1. Top Choice Investments have given you £2,000,000 to invest for them. The funds can be invested in one or more projects. These projects are all indivisible. The investors require a minimum return of 25% and they are high-risk takers.

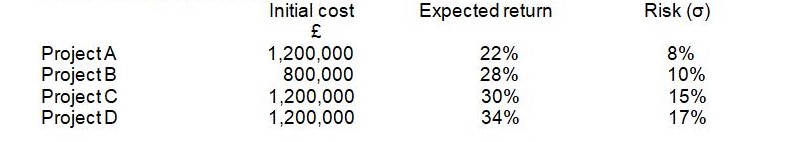

Details of the projects are as follows.

Correlation coefficients between project returns are as follows.

- A & B 0.7

- A & C 0.6

- A & D 0.6

- B & C 0.65

- B & D 0.3

- C & D 0.8

The possible combinations with a $2 million investment can be A & B, B&C, and B&D.

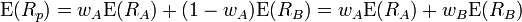

Portfolio return:

Portfolio variance (General) :

Portfolio volatility:

(Where A is the first asset and B is the second asset).

1) For Portfolio A & B:

Weight of investment in A = w A = 120000/2000000 = 60%

Weight of investment in B = w B = 40%

Expected Return of Portfolio = 60% (22) + 40% (28) = 24.4%

Since this offers lower than the minimum return required by the investors, this combination should not be invested in.

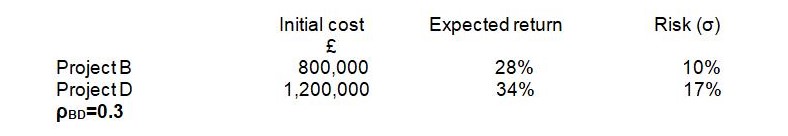

2) Portfolio B & C

Weight in B = w B = 40%

Weight in C = w C = 60%

Expected return =.4 (28%) +.6 (30%) = = 29.2%

With B & C in the portfolio: σ B = 10%, σ C = 15%, ρBC=0.65

σ2 P = (0.4×10)2 + (0.6×15)2 +2(0.4) (0.6) (10) (15) (0.65) = 143.8

Volatility= σ P = 12%

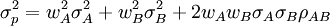

3) Portfolio B & D

Expected Return = 0.4 x 28% + 0.6 x 34% = 31.6%

Variance = (0.4×10) 2 + (0.6×17) 2 + 2(0.4)(0.6)(10)(17) (0.3) = 144.52

Volatility = 12.02%

The return on the Portfolio BD is higher against BC with minimal more risk; if investors are high-risk takers, they should invest in BD.

Hence investors should invest 40% in B, and 60% in D.

Views and approaches to Capital Structure

Capital structure refers to the mix of debt and equity in the financing of a company. A company is financed partially debt and partially equity. An optimal proportion of both are vital for the firm’s value and its cost of capital. Investors are concerned about the company’s overall risk along with the value, and the risk is greatly dependent on how a company is financed.

Modigliani-Miller

The most popular assumptions are given by Modigliani-Miller theorem. This theorem states that the total value of the firm in a perfect market is irrelevant of the mix of debt and equity. Second proposition is that the value of a leveraged firm (a firm with debt and equity) is equal to the value of an unleveraged (all equity) firm plus a premium for the financial risk. Hence there is no extra value for any of the firms.

The optimal capital structure, under perfect market, is all debt financing since tax deductibility of risky debt decreases the cost of capital, but in real world, there are additional costs to the debt.

Trade off Theory

Trade off theory states that although cost of capital decreases with incremental debt, other costs such as bankruptcy cost, interest rate (higher the debt, higher the interest rate that lenders demand), and overall risk compensation demanded by the investors. Hence the incremental benefit of further debt depends on these costs.

Pecking Order Theory

Pecking order theory thinks with the perspective of the reaction of investors to what mangers are thinking. It states that firm follows a hierarchy of financing options. Firm prefers internal financing first, then if needed it goes for external debt, and in further need it goes for equity raising. This theory explains that firm is reluctant and unwilling to issue equity. The reason is that managers are though to be taking advantage of overvaluation as they issue equity. Hence investors believe that the firm is overvalued and managers are issuing equity to take advantage of this overvaluation. In real world, however, little evidence supports this theory.

2. (a) Top Choice’s beta is 1.5. The expected return on treasury securities is 5 percent and the expected return on the market portfolio is 12 percent. Calculate the required return on the stock of this firm

Capital Asset Pricing Model suggests that the return required by the investors depends on the market risk premium and the firm’s beta; the market risk of the firm.

Required return = Risk free return + Beta x Market Risk Premium

Marker risk premium is the extra return demanded by investors on the market portfolio for the extra risk. It is a Market return – Risk-free return

Hence: Req. return = Risk free ret. + beta x (market ret. – risk free ret.)

