Introduction

Background

Dorchester has been rather efficient in the selected area, i.e., the field of electronics. Located in the United States, the organization has been growing successfully over the past few years and seems to have reached the stage at which it has to expand through acquisitions. The significance of the latter is obvious for the organization; once acquiring a firm located in another state, the entrepreneurship will have an opportunity to not only be represented in a new market but also target the global economy realm.

The choice that the firm is to make to gain the necessary weight and influence, however, is very complicated, as it will set prerequisites for its further stellar success, or, in the worst-case scenario, its untimely demise. Choosing the Epcos AG organization located in Germany seems to be the most sensible thing to do for the firm at present, as the rest of the options are likely to lead Dorchester to a rather convoluted situation due to the lack of financial opportunities.

Goals and Objectives

The goal of the project is to identify the risks that entrepreneurship is likely to face in the target environment and to suggest the tools that will help address the problems above in a manner as efficiently as possible.

Problem

Although the German market has been chosen instead of the rest of the options because of its comparatively high stability rates, some of the current financial indices thereof point to the fact that Dorchester is likely to face serious risks when acquiring the company.

Suggested Solution

It is recommended that the company should consider entering the German market and acquiring the Epcos AG Company. Although the specified entrepreneurship might not be the first choice due to the possible financial risks that the process of acquisition is likely to trigger, the further introduction of Dorchester to the German market and the support that the company will provide to Dorchester will propel the firm to the top of the target market.

More importantly, by acquiring Epcos AG, Dorchester will be able to consider the idea of competing in the global environment. Therefore, the reallocation of the company’s financial assets and the redesign of the cost management strategy aimed at providing financial support for the business to be acquired should be viewed as the ultimate tool for solving the current conflict.

Germany: An Economic Assessment (2015–2016)

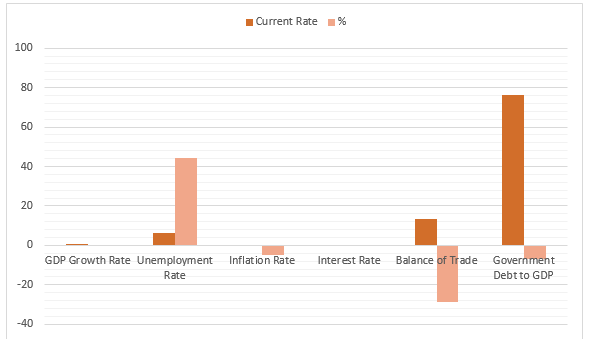

A closer look at the environment, in which Dorchester will have to operate, will reveal that the entrepreneurship will have to deal with a set of rather rigid requirements. Although the economic situation in Germany can be viewed as comparatively positive, some of the issues that the country is facing at a present point directly to the possible problems with managing the existing situation. Particularly, the lack of progress can be observed in the GDP ratio fluctuations. Also, the fact that unemployment rates are getting increasingly high in the specified environment serves as the marker of the possible issues that Dorchester is likely to have when attempting to carry out the acquisition.

The unemployment rates can be deemed as moderate in Germany (6.2%). Therefore, it will be comparatively easy to recruit competent employees in a specified environment for a reasonable salary. However, to make sure that the newly recruited people will be loyal to the organization, Dorchester will have to design the program including skills training options, information acquisition, etc. Thus, the loyalty rates among the new staff members will increase.

Market Analysis

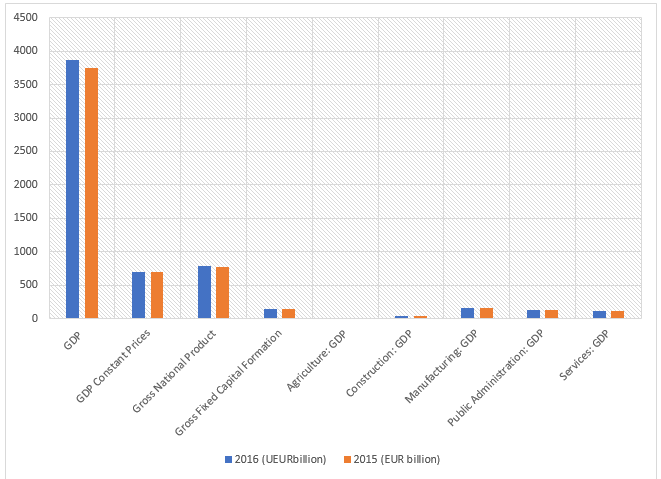

As recent data regarding the progress of the German markets shows, the average score reached 9,851 in March 2016 (Germany: Economic indicators, 2016). The amount specified above, though admittedly large, is, however, lower than the previous record (10,038). The fact that the statewide score dropped by 1.86% shows that there might be a threat to the progress of Dorchester in the designated environment.

