Executive Summary

The development of the domestic economy depends on both the trading relationship with other countries and the state’s self-sufficiency. To foster a local economy, developing countries tend to embrace the approaches of import substitution or export-led growth (Appendix F). The first approach, while facilitating technological progress and self-sufficiency, does not let foreign capital in the country. The second, on the contrary, can become exceedingly dependent on export. This report focuses on the peculiarities of both approaches and recommends adopting a hybrid import-export-trading policy.

Introduction: Definition of the Approaches

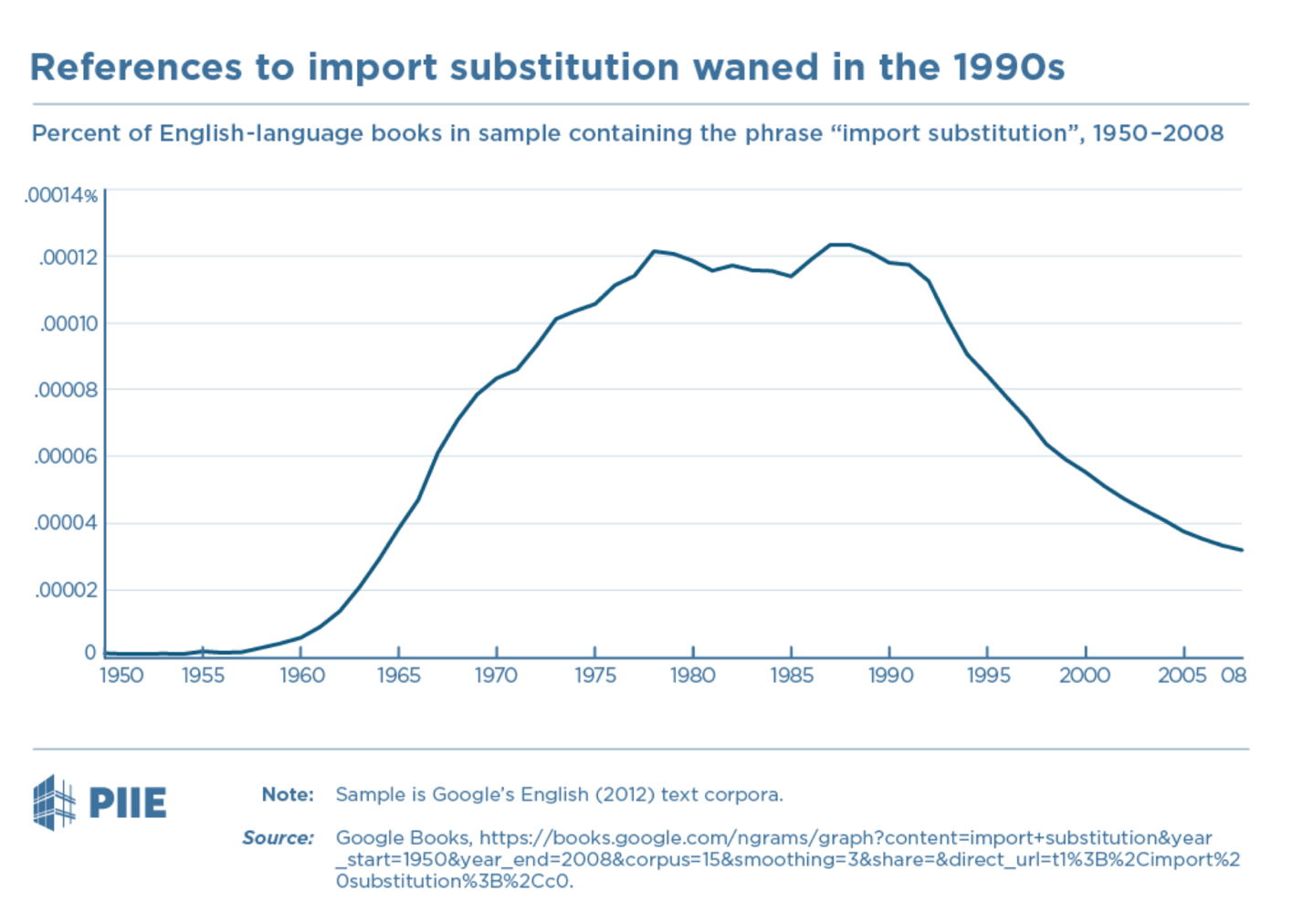

