Executive summary

It goes without saying that business and strategic planning is a very important aspect in the successful business development. Every business person should have a determined strategic plan of business steps that should be taken according to different types of business operations, companies’ actions, corresponding information about companies, industry, marketing, organization of the operations and, as a result, the effectiveness.

Businesses can no longer ignore the importance of business planning and strategic planning because they are a key pillar of success for both startup and mature business organizations. It is important to develop plans and ensure that formulated operational strategies are implemented in time. Moreover, businesses need to continuously evaluate progress of their business plans and also make strategic adjustments when necessary in order to achieve overall organizational objectives.

This case study takes a careful look at how operational and strategic inefficiencies accompanied by harsh economic conditions led to the closure and taking over of the EPPCO and ENOC (Emirates National Oil Company and the Emirates Petroleum Products Company), by National oil company Adnoc. By mid 2011, many ENOC and EPPCO petrol stations in Dubai located in Sharjah, Ajman, together with other Emirates were either partially or fully dry and as a result not only were the employees of the organization disappointed but also their regular customers.

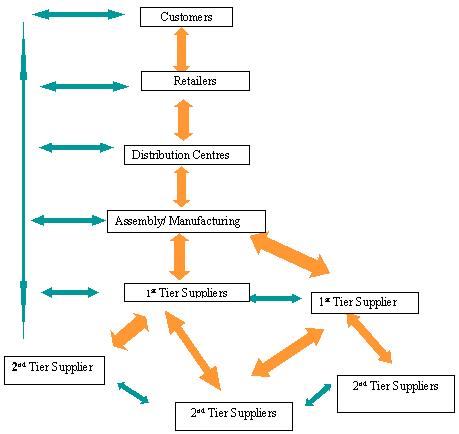

The flow of goods and services along the industries supply chain from the point of production to the point of consumption is part of the supply chain management process (Wisner 112). In the absence of supply chain and logistic activities it would become difficult for goods to arrive at the right place, on time and condition. Hence, a series and sequence of activities usually have to occur so that raw materials can be converted into useful finished goods that can be used to satisfy consumer needs. Supply chain activities are not activities of a single organization and these activities often involve many different organizations coming together to form a special relationship that will ensure the movement of raw materials and work in progress and finished goods strategically move from their points of origin to where they are needed efficiently.

High degrees of inefficiency that arose out of their supply chain and poor supply chain strategy made it impossible for petrol tankers from Jebel Ali to reach their destinations in time. This case study hence takes a look at particular sources of this commercial strategy from a strategic point of view. In an ideal economy, petrol and other petroleum products are essential to citizens but the move of ENOC and EPPCO to attempt to raise prices of petrol were met with maximum opposition.

Strategic management is a key part of business operation but this organization failed to put in place the necessary operation framework to get rid of inefficiencies that normally arise in the process of carrying out business (Michael & Jude 23; Wisner 112). In the absence of suitable operational strategies in various functional areas such as the supply chain, the organizations are most likely to increase supply shortages and increase cost structure (Worthington, Britton & Chris 115). This paper takes a look at the events that took place when stations belonging to ENOC and EPPCO ran dry in certain parts of the United Arab Emirates and what could have been done to avoid this crisis.

Introduction

Facilitating the movement of goods and services from the point of production to the point of consumption is the main role of supply chain management within an organization. In the absence of supply chain and logistic activities it would become very difficult for goods to arrive for consumption at the right place, time and condition. Hence supply chain management which is an integral part of operations management enables managers to carry out a series and sequence of activities that enable raw materials to be converted into finished goods so that they can reach their final destination of consumption (Baumol & Alan 84).

Supply chain activities are not actions of a single organization and these activities often entail many different organizations coming together to form a unique relationship that would ensure the movement of raw materials, work in progress and finished goods strategically progress from their points of origin to where they are needed with high degrees of efficiency (Porter 44). For this reason different organizations usually come together to make the supply of goods and services a success thus planning and designing supply chain activities are compulsory at all management levels within these organizations.

The demand of petroleum products has been on the rise over the past few years with the increased global expansion of population and economies; this trend is not likely to go down. Ever Since the 2008-2010 global economic meltdown hit many economies of the world causing a financial contagion, the prices and availability of petroleum products in numerous parts of the world has been negatively affected (Reid 44).

Due to increased levels of risk and costs associated with trading within the petroleum industry, many participants of this industry have been forced to push their pump prices up in order to cushion the effects of high costs that their business models are facing (Case 72). This recent development, that is as a result of the unpredictable nature of the dollar has led to international participants who are in this industry to face unprecedented loses and cuts in profits especially in situations where they import petroleum products from other nations (Ford, 59).

