Introduction

Hennes and Mauritz’s (H&M’s) stock prices dropped dramatically when the company entered 2019 despite its stable performance before (Figure 1). However, it began recovering steadily almost immediately and was back to its prior stock values by April, a tendency that held through most of May. H&M experienced another significant fall in the month’s second half and remained at the same performance level until July. Upon entering the period, it recovered almost instantly and continued its stable performance until mid-August. At that time, the company experienced a significant growth spike and exceeded its stock price at the beginning of the year by over 15%. The tendency has held since then, and the company’s value remains at the same level at present.

External Macroeconomic Factors

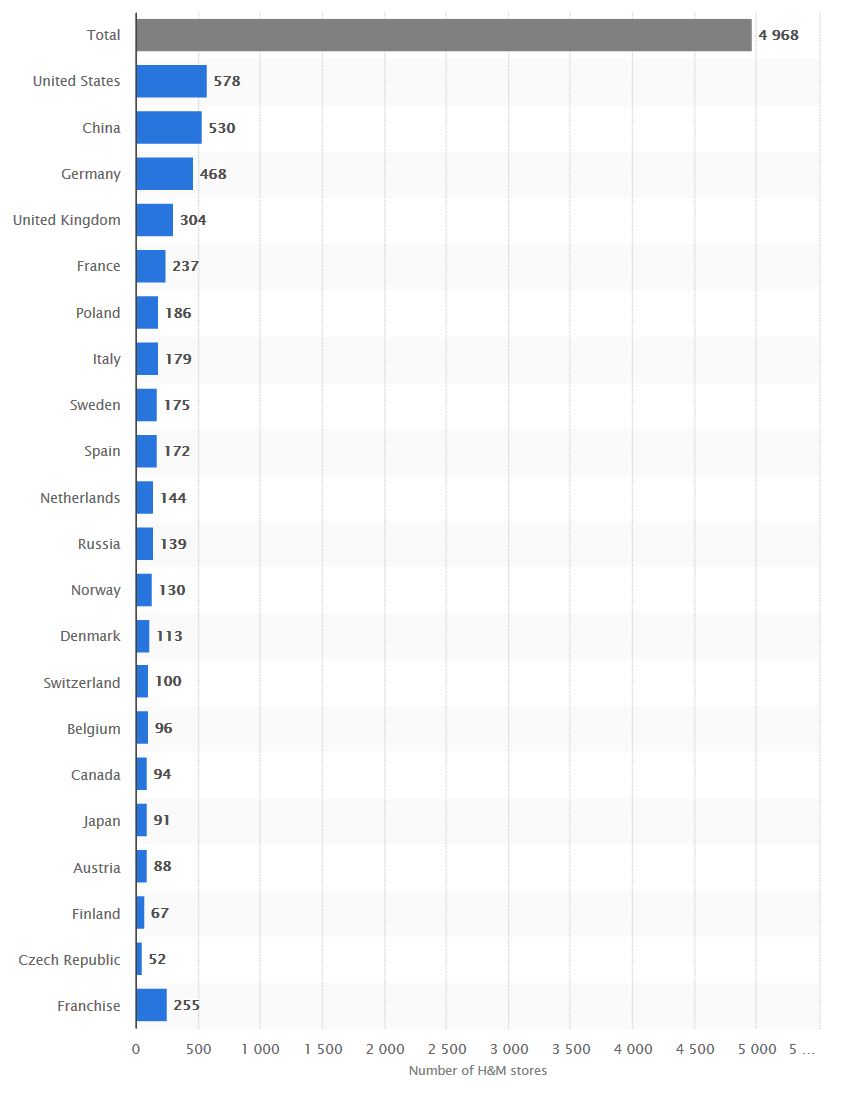

As can be seen in Figure 2, the United States is H&M’s biggest market, as the company only sells its products in branded stores. China and Germany are close behind, but the U.S. remains the leading market. As such, its environment and influences such as inflation, unemployment, currency, and the impact of Brexit will be the primary point of discussion in this report. The others will have to be relegated to a more thorough investigation.

