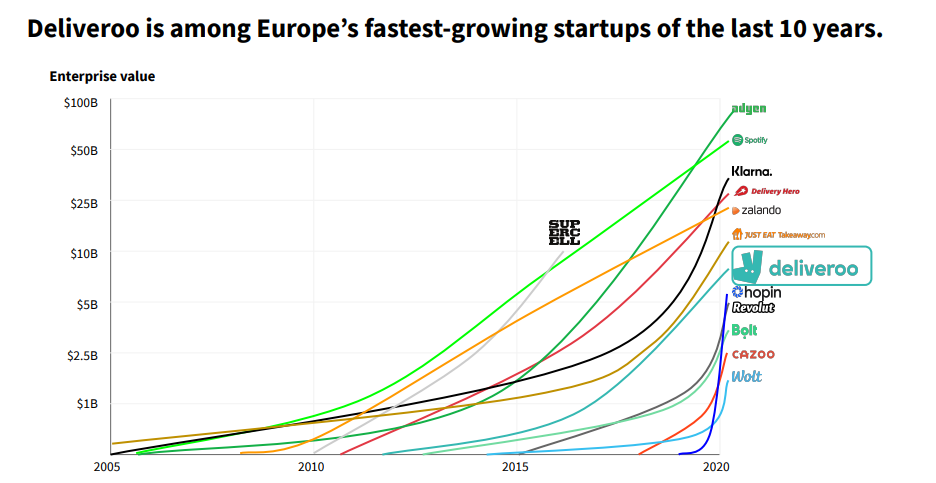

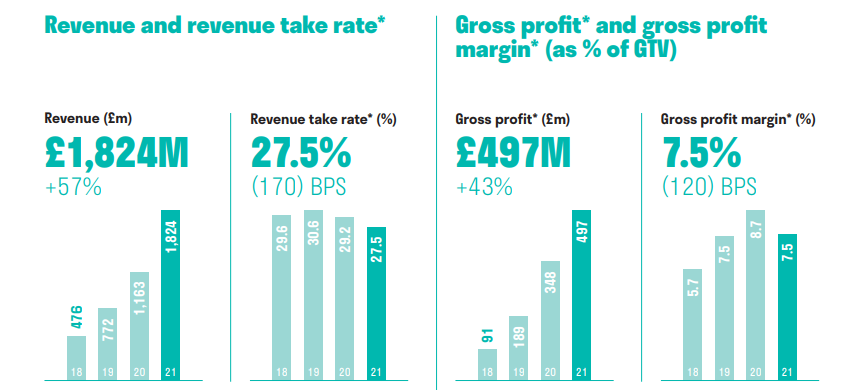

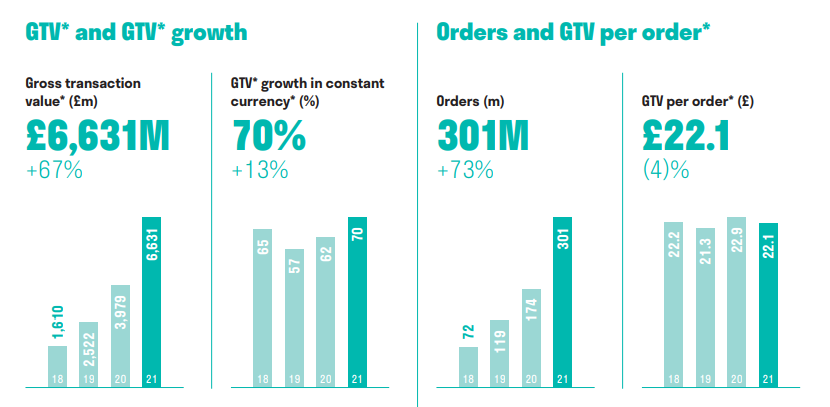

All this has a significant impact on the brand image. In the future, the company’s interaction and product will be based on delivery and logistics, which Deliveroo provides to its partners. The company charges a commission for an order from a restaurant (it can reach 30% but on average, it is less, especially for large chain establishments), as well as a delivery fee (dynamic and depends on the receipt; for large orders, it is usually free) and a service fee from users (Deliveroo Team, 2021). According to forecasts, the ready-to-eat food delivery market is expected to experience rapid growth in the coming years (Deliveroo Team, 2021). That is, the company still has a significant enough potential for the core business to grow at least several times from current levels; the share of delivery in the overall market and the share of aggregators in the delivery market will almost inevitably grow in the coming years.

