Introduction

Foreign Direct Investment (FDI) is regarded as a fundamental form of global capital flow (Cywiński & Harasym, 2012, p. 35). FDI has a considerable effect on both home and host economies. From the home country’s point of view, FDI is considered to be a convenient means of capital and technology transfer, as well as a means of funding major projects. In addition, FDI is a means of contributing to the global chain of production (Guimón, 2011, p. 6). On the other hand, the impact of FDI on host economies varies from one country to another due to a number of reasons, including the availability of resources and state of the economy (Cywiński & Harasym, 2012, p. 35).

There are numerous literatures examining FDI issues (Vernon, 1996, p. 195). Lipsey (2002, p. 12) believes that FDI is very essential in the development of economies, particularly developing economies. Nonetheless, the impact of FDI on economies is very intricate. From a macroeconomic viewpoint, FDI plays a major role in the generation of employment, growth of aggregate output, technology transfer, and access to the external market (Lipsey, 2002, p. 13). The role of FDI in technology transfer is supported by Razin and Sadka (2007, p. 45) who think that FDI can facilitate leakage of advanced technology to companies in the host economies.

As already mentioned, FDI affects both the host and home country. However, the study will focus on the impact of FDI on developing economies, which are often the host countries. The paper will explore different theories and concepts linked to FDI and key arguments between theorists and different theoretical positions. The paper will also examine the costs and benefits of FDI based on data available on the World Bank database.

The Main FDI Theories

In spite of numerous studies explaining the phenomenon of FDI, there is no unified theoretical explanation. However, most of these studies concur that FDI would not exist in a perfectly competitive market. In a perfectly competitive world, international trade is the only means of contributing to the global market (Denisia, 2010, p. 105). Theories explaining FDI include production sequence hypothesis, theory of conversion scale on the blemished capital market, theory of internal and external advantages and O-L-I theories developed by Dunning (Denisia, 2010, p. 106).

The production cycle theory of FDI was developed by Raymond Vernon in the mid 1990s. The theory emphasizes on FDI made by the American companies in Europe after the 2nd World War. Vernon believes that FDI follows four phases of the production cycle, namely: innovation phase, expansion phase, maturity phase and reduction phase. The innovation phase (the first phase) involves the creation of novel products for domestic consumption and selling the surplus abroad (Vernon, 1996, p. 205).

According to the product cycle theory, an increase in demand for exports leads to an increase in production, especially by companies in the home country due to technological advantage (Vernon, 1996, p. 205). As the production increases, the technology used also becomes known in the host country. As a result, companies in the host company also start to produce similar products and, therefore, reduce the overall demand and market share. When this happens, companies in the home country start to focus on the local market, hence a decrease in FDI (Vernon, 1996, p. 207). However, there are cases where countries do not have a technological advantage, but still makes foreign direct investment. For instance, a number of Asian companies have invested heavily in the European and American markets (Russ, n.d., p. 10)

The theory of exchange rate on defective capital markets also tries to explain FDI (Cushman, 1985, p. 297). Cushman (1985) conducted an investigation to establish the effect of exchange rates on FDI. He established that real exchange rate increase encourages foreign direct investment. On the other hand, appreciation of foreign currency negatively affects FDI. He concludes that foreign exchange rate can only affect FDI if one currency is involved, for example, the U.S. dollar. This means that the theory of exchange rate cannot explain FDI between economies when different currencies are involved.

The internalization theory explains the growth of multinational corporations and motivation behind FDI (Buckley & Casson, 1976, p.). The theory was developed by Buckley and Casson in the mid 70s. The theory states that multinational corporations always strive to create a specific advantage through its internal activities, and this can be exploited in the foreign market. The internalization theory states that foreign direct investment cannot be made if the benefits of exploiting the advantages locally outweigh the cost of operating abroad. The theory argues that multinational corporations only exist due to imperfections in the global market. This may be as a result of currency risks, preferential treatment of local firms by their respective governments and information costs. For this reason, multinational corporations incur extra costs when investing in foreign countries (Russ, n.d., p. 18).

The eclectic paradigm, on the other hand, comprises three theories explaining FDI. The three theories are denoted by O-L-I where O represents ownership advantages, L represents location advantages, and I represent internalization advantage. Ownership advantages signify intangible assets that a company exclusively has in possession and can be used to minimize cost or enhance profitability in the foreign country. They include monopolistic powers, technological advantages and economies of scale (Hosseini, 2005, p. 533).

