Introduction

At the present stage of development of society, in a world where, with the development of the Internet, the question of online payments for goods, works, and services has increasingly arisen, it is vital to have a solution for convenience. Today, electronic payment systems have become more in demand, along with the use of payment systems on the Internet, such as Visa and MasterCard. These include numerous online stores located in the network.

Nowadays, electronic checks are becoming increasingly popular, as many advantages can be distinguished. Digital receipts cannot be wrinkled or lost, they are convenient to use for tax calculation, and there is convenience in storage and when returning goods. Moreover, these checks will always be at hand, as they will not need to be looked for in wallets, gloves, pockets, and unnecessary papers.

Moreover, it has a number of positive aspects not only for ordinary buyers but also for entrepreneurs. An entrepreneur who issues an electronic receipt to a customer receives many benefits. These include, in particular, reducing the cost of paper consumption, saving time on printing checks, and creating a convenient way to store documents (Kotsis et al., 2022). In electronic form, there is no risk that the check will fade over time, be damaged, or be lost by the buyer, which will formulate image advantages (Kotsis et al., 2022).

The entrepreneur, by reducing paper consumption, acts pro-environmentally in accordance with the idea of corporate social responsibility. However, online cash registers were initially adapted only to the issuance of paper checks. Soon, an electronic receipt will be added to their capabilities, then the online cash register will be able to issue an online cash receipt on a par with virtual cash desks.

Today, personal data and information security is a priority in business and everyday life. It is due to the fact that globalization and the development of online technologies grant hackers a chance to gain access to personal data and use it for their own purposes. However, in some areas, old principles are still applied, such as paper receipts, which is even more dangerous (Kotsis et al., 2022). It not only poses a threat to users regarding data security but also negatively affects the environment.

Thus, the new model of receipt without paper is a revolutionary solution to several problems. Considering that the digital receipt application will be based on advanced security methods, it will be the most secure for both customers and sellers. Moreover, utilizing the application saves time and costs, which articulates its relevance and necessity for implementation. The paper will cover the basics of the application, implementation steps, a new business model for receiving receipts, and risk management.

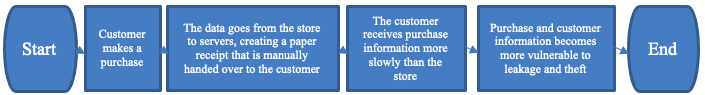

Primarily, one needs to pay attention to the existing receipt process in the retailer sector. The key aspects are the client making the transaction, the company’s servers where the transaction data is stored, and the merchant transmitting the receipt to the client. This process formulates several threats at once since the data stored on the server can be hacked. Further, during the transfer of data from a store computer to the servers, or vice versa, hackers can also intercept the information (Kotsis et al., 2022).

Finally, a paper receipt can be lost after it is received by the client, as a result of which attackers can use the information on it for their own purposes. It is the currently accepted business technology for receiving receipts, however, some companies offer the use of email. Although this is a more modern and secure option, the main threats remain, moreover, storing receipts via email is inconvenient for customers.

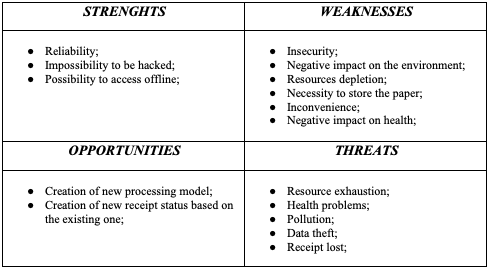

SWOT Analysis of the Current Model

To address this issue more effectively, one needs to apply SWOT analysis to the current model for receiving paper checks. It is worth noting that given globalization and the recent development of technology, using paper receipts does not have many strengths. As one may see in Table 1, Paper checks are more reliable since only the owner has the opportunity to personally view the data in case of having a receipt. Further, paper checks cannot be hacked, and the data can be read offline or when there is no electricity.

