The story is about the fiscal policies that have been put into place by the Indian government in recent years, and each of them has had a different impact on income distribution in the country. Progressive taxation is one such policy; it is a system in which people who earn more money are taxed at a higher rate than people who earn less money. In the two drawn diagrams, the first one illustrates the effects of income distribution when the rich and the poor pay the same tax amount (Petach and Daniele Tavani 10). The second one demonstrates how equal income distribution can be achieved by varying the taxation rates.

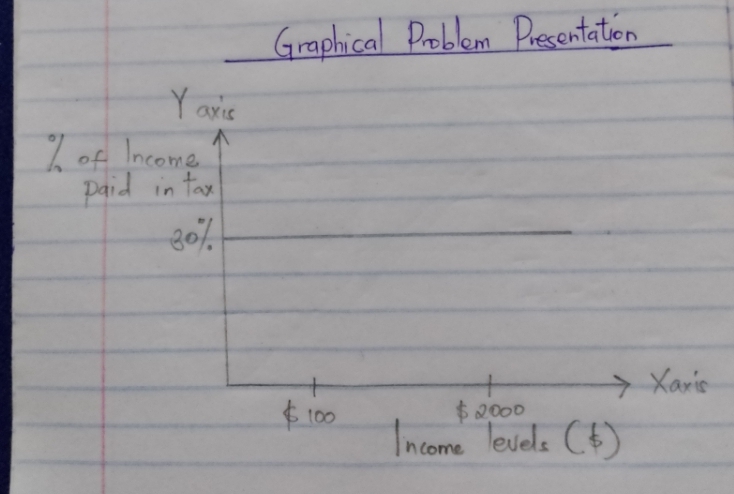

Graphical Problem Presentation

In this case, the tax paid is the same for the rich and the poor. When the poor and the rich pay the same amount of tax, the poor suffer because their wealth diminishes while the rich get to keep their money (Nguyen and Nguyen 94). The only people who benefit from this are those in the middle class, who receive a little bit of help from both sides (Slemrod 210). However, this does not do much to improve their situation because they are still not rich enough to be able to afford luxuries, and they are still considered poor by most people’s standards. “The sufferings of poor and migrant laborers during the Covid-19-induced lockdown in 2020 stand witness to the inequality in India” (Kundu and Maynor Cabrera 1). During Covid-19, the poor found it hard to survive since they relied on physical jobs, which were not allowed, while the rich could work online, but the tax percentage remained the same.

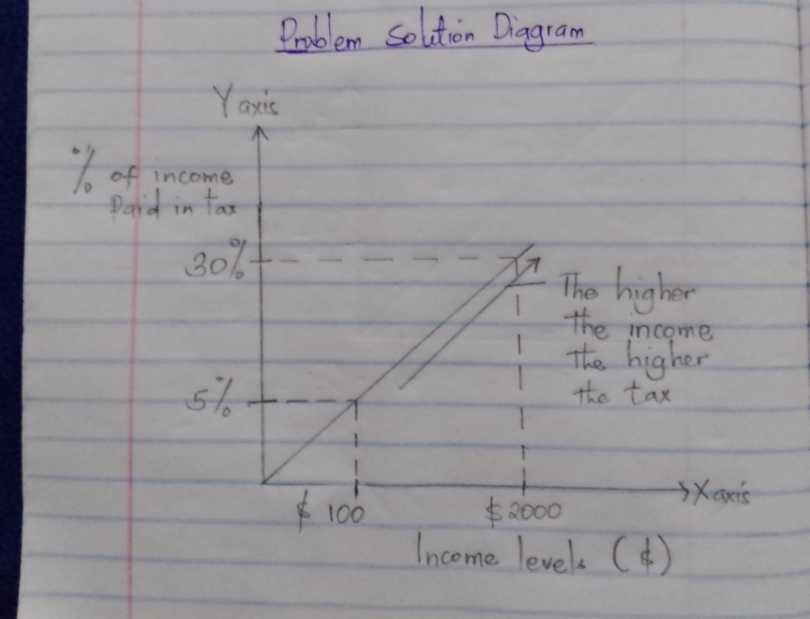

Solution Diagram

For example, we can have a graph showing the taxation % of income paid in tax vs. income. Levels ($). In this case, the equal distribution of funds is accomplished because taxation is rational (Lachapelle and Geneviève Boisjoly 4). And the tax rate is differentiated since those earning $100 per month are subjected to pay 5% tax of their salaries, while those earning $2000 and above are to pay 30% tax. This creates fairness so that the rich contribute to the economic development of the country more than the poor and financially straining individuals. Conversely, if the poor pay lesser taxes than the rich, it would create equality in income distribution (Raghavan 23). The tax system should be progressive so that those who can afford to pay more taxes do so, and those who cannot afford to pay are exempted (Lee and Keun Lee 11). This way, fairness and equity in income distribution is achieved; therefore, the method will work.