Inflation

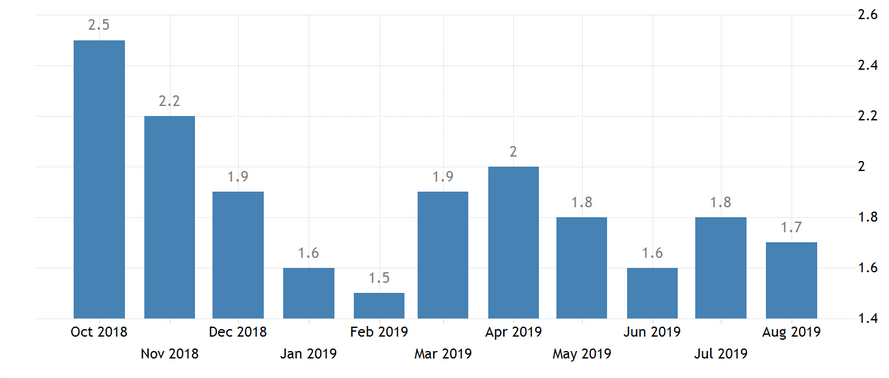

The inflation rate in the United States was high in 2018, but, as can be seen in Figure 3, it has declined to levels below 2% since. The low values indicate that economic activity in the country has slowed, impeding the growth of companies. At the same time, they ensure that the United States and the businesses that operate there remain economically stable. At the same time, the 2% value offers a compromise between growth and stability, and so the United States is currently a suitable environment for an international company’s investment. There are few dangers in doing so, and the benefits can be considerable, though not as potentially high as in a high-inflation country.

Unemployment

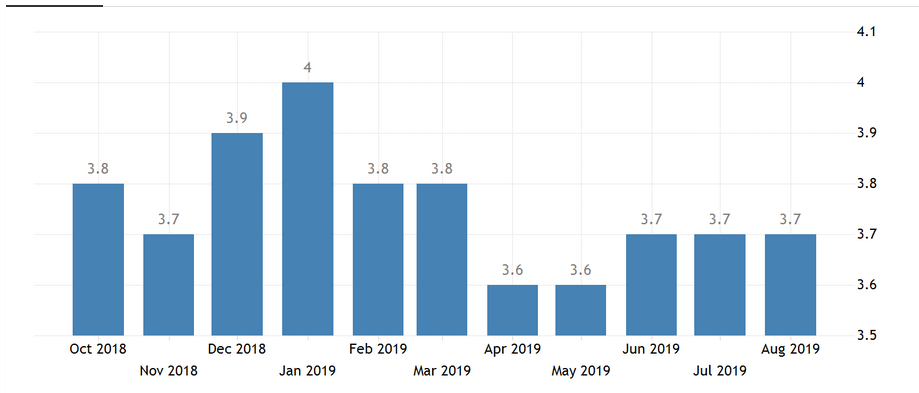

As demonstrated in Figure 4, the unemployment rate in the U.S. has remained mostly stable throughout the last year, fluctuating between 3.6% and 4%. The values indicate a healthy economy where constant worker movement occurs, and there is neither a shortage nor an excess of workforce members. As such, employee wages should remain at a stable medium level to stay competitive. Companies do not have to spend large amounts of money to retain their workforce, but they also cannot lower pay because most can then find better jobs at other companies. The unemployment rate in the country is not a source of concern or potential harm to any participants in the market.

Currency

The U.S. dollar has climbed steadily throughout the last year, though two events temporarily lowered its value without affecting the overall trend (Figure 4). As such, the country’s economic position has been strengthening, and the purchasing ability of its residents has been increasing as a result. The country has become a better environment for most companies, as their products have become more affordable, and consumers would be encouraged to purchase more of them. Businesses with a considerable presence in the United States would, naturally, benefit the most from the nation’s economic growth. Overall, the country appears to be attractive to any business and conducive to its growth.

