Introduction

Research Background

Fast growth of information technology and concurrently that of the banking services has triggered a great competition in the market. Electronic banking has been effective in transforming the lives of consumers and changing their expectations (Havasi et al, 2013).

The evolution of e- banking relates closely to the neo-classical economic theories of market functioning. It provides complete transparency of the markets enabling the consumers to compare and analyse the different banks. It helps them in making their choices regarding their banking partners.

Turner (2001) asserts that information technology has been an effective factor in cutting down the cost of the processing information. Internet has influenced the core of the banking industry (cited in Nitsure, 2003).

With the rapid increase of e-finance, completely innovated methods of offering financial services like internet banking and other technologies have fused in the financial systems (Rusu and Sehn, 2012).

Technological developments have widened the modes of communication between the clients and the banks. New services like home banking, internet banking, phone banking etc. are being integrated within the banking system (Chovanova, 2006).

The efficiency of the banking transactions has witnessed remarkable upgrading in terms of accuracy, time saving and reduction in operation cost, enhanced customer contentment, attractive services and innovative products and techniques. The innovative technology works in different forms:

“Electronic fund transfer within the bank branches and between the worlds’ banks; use of internet banking service and application; telephone and mobile banking; ATM services; and cards payment system including debit cards, credit cards, smart cards, point of sale cards, and magnetic cards” (Sabri, 2008, pg.68).

These services enhance the performance and competence of banking systems in the global economy; however, their applications are not very popular in the Arab economy, as people tend not rely on internet and ATM services. In case of accessibility, only few customers are inclined towards its use.

The reasons may be many: customers’ ignorance, unawareness of banking management and lack of support, dearth of infrastructure related to software and hardware and security reasons (Sabri, 2008). Few banks are imitating innovation, but they lack in having a personalized association with the customers. Further, the so-called convenient delivery channels have produced a conflicting and incoherent experience for the customers.

It has become necessary to find ways to understand the customers’ experience to determine the factors leading to positive outcomes and to realize the complexities that have arisen by these new delivery channels in banking.

The chief challenge before the retail banks today, is to be competent enough to make a distinct ranking in the highly productive and competitive market place. The banks need to focus on the varying requirements of the customers’ depending on their duration of association with the bank, their nationality and preferences related to products and services ( World Retail Bank Report, 2013).

Furthermore, they need to improve the traditional measures of operating in view of the expectations of the customers and their channel preferences. These attempts would enable them to have positive experiences in the desired areas (Sohrabi et al, 2013).

The global CEI index, 2013 observed in their worldwide survey that delivery channels and specifically the mobile channels play a vital role in making the banks distinguishable and magnetic for the new customers and retain the old ones in the competition.

The survey revealed, “The mobile channel is currently perceived as less important than traditional channels, but is rapidly gaining in customer usage, as well as in the importance and satisfaction that customers associate with it.

In order to use channels as differentiators, banks need to focus on building capabilities to deliver the right products through the right channels, and to deliver a consistent multi-channel experience to customers” (World Retail Banking Report, 2013, p.5).

According to Prahalad and Ramaswamy (2000), there have been abundant researches on the subject of increasing customer inclination towards e-banking in different contexts at the global level, however, the Middle East markets are lagging behind in this respect. Banking institutions are constantly engaged in applying diverse techniques to offer substantial services to their customers, but making these services widespread over the internet stimulates risk.

Wells Fargo bank set an example in this respect when it had to experience unfavourable consequences after enforcing PC-based services on their customers.

The newly introduced PC- based banking system did not yield much success due to customers’ dissatisfaction and caused a great loss to the bank (as cited in Kassim and Abdullah, 2006).

Hence, it is essential for the banks to provide diverse environments to their customers to increase their active participation in the e-banking processes (Kassim and Abdullah, 2006).

It is vital to consider the generational differences in the process of planning new products. The primary focus of the present day financial market is GEN-Y that lives a vibrant lifestyle upheld with basic financial products like cards, internet and mobile banking, loans etc. Unlike Generation X, they are not keen on investment or retirement products. Therefore, products should be designed according to their personality, mind-set and standard of living (Are Banks Ready for the Next Generation Customer, 2010).

The competition among financial institutions has led them to rethink about their strategies regarding customers’ satisfaction (AL-Smadi, 2012). In view of the mounting expenses on appropriate infrastructure and declining product margins, the institutions are compelled to make changes in their ways of operating and measuring success (King, 2010).

Almazari & Siam (2008) mention that electronic banking services are such facilities through which banks are constantly trying to offer easy, open and satisfactory services to their customers and remain at the forefront in the competition (as cited in Hamid, 2012).

Research Problem Statement

The present research is based on the context of e-banking services in Qatar, a small country with abundant natural assets. In spite of adopting different measures to generate value for the customer, banks in Qatar have not been able to get the majority of customers oriented towards e-banking. The electronic services are of no use if the customers do not realize the importance and implication of using those services (Jonsson & Hagg, 2009).

Customers disinclination towards e-banking is chiefly due to security and privacy and trust related issues. Hence, it is mandatory for the banks to implement exclusive services to sustain existing customers and magnetize the new ones (Yousafzai et al., 2005).

Electronic Banking services lag behind in their realization in Qatari banking sector in comparison to other global players. Additionally, companies are still looking at electronic banking services as a short-term strategy. Due to unforeseen technical hitches and blocks in e-commerce network at this time, few banks embrace the long-term benefits of investing in electronic banking services.

The need for greater customer satisfaction in the case study bank necessitates more research into the area of electronic banking services. Therefore, this research is focused on finding the reasons that are responsible for keeping the popularity of electronic banking services at a low pace in Qatar.

It would attempt to find the solution with respect to the technology to organize e-banking services, computerize, and bring the sales into line, improve marketing services and customer services, and provide technical support in the e-banking sector.

Aim of research

The main aim of the research is to increase active customer base for electronic banking services in the case study bank by developing proper technological applications and strategic campaigns in their mobile banking platform. It also concentrates on surveying different methods that the best banking institutions are adopting to improve customer satisfaction.

Further, the study focuses on customers’ perception about e-banking and the quality of e-banking services offered by the banks and the restrains in achieving customers’ satisfaction. It will help us to enhance our vision towards improvement in the desired areas.

Research Hypothesis

Customers’ perception and experience about e-banking services works as a deciding factor in increasing the number of its active users in a bank.

Proper technological application and strategic campaign will provide the case study bank with a framework for sustainable electronic banking services.

Significance of the Research

In Qatar, research on electronic banking services is still in its infancy stage. Among fifteen existing banks in Qatar, seven are under Qatari possession, seven are from foreign origin, and one specialized bank is under the possession of Qatar government. Out of these fifteen, the majority of the banks are operating 24-hour and seven days a week.

These banks provide convenience in managing an account with the help of internet, telephone, or ATMs. Consumers are more interested in finding an extensive range of products and efficient channels that are easy to use. The increasing competition demands that these services are offered at comparatively lower costs (Kassim, n.d.).