Subjecting the poor to lower tax rates than the rich provides individuals with more disposable income. The increased income can be used to invest in education and job training or to cover basic living expenses by the poor (Raghavan 23). In some cases, government benefits may also follow a progressive tax structure, whereby those who earn less receive greater assistance (Van Hootegem 12). “Public social spending (social protection, health, education, and other social spending) came to around 5.9 percent of GDP” (Kundu and Maynor Cabrera 15). This means that these social services are some of the most essential and most expensive that the poor cannot afford if they pay a huge tax.

The unequal tax payment depends on the reaction of key stakeholders, primarily the wealthy. The increment in tax payment will affect the rich since they will not be able to invest as they could when they were paying the same tax as the poor (Kurian and Shoba Suri 2). They could save more funds for investment since the taxes were lowered to enable the poor also to afford. And this made it easy for the rich to pay the taxes, which would not affect their income, thus having more to invest (Yang 18). The rich will react negatively, especially during the Covid-19 when most businesses were not operating. They may therefore begin investing out of the country; it could harm the economy (Allaire and Sarah Acquah 34). Solving the negative reaction from the rich depends on their willingness to pay their “fair share” in taxes, but the bottom line remains that they should be paying more than the poor.

The outcomes are different in the long run (LT) compared to the short-run (ST). In the LT, when the rich pay more tax than the poor, total output and income increase, as does welfare (Citoni 65). However, in the ST, there is a decrease in both total output and income (Kapiriri and Donya Razavi 10). This is because while the rich do indeed pay more tax in absolute terms, they also consume fewer goods and services due to their higher savings rates.

Works Cited

Allaire, Maura, and Sarah Acquah. “Disparities in drinking water compliance: Implications for incorporating equity into regulatory practices.” AWWA Water Science 4.2 (2022): e1274.

Citoni, Guido, Domenico De Matteis, and Margherita Giannoni. “Vertical Equity in Healthcare Financing: A Progressivity Analysis for the Italian Regions.” Healthcare. MDPI, 2022.

Kapiriri, Lydia, and S. Donya Razavi. “Equity, justice, and social values in priority setting: a qualitative study of resource allocation criteria for global donor organizations working in low-income countries.” International Journal for Equity in Health 21.1 (2022): 1-13.

Kundu, Sridhar, and Maynor Cabrera. Fiscal Policies and their Impact on Income Distribution in India. Tulane University, Department of Economics, 2022.

Kurian, Oommen C., and Shoba Suri. “Covid-19 Global Vaccination Drive: The Goal of Equity in an Unequal World.” (2022).

Lachapelle, Ugo, and Geneviève Boisjoly. “The Equity Implications of Highway Development and Expansion: Four Indicators.” Findings (2022).

Lee, Juneyoung, and Keun Lee. Kaldor and Kuznets Together in a Three-way Growth-Equity Nexus in Developed and Developing Countries: The Common Decoupling of Functional and Household Income Distribution but Different Details of the Nexus. 2022.

Nguyen, Nga Hong, and Trang Thi Thu Nguyen. “Assuring Social Equity and Improving Income from an Assessment of Government’s Supports in a Pandemic and Migrant Workers’ Integration in Vietnam.” Economies 10.4 (2022).

Petach, Luke, and Daniele Tavani. “Aggregate demand externalities, income distribution, and wealth inequality.” Structural Change and Economic Dynamics (2022).

Raghavan, Vijay. “Consumer Law’s Equity Gap.” Utah Law Review 3 (2022).

Slemrod, Joel. “Group Equity and Implicit Discrimination in Tax Systems.” National Tax Journal 75.1 (2022).

Van Hootegem, Arno. “Worlds of distributive justice preferences: Individual-and country-level profiles of support for equality, equity and need.” Social Science Research (2022).

Yang, Fan, Kenneth Roger Katumba, and Susan Griffin. “Incorporating health inequality impact into economic evaluation in low-and middle-income countries: a systematic review.” Expert review of pharmacoeconomics & outcomes research 22.1 (2022).