The fact that the government bonds have dropped over the past year also signals about the possible issues in the target market. However, the 0.01% change does not seem to be a major alteration that points to a major problem in the design of the market. Therefore, it can be assumed that Dorchester could acquire a small number of bonds, thus, expanding its current resources and creating room for a change in the current fiscal policy. The fact that the currency remains at the 0.12 level, in its turn, signals that the market is stable enough for Dorchester to explore it comparatively safely.

GDP-Related Indicators

According to the latest information concerning the GDP-related indices in the state economy, Germany could be experiencing a slight hiccup in its economic progress. Indeed, a closer look at the changes that the economic field has suffered over the past year will display rather sad tendencies:

However, the negative growth rates that can be traced in the contemporary economy of Germany should not be confused about the sign of a possible failure of Dorchester in the target market. Quite on the contrary, the fact that the state is experiencing certain problems with the productivity rates of the local entrepreneurship may serve as proof that the local organizations are likely to be willing to become partners with Dorchester, therefore, improving their current score.

Employment Issues

According to the latest statistical data, the unemployment rates are getting increasingly high in the environment of the German labor market (Labour market information, 2016). On the one hand, the above tendency shows that the current economic condition of the state leaves much to be desired. On the other hand, the increase in the number of employment issues shows that the company is likely to use the services of the local experts for a comparatively low price.

Pricing Statistics

The prices in the chosen area of the firm’s future operations can be described as moderate. Although the existing pricing strategy is still rather costly, the drop in the producer prices change to -0.3% makes it quite clear that the German environment offers a comparatively positive pricing approach based on the unique characteristics of the clientele, their capacities, and resources available to them.

The increase in prices should be viewed as a rather troubling sign for entrepreneurship. Seeing that the sensible use of resources is the primary concern for the firm at present, the rapid increase in the total amount of costs to be taken in the process will affect the success of the acquisition. More importantly, the rise in prices will jeopardize the overall success of the firm and its further performance rates.

Money-Related Issues

As far as the measurable money supply characteristics of Germany are concerned, the designated environment can be considered suitable for the further expansion and investment options. For instance, the fact that the M1, M2, and M3 indicators have grown slightly over the year points to the possibility of the company to receive enough financial support from the German banks. Because of the need to use the existing financial resources very wisely, Dorchester may need the support of the authorities, which the environment of the German market does not seem to offer. It is suggested that the redesign of the cost management approach will help deal with the issue and leverage the existing financial resources efficiently. Despite being rather challenging, the environment of the German market has a plethora of opportunities to offer in terms of becoming a part of the global market, and Dorchester cannot miss this chance to establish a strong presence in the designated area.

Trade-Related Statistics

Similarly, the information concerning the trade has to be taken into account when defining the financial policy to be adopted in the designated setting. According to the latest data concerning the BOT rates in Germany, the specified index has dropped from 19,000 to 13,600. On the one hand, the information provided above should be deemed as a warning against investing in the above market. Indeed, the lack of financial resources, which the local businesses are bound to be experiencing, might cause a rather frustrating experience for Dorchester with one of the less fortunate entrepreneurship in the target setting.

On the other hand, however, the further exploration of the target area could lead to impressively positive outcomes as the opportunity of retrieving investments from a powerful organization and the chance of entering a larger market may galvanize the target entrepreneurship and lead to efficient cooperation between Epcos AG and Dorchester. Moreover, Epcos AG has been represented in Germany for quite long, which means that it has gained an impressive weight in the designated economic environment and will serve as the means of succeeding in the German market as well.

State Government

Needless to say, when purchasing Epcos AG, Dorchester will have to consider the current economic issues that the German state government has. For instance, it should be brought to the company’s attention that government spending has increased by 1 billion EUR over the past year, whereas the state debt to DP has grown by 0.5%. While admittedly small, the specified data may indicate that, along with buying Epcos, AG, Dorchester will also be buying its debt.

Consumer Analysis

The differences between the American and the German consumers is quite big, not only because of the lack of similarities in the economic strategies of the states but also due to the unique characteristics of the consumers. Particularly, the information concerning the annual income needs to be taken into account.