On the other hand, banks are yet to learn about the different platforms available to them that offer various electronic banking services. This research will assist the case study bank and other banks in the State of Qatar to implement electronic banking services effectively by preparing a framework for their strategies.

It will be a set of best practices prevalent in the top banking institutions regarding e-banking services. The study will also assist banks to know how they can effectively manage their customers’ data in order to learn extra information about them.

Limitations of the Research

As mentioned earlier, insufficient information exists concerning the electronic banking services in Qatari banking industry.

The present study will not be a magic bullet in the electronic banking service proposal; however, it will only provide structures that must be combined with the values and goals of a bank for enhancing the utilization of e-banking services. Furthermore, the capabilities and resources available to an institution will determine the success of their initiative.

In view of the slow pace of e-banking services acceptance in Qatar and especially in our bank, I feel the need to introduce adequate innovative and productive strategies to facilitate e banking and attract more customers to my bank.

The Dissertation Is Presented in the Following Parts

Introduction: Introduction part provides an overview of the topic and related developments in the field. It also proposes the need for further research and strategic development in e-banking sector in Qatar and the case study bank in particular.

Literature Review: Literature review offers a more comprehensive insight into the subject of e banking. It presents an overview of different researches and studies done in this field and the prevailing trends related to e-banking in Qatar.

Methodology: This chapter presents the details of the study conducted to discover the innovative strategic approaches for increasing e-banking customer base in the case study bank.

Reflection: This chapter reflects how my research has an impact on the customers as well as employees of the bank and how it has affected me personally.

Recommendations: This chapter provides some suggestions that can be used for the appropriate implementation and development of e banking services in the case study bank.

Conclusion: This part of the dissertation summarizes different aspects related to e-banking discussed in the dissertation.

Defining the Terms

E- Banking

E-banking refers to the banking process in which customers can connect to their banking website using their personal computers or browsers. In this system, banks operate with the help of a web supported central database.

The physical identity of the bank’s branches is taken away once they are linked through satellite links and lead to limitless entity allowing banking at anytime, everywhere in the world and in several manners. Therefore, “e-bank is the electronic bank that provides the financial service for the individual client by means of Internet” (Vyas, n. d.,Para 3).

Functions of E- banking

The primary functions of e-banking services are as follow:

- Enquiry about the details of account information including balance in the account, detailed chronological credentials

- card accounts transfer in the same city

- fund transfer between personal bank saving account and personal capital account in the securities company

- dealing of foreign exchange and enquiry about the dealing

- B2C communication regarding the payment feedback

- Services like modification in the login password, particulars of the Credit Card and client’s information, closing or remove certain cards

- report of losses like Credit Card or passbook in the local area (Vyas, n. d.).

Benefits of E-Banking

Like the other financial sectors, banks are also adapting to information technology to elevate their efficacy, service excellence and draw new customers. According to Al-Sukkar & Hasan(2005), customers are preferring to use online banking since it is cheaper, does not require paper work and is almost error free ( cited in Havasi et al, 2013). Thronton and White assert that e- banking reduces transaction costs and provides a lucid course of processes.

E-banking has benefitted the consumers by offering 24/7 hours accessibility. Increased availability and accessibility to banking through e- banking has reduced the expenses on branch networking and staffing. Different options for channels of distribution will decrease the number of customers visiting banks and thus reducing the crowd in branches (cited in Havasi et al, 2013).

Qatar, like the other developing countries in the Middle East presents a typical portrayal of a socio-economic system that is predominantly influenced by its culture and religion.

The nation is still in the process of learning the use of E-Commerce as a large number of people and businesses are not proficient in using computers and information technology.

A significant number of banks and utility companies have developed their web sites to introduce extensive range of services to their clients (Qatar Investment and Business Guide, 2012).

Challenges in utilizing E-Banking

United Nations report (Conference on Trade and Development, 2002) has recognized some common challenges that the developing countries come across while utilizing the e-banking services. These challenges may pose a threat in achieving the utmost benefits of e-banking services.

Implementation of global technology to local needs

It is essential for the developing countries to build adequate infrastructure and develop human capacity for the satisfactory implementation of a global technology like e banking. The Society for Worldwide Interbank Financial Telecommunications review on its migration plan to internet revealed that developing countries lack in sufficient infrastructure for e- banking.

Further, insufficient working capital and lack of technical proficiency is a barrier in carrying out their migration plan related to internet in developing countries. Widely used e-payment system also is not successful in many of the developing nations due to lack of trust on the part of the consumers and corporate and inaccessibility to the required infrastructure for dealing out e-payments.

Public Support for e banking

It is important to fortify public support for the advancement of e-commerce in developing countries. Cooperation between the private and public sectors has contributed to successful e-finance initiatives in the developing countries. Public and private sectors and multilateral organization such as World Bank can make collaborative efforts to foster public support for programme related to e-finance.

Regulatory and institutional framework

For impeding the progress of the e-banking services, it is necessary to establish regulatory frameworks, build trust, safety and privacy standards. It is necessary to build high trade barriers, provide customer and investor protection for successful e-banking initiatives.

Enabling SME’s towards e-banking

To motivate the small and medium scale industries towards e-banking, quality data and banking information should be made easily available and accessible for them (Nitsure, 2003).

Influencing Factors for E-Banking

Technology is a significant aspect of economic development that brings innovative amalgamation of labour and capital. Developing countries do not experience widespread technological growth. The use of technology remains concentrated in urban areas of the country.

The effectiveness of substitute delivery channels depends on the availability of options to clients. In case of inconvenience experienced in the bank branches, they may look for alternate delivery channels. The complexity of the financial system also affects the use of complementary delivery conduits.

For instance, clients may look for online banking or mobile banking for basic payment services or simple fund transfer, whereas they may not rely on these for complex services like applying for mortgage or seeking life insurance and go for branch-based services in such cases.

Moreover, demographic features relating to financial and technical literacy also influence the clients’ approval to e-banking. Customer behaviour related to a particular market function affects product plan, deliverance and consumer support. With e-banking clients may need orientation and a variety of customer service alternatives like call centers, ATM attendants at busy sites and retail agents.

Customer education is a significant pre-requisite for establishing e banking. It is important to adopt special measures like, trained attendants for ATMs and call centres with ample staff, while introducing such novel technologies in the areas where literacy levels are low.

These efforts would assist the clients in learning the procedures, provide encouraging preliminary experience, and instil faith in the innovative approach making them self-sufficient for upcoming transaction.

Apposite national regulations and financial infrastructure is mandatory for the success of e- banking. International experiences may be useful while constituting national regulations. National authorities and private sectors should cautiously implement these regulations.

E- Banking creates many legal and policy related doubts that require easy and quick explanation. E- Banking and e-money easily surpasses the national borders, hence, crucial issues related to international cooperation on standards, security and monitoring require consideration.

Emerging problems like criminal abuse of pre-paid cards, risk of money laundering and terrorist financing also need to be handled (Isren, 2008).