Accordingly, in this case, based on the product life cycle, Deliveroo is in a phase of sales growth. The product has successfully established a niche, and demand and the organization’s income are expected to grow steadily (Prasad, Jha, and Verma, 2019). The company increases production capacity and produces more products. Due to this, it will be possible to reduce the cost of a unit of goods for the final and wholesale consumer (Prasad, Jha, and Verma, 2019).

Growth is possible when a brand attracts new customers and retains old customers. Competition is increasing, which means that the company needs to respond to the actions of its rivals, including seasonal discounts, promotions, sweepstakes, personalized offers, and bonus cards (Kotler et al., 2019). However, the potential for growth remains substantial, as the delivery market continues to gain popularity.

Price

Customers often pay a percentage of the order amount before discounts are applied, which includes delivery and service fees. It is essential to note that Deliveroo’s 5% discount has a minimum value of 99p and a maximum value of £2.49 (Deliveroo Team, 2021). The customer’s distance from the restaurant often determines the delivery fee.

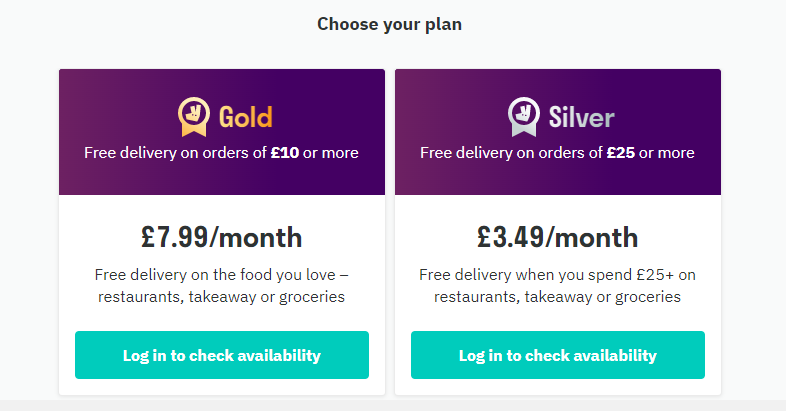

Restaurants that use Deliveroo exclusively, rather than multiple services, frequently receive lower prices. The company urges eateries to charge the same menu prices as they do for dine-in clients. This organization also offers a Delivery Plus subscription system, which is divided into two categories: Gold (£7.99/month) and Silver (£3.49/month) (Deliveroo Team, 2021). They offer customers additional conditions that allow them to receive free delivery if certain conditions are met. Thus, the total cost of the order made in the application is significantly reduced.