Possible Legal Impediments

Although the legal framework provided for the international trading processes in Germany is not that different from the one accepted in the United States, there are still a few unique characteristics that define the course of Dorchester’s actions in the designated market (Mäntysaari, 2015).

Financing Plan: Allocating the Existing Resources

Table 1. Financing Plan ($ million).

As the plan provided above shows, the company expects that the opportunities for a further increase in the firm’s profit margins within the first three years of its operations in the German market. However, to fully understand the implications of the step to be taken, the financial managers of the entrepreneurship will also have to consider the number of expenses that the firm is likely to suffer in the realm of the German economy. As the previous analysis of the designated market has shown, the German market offers the mildest environment for the company to operate in. The specified characteristics of the target area create the prerequisites for Dorchester to bloom in the market, therefore, updating its services consistently and making sure that the quality rates of the company’s products should remain consistently high.

According to the latest research (Mäntysaari, 2015), entrepreneurship is likely to face several financial challenges in the target environment. Particularly, it is expected that the firm will suffer expenses when investing in equipment and taxes. Therefore, an elaborate strategy was created. By reconsidering some of the expenses and using cheaper options, Dorchester will be able to save a significant amount of money.

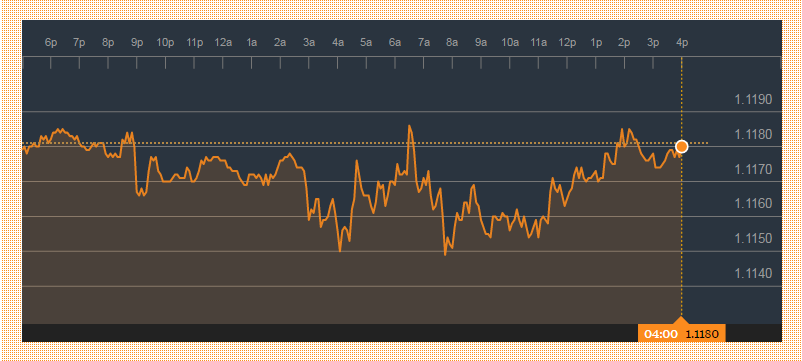

The savings, in their turn, can be used to invest in the promotion of the organization in the target market and address the financial challenges that the company will face. Particularly, the losses that the entrepreneurship will suffer when carrying out the exchange process and transferring from the use of USD to the adoption of EUR as the primary currency need to be brought up. According to the current rates and the forecasts for 2016, the company may suffer significant losses as the exchange rates of the euro are likely to drop in June by 2.58%.

Nevertheless, as Figure 1 above shows, the current exchange rates should be viewed as rather favorable in terms of integrating into the German market. Although there might be a few dents in the process of introducing Dorchester to the German market, the overall prognosis is rather favorable. Therefore, the organization should consider the options involving the redesign of the current investment approaches and the allocation of costs. As soon as Dorchester gets the firm’s priorities straight and considers the possible opportunities for the resource leverage, it will be able to acquire the firm successfully.

It should also be borne in mind that, along with purchasing the bonds of Epcos, AG, the company will also acquire its debts. Seeing that it will be unreasonable to wait until the debts mature significantly, it will be crucial to pay the specified debts within a relatively short amount of time. This is the point at which the above strategy of resource allocation factors in. By rearranging the financial resources in the company and supplying the corresponding departments with the exact amount of funds that they need, the entrepreneurship will be capable of paying its debts until they reach high maturity. Thus, a more sustainable approach toward managing the organization can be introduced.

Risk Mitigation Plan: Addressing the Possible Issues

As the analysis of the economic environment, in which Dorchester will have to operate, has shown, the company will face a variety of risks, the external ones being the primary concern. Among the key risks, the possibility for agreeing upon the conditions that meet the needs of both Epcos AG and Dorchester should be named first. Although the analysis of the German economy and the changes that have occurred to it over the past year point directly to the necessity for the local organizations to receive sufficient funding, Epcos AG has been in business for so long that it must have developed resilience to hiccups in the economic development of the state.

Also, the swap process that will have to occur will imply the possibility of unforeseen risks to emerging. Despite the creation of an elaborate plan and the design of a well thought out strategy, the company may face certain hindrances inflicted on it by sudden changes in the state economy, in Epcos AG’s course of development, or its financial state. For example, a sudden shock to the target market may create the environment, in which the process of acquisition will become impossible.