Literature Review

In this section of the study, an examination of the relevant histories, strategies, methods of customer engagement and other related topics will be examined in order to create a better idea regarding what potential strategies have been implemented and how they can be improved upon in order to create a better method of consumer engagement.

It is based on this that various literary sources delving into the differences in the adoption of financial tools and resources by various consumer demographics (i.e. Gen Y, Gen X, Millennial, etc.) will be examined to determine how different types of consumers respond to the assortment of strategies implemented by banks to encourage spending, deposits and electronic methods of transaction.

As such, this section should be able to clarify such concerns and will act as the framework behind understanding how particular types of banking instruments will be adopted by a diverse array of possible consumers.

The early 1990s witnessed significant financial reforms leading to the development of a strong and efficient financial industry. Banks realized that Information technology was an ideal tool to upgrade their customer services. Technology presented various delivery channels to facilitate the consumer with lots of options. To influence the consumer behaviour, banks need to be aware of their customers’ outlook towards technology in common.

Stranberg et al (2012) asserts that globalization and developments in the realm of information technology have intensified interbank competition (as cited in Mircholi et al, 2013). According to Abdullah et al (2011), banks are forced to offer eminent services to their customers for attaining success and stability in the competitive environment (as cited in Mircholi et al, 2013).

In view of the inevitability of higher customer satisfaction, there has been an urgency to study the correlation between service quality, satisfaction, and behavioural outcomes in past few years (Yavas et al, as cited in Mircholi et al, 2013).

With the increased complexities of market trends and the changed competitive environment, banking institutions need to focus on the customers’ needs and develop strategies that would provide them simple and convenient, time saving and comprehensive banking procedures.

It is also helpful to refer to the strategies taken up by other industries in the same field and their repercussions (Catalysts for Change: The Implications of Gen Y Consumers for Banks 2008).

Banks have been using mobile banking software for 2-3 generations. Initially, the services were based on the online banking systems of the banks, however, now all banking services are available through mobile such as enrolment in mobile banking through phone or tablet. Mobile banking has emerged as a global business (Groenfeldt, 2014).

Information and communication technology has paved the way for electronic media, internet and mobile phones in almost every aspect of our lives. Mobile phones were thought to be luxurious items, solely utilized by the people of developed and wealthy nations of the world, until a few decades ago.

However, today it is accessible to the people living even in the remote areas of Sub-Saharan Africa, Latin America and Southeast Asia. Moreover, cell phones today are performing multiple tasks beyond phone calls and text messaging.

Along with internet access and social networking uses, mobile phones are being used for banking purposes providing a new dimension to information and communication technology. These are also providing new capabilities to the people with respect to the financial transactions and other services (Graham & Nikolova, 2012).

Expansion of M-Pesa in Africa exemplifies the innovation in this field. In Kenya, the use of M-Pesa has reached up to 70 percent. It is also gaining grounds in many other countries including Tanzania, Egypt, South Africa and Qatar. Mobile apparatus are considered a better option to substitute payment cards.

According to Bloomberg Business week, Chinese savers can easily manage transaction of funds from a bank account to the money market mutual fund using their Smartphone. The Hana Bank in Korea, in this regard, takes another initiative by replacing the paperwork for various loans with Smartphone. Hana Bank claims that it credited $4 billion through mobile banking without making the applicants visit the banks (Groenfeldt, 2014).

According to Philip Lu, (vice president, Knowledge Management Centre of Market Research and Management, Well Fargo) the mobile device will be the basis for raising a banking connection with the Generation Y. Gen Y are most occupied with mobile banking.

Hence, it is important to develop a mobile strategy enabling them to have different options for paying with the smart phone such as making payments by text, through the browser and the mobile app and at the time of sale. For the successful implementation of the mobile device, it is essential that the mobile user experience is modified as per the quality of the mobile device (Smartphone or a tablet).

It is necessary to make these services easily available so as meet the expectations of the Generation Y. Most importantly, banks require incorporating the solutions and products into wallet-based solutions. He says that the Gen Y are concerned about their finance and eager to use the PFM tools. Banks are also required to tap into social media networks to be associated with Gen Y customers (Camhi, 2014).

Gen Y is becoming the focus of several banks, as it is emerging as a prosperous and strong customer segment. According to Javelin Strategy and Research, “the group has more than 70 million members, second in population only to the 80 million Baby Boomers, and boasts a collective income of approximately $1.89 trillion” (n.g. 2008, pg.3).

Hence, it is important to maintain a positive and long lasting bond with this group. It is essential to review the strategies relative to dimensions of channels, products and marketing while focusing on the demands of this vital segment of customers.

These strategies would require a comprehensive knowledge of the values that influence the requirements and preferences of these consumers (Catalysts for Change: The Implications of Gen Y Consumers for Banks, 2008).

The financial institutions need to utilize a fundamentally innovative strategic approach to meet the distinguishing needs of the Gen Y consumers. The Gen Y is surpassing the older generation in terms of online banking convenience, confrontation with the conventional marketing and environment related considerations. Hence, it is important to visualize their requirements in view of larger market benefits.

One example of a remarkable strategy for the development and marketing of services is set by ING Direct. Simple and practical approach is required while aligning products with Gen Y. These products should be less complicated and easy to practice.

The overall product strategy will catch the attention of the Gen Y, if it exhibits commitment towards the benefits of the broader society. Gen Y is more attracted towards the products that signify social benefit. Banks require having the expertise in making the simpler things more distinctive and stimulating.

Joining the bank products and services in other industries together such as entertainment or retailing would enhance the banking experience of the users. The Robo bank in Netherlands presents an appropriate example of such banking initiative. The bank started the MiniTix scheme, which enabled consumers to pay through their mobiles for online TV content. It enabled the users to pay by SMS or mobile Internet for online and TV content.

It also offered scenario for monetization of the growing retailing prospects through Internet. Such facilities attract the younger generation or Gen Y- Robo bank has worked innovatively in this connection and is incorporating different experiments in various fields for payments such as supermarket, cinema ticketing, and school fee frequently.

This initiative is a fine example of the product development under controlled experimentation and suggests usefulness for Gen Y. Robo bank is the pioneer in combing mobile banking with striking calling charges in Europe that enables the users to have unlimited access to mobile internet for a fixed price.

“Robo bank has targeted Gen Y, hoping to differentiate itself from its competitors, with its simple to use, affordable and practical mobile banking services and an operating model that supports the product approach” (Catalysts for Change: The Implications of Gen Y Consumers for Banks, 2008, pg.14).

However, the bank’s strategy for attracting the Gen Y customers also visualizes the increase in the overall number of customers across all generations (Catalysts for Change: The Implications of Gen Y Consumers for Banks, 2008).

According to a research conducted by the Forrester’s research Gen Y is very prompt in switching the banks. Hence, it is wiser on the part of the banks to offer them personalized services like “opening accounts online or on mobile and funds transfer online as they spend so much of time online.

Gen-Y is ready to pay premium for services that are available round the clock, anywhere, easy to access and quick to use” (Are Banks Ready for the next generation customers, 2010, p.17). Hence, it is crucial for the banks to adopt and implement the most up-to-date technologies and improve their performance for greater customer satisfaction.