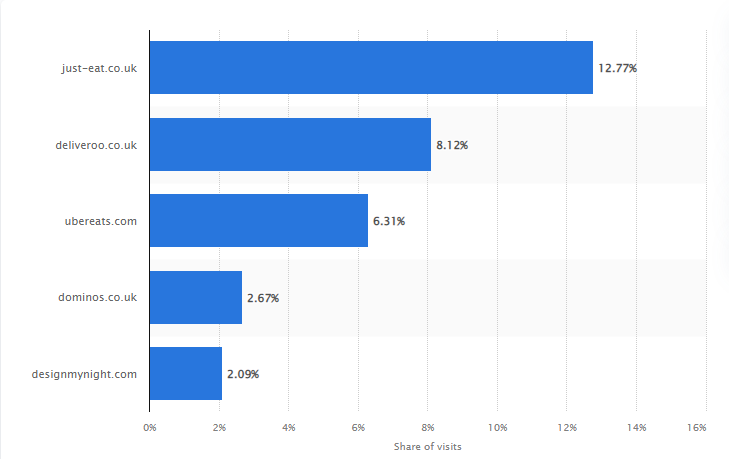

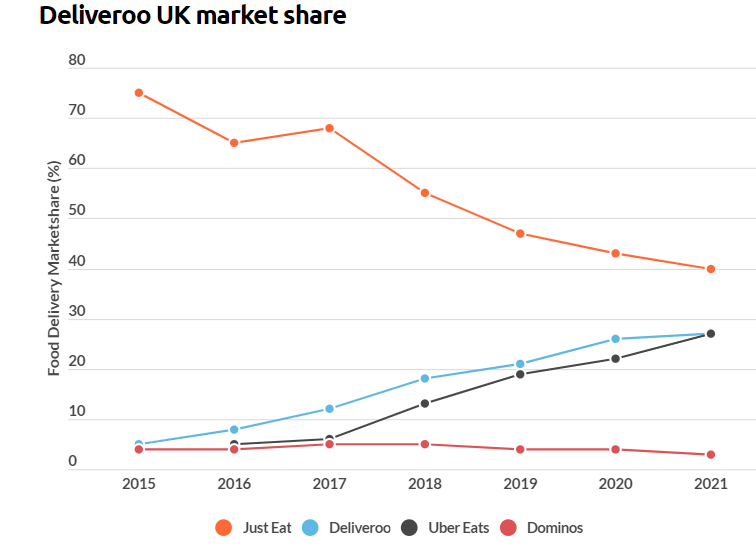

Various preferential strategies are used because the company needs to reduce the overall cost of products from restaurants and grocery stores, which are often overpriced. Neutral pricing often becomes a forced strategy for companies operating in the market where buyers are sensitive to the price level, which does not favour premium pricing (Kotler et al., 2019). Moreover, competitors respond harshly to any attempt to change the prevailing sales proportions, which makes a price breakthrough strategy dangerous. This is observed when two more large delivery companies in the British market (Uber Eats and Eat) set a reasonably strict price threshold.

Place

A delivery service program branded Deliveroo is available through a browser or an app. It serves as a link between customers, drivers, and businesses. The menu offers service alternatives for more significant events, such as corporate conferences, and features food from various cultures. Supermarkets also sell goods in addition to meals from restaurants. Consequently, the primary interaction between the user and the restaurants occurs through the Deliveroo application (Deliveroo Team, 2021).

It provides customers with opportunities to purchase the necessary products and have them delivered. For the restaurants themselves, the company provides an opportunity to track the position of the deliverers and build the necessary routes to fulfil the end user’s needs. Thus, the company primarily employs an intensive distribution strategy, continually expanding its network of partner restaurants and offering additional conditions and benefits (Langga, Kusumawati, and Alhabsji, 2020). It is worth noting that about 8000 restaurants are connected to Deliveroo in the UK. This is evident in the company’s rapid increase in market penetration rates. Therefore, expanding the partner network is a top priority for the company.

In cooperation with partners, Deliveroo builds a vertical distribution system that integrates all links of the distribution channels. Restaurants and intermediaries work as a single system. Deliveroo dominates the rest by using the owner’s rights or strengths. Such a relationship is determined by the fact that the company undertakes obligations to increase the number of customers and orders, as well as to deliver, manage logistics, and address any customization-related issues and suggestions. Thus, Deliveroo holds a higher position than other partners, enabling it to dictate terms regarding commission and delivery locations.

The advantages of intensive distribution are achieving the most significant availability of goods and a high market share. By establishing various principles of interaction with its partners, Deliveroo achieves as extensive a territorial distribution as possible (Langga, Kusumawati, and Alhabsji, 2020). This contributes to revenue growth and attracts a much larger number of customers. However, this complicates the logistics and operational activities of the company, as a significantly larger number of employees and distribution centers are required. However, from the perspective of marketing strategies, Deliveroo is achieving universal availability, which expands the geography of its operations.