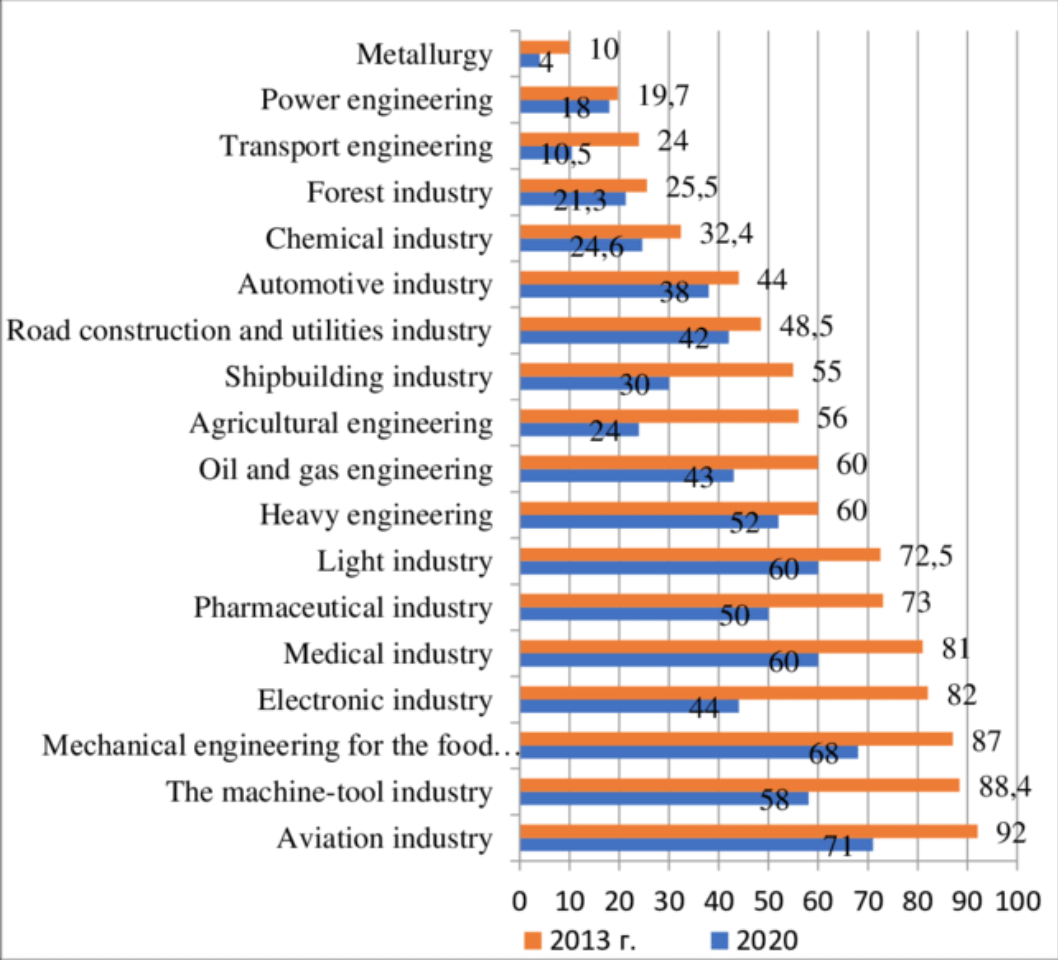

Import substitution industrialization growth and development policy apply to countries that want to be on their own, produce, and sell their products. It aims to replace imports with domestic production, thus empowering its people (Appendix E). It helps to grow other local industries by supplying the required machines (Jackson and Jabbie, 2021). An approach was widely used in the Asian segment, but the global isolation it caused created a significant impact on the regions. Since the introduction of the Washington Consensus that focused on fewer state restrictions in favor of free trade, the relevance of import substitution has decreased significantly: (Appendix A).