Keeping in mind the status of their consumers as multi channel users, banks should focus on creating integrated experience across channels. Banks need to produce appealing offers to magnetize Gen -Y for making them visit the branch.

The idea of applying for premiums online and distributing in the same manner would provide convenience to the consumers. Moreover, the consumers are enabled to confirm the premium data on their mobiles. These advantages attained through e banking may enable the banking institutions to attain popularity among customers and innovate further in capitalizing on these channels. (Are Banks Ready for the next generation customers, 2010).

In view of the developing financial concerns of customers in the United States, the Cisco Internet Business Solutions Group (IBSG) carried out a study involving a large number of consumers to review their service expectations and communication choices with the bank. It was identified in the research that Gen-Y’s cherish a positive outlook towards latest technologies such as online networking.

The survey revealed that the younger generation would affect the retail-banking sector profoundly in the years to come, leading to enhanced revenue growth. Cisco IBSG deduces that “banks can increase revenues 5 to 10 percent by delivering next-generation advisory services that utilize personal financial management (PFM) tools, video, and virtual communities of interest” (Top ten reasons young consumers will transform retail banking, 2010, Para 2).

Jibun Bank in Japan initiated the utilization of cell phones for providing their products and services to their customers. It initiated the concept of internet shopping and auctions at any time across the world and recorded a striking boom in customers’ accounts reaching up to 500,000 within 8 months. Use of social media has been useful for making the banks more popular in the community.

The United States exemplifies this change appropriately. In the U.S., Facebook has offered a distinctive online service recently that enables the users to transfer funds between themselves. Using social media for constructing online communities with the present users and attracting more users has become a promotional strategy of many of the U.S. banks.

The U-Bank in Australia presents another example of social media inclusion in banking services. The extensive social media involvement in the form of Facebook has offered vibrant experience to the consumers. Further, blogs and other useful approaches intended to provide enhanced customer experience in this connection.

U-Bank hosts pages on market research on its Facebook site. It also provides saving guidelines to the consumers and welcomes customer feedback on this site. Moreover, it allows debate and provides You Tube videos (Are Banks Ready for the next generation customers, 2010)..

Various innovative payment platforms through mobiles have emerged recently. A newly introduced mobile payment platform Boku is becoming popular e-banking service around the world. “The San Francisco-based startup has secured $40m in funding since it was launched in june2009, and it now operates in 67 countries, working with more than 240 carriers across 40 different currencies” (Sawers, 2012, para14).

Boku allows people to pay online with their mobile number. It minimizes the efforts made in entering the long credit card numbers for every purchase on the web. The charges reflect on their mobile phone bill. Boku also developed software for merchants in this regard.

Later, the white –label Boku Accounts platform was developed through which the Mobile Networking Operators (MNO’s) made it possible to provide a branded mobile payment account to the users. This account is accessible through mobile devices such as Web, Android, iOS etc. enabling the users to “make payments online, in-app and in-store through a branded debit card or NFC- enabled POS” (Sawers, 2012, para16).

PayPal has been in active use for a long time now. This system allows the users to transfer money between themselves or to pay for supplies electronically.

However, it is not a bank in traditional sense, but it is like a digital debit card that avoids the process of entering the lengthy card number every time for purchasing something online. It reduces the task of monitoring balance in one’s account as in case of insufficient funds, it is connected to the debit card which is connected to the current account.

Though, online banking has gained a vital position in the Qatari financial institutions, there are still few companies that do not want to adapt to this innovative functional approach. Their outlook, regarding the new technology may hamper their growth in this competitive environment.

By not providing e-banking services, they may not be able to serve their customers with reduced operational costs and strengthen customer retention.

Banking trends in the Middle East are suggestive of the fact that customers satisfaction is largely associated with technological progress and demand for improved services has led the banking procedures to be less associated with branch access and more with 24/7 availability (E-banking to sweep Middle East, 2002).

Electronic banking transactions are still in their developing stage in Arab countries.

“The investments in technological infrastructure and application of these technologies in the financial services industry have been considerably slow partially due to public information policies in the region that restrict access to certain sites”(Moody’s report, 2002 as cited in Grais and Kantur,2003, p,11).

SunGard, a technology company, revealed in its survey that 43% of the customers in Qatar thought that mobile banking services require improvement and 51% customers acknowledged that the online banking services should be upgraded (Ryman, 2013). According to the Internet World stats (2005), only 21.5% of the population in Qatar is using internet. The requirements of customers are rising and shifting because of increased educational level and mounting wealth.

Customers are looking forward to attain a wider range of services and facilities that can be achieved by utilizing more efficient and convenient channels at more viable prices. Through internet, customers can actively converse with the makers of product and service providers. It becomes crucial for the banks to provide more customized products and improved services to the customers.

However, banks are struggling hard to magnetize larger number of customers to their services and sustain their position in this ever-growing competitive environment. Qatari banks are determined to provide better services and opportunities to their customers through e banking.

Mashreq Bank base in Qatar has been awarded with the title of the Best Internet Bank for the year 2013. It is operating since 1967 and is among the best financial institutions.

It provides simple and easy to use apps and facilities like ATM locator, credit card summary facility, trouble-free fund transfer facilities, bill payment and further online services to its consumers (International Finance Magazine Announces Financial Award Winners for Qatar 2013, 2013).

Kassim and Abdullah (2006) revealed in their study that trust and attraction play a vital role in determining the use of internet banking in Qatar. They found that banks need to attract customers towards online banking by including certain innovative and interesting models into their banking processes.

Moreover, extensive communication displayed by the banks has greater impact on customers’ inclination towards internet banking. They also recognized the significance of creating easy, interactive, trustworthy, confidential and safe internet banking system for customers (Kassim & Abdullah, 2006).

So this literature helps in finding out the needs of the banks’ customers and discusses on improving e-banking system through various advanced modes which can help the banks customers in accessing e-banking channels easily. Information technology has offered a variety of delivery channels to facilitate the consumer with lots of options.

To influence the consumer behaviour, banks are required to be aware of their customers’ viewpoint towards technology in common. To achieve higher customer satisfaction, there is a need of studying the connection between service quality, satisfaction, and behavioural results.

Banks need to focus on the customers’ needs and develop strategies that would provide them simple and convenient, time saving and comprehensive banking procedures in this competitive world. Along with internet access and social networking uses, mobile phones are also being used for banking purposes. They are also providing a new dimension to information and communication technology.

Gen Y is most occupied with mobile banking. Hence, it is important to develop a mobile strategy enabling them to have different options for paying with the smart phone such as making payments by text, through the browser and the mobile app and at the time of sale. For the successful implementation of the mobile device, it is essential that the mobile user experience is modified as per the quality of the mobile device.