Brexit

The United States is not located in Europe, and so the country will be mostly unaffected by Brexit regardless of whether or when it is finalized. However, it may benefit from the damage to the relationship between the United Kingdom and the European Union’s countries and expand its trade with the former. It has the economic capacity to do so and is an attractive trading partner due to its size and resistance to political influence. In the event of a successful Brexit and a consequent increase in trade between the two countries, the United States would benefit further and grow further. The companies operating there would have access to more resources as a result, as well.

Internal Analysis

Objectives, Mission, and Vision

H&M sells clothing at prices that often undercut much of its competition. Its vision reflects that tendency, as the company proclaims its goal of democratizing fashion and making it sustainable and lasting (H&M Group 2019). As such, the company actively tries to minimize costs without compromising the quality of its products with approaches such as supply chain optimization, material innovation, and recycling. Per the company’s stated objective of sustainability, these actions also allow it to withstand any economic downturns. H&M’s recovery from the multiple stock price drops and eventual significant growth in the last year demonstrates the company’s tenacity and the success of its business model.

Business Legal Structure

The H&M Group is a corporation that operates in many different countries worldwide. However, it is based in Sweden and follows Swedish and EU laws in its governance (H&M Group 2018). Local business legislation also applies in all countries where H&M operates, and so the company has to observe many different forms. Notably, as stated by H&M Group (2018), Swedish corporate governance law allows deviations from individual rules as long as the corporation identifies them explicitly and explains the reason for the departure. Due to this provision, it should be possible for the company to adapt to some contradictions between local law and Swedish legislation in a manner that does not damage it.

Business Organizational Structure

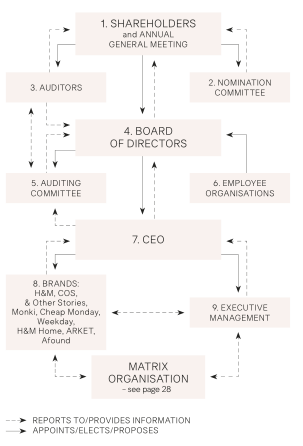

H&M’s innovation lies in its production and sales methods and not in its approach to organizing its business. As such, the company uses a traditional and reliable framework for its structure. The organization is governed by its Board of Directors as well as its shareholders, auditing committee, and CEO. As can be seen in Figure 5, the shareholders hold the most power, followed by the board of directors and then the CEO, who interacts with the executive management and the company’s brands directly. Overall, the corporation’s structure is mostly standard and does not display any noteworthy deviations from the norm. There should not be many abnormalities in its performance that can be attributed to this aspect.