Strategic management is an important part of businesses, especially operations management which is a crucial element of today’s business environment because it enables careful planning of each aspect of operation in order to ensure every business process is executed with high degrees of accuracy (Wisner 56). The projected success or failure of organizations is directly linked to the various strategies that the management formulates and implement within their organizations and therefore when poor strategies are set in any functional area of business as a result of poor planning, then the organizations are more likely to fail to realize their business objectives.

Leading multinational organizations within the oil Industry have over time understood that their operations spread throughout the globe or vast regions and as a result develop the necessary strategies to ensure that petroleum and other related petroleum products reach where they are needed in good time in order to match demand and supply patterns of the market. It is consequently compulsory that these organizations operate in such a way that will allow the company to be highly efficient and dependable because once the availability of petrol is interrupted, many citizens as well as the economy are likely to suffer negatively.

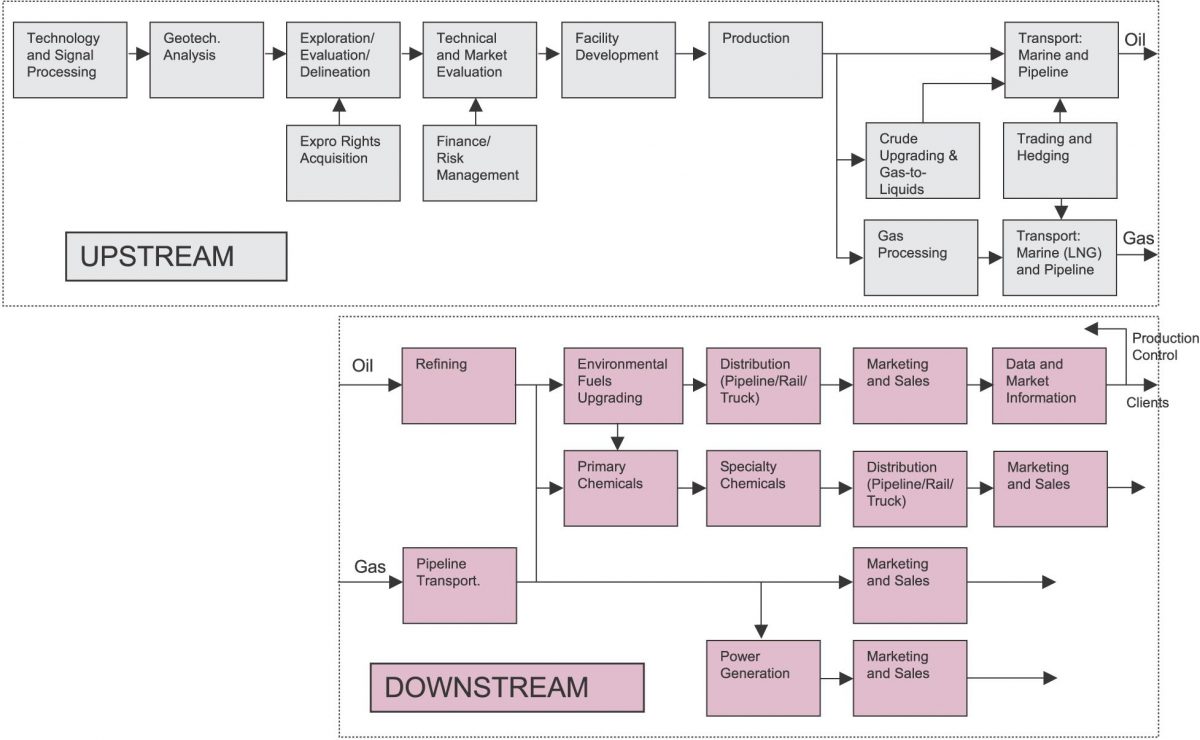

The supply chain and logistical framework of the oil industry organizations is very complicated since it is made up of numerous subsystems which consist of semi-autonomous and autonomous organizations. This as a result makes it necessary that managers in this field carefully plan and map all processes in order to ensure petroleum products follow a simplified path in order to reach where they are needed at the right time and price.

An industry’s value chain consists of activities that aim to take in inputs and convert them into outputs that are of high quality in order to cater for the needs of the end consumer (Worthington, Britton & Chris 85). Value chain activities are highly imperative because they add value and quality to the end product so that customers can use the good/service and obtain contentment but in this case ENOC and EPPCO failed to realize this by denying towns that highly depended on petrol from getting that precious commodity.

Value chain activities are often carried out by numerous departments which all work together to achieve high levels of synergy in order to produce the best products. Some of the departments that work together in order to add value to raw materials/goods as they move down the industry value chain include; the exploration department, manufacturing department, inbound and outbound distribution department, sales and marketing department, after sales department and the administration department ( Wisner 35).