Another possible risk that Dorchester may face is that the actual expenses to be taken will exceed the predicted ones. Even though the current price per Epcos AG’s stock is known well, the entrepreneurship may ask a higher one due to specific changes in its design or the economic environment.

Lastly, the problem concerning the debt needs to be brought up. As it has been stressed above, government debt has been increasing consistently over the past few years in Germany. Although the increase is barely noticeable, it still has a tremendous effect on the overall performance of the organization. Therefore, by acquiring the company that already has several maturing debts, Dorchester may face the need to make significant expenditures to cover the losses. Because the entrepreneurship will have to establish itself in the German market by designing a brand product and expand into the global economy realm, it will be necessary to make sure that a significant amount of financial resources should be streamed in the marketing direction. Thus, the firm cannot suffer significant costs at present.

Impact and Probability

To address the threats to the company’s wellbeing listed above, one will have to consider the use of the concepts of impact and probability. Traditionally defined as the measurement of the effects and chances for the impediment to occur (Eun & Resnick, 2015) correspondingly, the above phenomena allow identifying the gravity of the threats listed above. The table provided below shows quite graphically the weight of the situation.

The effects of some of the risks identified above are not as deplorable as they might seem. Moreover, some of the most feared risks have a rather low probability; for example, given the current performance of Epcos AG, it is highly unlikely that it has mature debts and that the Dorchester organization will have to share them with its new acquisition.

The issue regarding the possible expenses, in its turn, seems to have rather high probability rates. Given the current financial strategy focusing on improving the quality of the services and sustaining the power of the brand product, it will be very challenging to come up with the means of allocating the company’s resources appropriately.

Mitigation Strategies and Time Frame

Before addressing any of the risks identified above, Dorchester will have to design the risk mitigation framework that can be used to address any incident and, therefore, should be viewed as the universal tool for improving the company’s score in the target market. It is highly recommendable that the traditional framework including the stages such as the identification and analysis of the emergent and existing risks should be carried out.

Afterward, the process of planning the ways of mitigating the identified risks should take place. The further implementation of the steps designed should be followed by the process of outcomes evaluation. Though often neglected, the process of analysis and assessment of the changes made to the company’s design is essential to the overall success thereof in the new economic environment. To carry out the above evaluation, one will have to adopt the traditional analytical tools, including the SWAT analysis and the quantitative tools such as the ANOVA test for locating the emergent issues.

To create the approach that will allow for enough flexibility and at the same time set the premises for designing a sustainable approach that will help the firm gain enough confidence to carry out the acquisition process and establish its renewed self in the global market. To address the above problems, Dorchester will have to consider the redesign of its current approach to resource leveraging.

Particularly, saving on one of the processes that the firm spends an extensive amount of money should be viewed as a possibility. For instance, Dorchester should view the change in its current procurement approach so that the issue in question could be addressed properly. For instance, the losses that the company suffers regularly due to the lack of a cohesive knowledge management strategy should be addressed by rearranging the existing knowledge management approach and introducing more sophisticated IT tools so that the data could be arranged and digested more efficiently and expeditiously. As a result, the firm will experience fewer losses in the process of managing its supply chain-related processes. Consequently, the money saved can be used for addressing the specified risks.

Another essential element that the firm should introduce into the framework of its operations as soon as it acquires the company under analysis, the use of the tools that will help it fight unforeseen crises. Entering the new economic realm, Dorchester will have to accept the fact that it is highly vulnerable to external factors.

It is expected that the above goals will be accomplished within the next year. Despite being rather complicated, the process of reaching the goals set is likely to be completed within the time frame set once the priorities of the organization are set straight. As it has been stressed above, the lack of a clear and adequate approach toward managing the existing financial resources is the foundational problem of the organization.

Conclusion

Introducing another organization to the environment, in which Dorchester operate, and inviting it to become an integral part of the company, is a challenging task, primarily due to the financial and economic obstacles that stand in the way of the acquisition. Because of the differences in the economic environment of Germany and the United States, the key challenges must be addressed properly. As soon as the firm identifies the means of reallocating its costs, ti will be capable of acquiring Epcos EG and succeeding in the target market.

Reference List

Eun, C. S., & Resnick, B. G. (2015). International financial management (7th ed.). Boston: McGraw-Hill Irwin.

EURUSD Spot Exchange Rate. (2016). Web.

Germany: Economic indicators. (2016).

Labour market information. (2016).

Mäntysaari, P. (2015). EU electricity trade law: The legal tools of electricity producers in the internal electricity market. New York, NY: Springer.