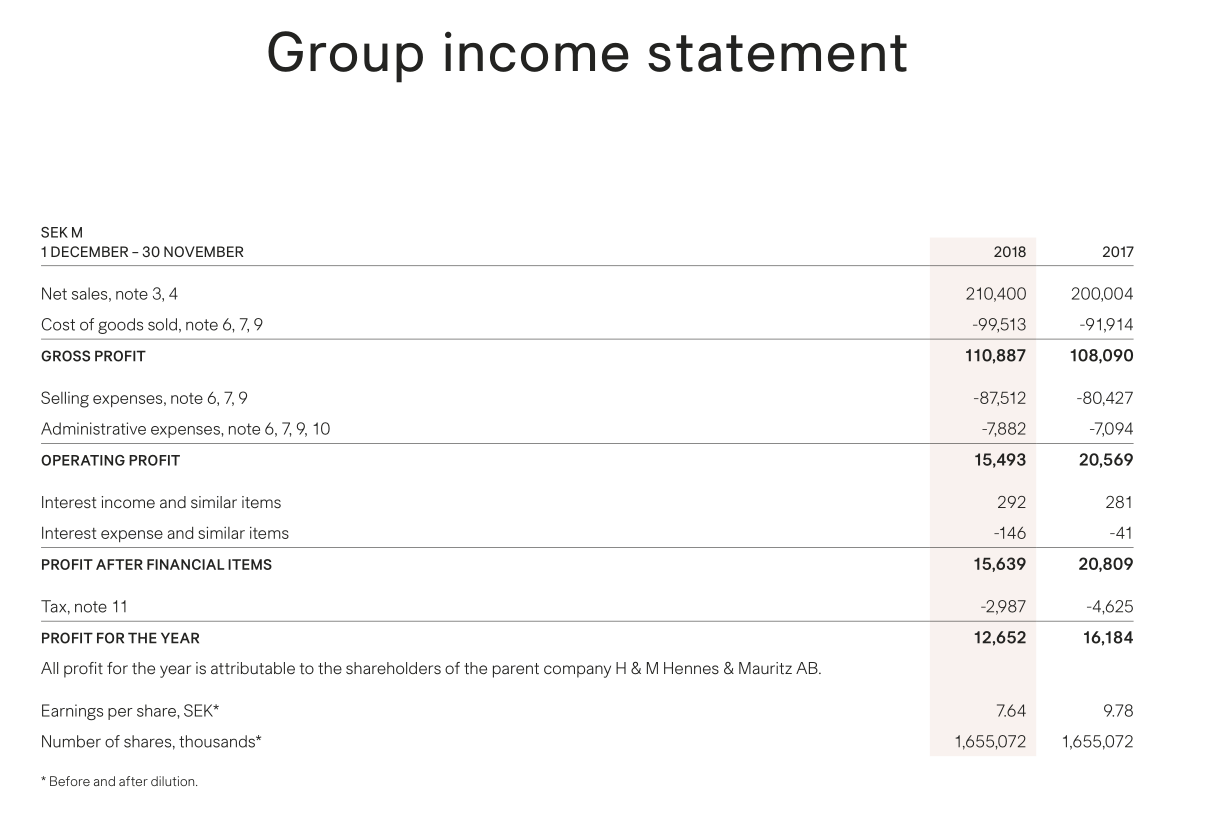

Financial Performance

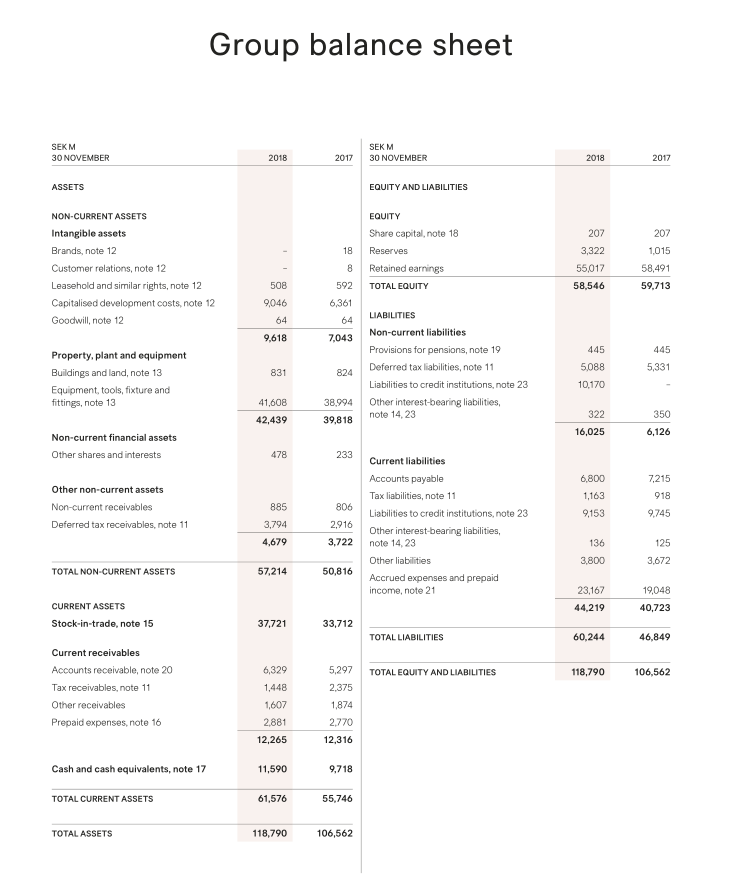

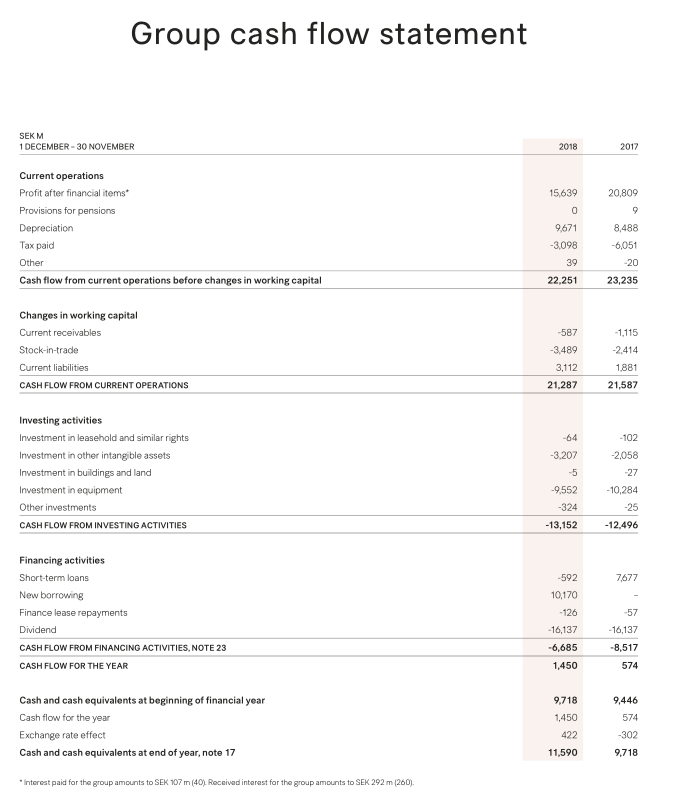

H&M’s performance declined in 2018, and some statistics can be a cause for concern. According to H&M (2018), its revenue has grown slightly since 2017, but the company’s profit has declined substantially due to increases in the cost of goods sold and selling expenses. As such, it is possible to infer that the company has opened new stores that have underperformed. The stock price drop in early 2019 may be associated with the release of the annual statement that demonstrated the decline in profit. Additionally, H&M’s net debt escalated dramatically as the company accumulated liabilities to credit institutions (H&M Group 2018). However, its stock price has recovered and increased further since then, as can be seen in Figure 1, so the company has likely overcome its issues.

Conclusion

Despite the difficulties H&M has experienced throughout 2019, it has been able to recover and continue its growth. The behavior may be attributed to its principal markets, which have been experiencing stable growth, or to the company’s robust business model that can recover from adverse events. Its expansion efforts were likely the cause behind the weak performance in 2018, but the new stores have probably improved their results since, and so H&M’s stock is significantly higher than it was at the beginning of the year. However, the organization should still be careful about its publicity to avoid losing shareholders. Also, another annual report that shows low profits would likely be devastating to the company’s performance.

Recommendations

H&M should reduce its expansion efforts and concentrate on solidifying its current position. The reduction of its existing debts is a critical goal, as their absence would allow the company to act more freely in the future. It should also work to present a better annual report at the end of 2019 than it did the year before. As such, it should work on increasing revenue while reducing selling expenses. An increase in the profit margin to ensure that revenue growth matches that of the cost of goods sold would also be beneficial. However, such an action would go against H&M’s vision and objective, and so, this report does not suggest it.

Appendices

Appendix A: H&M Group’s Income Statement

Appendix B: H&M Group’s Balance Sheet

Appendix C: H&M Group’s Cash Flow Statement

Reference List

Business Insider 2019, Hennes & Mauritz (H & M, H&M), Web.

H&M Group 2018, Annual report 2018, Web.

H&M Group 2019, Vision and strategy, Web.

Market Watch 2019, U.S. Dollar index, Web.

Statista 2019, Number of stores of the H&M Group worldwide as of 2018, by selected country, Web.

Trading Economics 2019a, United States inflation rate, Web.

Trading Economics 2019b, United States unemployment rate, Web.