Promotion

According to Deliveroo, growth marketing combines traditional performance marketing, customer acquisition programs like new user free trials, and CRM-based customer retention. Deliveroo’s marketing efforts last year included the “Full Life” campaign, in which the company pledged to collaborate with its restaurant and supermarket partners to provide 1 million meals to impoverished communities by the beginning of 2022 (Deliveroo Team, 2021). The main objective of various campaigns and events is to increase the social significance of the brand. Thus, Deliveroo strives to establish a stable position in which the company is associated with the support and care of various communities.

Various advertising strategies, such as a new approach to 3D billboards, are worth mentioning. Deliveroo has launched a similar campaign in London to attract new customers. The immersive spring campaign, “Food. We get it,” demonstrates the company’s desire to utilize modern promotional strategies. Such advertising campaigns contribute to the brand’s being associated with technology and futurism. Additionally, the rarity of such advertising enables the company to significantly increase its presence in the media sphere.

Highlighting the theory, it is worth noting that Deliveroo strives to achieve relatively intensive growth. The goal of this strategy is to achieve leadership in a specific market segment or to create a unique product. This strategy is based on the concentration and intensification of the company’s resources to achieve its marketing goals (Andrews & Shimp, 2017).

To the highest degree, it aims to strengthen and develop the business. This is determined by the fact that the company has been on the market for a long time and is in a competitive environment. Therefore, making decisions and taking actions that support this aspect of business development and marketing strategy is necessary.

Following an intensive growth strategy, companies strive to enhance their existing products or introduce new goods and services without disrupting the industry. In the market, companies may seek new opportunities to enhance their current market position or expand into new sales markets (Wegwu, 2022). The main advantage of using an intensive growth strategy is the absence of insurmountable difficulties in its implementation, as the business’s gradual development allows for a smoother process. In addition, the intensive growth strategy itself implies an increase in the efficiency of resource utilization already at the company’s disposal, and the costs necessary for its implementation can be covered from the company’s funds.

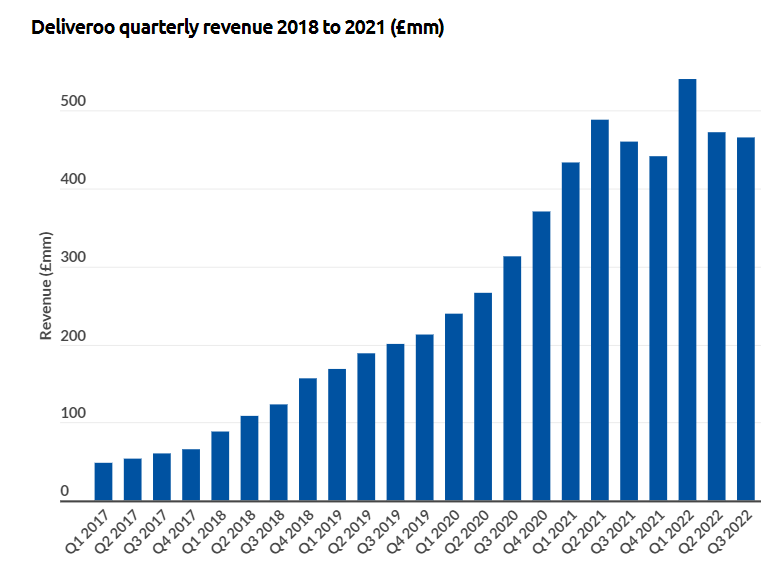

Metrics of Marketing Effectiveness

Based on the report’s data, Deliveroo mainly uses indicators related to profitability and profits. This data is divided into the number of orders according to the total revenue. However, it is worth noting that the company does not track metrics related to growth in social networks. This is important because it can help an organization investigate more detailed brand awareness statistics. In addition, it contributes to obtaining further competitive advantages, as not all business success is based solely on financial growth, as reflected in the annual report. Social media promotion defines ROI as a metric of the value of investments in it (Chaffey & Ellis-Chadwick, 2019).