The need for creating value along the distribution chain has forced supply chain management managers to integrate planning and use proper strategies to ensure that raw materials, work in progress and finished goods reach where they are destined at the right time and in good quality in order to reduce the chances of increased inventory costs. Moreover, it is important for supply chain experts to formulate contingent strategies and tactics that will permit their distribution networks obtain high degrees of flexibility as goods move either forward or backwards for them to reach the consumers in good time (Wisner 65).

Company Profile

The Emirates National Oil Company has been in existence since 1993. The Emirates National Oil Company Limited (ENOC) is a company that entirely belongs to the government of Dubai Government Company and the company is also the parent company of Emirates Petroleum Products Company (EPPCO). This organization is a key player within the energy sector of the various Emirates within Dubai; ENOC plays a major role in the energy sector and is responsible for ensuring that oil and gas products are able to move upstream and downstream within Dubai and to all its clients through all its subsidiary group of companies.

Emirates National Oil Company is an international energy group in service through 30 active subsidiaries and numerous joint ventures. Emirates National Oil Company limited provides numerous services within the energy sector ranging from services such as oil and gas exploration, refining and marketing in Dubai and the Middle East. The company is also plays a big role within the Oil supply chain by shipping and offering terminal services besides other numerous energy related services in Dubai.

Emirates National Oil Company provides a wide variety of services to other members of the oil industry. The organization provides petroleum-based chemicals, gas, petroleum for the aviation industry, shipping and transportation of petroleum related products, petroleum storage facilities, information technology services and retail of petroleum products. Emirates National Oil Company limited has joint ventures with other like-minded organizations which are major global companies such as Caltex, Vopak and Total.

Resources

The government of Dubai owns the whole of ENOC and EPPOC. The government company is on the fore front in leading other energy companies in economic diversification. ECON and EPOC is in every respect a worldwide energy group by virtue of the fact that it is operational in not less than thirty very active subsidiaries as well as joint ventures, most of which were formed with major international companies.

It has a wide range of services, from real estate to retail. Its network of ENOC and EPPOC service station is extremely expansive that extend across the whole of Dubai all the way to the northern Emirates. These service stations meet the needs of motorists in terms of fuel as well as a wide range of other products and services that are vehicle related. These service stations have got other facilities within them that do not fall under their core business of providing fuel and other related products that are used to power motor vehicles. The stations have got car wash and oil change facilities in them as well as convenience stores.

The ENOC is a very significant player in the field of fuel, various chemicals, as well as lubricants. These operate internationally and have even opened offices in places as far as London and Singapore.

The core work of this division is to develop and subsequently distribute products locally as well as internationally. This division is also charged with operating bunkering as well as trading services. The underlying activities in the group’s shipping, terminalling, and liquid and petroleum gas operations include the manufacturing of liquid petroleum gas as well as the containers that are used to store and ferry the gas. The group is also responsible for distributing the products that it has produced both locally and internationally.

Its operations also include the terminalling at Jebel Ali and Fujairah. The group also deals with the international fleet of chemicals, as well as oil tankers through its “Gulf Energy Maritime joint venture”. The group has partnered with Caltex – an international energy group also- and taken their shares to the United Arab Emirates aviation refueling and lubricants marketing department. ENOC is the holder of 51.9% of Dragon oil plc which is listed in the Dublin and London stock exchanges.

Strengths, weaknesses, opportunities and threats facing ENOC and EPOC (SWOT Analysis)

A firm’s strength are usually the resources and the capabilities that it has which can subsequently be used to develop the firm’s competitive advantage over its competitors. ENOC and EPPOC group, which is owned by the government of Dubai, is among the leaders in the United Arab Emirates in terms of economic diversification. The group has a comparatively strong brand name. This can be considered as one of the group’s strengths. The fact the group has a strong brand name implies that its products and services are widely recognized hence it will not have to fret or spend a lot to publicize its products to the market as they are relatively well known. Those resources can be channeled elsewhere where they will enhance the growth of the company.

The government owned outfit has invested significant amounts of money in research and development in an effort to increase efficiency and effectiveness in their production and distribution of its products. Recently, its scientists came up with a cutting edge invention that earned them their first American patent. The scientists had discovered a method of preserving jet fuel structured to save airlines substantial amounts of money. The process makes it possible for refineries and transporters to move different types of jet fuel from tankers to tracks and to aircrafts without the quality of the fuel degenerating. This emphasis on research and development leads to invention of cutting edge technology that gives the group a competitive edge over its competitors

The most glaring of ECON’s strength is in its diversification exploits. The group is involved in numerous number of business activities ranging from manufacturing of petroleum and gas to real estate. This business ventures are not only limited to their local or regional markets but extend to as far afield as virtually the whole world. This opens up new opportunities for the group that did not exist at home. Their target market also increases significantly because they will have access to a new group of customers for their products.

