Introduction

Businesses can combine financially in several ways. For instance, businesses of equal sizes can merge their operations and become one large entity or one entity can acquire another company. In the case of acquisition, the acquiring company needs to pay for the entity being acquired. There are several ways through which the acquired company can be paid for. One option is the use of cash. The payment does not necessarily have to be in cash. A commensurate consideration in exchange for the acquired company is adequate. Another option is where the acquiring company makes use of assets to pay for the business. Further, the acquiring company can also make use of stock to pay for the acquired company. Out of these three options, the most suitable one for Dorchester, Inc. is stock swap. The stock swap option is discussed further in the subsequent section.

Discussion

Several swap options are available for Dorchester, Inc. to choose from. The choice made should be suitable for electronic businesses that are based in China, Germany, and Nigeria. Thus, a stock swap will be the most ideal. Under the stock swap, Dorchester, Inc. will make use of its stock as a consideration for the proposed acquisition (Hourani & Zarai, 2014). The shareholders of the acquired company will get a preset number of shares from Dorchester Inc. Before a stock swap can take place, the companies should estimate the value of their businesses. This needs to be done with a lot of accuracies because it will determine the value of the swap ratio.

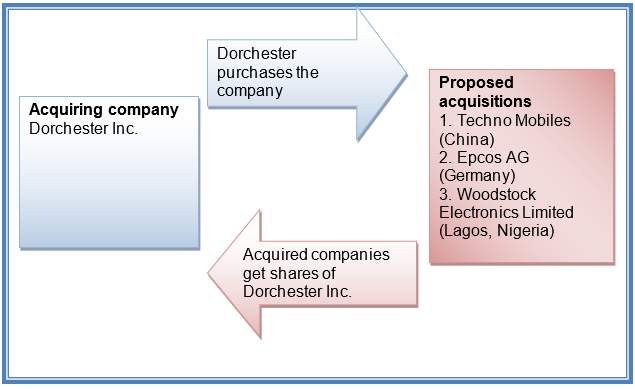

It is worth mentioning that the estimation of the value of a company is a complex process. Therefore, most businesses prefer to use a combination of intrinsic and the fair market value of their businesses during the exchange (Malkawi, 2014). A swap ratio will give guidelines on the shareholdings after the acquisition. Other than the payment of the company using shares, Dorchester Inc. may also need to give the board of directors of the acquired company some incentives in the form of shares to make the process of acquisition smooth (Hourani & Zarai, 2014). The process of acquisition of the proposed company can be summarized in the diagram presented below.

The diagram above shows the process of acquisition through a swap of shares. It indicates what the two companies will gain from the acquisition process. The acquisition is an important avenue through which a company can expand globally and improve its presence.

Through the acquisition, Dorchester Inc. can obtain strategic assets that can improve their bottom line. Besides, the company will be able to put into immediate use of the assets acquired from the three companies to increase their market share globally, serve several customers across various regions, and improving their corporate image. Thus, Dorchester should acquire these three companies with long term profitability in mind. Besides, they should also protect the interest of the shareholders by ensuring that the proposed acquisitions are strategic and till result in the growth of shareholder’s fund (Hourani & Zarai, 2014).

Venturing into foreign markets through acquisitions will enable Dorchester Inc. to penetrate the market easily. This is based on the fact that the stock swap reduces the possibility of discrimination. Finally, the use of a stock swap will enable the company to preserve cash that is much needed in the organization for various reasons such as managing working capital and funds required for future capital expansion. Therefore, the company will be able to run smoothly without cash flow problems that are associated with the payment of acquisition in cash (Eun & Resnick, 2015).

Another way through which Dorchester can gain from the stock swap is the restrictions that relate to the sale of shares. The stock swap option limits the ability of new shareholders to sell their shares until the shares reach a threshold price. The threshold price is often equal to the exercise price. As mentioned above, the shareholders of the three acquired companies will receive a predetermined number of shares in Dorchester Inc. However, these shares are received with conditions that do not allow the new shareholders to sell their shares over some time. Therefore, they are required to hold the shares until the period stipulated in the terms of allocation elapses. This will enable the company to have a stable capital structure over some time (Eun & Resnick, 2015).

Based on the discussion above, it can be deduced that the use of a stock swap is the best swap option that is available for Dorchester, Inc. It has several benefits that the company can gain from. Besides, it will grant the company a lot of flexibility that may not be achieved when other swap options are used. Therefore, Dorchester Inc. should go ahead and acquire the three companies through a stock swap.

References

Eun, C. S., & Resnick, B. G. (2015). International financial management (7th ed.). Boston: McGraw-Hill Irwin. Web.

Hourani, Y. M. & Zarai, M. A. (2014). Investment in financial derivatives contracts from an Islamic perspective. International Finance and Banking, 1(1), 51-73. Web.

Malkawi, B. H. (2014). Financial derivatives between Western legal tradition and Islamic finance: A comparative approach. Journal of Banking Regulation, 15(1), 41-55. Web.