= 5 + 1.5 x ( 12 – 5)

Required Return = 15.5%

(b) Explain the following:

- Investors’ required rate of return. Investors have several options to invest in. Each option has its own risk (that we measure as volatility of returns). The treasury bills issued by the government are considered virtually risk-free. Hence these securities are the safest option to invest in. On other hand, investors can invest in stock exchange in different stocks of companies. These stocks have the risk of varying returns. Hence investors demand a higher returns for the extra risk that they have to bear if they invest in stock rather than treasury bills. Such extra return is called the risk premium. The capital asset pricing model gives a tool to measure the required return of investors; that is, the return that investors expect to gain from a stock given its risk.

- Systematic Risk. Systematic Risk refers to the market risk of a security. Market risk is the risk due to economy-wide higher returns in factors that surround all the firms irrespective of their industry and circumstances. Market risk is inevitable and it cannot be diversified to nil. Market risk of any stock is defined by its Beta; that is, the sensitivity of the stock’s return to the market returns. Beta measures the change is stock’s return when market return varies by 1%. Stocks are said to be cyclical if their returns have a positive correlation with the market and counter-cyclical if stocks move negatively with the market.

- Unsystematic risk Unsystematic risk refers to the unique risk of a stock. A company is surrounded by many perils and risks that are specific to that company and industry. For example, risk of default, high debt, low profits, high competition is such risks that are unique to a particular company. Unique risk can be diversified totally. By investing in stocks with negative correlation; unique risk can be minimized. The unique risk is measured by variance or standard deviation of the returns.

- Standard Deviation

Any stock actively traded in the market gives variable returns to the investors. The stock may rise or fall daily depending on various factors. The deviation from the mean return over a period is said to be a deviation from the mean. Standard deviation measures the volatility or the uncertainty of the stock return. The variance is measured as the average squared deviation from the mean. Standard deviation is simply the square root of the variance.

(c) Assumptions of the Capital Asset Pricing Model?

Capital Asset Pricing Model gives a relationship between a stock’s expected return and its beta. It proposes that there is a direct relation between the expected return of the stock and its market risk. It is strictly valid only under some underlying assumptions that are as follows:

- All investors are rational and risk-averse who want to maximize their return depending on the minimized risk.

- All investors have homogeneous expectations; they all have the same information at a given time.

- The return on treasury bills is virtually risk-free and investors may borrow or lend this risk-free asset at a fixed rate unlimitedly.

- The beta of risk-free assets is zero.

- Asset returns are normally distributed.

- All assets are traded in a perfectly competitive market; their returns can only be predicted given their risk.

- The number of securities in a perfect market is fixed and the beta of the market is 1.

- The information about all the markets is costless and simultaneously available to all investors.

- All investors can trade without transaction or taxation costs.

- All investors are price takers in the perfect market; they cannot influence stock prices.

- (d) Explain the following sources of short-term financing

- Trade credit. Trade credit is a liability or receivable incurred in the normal course of business. Trade credit occurs when the provider of goods or services transfers goods or provides services and agrees to be paid later. Hence buyer and seller reach an agreement where seller terms and conditions under which buyer can pay the price later in a given time. Such credit is very common and inevitable in large business transactions. One-time transactions of sale-purchase are thousands of dollars or millions and cash cannot be paid easily. Large firms keep a good capitalization through trade credit as they have to make payments to the suppliers and get receipts from the retailers at different points of time. Managing the trade credit is very vital for the desired level of liquidity and working capital of the firm.

- Overdraft facility. Overdraft facility is a short-term financing option for the large firms provided by banks. A bank may give an overdraft facility when a large payment is made through the current account of an amount exceeding the balance in the account. Banks normally agree to make arrangements of overdraft facility in such cases. This amount is repayable if demanded by the bank.

- Commercial paper. Commercial paper is another way of raising short-term debt with a fixed maturity of 1 to 270 days. It is a promissory note that is issued by large banks and corporations for short-term debt. The interest payments are different from those on normal bonds. These papers are issued on the mere promise of repayment from the corporation or bank, hence it vitally depends on the credit rating of the firm whether it gets to sell such note or not. The issuer promises to pay the face value on maturity. Since the maturity is very short generally, the note is sold at a discount.

- Transaction loan. A transaction loan is a loan that is extended by a lender for a specific purpose or project. By contrast, other types such as lines of credit or revolving credit agreements are loans that can be used for various purposes. A transaction loan is demanded after a well-founded project or expansion is presented before the bank. Almost all corporations need financing through transaction loans. Banks are willing to invest in a project or expansion with certain future success. The management of the bank considers all the worst and best-case scenarios based on projected and best-estimated results of the project. Once a transaction loan is granted, banks keep track of all the progress and developments in the course of the project being a vital stakeholder. Other variations of transaction loans are consumer-based loans such as house-financing and car financing. The property financed by the bank is legally owned by the bank until the consumer pays the full amount of debt.

Sources

Lawrence J. Gitman (2006) “Principles of Managerial Finance” 11th edition (International Edition), published by Pearson International.

Brealey, Marcus and Myers (2004) ‘Fundamentals of Corporate Finance’, 4th Edition, (International), McGraw-Hill.

Atrill P. and Mclaney E. (2001) “Accounting and Finance for non-specialists” 3rd edition, published by Pearson Education.