Having mentioned the above strengths associated with ENOC group, we shall also highlight some of the weaknesses that bedevil the group. Some of ENOC’s fiercest competitors have exclusive access to natural resources such as oil and gas because of their affiliation with individuals who are highly placed in the government. This gives them undue advantage compared to ENOC who have to source for the same resources internationally at inflated prices. This gives their competitors undue advantage over them.

As a result of incurring losses following directive by the executive council to sell petroleum at prices lower than what ENOC had spent to purchase the same, the group decided to stop selling fuel in all its stations in northern emirates. This lowered their credibility in the eyes of their customers due to the shortage that was experienced in the region as a result. Good reputation among the customers of any firm is regarded as a key strength. ENOC’s market share dwindled as a result, when many of their customers opted to purchase fuel from ENOC’s competitors. What is worse is the fact that winning back the customer confidence will not be an easy task considering the vital role that fuel plays in the United Arab Emirates’ economy. Therefore, customer apathy is regarded as a weakness on the part of ECON (Ian, et al 154).

Nevertheless, there are numerous opportunities that come ECON’s way as a result of its activities. Cutting edge technology such as the discovery by its scientists of a method of transferring jet fuel without compromising on its quality presents an opportunity for ECON to provide a service that did not exist before. There are also a few restrictions in terms of trading internationally. This presents ENOC with the opportunity to access diverse international markets for its products and services and hence increase its sales volume and consequently its profits.

Among the threats facing ECON include regulations by the executive council to sell petroleum at a price lower than that it purchased the same products. This resulted to ECON incurring significant losses. Another threat emerges from the nature of core products that ECON is involved in producing. There many other companies that are in the same business as them therefore it is not hard for customers to switch their loyalty from one company to the other depending on which is more convenient.

Competitive Advantages of Superior supply chain management strategies among Oil companies

Costs

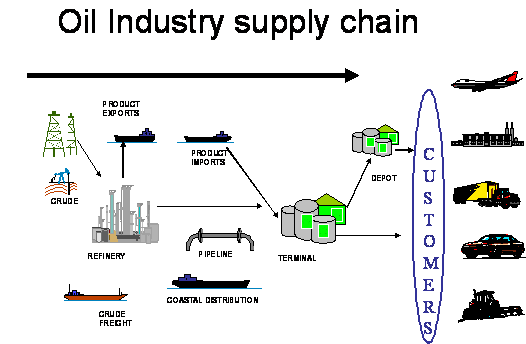

Good supply chain distribution strategies within the oil industry supply chain can assist in reducing costs especially if participants within the oil industries are able to form the right relationships and partnerships with other companies (Zahorsky, n.d). Using ships as the main mode of transport is quite expensive and takes a long time for crude oil to be delivered and using trucks as compared to pipelines can be quiet risky and inconveniencing.

It is hence necessary for marketers of various oil companies to carefully plan their inventory levels and operate with buffer stocks that will allow them to smoothly operate for periods close to six months as they await fleets of oil ferrying ships to arrive in their destined markets (Baumol & Alan 34). Poor network design within the supply chain would therefore increase the lead time and therefore lead to undesirable consequences (Edward 93).

Designing global supply chain networks is a very important part of international business management. A well designed supply chain is able to reduce additional costs, operate with flexibility and ensure that the quality of goods being delivered is high and time schedules are adhered to. Designing supply chains can be achieved by use of trial and error method which may be gained after a lengthy period of operations and statistical planning to come up with the most appropriate supply chain routes and alternatives (Edward 68).

Consequently, further inefficiencies can prove more costly and therefore affect the goals and objectives of those participating within the oil industry simply because there is a ceiling limit upon which businesses can absorb costs before they start facing loses. It thus becomes necessary to strategically plan supply chain activities and other logistic components in order to avoid incurring any incremental costs. According to Wisner (304), this is why logistics and supply chain engineers use complex mathematical models such as “ mean time between failures (MTBF), mean time to failure (MTTF), mean time to repair (MTTR), failure mode and effects analysis (FMEA), statistical distributions, queuing theory to plan activities that take place throughout the supply chain” (Edward 40).

The costs that are accumulated during shipment and channeling oil thorough pipelines make it necessary that additional costs are transferred from refiners and marketers to the end consumer. Due to the flammable nature of oil products, it is thus necessary to use specialized mechanisms to move these products from one region to another (Edward 105).

Flexibility

Larger oil mining companies like BP, Royal Dutch Shell, and Exxon Mobil operate many oil rigs within various on shore and offshore locations; this fact hence makes the supply chain activities become more flexible because of good supply chain strategies. In case one rig or supplier experiences difficulties that will delay the distribution of oil, other but if a company operates with contingent plans which involve multiple sourcing then the problem can be solved easily and quickly.