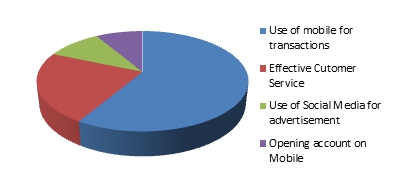

The following diagram shows the expectation of Gen Y. All different parts of the pie show different expectations of Gen Y:

Methodology

This section will provide an overview of the methodology and the data collection tools used in doing the case study of Commercial Bank of Qatar in view of increasing active customer base of electronic banking services in the bank.

The present research is a qualitative as well as quantitative analysis of the effectiveness of e-banking services in Qatar. It uses a descriptive survey design to investigate if employees as well as customers of the bank are comfortable with the currently used e-banking platforms and what they like or suggest having in e-banking. The findings provide a detailed analysis of the data from a given population to determine the status of e-banking.

According to Dawson (2009), it is important to know the difference between qualitative and quantitative methods before research methodology starts (Dawson 2009, 1)

Qualitative research involves subjective data. Dawson (2009) mentions that qualitative research focuses on behaviour, attitude and experience through methods like interviews. Since attitudes, behaviour and experiences are very important so this kind of research tries to get in depth feeling and opinion from the people who participate in the interviews.

Quantitative research is a pragmatic approach used for research purposes. The quantified data is captured here. It involves objective data. Collection of large data has encompassed the use of questionnaires as well as structured interviews.

According to Dawson (2009), quantitative research aims to target more people and connecting with people. He further mentions that this method is much quicker than it happens in qualitative research. Both the researches need skilful, trained and experienced researchers.

According to Veal (2005), the following are some traits of the qualitative approach:

- This method aims that the researcher understands the personal experiences of the participant in depth.

- It mainly aims at people’s understanding instead of focusing on external causes.

- It helps the researcher to understand the research issues form the point of view of the participants.

- It examines personal changes happened in a period of time.

- It focuses on human-interest issues

Research Methodology

This part of research deals with research methodology that was employed in conducting the study. It, therefore, covers the research locale, research design, target population, sample selection, research instruments, conducting, reliability of research instruments, validity of the research instruments, data collection procedures, data analysis, and reporting.

The research methodology used in the study is the mixture of qualitative as well as quantitative research methods. By using this mixed methodology, the hypotheses of the research questions can be measured, determined, and analysed. The method also helped in determining the quantity and consistency of results. The method contributed in determining the satisfaction of the employees and the customers of the bank for e-banking system within the bank.

The method used is a descriptive representation of the phenomenon and the collect of quantifiable data that can be statistically verified and analysed to measure the effectiveness of the whole research.

Hence, the qualitative research technique was used as it was concerned with the quality of the data. This research technique uses in depth interviews for exploring the better view of the situation. It also intends to know about the understanding of people relating to a particular subject or institution.

Moreover, the survey provided important statistical quantitative data to compliment and confirm the findings presented by qualitative data.

Qualitative research is done with an aim to improve quality and is often considered as ‘Motivational Research’. It also focuses on people’s opinion about particular subjects or institutions.

The statistical survey provides standardized information about the research subject. It is a well-organized way to gather information regarding the understanding of a subject by a large number of respondents. For the purpose of this study, Likert scale, a bipolar scaling method, is used to construct the questionnaire.

Likert scale is used to construct questionnaires to get psychometric replies from the people. It aims at obtaining the degree of agreement or knowing the preferences of the respondents. These scales do not use comparative techniques, but rather evaluate a single feature. The level of agreement has to be shown with the statements in an ordinal scale (Bertram, n.d.).

The Likert Scale is an easy to use system in the surveys. It can be in the form of self- completion questionnaires or can be given as a self-completion part of survey, administered by an interviewer (Brace, 2008). In this system, participants show their agreement on any statement by using different scales.

Likert scale system uses five-point scale system where the respondents have to pick any one option from the given five points. Before the final distribution of the questionnaire, a test research was carried out. For this purpose, 10 copies of questionnaire were sent randomly through email.

The aim of the pilot study was to make sure that the questionnaire is easy to understand to the participants. Then the questionnaire was sent to the sample selected for the research.

The design is best suited for this study. The rationale behind the choice of the design is that it studies individuals or objects as whole units and not in parts. The design also investigates tunnel environmental conditions in depth with a view of understanding it more broadly.

The purpose of the study is to study how to increase active customer base of electronic banking services in Qatar bank. Quantitative research methodology is used because data (perceived effectiveness) being tested in this study was through various sources which support it.

The study is guided by the actual data collected from the respondents, and the purpose of the study is to analyse them. Such worldview requires the analysis of the strength of the facts and comments.

This worldview entails a systematic procedure and structure in the research process because it follows a rule-bound approach, which meant that this worldview made use of surveys, content analyses, field experiments, and other assessments that will collect verifiable data (Philimore & Goodson, 2004).

The worldview also entails the focus on data that will reveal trends, patterns, and statistical relationships. A quantitative research methodology will also be used because the method will utilize open –ended questions as well as close questions; pre-determined approaches, and numeric data (Creswell, 2003).

According to Ross (1999), the quantitative method is more frequently associated with using surveys, which entails studying a large number of subjects that is drawn from a specific population. The research design for this study will employ the use of survey questionnaires and analysing data gathered from the respondents.

The study involved the use of the questionnaires. These were prepared in advance, and the questions were reviewed to find their relevancy in the concept being investigated. The language used in the questionnaires was relatively simple, which enabled it to be understood easily by the research subjects.

There were some short answers type questions too where the participants had to choose just one answer out of five options.

Population and Sampling Procedure

The population of interest for this study is 20 people working with different banks including Commercial Bank of Qatar. A large no of participants is used in the sample. Since this is a descriptive design, sampling is a significant process because of the need to obtain an accurate representation of the population (Heck, 2004).

Instrumentation

Survey questionnaires were used as the research instrument. The survey was conducted in three ways- a face to face interview, a telephonic interview and through emails. In a face to face interview, all the participants were provided with survey questionnaires in order to determine their perceived level of explaining their views on e-banking platforms and their suggestions for e-banking system.

The survey instrument was based on the general type of questions related to their understanding about e-banking and its system.There were two types of questions open-ended and closed, targeting different groups from different banks.

In a telephone interview similar survey questionnaire was used. Normally telephonic interviews are avoided in the qualitative research as the reliability of data seems not to be very authentic. Also there is much probing required.

Though the respondents feel comfortable through a telephonic interview yet, it is perceived that the quality of the data will not be very good (Novick, 2011). Two sets of the questionnaire were prepared recognizing the different levels of understanding of the situation by the employees and the customers of various banks including Commercial Bank of Qatar.

Reliability

The data collection method that was used needed to be clearly defined and described; in terms of the how instrument has been tested and validated by past studies (Sunderman et al., 2004).

The strategy for obtaining good measures for the study involves upholding the relevance and appropriateness of the study for the data collected and the purpose of the study. Thus, the instrument section clearly defined the processes for this method, which will enable future researchers to duplicate the study.

In order to uphold the reliability of this study, the participants were selected according to their various types of nationalities. The questionnaires targeted people from different banks as per the setting of its questions.