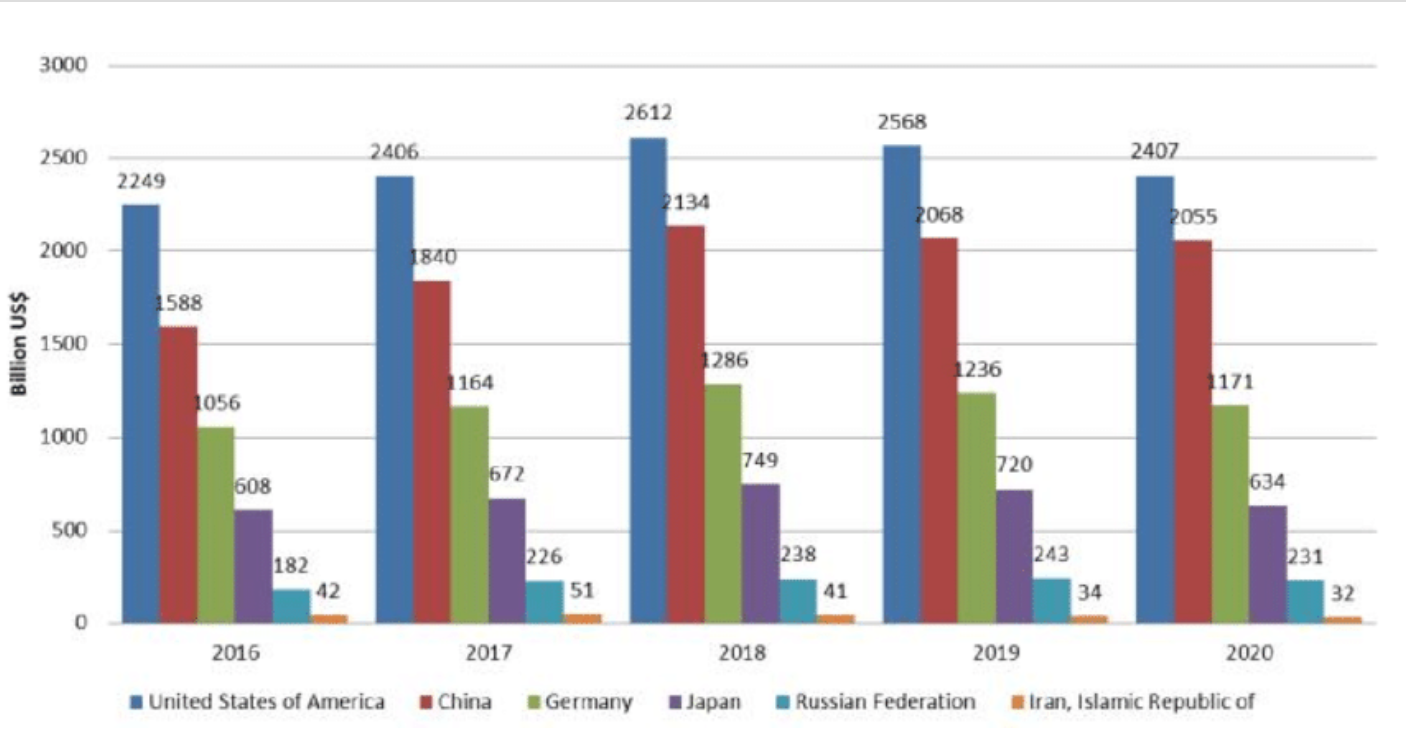

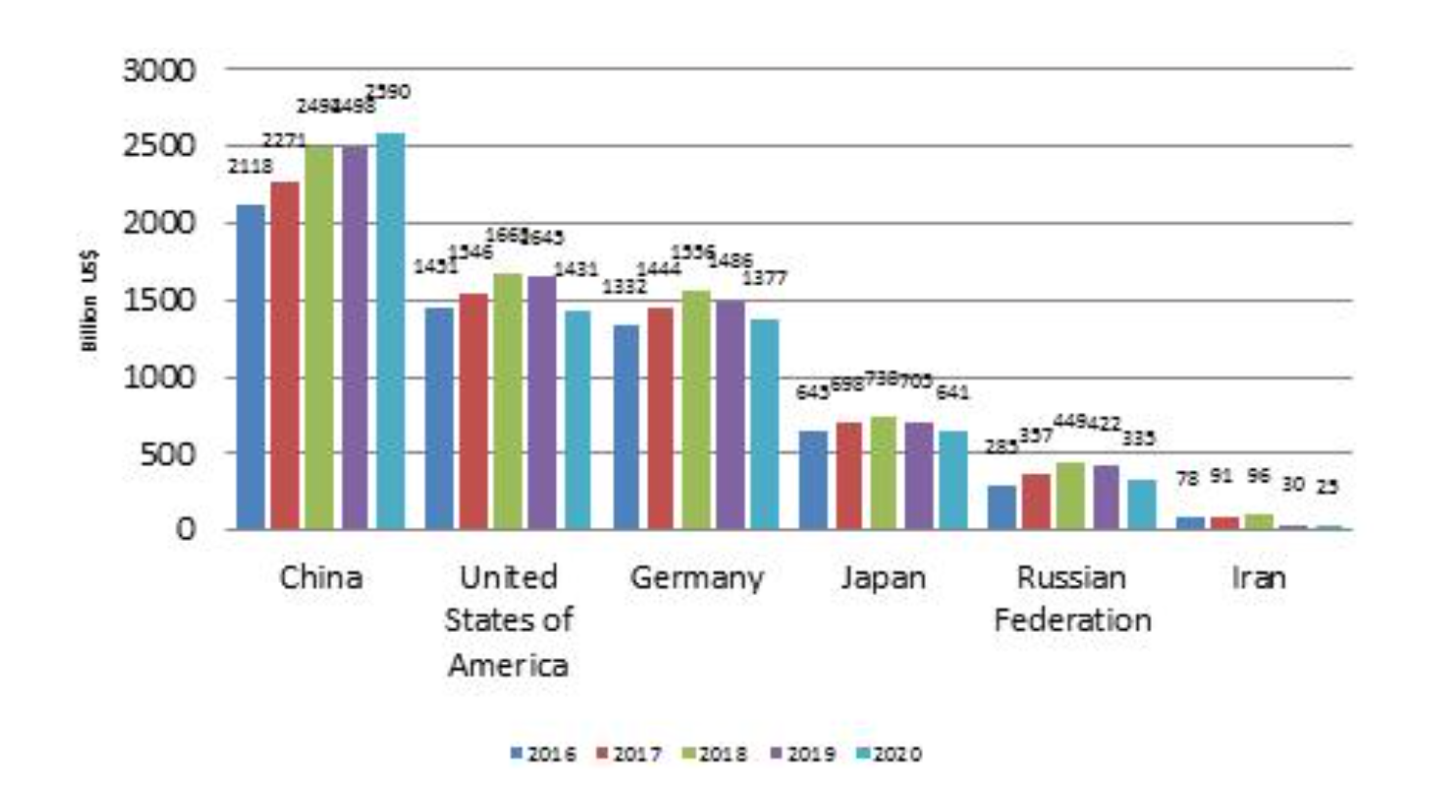

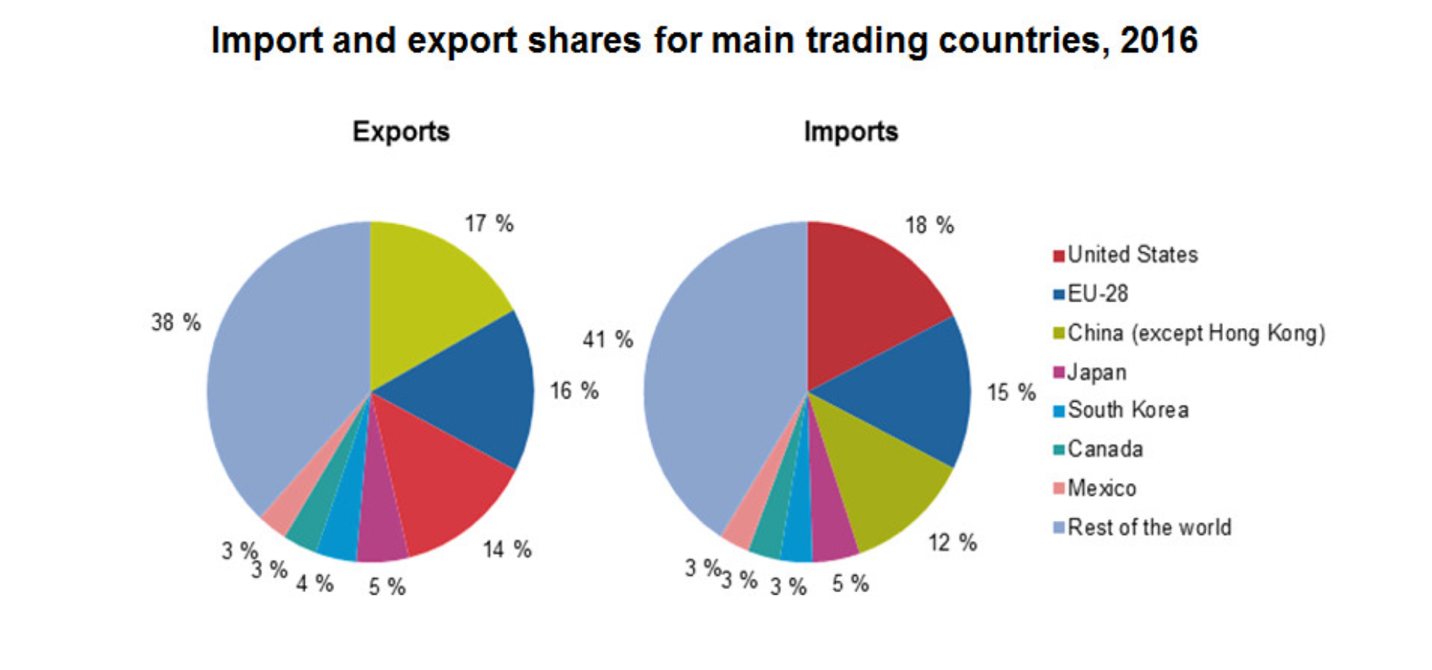

The approach for developing countries has been export-led growth policy, which happens when a government searches for economic advancement through global business. Similarly, the export-led growth policy model aims to identify a place in the global economy for a specific export type. Most developed countries in the world, such as Germany and Japan, know clearly that an export-led growth policy will help a country grow so it can be dependent on its own in the future (Emelianov, 2020). Government subsidies and improved entrance to homegrown marketplaces may be open to industries that produce this export. Nations seek to get adequate hard cash by hiring this technique to import commodities produced more cheaply abroad.