Flexible supply channels present consumers with numerous alternatives and therefore when an occurrence interrupts the supply of crude oil from one avenue other than existing contingent sources can be used to ensure that there is continuity in the supply of crude oil to whichever consumer who needs oil (Kotler 256). Therefore, it is hard to experience shortages if a supplying company is said to have flexible supply chains because if the first option fails then through strategic planning the company uses other means to make sure supply chain activities are not disrupted. Thus this is why it can be able to assist all its clients to acquire good transport and insurance facilities when transporting crude oil in the high seas, especially in a situation where a client has negotiation capabilities to negotiate on his/her on behalf.

Time/speed

The nature of crude oil and exploration of oil in the high seas usually makes it quite a challenge to move crude oil across the world’s waters to the respective countries on dry land. Ships are known to be very slow thus making the business cycle of the oil industry to become quite long. In some cases it may take close to 6-9 months to transport oil to certain parts of the world but this can further be delayed by piracy activities in certain parts of the world (Lambert 104). Therefore the further the country is from an oil rig belonging to Shell then the longer the lead-time, it therefore makes it necessary for this countries to order very large volumes that are above their consumption rates and consequently store the surplus as safety or buffer stock to avoid a future shortage of crude oil or other oil related products (Heide 46-51).

Due to the long time frame that is usually taken to deliver crude oil from where mining activities occur it therefore becomes very important to use supply chain design disciplines that incorporate mathematical and statistical models to ensure that delivery occurs by following the optimal route (Lambert 77-79; Bryson 68). This is done usually through increasing global operations, which involve more and more global coordination and strategic supply chain management planning to achieve global optimum performance.

Thus logistical operations like order tracking using globally positioned satellites can be incorporated within the supply chain so that ships and other modes of transporting crude oil can be easily located using real-time time techniques when in transit and during storage. Such a move will help companies meet supply chain expectations by carefully designing the steady and timely flow products at any level of the industries supply value chain (Kourdi 36; Case 56).

Quality

The quality of crude oil delivered when participants within the oil industry have developed the most appropriate supply chain management strategies usually remains un-altered because ships usually carry what they are given and thus do not attempt to alter the quality of the crude oil until it reaches to their respective destinations. While in other businesses, delicate products need extra care and may end up being compromised in the process of delivery this is highly unlikely because crude oil is a product which requires a lot of heat and various catalysts for it to change form (Wheelen & Hunger 43; Porter 56). The conditions and surroundings of ships are often customized and thus making it suitable to carry crude oil without affecting quality of oil.

Stake holder diagram

Organization chart

Operations locally and globally

ENOC and EPOC engage in a wide range of services both locally and abroad. The group manufactures oil, chemicals, gas, aviation, shipping, liquid storage, information and technology and real estate. It engages in developing and distributing aviation fuel, lubricants as well as chemicals, manufacturing and distributing liquefied gas together with the containers used to store them. They provide ship management services on top of supplying liquefied petroleum gas to industries, hotels and residential areas.

The group operates more than thirty vibrant subsidiaries as well as joint ventures. Many of these joint ventures were formed when the group partnered with international blue-chip companies. The group runs an extensive network of stations across the whole of Dubai and the northern Emirates supplying motorists with fuel. The Groups International Refining and Marketing division including the ENOC is considered to be a leader in the field of aviation fuel in London and Singapore. It is also a leader in lubricants and chemicals with international offices in the same cities.

Competition

State-owned (ADNOC) has over the years expanded its coverage over the United Arab Emirates. It is the fourth largest national reserve the world over behind Saudi Arabia, Iraq and Kuwait. The ADNOC group is involved in the production companies, support companies, maritime crude oil transport companies and refined product distribution company that runs not less than two hundred service stations in the wider United Arab Emirates. It is headed by the chairman of supreme petroleum council, His Highness Sheikh Khalifa Zayed Al Nahyan. ADNOC is ENOC’s greatest and fiercest competitor in the energy business.

Initially, the government of United Arab Emirates used to subsidize demand for fuel in the northern Emirates. But this has since stopped; the government even went further to issue a directive to all fuel producers and distributors to sell fuel at a price which had been set by the government regardless of whether the said price was lower than what the oil companies had paid for when purchasing fuel. This is exactly what happened to ENOC. Their main competitors ADNOC has unlimited access to the country’s vast oil and gas resources.

ENOC decided to quit selling fuel at its service stations as they were experiencing immense pressure on their profits because they sourced for fuel at international rates which had gone over the roof at that point in time. The emirates executive council threatened to cancel their license if they did not resume operations in their stations within seventy two hours. ADNOC even expressed interest in taking over the operations of EPPCO and ENOC. It raised suspicion of a plot to take over the operations, more so because the supreme petroleum council doubles up as the board of directors for ADNOC.