Data Collection Procedures

The dissertation captured both primary and secondary data to get proper answers of the research questions. For this study in depth interview was chosen as data collection method. The questionnaire was used for in depth interview. The survey took place at the participants’ work place so they could feel relaxed and comfortable and could answer the questions with their full thoughts, experiences and feelings.

According to Kinnear and Taylor (1979), “In-depth interviews may be defined as an unstructured personal interview which uses extensive probing to get a single respondent to talk freely and to express detailed beliefs and feelings on a topic with little directional influence from the researcher” (as cited in Research Methodology: An Introduction, n.d.).

Each participant was asked 4 open ended and 6 close ended questions. Every question was explained by the researcher to make sure that the respondent understood the question and was comfortable to answer. This survey lasted for half an hour.

Primary data is composed through direct practice. First the researcher gets some insight of the issue by collecting secondary data then primary research is conducted. This process involves many forms such as questionnaires, direct observation and telephonic interviews.

Secondary data is an available data and it is collected by others. Secondary data is time saving which one could spend while collecting data. It gives bigger and better data. If any researcher could try to collect on their own, it could be expensive for him.

The main advantage of using secondary data is that it is obvious that background work like literature reviews, any case studies etc have already been done. Uses of texts and other statistics have been done and personal contacts have been consumed. On the other hand, there are some drawbacks to the fact that the researcher is not able to check the data face-to-face so it is difficult to check the reliability of the data.

It was planned how to reach the people for collecting data. The locale of the study was conducted in various Qatar banks. The choice of location was based on how accessible the organisations were to the researcher based on Singleton’s (1993) argument that the ideal setting for any study should be easily accessible to the researcher.

The target groups for this research were the employees as well as customers working with different banks. A sample that is fully representative of attitude and views of people that use e-banking was selected. Sampling is a technique used by researchers to gather information. It involves selecting individuals or objects from a population or a group for study. The main research instruments to be used in this study were questionnaires. In this case, three sets of questionnaires were prepared for the target groups. These questions targeted many employees and customers of different banks.

After making the survey questionnaire, some people were approached directly but some people of any particular companies were approached through their banks’ administration department which would receive the questionnaire.

The test-retest method was used when one bank was selected. Printed copies of the questionnaire were distributed later. The questionnaire was given to the respondents to fill for a later scoring. The participants were given sufficient time to complete the questionnaire. After one week, the same questionnaire was given to the group for scoring.

Ethic Issues

The qualitative research has different ethical problem in comparison to quantitative research. The ethical conflict occurs in connection to how a researcher approaches a group and what kind of effect he may have on the participants. The main focal point of qualitative research is to define, explore and examine people their likely atmosphere.

Respondents were made aware of the purpose of the study, the researchers agreed not to reveal the identities of the participants and not to disclose their personal information for ethical reasons. All the respondents were made sure that their views on any questions would be kept confidential.

This was to win their trust so the quality of data could be good. A particular time frame of the survey was decided and it was determined that interview time would not exceed from the set time and the respondents would not be stressed except they themselves wanted time for answering questions.

Sample Questionnaires

Questionnaire for employees

Type A: Open Ended Questions:

- What authentication technique is utilized for e-banking in your bank?

- What measures have you taken for security?

- Have you designed any new products to generate more customers?

- What steps have you taken to attract generation Y customers?

Type B: Tick only one option:

Questionnaire for customers

Type A: Open Ended Questions:

- What benefits do you think e-banking brings to you as a consumer?

- What explicit services your bank offers you through e-banking ?

- Are you satisfied with the measures taken by your bank for the security and safety of your account?

- What difference do you notice in the e-banking and traditional banking costs? Which one is more convenient?

- What measures do you want your bank to take for improving its e-banking services?

Type B: Tick only one option:

Analysis and Discussion

Primary Research Findings

This dissertation presents the finding of the primary research. The primary research was conducted by designing questionnaires and those questionnaires were distributed among 20 participants. The participants were divided in two groups.

This division was based according to their status as an employee or as a customer of the bank. For 10 of the participants, the survey was conducted through their administrative department and also by sending them e-mails via their MS-Outlook account. This was done in order to facilitate a far more efficient means of data collection rather than going up to them personally and asking their opinions.

The remaining 10 people were interviewed through telephone and personally. This research was carried out to collect primary data. Different questions were formed to know the answers from different groups to identify if they were satisfied with e-banking system of their banks. Each participant was explained clearly each and every question.

The results of the interview are shown below:

While asking about the authentication techniques utilized for e-banking in the bank, some employees responded that banking activities are more sensitive than any other internet activities so advanced security standards are required. Normally there are two factors of authentication:

- The user knows his or her password, PIN or pass phrase

- The user uses his or her smart card or hardware token.

The most common method is user name and password but to make it more secure, the bank normally ask for OTP which is One Time Password.

The implementation of the authentication is divided as follows:

- A certificate based approach

- A one-time password approach

- A timer based password approach

- A certificate-smart card based approach

Some respondents mentioned mutual authentication techniques for their banking. This focuses on the connection between the user and the bank. It actually submits the idea that two parties are authenticating each other. In online authentication processes, mutual authentication is related to website-to-user authentication.

It shows that the user is using a valid banking website. In mutual authentication the customer is asked some questions and he or she chooses an image, its title and a text phrase from some collections of images. These images are provided by the bank when the customer enrols himself with that bank’s website. After first login the customer has the option of replacing the image from the one he chose at the time of enrolment.

When the customer enters login id and password the site asks some questions arbitrarily and after getting the answers, it shows image, title and phrase. If the image shown is right, the customer can log in. If the image shown is not right, the customer does not log in and customer can contact the bank.

This is a good way for the customer to know whether the bank site is genuine or fake. This technique between the customer and server is called mutual authentication and it helps in capturing the phishing cases.

Such images are one of the authentication features which can be provided for website authentication. These images actually stop the use of the website of the bank in an unauthorized way and protect the customers from being the victim of any phishing activity.

These images can be saved in three different ways:

- Images saved by the client,

- Images saved at server,

- Images can be separated in two ways- saving some at server side and some at client side and then mixing them by using visual cryptography

While asking about security measures taken by the their banks, some employees answered that first of all, while logging in the Online Banking Service, a secure session is specified by the URL. Also, Secure Sockets Layer Encryption Technology is used to encrypt personal information before the customer leaves his computer.

ATM card number or username and password are used to keep the data confidential. The bank suggests changing the password every 6 weeks. For security reasons there is time out session if the site is not used for 15 minutes.

The important question related to new products of the bank got useful responses from the respondents. They mentioned that new services like home banking, internet banking, phone banking etc. are being integrated within the banking system.

With the rapid increase of e-finance, completely innovated methods of offering financial services like internet banking and other technologies have fused in the financial systems.

Such types of new services are drawing the attention of customer and the bank is generating new customers with a rapid speed. Some employees mentioned that they wanted to have better modules that have the customer register himself or herself from A-Z without employees’ interference.

While asking about the steps taken to attract generation Y customers, they mentioned that banking institutions are constantly engaged in applying diverse techniques to offer substantial services to their customers and to attract more customers to the bank which especially includes generation Y customers. It is vital to consider the generational differences in the process of planning new products.