However, it poses many weaknesses, and primarily, paper checks are not secure because they can be lost or stolen, and information stored on servers can be hacked. It negatively affects the environment since paper receipts are not recycled. Valuable resources must be expended to produce receipts, which poses an attrition problem.

Further, the weakness of the current receipt model is paper clutter. A person must carry or store a large amount of documentation somewhere, which is inconvenient. Paper checks, compared to electronic ones, are significantly problematic as they get mixed up with other items on the desktop or in the wallet. Finally, paper receipts have a negative impact on health due to chemicals applied to the surface, which also pose a threat. Among the possibilities, one can single out only the creation of a new model for processing paper checks to level the aspect of piling up garbage. However, at the moment, it does not exist, and development may take a long time. Another advantage could be the development of a new principle, such as the one proposed by Dijii, applying the experience, mistakes, and lessons of the current model. Finally, paper checks carry the threat of environmental pollution, resource depletion, and data loss.

Digital Transformation Roadmap

To solve the problem of paper checks, a revolutionary solution was proposed to create a single platform in the form of an application. In this application, one will be able to store all electronic checks and have quick access to them. In addition, companies will be able to offer discounts, promotions, advertising, and other essential aspects in the application. It will allow one to save time and money resources, in addition, the application is a convenient option for storing and using checks.

This program solves all the issues associated with paper checks, namely, they do not take up space and cannot be lost. Moreover, it solves the problem of resource depletion since there is no need to waste natural resources on production. Finally, the application levels the issue of environmental pollution since everything is stored on the phone or on servers.

As one can see in Figure 1, the business model after transformation articulates convenience, speed, and security. In the first stage, the client, similarly to the old business model, makes a purchase, including the moment of payment and the transfer of goods to the buyer. Further, in the old model in Figure 2, information about the purchase was sent to the servers, and a paper receipt was created, which was transferred to the client. However, with the new business model, the information is sent to the servers and to the application carrier, namely the smartphone. Thus, after that, both the customer and the store have quick and convenient access to information about the purchase. This is done so that one would be able to view the data at any time, if necessary. Finally, all information is protected by two-factor authentication and encryption, which makes it impossible for data to be leaked or stolen.

For a successful transformation, it is necessary to develop the intended steps to be taken. As one can see in Figure 2, the first step is to notify potential customers of new opportunities. Next, one needs to conduct an advertising campaign to prepare the target audience and the influx of customers for the first time. It will help raise the rating of the application and make it recognizable, after which the application will work for itself, which is also called self-promotion. Further, it is necessary to inform customers properly about the features of using the application so that one does not have questions about the functionality or processes. It is essential so that customers immediately feel the convenience of new processes but do not waste time learning how to use it. Finally, after the above steps, one can take to the implementation, which will include installing the application and using it directly by the clients.

Risk Management

There are a number of risks associated with electronic checks and the implementation of this program. The buyer will not receive a check in the absence of an Internet connection or technical failures. The solution is that the transaction history of payments is saved, and when the work is resumed, information about transactions will not be lost. The client can enter the mail or number with an error and will not receive a check, or the letter will end up in spam. To solve the issue, one needs to double-check the entered mail and make sure that one received a check in the mail. If the correspondence was entered correctly, but the check was not received in the mail, then one needs to check the spam, junk mail, and mailing folders.

Conclusion

To conclude, it is worth mentioning that there is a risk of receiving an invalid online receipt generated outside of a purchase. The solution is the tax office, which conducts on-site inspections and imposes hefty fines for violating the law on the use of electronic checks. It is possible to reduce the risks of receiving a fictitious check by studying reviews about the company before buying.

In addition, the cost of goods and services will increase due to innovations, and the solution is that innovations do not increase the costs of sellers. The introduction of electronic checks allows for saving on receipt paper and ink for printing, as well as reducing the cost of servicing cash registers. The main risk of implementing the program is the threat of hacking the server or data, but two-factor authentication eliminates this risk. In addition, all information is stored using encryption, which increases security.

Reference

Kotsis, G., Khalil, I., & Haghighi, P. (2022). Advances in mobile computing and multimedia intelligence. Springer Nature Switzerland.