Implications Poor supply chain management and operation strategies in the Petroleum industry

The smooth flow of goods from point of origin to its various destinations is very important and hence organizations within the oil industry should be able to receive its orders estimated from the market and make necessary arrangements to make the petrol and other products available to match demand. But when the strategic framework supporting supply chain management activities and operations is poor, then this may not be able to happen (Edward 93; Frey 64).

When an organization has poor strategies then it becomes impossible to plan accurately and supply accurate information where it is needed and this ultimately leads to inefficiencies (Ian & Chris 146). Logistical nightmare may therefore arise and petrol together with other products may fail to reach where they are needed and this will ultimately lead to loses and it portrays a bad image of the company.

Technology and its role in supply chain management strategy

Oil and petroleum companies have introduced systems whereby they place orders and receive responses through the special Electronic Data Interchange (EDI). It then becomes the responsibility of executives who are in charge of procurement and sales to come together and scrutinize the data and then quantify various orders and group them according to specific timeframes (Hiles 103). Large participants within this industry operate many oil rigs within various parts of the world and their customers are classified according to the various regions where they come from and the orders are dispatched from oil rigs which are nearest to the locations of origin (Hartmut 14).

The absence of EDI makes the entire business operation cycle time and lead time becomes longer (Hartmut 78). Technology is known to reduce workload and at the same time increase efficiency. Previously, before these systems came into existence, companies were forced to mail their orders in advance using postal services or email. These methods were not synchronized with the goals of supply chain management activities.

But with the introduction of EDI, specific supply chain management relationships concerned with ordering and dispatch can be handled in real-time to achieve a high degree of accuracy and efficiency (Worthington, Britton & Chris 42). Additionally, the bull whip-effect is a situation whereby order and demand forecasts become more and more inaccurate as information moves through the supply chain and therefore the introduction of an information system that incorporates an electronic data interchange can make it possible for order to be dealt with a high degree of accuracy that would otherwise have been somewhat individually achieved between Shell and its supply chain partners (Hartmut 83; Edward 93).

The problem and Crisis that arose out of wrong strategic decisions

In the first quarter of 2011, it proved to be a very challenging quarter for both the Emirates National Oil Company and the Emirates Petroleum Products Company and the numerous petrol stations located in Dubai, Sharjah, Ajman and other emirates since they started facing inconsistent supply of petrol. The effects of the inconsistent supply of oil as a result went from degree temporary shortages to full shortages in petroleum pumps and by mid march midnight petrol tankers which were responsible for carrying petrol from Jebel Ali failed to supply numerous petrol stations with petrol and as a result demand from the public increased and this brought negative publicity to the organization (Worthington, Britton & Chris 87).

Moreover Emirates National Oil Company and the Emirates Petroleum Products Company were forced to turn away customers who showed up at their petrol stations because the organization had run out of the most used fuel commodity in that region. By the end of March the company was still unsure as to whether they could steadily guarantee the timely and reliable supply of fuel using their trucks from Jebel Ali Port. This therefore forced the organization(s) to give some of their employees at these petrol stations some time off from their regular working positions.

The workers who were left behind were left to attend to regular customers and inform them that there was no petrol. In its reserves, the station had only high quality diesel and petrol. The bad news was that although super quality petrol was more expensive than the special category, all customers wanted to fill their tanks with super petrol because over 90 percent of these clients had their cars which used petrol.

Moreover, during regular working days, most of the refueling stations belonging to Emirates National Oil Company and the Emirates Petroleum Products Company used to operate 8-10 dispensing machines but when the crisis and shortage struck, the fueling stations were forced to close around 6-8 of their dispensing machines. In the most severe case, there was total shut down of three petrol stations in Sharjah which was publicly announced by EPPCO.

The irony of the situation is that as numerous stations belonging to Emirates National Oil Company and the Emirates Petroleum Products Company (ENOC &EPPCO) closed down, business activities in the rival petrol stations went up and this fact left EPPCO and ENOC under more pressure since employees felt as if the management was at fault. The poor supply chain practices of ENOC and EPPCO made it quite unpredictable and impossible for the managers of the fuel stations to guarantee the uninterrupted supply of petrol while other petrol stations were able to get this precious commodity.

EPPCO management stated that the main reason behind their crisis was due to the fact that the government had withdrawn subsidies that they had previously been giving them in order to cushion price shocks that are regular in the oil and petroleum industry. With the subsidies withdrawn by the government, the organization was forced to cater for any incremental costs by themselves. Moreover, their wide business portfolio made the organization(s) face more loses arising from reduced customer traffic which meant that there were no sales in their car washes, convenient stores and diesel dispensers.