Export-Led Growth

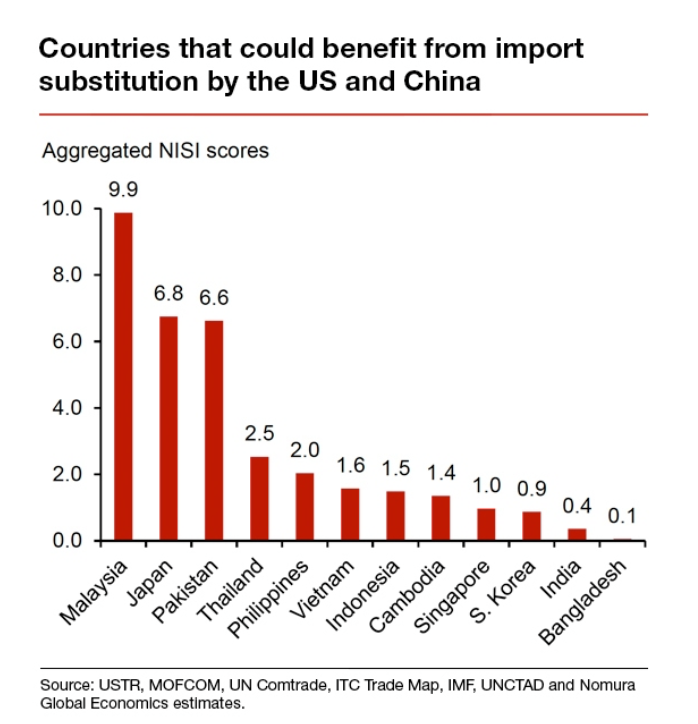

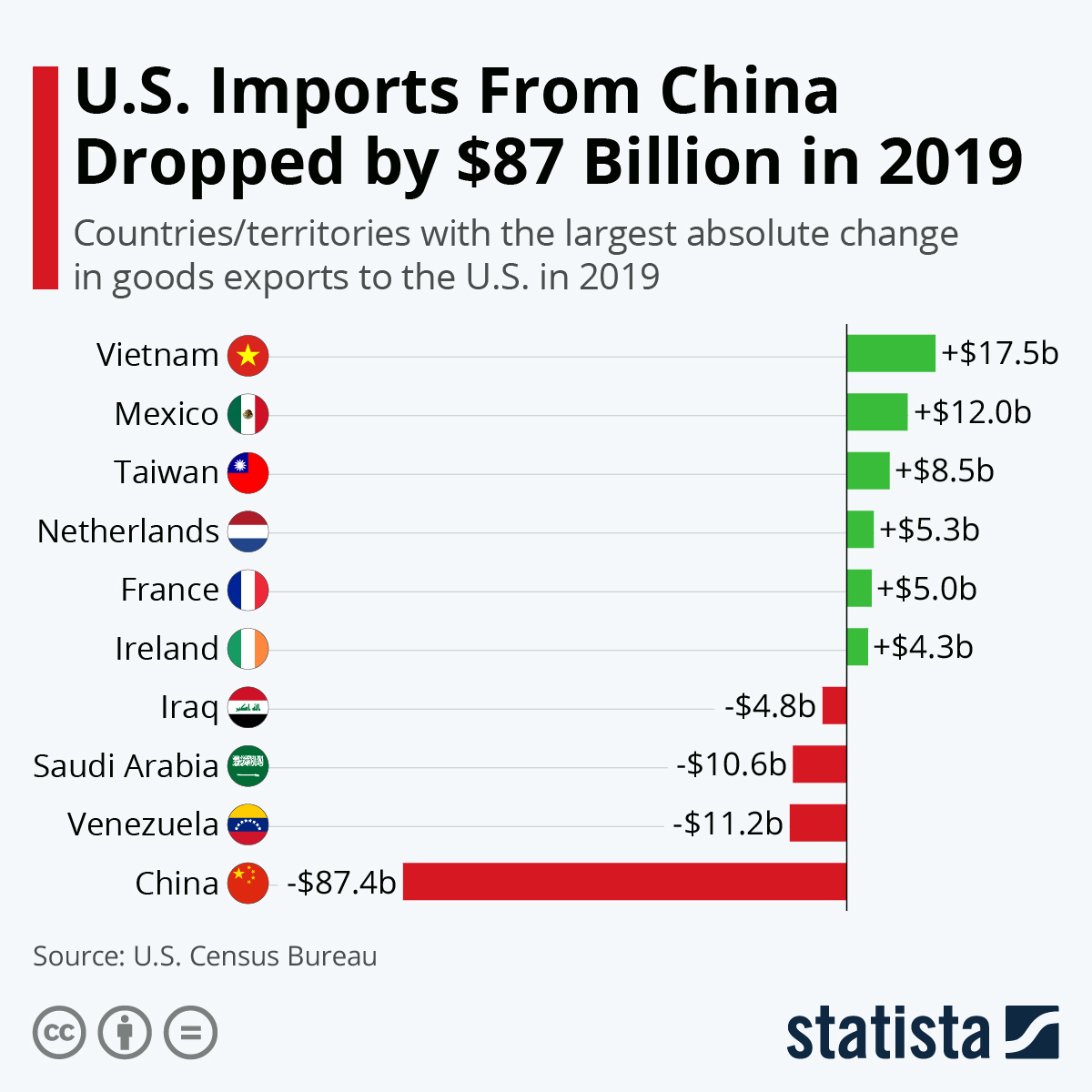

The export-led growth paradigm superseded the import substitution industrialization paradigm (Appendix G). Indeed, import substitution industrialization viewed as a springboard for local economy development resulted in high production costs and lack of market competition (Frizyak, 2019). Exporters suffer because of the import substitution strategy, making it hard for them to do their exportation business smoothly. As the currency rate rises, domestic items produced in internal industries become more expensive, harming exports. The trade balance deteriorates as exports decline and reliance on imported intermediate goods grows. Although export-led growth has had some attainment in Germany, Japan, and East and Southeast Asia, present situations specify that a new, improved model is vital (Appendix D). Self-sufficiency is a vast portion of export-led growth, which implies that the country is doing well economically, thus able to fund the projects the more developments in the country. Xiao and Yao (2022) claim that the international debt statistics of low and middle countries in 2020 rose to $8.7 trillion, represented by 5.6% from the previous years.

Export-led growth is essential mainly for two motives. The first motivation is that export-led change advances a republic’s foreign-currency assets and permits it to pay arrears as long as the essential amenities and resources are accessible (Alcorta and Tesfachew, 2020). Many developed countries had borrowed money from the already developed countries, and now they are paying off the debts with profits (Feasel and Kumazawa, 2018). Reasonably, most countries never prosper on their taxes, but rather, they have to borrow more financial support to enable them to run projects for the country’s benefit. The motivation for exports stems from many economists’ assumptions that commerce is the engine of growth. It may help governments allocate resources more efficiently and transmit change across countries and regions.

Furthermore, the expansion of exports contributes significantly to economic growth by stimulating demand, promoting savings, capital accumulation, and increasing economic supply potential via the increased capacity to import (Wan et al., 2022). As a result, exposing a country’s market to foreign markets allows it to focus on producing goods with a comparative advantage based on its factor endowments, resulting in more efficient production and resource allocation. Participating in trade fosters dynamic innovation and technology diffusion. It also encourages a country to increase output and scale economies, resulting in more significant returns. Many development economists employ Taylor’s “two-gap or three-gap” models to justify gaining foreign cash through exports.