The location advantages help in the determination of the host country and must based on the following: economic benefits, political advantages and social advantages. Economic benefits include transportation cost, the size of the market, factors of production and infrastructure (Hosseini, 2005, p. 533). Political advantages are basically state laws and policies governing trade and industrialization. Lastly, social advantages include cultural factors, attitude of the society towards foreigners and distance between the host and home country (Hosseini, 2005, p. 534).

As already been mentioned, internalization basically refers to the company’s internal advantage that can be exploited abroad. In order to explore this advantage, the conditions for ownership advantages and location advantages must be met. Internalization provides companies with a framework for evaluating various means of exploiting its powers through foreign agreements. Internalization benefits are higher for companies that directly take part in foreign production than those that have entered into agreements with the local companies to produce or sell their products (Hosseini, 2005, p. 535). Eclectic paradigm shows that FDI depends on challenges and opportunities offered by the host nations.

Costs and Benefits of FDI to Developing Economies: Case study of India

Generally, FDI refers to the net inflow of investment in an economy, which includes long and short term capital. FDI can be an inward investment or outward investment, hence the term net inflow. Net inflow is the balance between inward FDI and outward FDI (Cywiński & Harasym, 2012, P. 37). The benefits of FDI to developing economies can be grouped as follows: resource transfer effect, the employment effect, balance of payment effect, and competition effect. Resource transfer effect basically refers to the capital invested by multinational corporations in the host country, as well as the technology and skills transferred to the local companies. The employment effect describes the employment opportunities created by such investment (Guimón, 2011, p. 26; Lipsey, 2002, p. 102).

In terms of balance of payment, FDI can either create a positive or negative effect. Positive effects can be brought about by an inflow of capital and inflow of payments from exports (Hanson, 2001, p. 13). Goods or services produced by FDI can act as a substitute for imports (Guimón, 2011, p. 27). Lastly, more investment in an economy can improve the functioning of domestic markets by increasing the level of competition. In addition, Increased FDI may give a country substantial voice in the global summits (Guimón, 2011, p. 26; Lipsey, 2002, p. 104).

The cost of foreign direct investment to developing economies can also be categorized into four groups, namely: unfriendly impacts of rivalry, unfavourable impact on parity of instalment, overreliance on one sector, and the impact on the nation’s sway and autonomy. Adverse effects on competition are usually associated with multinational corporations with monopolistic powers. Such companies may kill the local infant companies. The antagonistic impact on the balance of payment may be credited to excess outflow of FDI profits and importation of inputs utilizing FDI. A lot of investment in one sector, for instance, petroleum industry may lead to overreliance on the sector and that is very risky. Last but not least, too much FDI may put a country’s sovereignty at stake. The foreign investors may have the powers to make key decisions that may have enormous impact on the country’s economy (Lipsey, 2002, p. 105).

In the case of India, FDI has played a major role in the development of its economy. Foreign direct investment in India can be traced back to the early 1950s, when the colonialists established the first East India Company (Malhotra, 2014, p. 18). According to the recent survey conducted by UNCTAD, India’s net inflow of FDI over the last decade is over 2.5 trillion dollars. As a matter of fact, India is the second largest destination of foreign direct investment in the world, especially among the multinational corporations. The country is second to China. The highest FDI inflow was witnessed in 2008 (Banerji, 2013, p. 5).