The economic situation in Dubai then made the sales of diesel drop drastically. The supply problems that the organization faced were very severe and repetitive thus indicating that the management of Emirates National Oil Company and the Emirates Petroleum Products Company had failed in managing the problem. When petrol pumps belonging to Emarat were faced with similar shortages the supply problem was solved in good time and Emarat was back to ordinary business in a few days but in the case of ENOC and EPPCO the problem seemed to be more serious.

Following the event, the company therefore thought it necessary that the prices of petrol be raised so that it could cushion for the various increase in costs along the lines of production. The greatest fear of the organization at that time was that the organization would face loses amounting to $2.7 billion and therefore the company needed to raise more funds to reduce this deficit. Since most of ENOC and EPPCO businesses were anchored, the sales of petrol was practically almost zero and this decreased demand for diesel implying that actual customer traffic was at its lowest in decades because most of the citizens around Sharjah lived in residential areas and therefore relied a lot on petrol rather that diesel (Campbell, David, Stonehouse, George & Bill, 56).

During this time, employees were eager that business would return to normalcy because they felt as if they had lost their jobs and lacked future assurance that they would be able to retain their jobs. Many customers who had vehicles using Petrol were forced to leave Sharjah to go to Dubai in order to have their vehicle tanks filled. Moreover, the large workforce of ENOC/EPPCO currently work for Dh1,200 to Dh1,400 and their dream of having their salary increments were crushed by the poor supply problems that led to the petrol crises in Sharjah.

As a result of diminished petrol sales, customer traffic dropped significantly therefore all other business operations that operated in the form of convenient stores were furthermore affected negatively. Other businesses, such as “fast food outlets” and “related businesses”, such as shops housed were also forced to close down either temporarily or permanently. The crisis also put a image on the company and staff were forced to struggle to persuade and convince customers to spend more time on the premises of the petrol station but they failed to do so because there was nothing interesting that seemed to go on there. Furthermore, the presence of a big poster that stated ‘wait for your turn line outside our station whenever petrol is available’ forced customers to become moody and this usually led them to taking out their frustrations on the employees and this made their life a living hell.

Since the government had partnered up with ENOC/EPPCO stations, the company was able to acquire petrol easier due to the subsidies that were made available by the government. But serious problems arose once the government withdrew its offer to cushion the organization(s) against rising costs that the company had to incur in the process of acquiring petrol from far countries such as Bahrain. Despite the fact that subsidies were stopped, the legal framework and pressure from regulating bodies made it quite hard for ENOC/EPPCO to increase the pump price of petrol.

As much as it made logical sense that when costs of production increase the price of products should also increase, the hard economic times in Dubai and particularly Sharjah made it quite hard for the company to have its price increment plan to be approved. The policy makers in Dubai and all those in various Emirates feared that if they gave in to this pressures then a slight increase in the price of petrol would have a ripple effect that would affect other sectors of the economy and other sectors of the economy would experience the same effect forcing prices of other commodities to go up.

Recommendations

The failure of Emirates National Oil Company and the Emirates Petroleum Products Company to supply petrol to the numerous petrol stations located in Dubai, Sharjah, Ajman and other emirates could have been avoided if the top management in ENOC/EPPCO would have used more contemporary supply management practices. If the organization would have been proactive instead of reactive then the management would have been able to plan in advance using various forecasting techniques. It is hence necessary to note that if ENOC/EPPCO aims to continue running stations in other parts of Dubai, the management should change its management style and concentrate more on using more reliable inventory management and forecasting techniques.

The current weaknesses reduce the level of efficiency within the supply chain and it is therefore very important to reduce the number of risks that usually exist within the supply chain to ensure a continuous flow of products. The absence of risks within the supply chain will thus reduce the lead time and therefore reduce the length which is usually taken to complete business process. Inefficiencies within the supply chain of the oil industry will always result to increased costs which are to be included in the costs that are computed in the global supply chain.

By the use of strategic planning in supply chain management then organizations can successfully manage to reduce risks through carefully queuing and using mathematical models such as simulation to design the overall supply chain activities. If the following implementations are carried out then the flexibility of the oil supply chain will improve and the movement of oil and other related products will be improved. Furthermore extra costs incurred throughout the global supply chain will be reduced thus empowering the end consumer (Geoff 25)

Conclusion

For the business to be successful, it is important to plan thoroughly a systematic plan of incomes and outcomes of the producers in order to clarify the further development of balance’s changes of the social layers on the determined stage of historical development. One should realize that the scientific strategic planning is the only instrument to provide a non-crisis development in economics in the direction of stable growth of the quality of life. Supply chains are a fundamental for successful businesses and this is due to the fact that they are majorly responsible in facilitating the smooth flow of raw materials, work in progress and finished goods within the organization and intra-organizationally.