The primary focus of the present day financial market is GEN-Y that lives a vibrant lifestyle upheld with basic financial products like cards, internet and mobile banking, loans etc. Unlike Generation X, they are not (yet) keen on investment or retirement products. Therefore, products should be designed according to their personality, mind-set and standard of living.

They further mentioned that Gen Y is most occupied with mobile banking. Hence, it is important to develop a mobile strategy enabling them to have different options for paying with the smart phone; such as making payments by text, through the browser and the mobile app and at the time of sale.

While asking about the benefits of e- banking to consumers, some mentioned that electronic banking has been effective in transforming the lives of consumers and changing their expectations. Their life has become easier in terms of dealing with banks.

The customers do not have to go the bank and wait in a queue. They can easily get money through ATM machines. This being said, the majority of customers are looking for enhancing the electronic banking services and increased interactivity.

While asking the customers of the bank about precise services of their banks, they mentioned that they have the facility of opening accounts online or on mobile and can easily send money from one place to another. They have up-to-date customer services.

The customers showed their satisfaction for the security measures taken by their banks in e-banking. They believed that their accounts were safe with the bank.

While asking about the difference between e-banking and traditional banking cost, the customer said that the cost of e-banking was lower than traditional banking. They mentioned that e-banking is much more convenient than traditional banking.

For the measures taken by their banks for improving their e-banking services, a few customers said that the financial institutions need to utilize a fundamentally innovative strategic approach to meet the distinguishing needs of the Gen Y consumers.

What must be understood is that Gen Y is surpassing the older generation in terms of online banking convenience, confrontation with the conventional marketing and environment related considerations. Hence, it is important to visualize their requirements in view of larger market benefits.

Some of the customers were aware of the initiative taken by a Netherlands bank, which has adopted the method of mobile payments for online TV content through banks own micropayment systems called MiniTix. It enabled the users to pay via SMS or mobile Internet for online and TV content.

It also offered a scenario for helping entrepreneurs when it came to the growth of online retail through Internet. These services are appreciated by Gen Y since it conforms with what they need in terms of financial flexibility as well as various tools to help them with their various transactions.

Some respondents mentioned that the consumers are multi channel users so the banks should focus on creating integrated experience across channels. Banks need to produce appealing offers to Gen -Y in order for them to patronize various bank branches or the websites of the bank.

They should be enabled to apply and disburse premiums online. Moreover, they should be provided the facility of verifying the premium particulars on their mobiles. These advantages attained through e banking may enable the banking institutions to attain popularity among customers and innovate further in capitalizing on these channels.

A few customers were aware of the newly introduced mobile payment platform Boku, which is becoming a well accepted e-banking service around the world. Boku allowed people to pay online with their mobile phone number.

It minimized the efforts made in entering the long credit card numbers for every purchase on the web. The charges reflected on their mobile phone bill so these customers wanted their banks also to adopt such technology to enhance their banks’ e-banking services.

The employees data for e-banking service

Employee Perception of Electronic Bank Services

The above mentioned data shows that 50 percent of the employees said that using mobiles as contact-less payment instruments for executing small transactions is a good practice by banks. 40 percent of the employees showed their appreciation towards the facilities such as online funds transfers, online updates of stock prices and trading in stocks online. 10 percent of the employees showed their appreciation towards the technique of opening an account with the bank using their mobile phone or phone camera. 15 percent of the employees got agreed that using social media to brand the banks is a successful technique.

The Consumer Data for E-banking Service

Consumer Perception of Electronic Bank Services

The above mentioned data shows that 59 percent of the consumers said that using mobiles as contact-less payment instruments for executing small transactions is a good practice by banks. 23 percent of the customers were satisfied with the services like transfer of funds while travelling.

They confirmed that it is very useful to know the stock prices online. 9 percent of the consumers found it interesting to open a bank account with the help of their mobile phone. 10 percent of the customers agreed that using social media to brand the banks is a successful technique.

Combined Perception

Based on both employee and consumer perceptions surrounding improved bank services via electronic banking, it can be seen that both groups of research subjects unanimously agreed that increased efficiency in banking services as well as the general convenience associated with electronic banking and its various tools creates a greater desire for consumer patronage of that bank’s services.

It is the convenience and the flexibility provided through such tools that makes the lives of consumers and employees that much easier and helps to cut down on the “red tape” so to speak when it comes to conduction particular transactions. It is based on these observations that it can be stated that implementing electronic methods of online consumer transactions is definitely and effective means of increasing the amount of clients that a bank has.

Discussion

As stated earlier, the present research is based on the context of e-banking services in Qatar wherein in spite of adopting different measures to generate value for the customer, banks in Qatar have not been able to get the majority of customers oriented towards e-banking.

The electronic services are of no use if the customers do not realize the importance and implication of using those services. It was explained that the disinclination of customers towards e-banking is chiefly due to security, privacy and trust related issues.

Hence, it is mandatory for the banks to implement exclusive services to sustain existing customers and bring in new ones. Taking this into consideration, it was shown in the analysis section of this study that adoption of electronic services is possible for consumers within Qatar, however, what is needed is to enhance the overall convenience, accessibility and means by which proper security measures are implemented.

It was explained by both bank employees and customers alike that electronic services would make matters far more convenient and easier when it came to online banking, however, the main issue in this case comes in the form of convincing customers that adoption of such services is in their best interest.

As explained within the literature review section of this paper, consumers have different needs and preferences when it came to particular types of bank services. Gen Y for instance is more willing to adapt towards electronic based methods of banking transactions as compared to Gen X or the millennial generation.

This is primarily due to the impact that being born in a particular generation has on their predilection towards the adoption of different types of financial transactions. Some people merely prefer to do things “the old fashioned way” as compared to other consumers that prefer greater levels of efficiency and convenience when it comes to their methods of conducting banking transactions.

It is based on this that when it comes to promoting electronic methods of transactions, it is necessary to implement better means of targeted marketing. The reason behind this is quite simple, since it is Gen Y that prefers electronic transactions over their predecessors, then it should be this particular generation that the banks should target when it comes to their marketing campaigns that promote electronic banking via mobile phones.

By doing so, this creates a far more effective method of attracting customers to the bank as compared to implementing a broad generalized strategy that targets all possible consumers groups yet has a lower likelihood of getting the type of customers the bank wants.

As stated in the literature review, innovation in the type of products bank offers in the form of mobile transactions is an important facilitator of dynamic growth; however, what should also be taken into consideration is the fact that such growth needs to be tempered through the development of trust between consumers and the bank. This is where the data involving security in conducting electronic transactions comes into the picture.

It was shown both in the literature and in the data analysis that security in financial transactions is important for a vast majority of bank customers, especially Gen Y given their preference for online transactions.

As such, given this assumption and the need to develop trust between customers and the bank, it would be necessary for any bank in Qatar that is attempting to bring in more customers via the use of electronic methods of transaction to emphasize that their systems are secure and can be utilized without the customer having to worry.