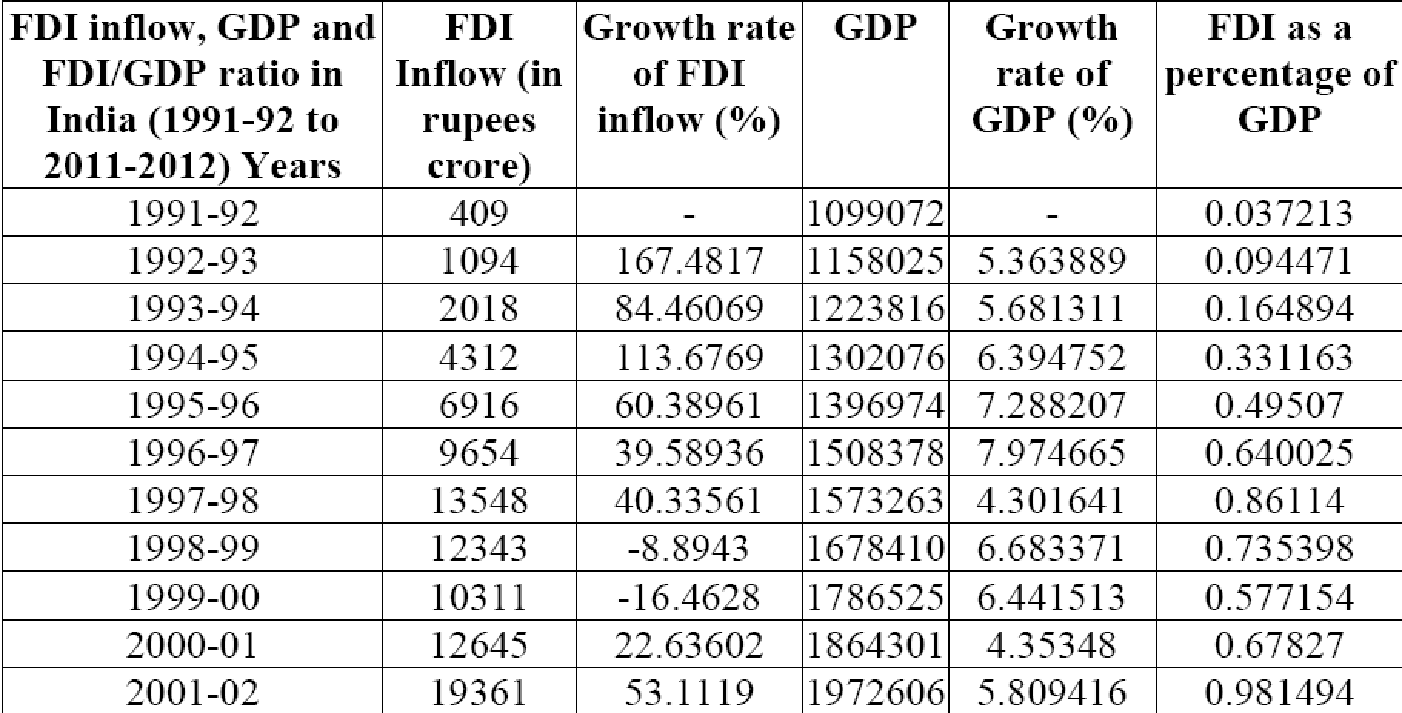

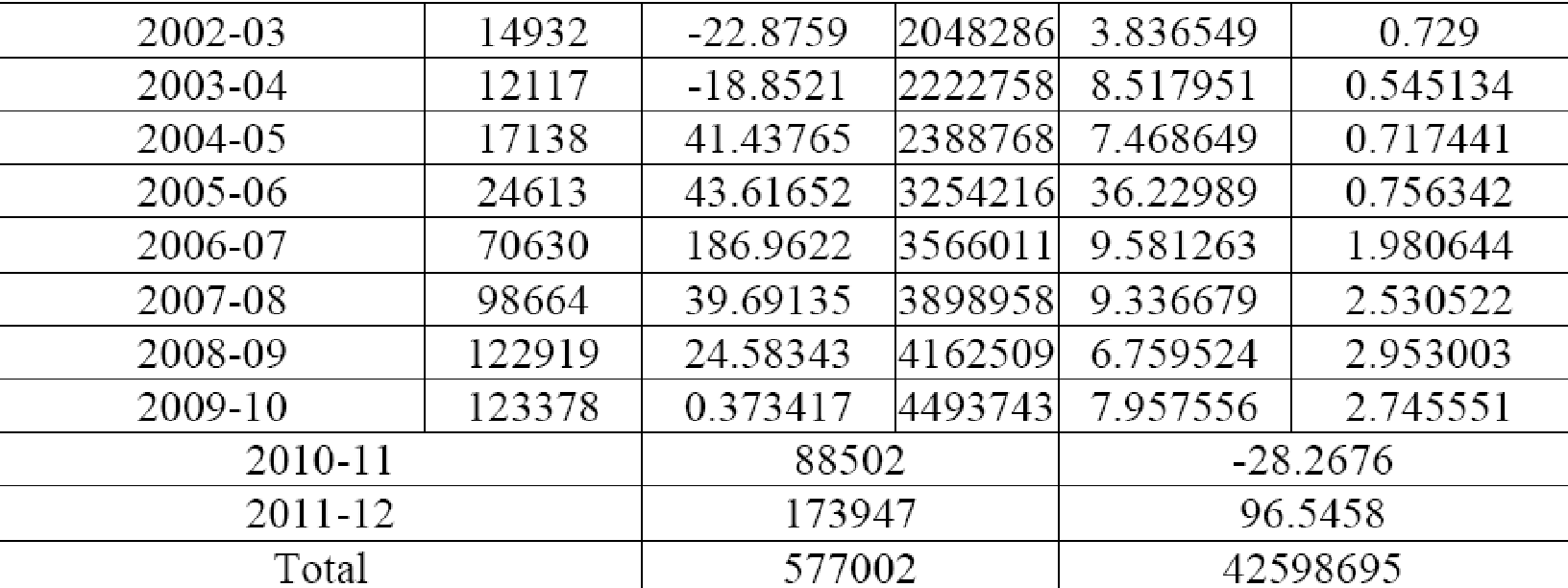

From the figures provided in Appendix 3, it is obvious that FDI has boosted the country’s economy from a minimum of 0.3 percent to nearly 3 percent. Economic estimates also show that FDI has provided employment opportunities for at least 2 million Indians annually for the last decade (Malhotra, 2014, p. 19). In addition, FDI inflows have supplemented the domestic income, as well as technical ability of the local companies, hence the double digit growth of the country’s economy (Banerji, 2013, p. 5). However, all the above benefits have come at a cost. India’s economy is currently dominated by large multinational corporations that have a massive influence on key decisions. India also risks losing strategic industries by opening up its domestic markets to foreign competitors and investors (Malhotra, 2014, p. 21).

Conclusion

FDI is a significant component of a country’s economy. The inspiration behind FDI has been explained by a number of theories. These theories include production succession hypothesis, theory of conversion scale on the blemished capital market, theory of internal and external advantages and O-L-I theories. Despite the fact that there is no common theoretical ground on FDI, it is apparent that FDI is inspired by both internal and external advantages. In addition, FDI has both positive and negative impact on the economy. However, the advantages outweigh the disadvantages.

References

Banerji, S 2013, Effects of FDI in the Indian Economy, Indian Statistical Institute, Kolkata, West Bengal.

Buckley, PJ & Casson, M C 1976, The Future of the Multinational Enterprise, Homes and Meier, London.