The oil industry is a very important industry to the economy and the crisis that hit ENOC/EPCO is a clear example that should compel all participants within the oil industry to put in place the necessary supply chain framework in order to ensure that petrol reaches customers in the right time and quality. Business executives who are in charge of formulating and implementing organizational strategy should therefore pay more attention towards ensuring that their organizations take the issue of supply chain management and other parts of operational management seriously.

The satisfaction of customers and the image of the company largely depend on the ability of the organization to formulate and implement supply chain management strategies that ultimately increase their level of efficiency at which raw materials, work in progress and finished goods move from one level of the industries supply value chain to another level. Active participants within the oil industry especially those handling petroleum products should strive to take a look at how other multinational organizations like British Petroleum.

Royal Dutch Shell, Mobile Exxon and Philips Conoco have been able to develop the most unique and effective supply chains using unique supply chain strategies over the years that have enabled them deliver petroleum related products in all the continents of the world with high levels of speed and reliably. It hence the duty of ENOC/Eppco officials to come up and carefully design, plan, control, continuously evaluate and monitor all supply chain activities with the aim of creating value as goods and services move through the various levels of the supply chain and through the interconnected business organizations which exist as interdependent systems to reach the final destination of consumption in the right time and quality.

Works Cited

Baumol, William & Alan, Blinder. Economics: Principles and Policy. New York, NY: Cengage Learning, 2007. Print.

Bernstein, Jonathan. “All about crisis management.” Free Management Library. 2011.

Bryson, John. Creating and implementing your strategic plan: a workbook for public and nonprofit organizations, 2nd edition. Hoboken, NJ: Wiley and Sons, 2004. Print.

Campbell, David, Stonehouse, George & Bill, Houston. Business Strategy An Introduction, 2 edition. Title Linacre House, Banbury Rd: Butterworth-Heinemann, 2002. Print.

Case, James. Competition: The Birth of a New Science. New York, NY: Farrar, Straus and Giroux, 2008. Print.

Edward, Jones. Royal Dutch Shell: The Power and Policy of Big Oil Super-major, 4 edn. New York: Springer, 2010. Print

Ford, David. “Buyer/seller relationships in international industrial markets”, European.” Journal of Marketing, Vol. 14 No. 5 (1980): 339-54. Print.

Frey, Robert. Successful strategies for Small Businesses: using product knowledge, 5 edn, Artech House Inc: Norwood, 2008. Print.

Geoff, Lancaster & Frank, Withey. Marketing Fundamentals’: CIM Course book. Butterworth-Heimann London, oxford publishers, 2006.Print.

Hartmut, Stadtler. Supply chain management and advanced planning: Concepts, models, software, and case studies. New York: FastBook Publishing, 2008. Print.

Heide, Jan. “Interorganizational governance in marketing channels.” Journal of Marketing Vol. 58 (1994): 71-85. Print.

Hiles, Andrew. The definitive Handbook of Business Continuity Management. New Jersey: John Wiley and Sons, 2010. Print.

Ian, Worthington & Chris, Britton. Business environment, 6th edition. Canada: Pearson Education, 2009.Print.

Jaber, Mohamad. Inventory Management: Non classical views. Florida: CRC Press, 2009. Print.

Kotler, Philip. Marketing Insights from A to Z: 80 concepts every manager needs to know, New Jersey: John Wiley & Sons Inc.2003.Print.

Kourdi, Jeremy. Business Strategy: A Guide to Effective Decision Making, 2 editions. New York: Economist books, 2009. Print.

Lambert, Douglas. Supply chain management: processes, partnerships, performance. New York: Supply Chain Management Inst., 2008. Print.

Michael, Allison & Jude, Kaye. Simplified strategic planning: a no-nonsense guide for busy people who want results fast. Worcester, MA: Chandler House Press, 2005. Print.

Porter, Michael. Competitive advantage, illustrated ed. Northampton, MA: Free Press.1990.Print.

Reid, Lenon. Crisis management: planning and media relations for the design and construction. New York, NY: John Wiley and Sons, 2000.Print.

Wheelen, Thomas & Hunger, David. Strategic Management & Business Policy: Achieving Sustainability.12th International Ed. New York: Pearson Prentice Hall, 2010. Print.

Wheelen, Thomas & Hunger, David. Strategic management and business policy. New Jersey: Prentice hall, 2002. Print.

Wisner, Joel et al. Principles of Supply Chain Management. New York: Cengage learning, 2008. Print.

Worthington, Ian & Britton, Chris. Business environment, 6th edition. Melbourne: Pearson Education, 2009. Print.

Zahorsky, Darrell. “Pricing for Small Business.” About.com. n.d.