By taking the burden of security off the shoulders of consumers, this makes them more willing to patronize the bank’s services resulting in a greater degree of trust, better community reputation which in the end brings in more customers as a direct result.

Conclusion

A number of features like customer service, competitive cost tools and demographic considerations are encouraging the banks to analyse their technologies, electronic commerce and internet banking approaches. It is expected by many researchers that there could be a fast growth in customers who are willing to use online banking services.

The banks are trying to enhance and modify their services to target Generation Y customers. To increase their active users, the banks are trying to adopt various practices and services used worldwide so they could satisfy their customers. Technologically, putting into practice, a web-based banking is challenging. If full advantages of this service are to be taken, then careful planning is a must.

Leading retail banks in Qatar have invested millions in establishing their internet banking system, however, despite its availability; the facility is largely unobserved and underutilized by the customers.

Hence, it is important to understand the reasons behind the restricted utilization of internet banking so that more efficient measures and service technology can be implemented for the appropriate utilization of e- banking services (Kassim & Abdullah, 2006).

Recommendations

Competitive approaches of banks for attracting more consumers to their services has compelled them to rethink about their strategies regarding customers’ satisfaction in the field of e-banking. Here are a few suggestions that may help the banks stand ahead in the competition:

- The success of alternate delivery channels depends on the availability of options to the clients. If the customers experience any inconvenience in the process, they may seek out alternate delivery channels.

- Customer education is a significant pre-requisite for the effective implementation of the innovative e- banking services. Clients may need orientation and a variety of customer service alternatives like call centers, ATM attendants at busy sites and retail agents.

- Banks should acknowledge the fact that the customer is related to the bank across each channel.The success of an institution is measured through its revenue, but knowing about the customers’ behaviour enhances our vision towards improvement and tells us why, and where we can do better (King, 2010).

Banks should acquire personal financial management (PFM) competency to enable customers to manage personalized recommendation on internet platform, and synchronized alerts, decision making and evaluations on mobile platforms.

Further, banks should think of establishing possibilities of communication with the financial services consultants over video.

Limitations

As mentioned earlier, this study limited itself to primarily distributing questionnaires to members of the urban populace within Qatar that had a direct interest with the local banking sector.

Aside from this, the research avoided an examination of the other states within the Middle East because of the necessity of having to create an even more expansive literature review and population examination that would go beyond the initial premise of this examination.

In relation to the data that was examined, the research primarily confined itself to a 5 year period starting from the present to 5 years in the past. This was done due to the technological limitations and consumer demographics that existed in the past wherein the current predilection towards convenience via electronically based methods of banking became popular only within the past 5 years.

Research Constraints

In terms of the social analysis, primary research has been conducted to fill some of the evolving gaps and to get a better insight into the matter.

Yet, it must be noted that the time constraint only allows structured interviews/questionnaire distribution with an unrepresentative number of people, and also a limited flexibility when conducting the interviews/distributing the questionnaires.

A general overview is therefore not possible, although the statements certainly add to the knowledge about utilizing technology to improve the overall rate of consumer patronage of a specific bank.

Study Delimitations

Overall, the data-collection process was very quick and did not present much in the way of significant obstacles however, some challenges were present in collecting demographic data because of the inherent limitations in data-collection procedures by the location utilized in this study. Such issues, however, were resolved through access to online academic resources such as the EBSCO database.

Relevant books were also included in the examination which helped to bolster the content of the study. Furthermore, information from various websites were also chosen as a means of guiding the study yet were utilized only as secondary sources of information due to the need to ensure proper academic veracity based on the type of sources utilized to justify the arguments utilized within the paper.

Recommendation for Future Study

It is the recommendation of this paper that future studies that will attempt to delve into this topic will examine the various methods by which electronic banking can be made easier for consumers.

This can come in the form of particular design choices for online applications, whether payments for bills and credit cards can be done by pressing just a single button on the phone and how notifications regarding pending bills and transactions can be sent to the customer without disturbing them.

It is expected that through the implementation of such procedures, a bank in Qatar will be able to sustain the momentum of attracting customers and having them patronize the bank’s services.

Reflection

While doing this research, my main focus was on knowing about the views of various participants about e-banking strategies and developments and also their suggestions for any new techniques. Since I am also a bank employee, I was keen to know about the competitive approaches of different banks for attracting more consumers to their services.

During my research, I came into contact with different employees and the customers of other banks and I gathered a lot of information about the techniques in their banks and learned about their various programs which they conduct for their employees and the customers.

I came to know that to ensure the successful adoption of e- banking services by the customers, banks need to focus on measures such as trained attendants for ATMs and sufficient staff in the call centres, while at the same time introducing novel technologies in the areas where literacy levels are low.

These efforts would assist the clients in learning the procedures conveniently and effectively. They would have an encouraging first experience that would instil faith in the innovative approach making them self-sufficient for an upcoming transaction.

I highly appreciate the contribution of all the employees and the customers in this study which helped me my research topic. I feel that the banks should think of creating innovate teams equipped with adequate competence and knowledge and draw the attention of employees from each department towards innovative approaches.

This whole research experience has taught me on how banks can attract customers if they adopt some innovative techniques especially in their e-banking system. Banks can take initiatives in building online financial services community that includes people focused on the common aim of cherishing an improved financial management.

My research has an impact on the whole banking industry which is continuously striving for generating new customers by adopting various new techniques and strategies. I feel that my research will be beneficial not only for me as a bank employee but also for other employees and bank customers who want to bring change to banking sector in creating a variety of products that would lead to the full satisfaction of consumers while using bank services.

Reference List

Al-Samdi, M.O. 2012, ‘Factors affecting adoption of electronic banking: An analysis of the perspectives of banks‘ customers’, International Journal of Business and Social Science, vol. 3 no. 17, pp. 294-309.

Are Banks Ready for the Next Generation Customer, 2010.

Bertram, D, n. d,‘Likert Scales…are the meaning of life’, CPSC 681 – Topic Report. Web.

Brace, I, 2008, Questionnaire Design: How to Plan, Structure and Write Survey Material for Effective Market Research,2 edn., Kogan Page Publishers, United States

Camhi, J. 2014, How to attract generation Y customers?

Catalysts for Change: The Implications of Gen Y Consumers for Banks, 2008.

Chovanova, A. 2006, ‘Forms of electronic banking’, BIATCE, vol. XIV, pp. 1-4. Web.

Creswell, J.W, 2003 ‘Research design: Qualitative, quantitative, and mixed methods approaches.’ Thousand Oaks, CA: Sage Publications.

E-banking to sweep Middle East, 2002.

Graham, C. & Nikolova, M. 2012, ‘Does access to information technology make people happier?’, Global Economy and Development, Working Paper 53.

Grais, W. & Kantur, Z. 2003, The changing financial landscape: Opportunities and Challenges for the Middle East and North America. Web.

Groenfeldt, 2014, Smartphones boost mobile banking.

Hamid, A.S. 2012, Effect of e-banking services on customer value and customer loyalty.