The second importance of export-led growth policy, and possibly more contentious, is the idea that improved export progress can lead to better throughput. Equally, this will, in turn, lead to even more exports in a confident, rising helix series (Emelianov, 2020). The tightening of manufacturing output discrepancies, the domination of Intra-industry trade, and constructive Canadian trade stability for manufactured products and fictional resources have resulted from trade liberalizations between Canada and the United States.

Import Substitution

Import substitution industrialization responded to the growing issue of foreign markets isolation and the Great Depression. Initially, both Latin American and Asian governments utilized this method. However, Asian nations such as Taiwan and South Korea began focusing their expansion outward in the 1950s and 1960s, culminating in an export-led development policy. Many Latin American states sustained to pursue import substitution industrialization in a broader sense. Some have argued that export-led progress should be considered the best method for promoting change because of the achievement of Asian realms, particularly Taiwan and South Korea.

Import substitution industrialization growth can only happen when a country is never in need of any support and the fact that it can produce the materials or the inputs for the productions. However, it cannot improve a country’s economy because if a country imports and never exports outside, the state’s economy receives no income and financial support outside the state, limiting its international position. Growing reliance on import substitution will lead to total isolation and the unwillingness of external suppliers to enter into an economic partnership (Appendix C).

Recommendation

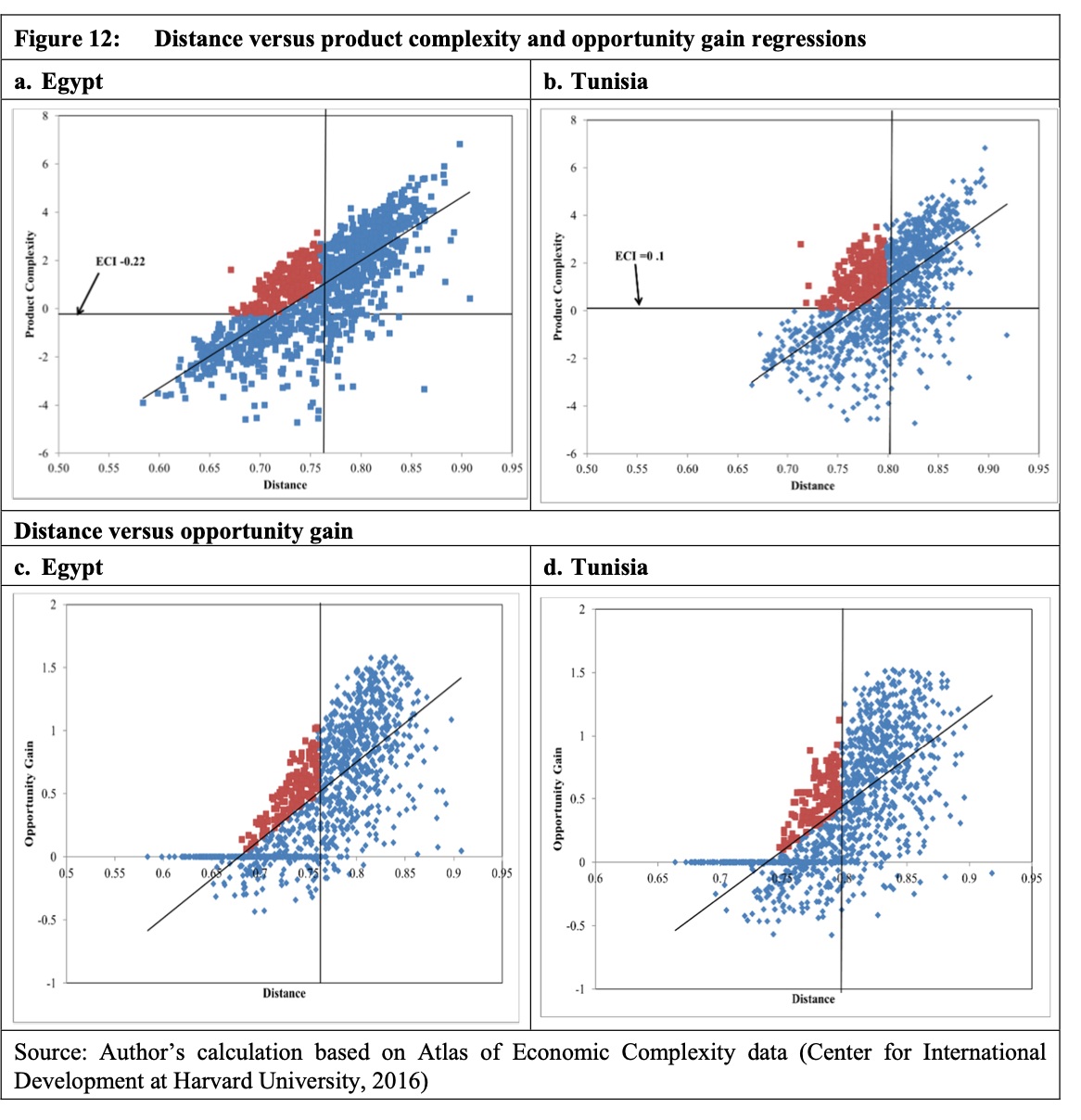

To create a successful model for economic growth, the country needs to identify the spheres of export that bring the most value to the global community and exploit this opportunity. For example, in the case of Tunisia or Egypt, the researchers identified the scope of regression between the distance and the complexity of exported goods. As a result, when it comes to export, the country needs to define what value it presents to the market and put more resources into the product manufacturing (Appendix B). The country has to adopt the export-led growth approach in the spheres with less value. A hybrid strategy is recommended for developing countries.

Conclusion