Cushman, D 1985, ‘Real Exchange Rate Risk, Expectations and the Level of Direct Investment’, Review of Economics and Statistics, vol. 67, no. 2, pp. 297-308.

Cywiński, L & Harasym, R 2012, ‘Review of FDI Theory in the Knowledge-Intensive Economy’, Financial Internet Quarterly, vol. 8, no. 4, pp. 35-225.

Denisia, V 2010, ‘Foreign Direct Investment Theories: An Overview off the Main FDI Theories’, European Journal of Interdisciplinary Studies, vol. 2, no. 2, pp. 104-110.

Guimón, J 2011, Global Trends in R&D-intensive FDI and Policy for Developing Countries, World Bank Workshop Papers, Washington, D.C.

Hanson, G 2001, ‘Should Countries Promote Foreign Direct Investment?’ G-24 Discussion Papers 9, United Nations Conference on Trade and Development.

Hosseini H 2005, ‘An economic theory of FDI: A behavioural economics and historical approach’, The Journal of Socio-Economics, vol. 34, pp. 530-531.

Lipsey R 2002, Home and Host Country Effects of FDI, Lidingö, Sweden.

Malhotra, B 2014, ‘Foreign Direct Investment: Impact on Indian Economy’, Global Journal of Business Management and Information Technology, vol. 4, no. 1, pp. 17-23.

Razin, A & Sadka, E 2007, Foreign Direct Investment: An analysis of aggregate flows, Princeton University Press, Princeton.

Russ, K n.d., The New Theory of Foreign Direct Investment: Merging Micro-level and macro-finance, University of California, California.

Vernon, R 1996, ‘International investments and international trade in the product life cycle’, Quarterly Journal of Economics, pp. 190–207.

Appendices

Appendix 1: A Chat for India’s FDI from 2005 to 2013

Appendix 2: Figures for India’s FDI from 2005 to 2013

Appendix 3: Impact of FDI on GDP