SMA is part of the positioning strategy in social networks, which determines the degree of audience engagement, the growth of the target audience, and the frequency of posts (Chaffey & Ellis-Chadwick, 2019). These ideal parameters distinguish Deliveroo from competitors. Social media analytics measures the effectiveness of content to understand how to work with an audience. In turn, social listening offers an opportunity to discover what is being written about the brand on social networks. This is how marketers learn about the client’s pain points, potential problems, and current needs by analyzing hashtags, keywords, and mentions.

The audience’s interest is well demonstrated by micro-conversions – small steps that the user takes on the way to making a purchase. As an efficiency metric, for example, Deliveroo can take the number of:

- clicks on social media buttons;

- free registrations on the site;

- subscriptions to the email newsletter;

- transitions to the section with restaurants.

There is no such data in the standard reports of web analytics systems, so the company needs to configure goals additionally to track visits to specific pages or events. By setting up a composite goal, they can see which part of the users eventually reaches the macro conversion. The engagement and interest of the target audience can be assessed not only by the behaviour on the site and app, but also by the business’s communication on other platforms.

Therefore, based on this, the company establishes its positioning, which is driven by the desire to maintain an innovative approach to creating more effective interactions with partners and customers. To achieve the highlighted aspects, Deliveroo’s marketing mix is based on four essential indicators: product, price, place, and promotion. In accordance with the essential requirements, the company employs various approaches to enhance the accessibility of the application and website for users, and promotes them through innovative advertising campaigns (Deliveroo Team, 2021).

Deliveroo evaluates the effectiveness of its marketing strategies due to various KPIs related to the company’s profits and revenue (Deliveroo Team, 2021). To expand this range, recommendations were put forward for tracking detailed statistics of social networks and various mailings. This will allow Deliveroo to evaluate the overall condition of the brand, its popularity, and demand.

Reference List

Andrews, J., and Shimp, T., 2017. Advertising, Promotion, and other Aspects of Integrated Marketing Communications. 10th edition. South West: Cengage Learning.

Chaffey, D., and Ellis-Chadwick, F., 2019. Digital Marketing, Strategy, Implementation and Practice. 7th edition. Harlow: Pearson.

Dealroom (2021). Deliveroo: An Incredible Ride to IPO. London: Flow Partners, pp.1–21.

Deliveroo (n.d.). Deliveroo Plus. Web.

Deliveroo plc (LSE: ROO). (2021). Half-year Report. Web.

Deliveroo Team (2021). Annual Report (2021). London: Deliveroo Plc, pp.1–196.

Iqbal, M. (2021). Deliveroo Revenue and Usage Statistics (2021). Web.

Kotler, P., Keller, K., Goodman, M., Brady, M., and Hansen, T., 2019. Marketing Management. 4th European Edition. Harlow: Pearson.

Langga, A., Kusumawati, A. and Alhabsji, T. (2020). Intensive Distribution and Sales Promotion for Improving Customer-Based Brand Equity (CBBE), Re-Purchase Intention and Word-Of-Mouth (WOM). Journal of Economic and Administrative Sciences, 37(4), pp.577–595. Web.

Macaulay E. Wegwu (2022). Intensive Strategies and Market Position of Competing Firms in an Atractive Industry. World Bulletin of Management and Law, 7, pp. 159-167. Web.

Prasad, R.K., Jha, M.K. and Verma, S. (2019). A Comparative Study of Product Life Cycle and Its Marketing Applications. Journal of Marketing and Consumer Research, 63. Web.

Vimeo.com. (n.d.). Food in 3D | Deliveroo. Web.

Youtube.com. (n.d.). Deliveroo’s Full Life campaign with Maya Jama. Web.