Both import substitution and export-led growth have a series of favorable arguments (Appendix G). Import substitution saves foreign reserves and reduces the global market’s dependence (Appendix H). Export-led growth encourages the state to build rapport with the international market and investors (Appendix I). The exclusive reliance on either one of the results in the radial isolation or external dependence of the local market. The most viable solution is to create a combination of export-led growth and import substitution based on the resources accessible to the economy.

Bibliography

Alcorta, L. and Tesfachew, T. (2020) ‘Special economic zones and export-led growth,’ The Oxford Handbook of Industrial Hubs and Economic Development, p. 323.

Buchholz, K. (2020) Which countries are net exporters & importers?

El-Haddad, E. (2018). Exporting for growth: identifying leading sectors for Egypt and Tunisia using the Product Space Methodology. German Development Institute, 25. Discussion Paper.

Emelianov, E. (2020) ‘International trade at the end of the second decade,’ International Trade and Trade Policy, (1), pp.54-61.

Eurostat (2017) The EU, USA and China account for almost half of world trade in goods.

Feasel, E.M. and Kumazawa, D. (2018) The importance of export-led growth: time series and panel data evidence. In Exports, Trade Policy and Economic Growth in Eras of Globalization (pp. 158-189). Routledge.

Frizyak, N. (2019) ‘US role in international services trade,’ International Trade and Trade Policy, (2), pp.25-33.

Irwin, D. A. (2020) Import substitution is making an unwelcome comeback.

Jackson, E.A. and Jabbie, M.N. (2021) ‘Import substitution industrialization (ISI): an approach to global economic sustainability,’ In Industry, Innovation, and Infrastructure (pp. 506-518). Cham: Springer International Publishing.

Novikov, S. V., Lastochkina, V. V., and Solodova, A. D. (2019) ‘Import substitution in the industrial sector: analysis and facts,’ IOP Conference Series: Materials Science and Engineering, 537(4).

Rasoulinezhad, E. (2021) Regionalism approach under The Covid-19 circumstances.

Richter, F. (2020) U.S. Imports from China dropped by $87 billion in 2019.

Subbaraman, R., Varma, S., and Seth, C. (2018) US-Sino trade friction: not all a lose-lose outcome for Asia. Web.

Wan, X., Kazmi, S.A.A. and Wong, C.Y. (2022) ‘Manufacturing, exports, and sustainable growth: evidence from developing countries,’ Sustainability, 14(3), p.1646.

Xiao, J. and Yao, R. (2022) ‘Good debt, bad debt: family debt portfolios and financial burdens,’ International Journal of Bank Marketing.

Xie, L. and Lu, X. (2022) ‘Export-led growth strategy and government quality,’ In Suzhou Industrial Park (pp. 5-31). Palgrave Macmillan, Singapore.

Appendix A

Appendix B

Appendix C

Appendix D

Appendix E

Appendix F

Appendix G

Appendix H

Appendix I